Deckers Outdoor: An Attractive GARP Company

Summary

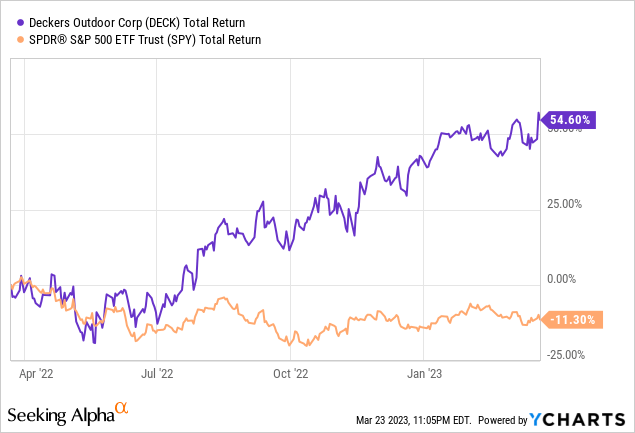

- Deckers Outdoor is up over 50% in the past year and currently trading nearly its all-time high.

- The increasing popularity of HOKA and Teva should continue to be strong growth drivers.

- Despite macro headwinds, its latest earnings reported double-digit growth in both the top and the bottom line.

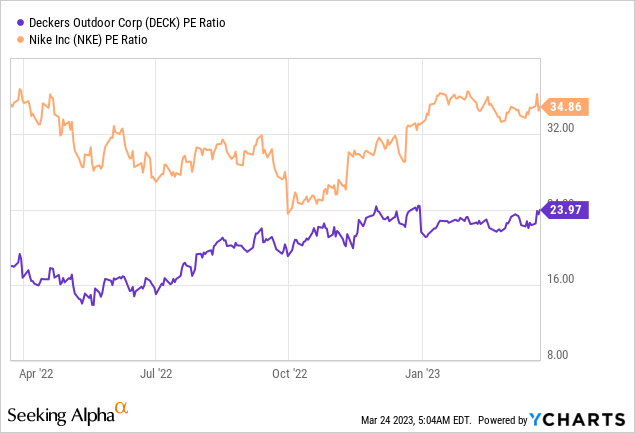

- Its current valuation remains discounted compared to peers.

- I rate the company as a buy.

Roman Tiraspolsky

Investment Thesis

Deckers Outdoor (NYSE:DECK) has performed extremely well in the past year. Unlike the S&P 500 Index, which dropped 11.7%, the company is up over 50% and currently trading near its historical high. Despite the recent rally, I still believe the company offers a solid buying opportunity for investors. Its HOKA brand is gaining strong momentum and should continue to be a major growth driver. The latest earnings reported decent growth, with double digits increases in both the top and the bottom line. The company is also trading at a discounted valuation compared to peers, which should present further upside potential.

HOKA Is A Growth Driver

Deckers Outdoor is a California-based company which owns multiple fashion and performance lifestyle footwear brands. Its fashion brands include UGG and Koolaburra while its performance brands include HOKA, Teva, and Sanuk. Among all the brands, I believe HOKA is the one that has massive growth potential. In recent years, a lot more people have been promoting an active healthy lifestyle, and engagement in sports such as Hiking and Yoga has increased exponentially. The trend has been boosting the demand for performance lifestyle footwear. According to Statista, the athletic footwear market is estimated to grow from $53 billion in 2023 to $64.9 billion in 2028, representing a solid CAGR (compounded annual growth rate) of 4.3%.

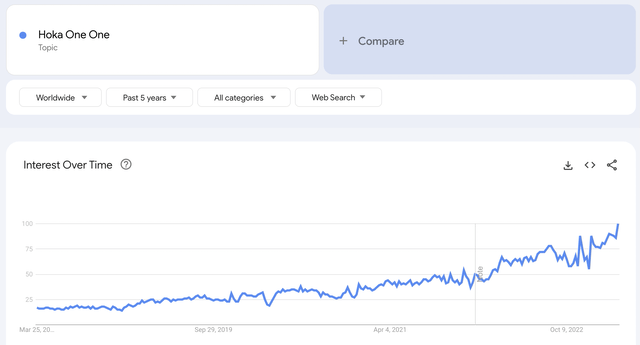

HOKA differentiates itself through superior comfort and performance, and its footwear has won multiple awards in the past quarter alone, which I have cited below. This has helped them win over customers and continues to drive its brand awareness and adoption. From the Google Trends graph shown below, you can see that HOKA's popularity has grown significantly in the past 5 years. According to the management team, its US market share rose 5 percentage points in December compared to the prior year. The brand's expansion opportunities are even greater in the international region, which has even lower brand awareness at the moment. I believe HOKA will continue to be a major growth driver for the company.

Dave Powers, CEO, on recently winning awards

On the product side, HOKA has continued to introduce award-winning footwear, in October, HOKA was featured in the 2022 Men's Health Sneaker Awards with Bondi 8 being chosen for the most comfortable cushion, and the Kaha 2 GORE-TEX noted as the best hiking sneaker boot. In addition, Outside Magazine published its Winter Gear Guide for 2023, selecting the Mafate Speed 4 as the best shoe for fast in rugged trail runs.

Financials and Valuation

Deckers Outdoor announced its third-quarter earnings last month, and the results are decent considering the weakening economy. The company reported net sales of $1.35 billion, up 13.3% YoY (year over year) compared to $1.19 billion. Revenue growth was 17.5% on a constant currency basis. The growth was primarily driven by HOKA and Teva. Revenue from HOKA grew 90.8% from $184.6 million to $352.1 million, now accounting for 26% of total revenue. While revenue from Teva from 48.3% from $20.6 million to $30.5 million. Gross profit was $712.5 million, up 14.7% YoY from $621.2 million. The gross margin edged up 70 basis points from 52.3% to 53%.

The bottom line showed even stronger growth as operating leverage improved. Despite double digits increase in revenue, SG&A (selling, general, and administrative) expenses only rose 6.7% YoY from $327.8 million to $349.9 million. This resulted in operating income increasing 23.6% YoY from $293.4 million to $362.7 million. The operating margin also expanded 220 basis points from 24.7% to 26.9%. The diluted EPS was. $10.48 compared to $8.42, up 24.5% YoY. The company's balance sheet remains very healthy with $1.06 billion in cash and no debt, which provides ample flexibility for further buybacks or potential acquisitions.

Despite the massive rally, the company's valuation remains compelling in my opinion. It is currently trading at a PE ratio of 24x, which is discounted compared to footwear peers with similar growth rates. For context, footwear giant Nike (NKE) reported revenue growth of 12% in the latest quarter, yet it has a PE ratio of 34.9x, which represent a significant premium of 31.2%. This indicates that the company may see further expansion in multiples, which could offer solid upside potential

Investors Takeaway

I believe Deckers Outdoor is a compelling GARP (growth at a reasonable price) company. HOKA is seeing strong traction lately and the increasing brand awareness should continue to drive growth. The fact that the company owns multiple respectable brands also diversifies the risk of relying too heavily on either brand. Its latest earnings remain solid as HOKA led the top-line growth while the bottom line benefited from improving operating leverage. Despite the massive rally in the past few months, its current valuation is still discounted compared to peers, especially when you also consider its fundamentals and growth. Therefore, I rate the company as a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.