Integral Ad Science: Limited Upside After The 100% Rally

Summary

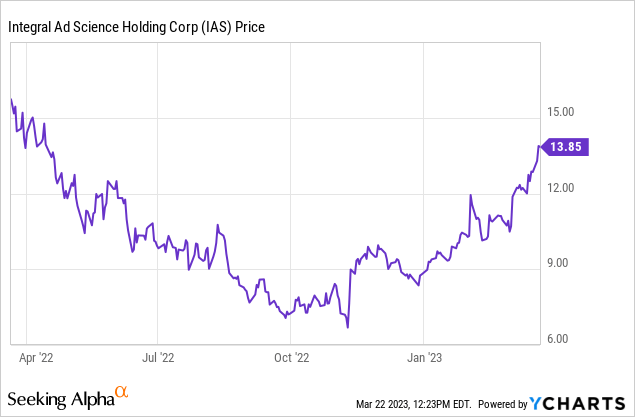

- Integral Ad Science has rebounded almost 100% from its 52-week low in September.

- The company operates in the fast-growing ad fraud niche that continues to provide solid tailwinds.

- It demonstrated strong resilience in its latest earnings with double digits growth in both the top and bottom lines.

- However, the current valuation looks elevated.

- I rate the company as a hold.

GOCMEN

Investment Thesis

Integral Ad Science (NASDAQ:IAS) has rebounded over 100% since hitting its 52-week low in September last year. It is benefiting from the increase in ad fraud, as the adoption of digital advertising continues to grow. The company's solutions are also critical in the advertising ecosystem, which gives them much stronger resilience compared to other digital advertising companies. The strength is translated to its latest earnings, as it reported solid growth despite facing tough headwinds from the slowing advertising market. However, the current valuation looks elevated after the rally and the growth rate does not look strong enough to support further multiple expansion. I believe the upside is limited therefore I rate the company as a hold.

Why Integral Ad Science?

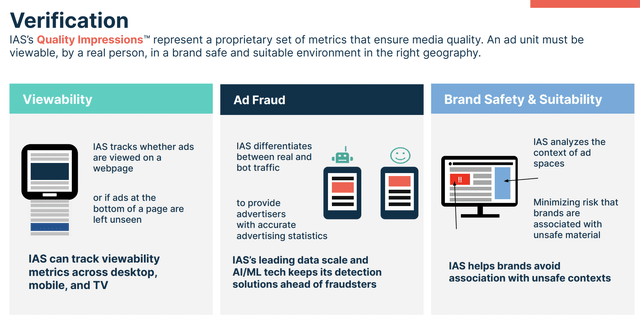

Integral Ad Science is a New York-based digital advertising company founded in 2009. The company specializes in the ad fraud space, which is a relatively unknown but fast-growing niche. It provides solutions for fraud, viewability, brand safety, and targeting to publishers and brands. For example, it can differentiate whether the web traffic is real, or whether the ad is displayed in an unsafe context that could harm the brand. The company currently has over 2,100 customers across the world, including blue-chip companies such as Microsoft (MSFT), Meta Platforms (META), and Disney (DIS).

The company has a critical position in the digital advertising ecosystem, as it offers substantial value to both publishers and advertisers. It is a safeguard for publishers which verify that the advertisements on their platform are viewable, fraud-free, and brand safe. For example, streaming giant Netflix (NFLX) recently partnered with the company for its viewability and traffic verification solutions. On the other hand, it also helps advertisers maximize their ROI (return on investments) through contextual targeting, which ensures the ads they paid for are displayed at a relevant place.

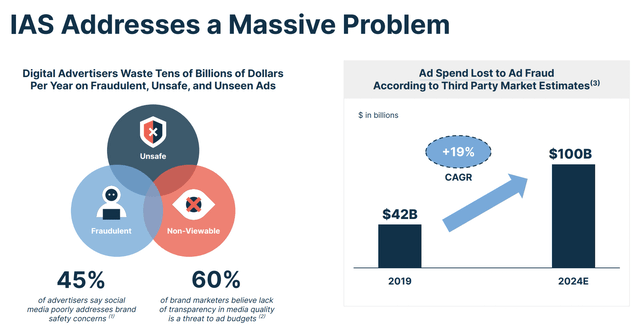

The ad fraud market also presents a huge opportunity for the company. As the adoption of digital advertising continues to increase in the past few years, the amount of ad fraud has also risen significantly. According to the company, advertising spending lost to ad fraud is estimated to grow from $42 billion in 2019 to $100 billion in 2024, which represents a CAGR (compounded annual growth rate) of 19%. The ongoing increase in ad fraud should provide strong tailwinds as it boosts the demand for the company's solutions.

Q4 Earnings

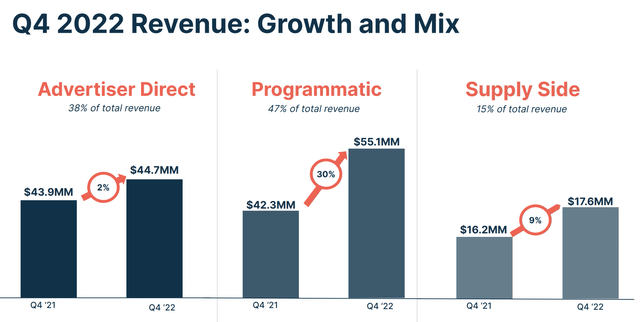

Integral Ad Science announced its fourth-quarter earnings earlier this month and the results are pretty solid considering the backdrop of the advertising market. The company reported revenue of $117.4 million, up 15% YoY (year over year) compared to $102.5 million. The growth is mostly driven by the programmatic segment, which grew 30% from $42.3 million to $55.1 million. Revenue from Supply Side also increased by 9% from $16.2 million to $17.6 million. Advertiser Direct was the softest segment due to shrinking ad budgets. It only grew 2% from $43.9 million to $44.7 million. Net revenue retention rates remain healthy at 118%. The gross profit increased 11% YoY from $86.1 million to $95.5 million, or 81% of revenue.

The bottom line was also strong as operating spending moderated. Operating expenses for the quarter were $110.1 million, up only 5.3% YoY compared to $104.6 million. Most of the increase is attributed to S&M (sales and marketing) expenses, which grew 20.9% from $23.4 million to $28.3 million. This was partially offset by D&A (depreciation and amortization) expenses, which declined 25.6% from $17.2 million to $12.8 million. The slower increase in spending resulted in the adjusted EBITDA rising 20% YoY from $33.4 million to $40 million. The adjusted EBITDA margin edged up 100 basis points from 33% to 34%. The company also flipped from a net loss of $(4.8) million to a net income of $11.5 million, or 9.8% of revenue. The diluted EPS was $0.07 compared to $(0.03).

Investors Takeaway

I believe Integral Ad Science is a hidden gem in the digital advertising market with solid growth opportunities, as it continues to benefit from the increase of ad fraud. Its unique position in the industry should provide stronger resilience compared to peers. Despite the decline in advertising spending, the company still reported decent growth rates on both the top and bottom line. However, the current valuation look stretched after the massive rally in the past few months. It is currently trading at an EV/EBITDA ratio of 31.62x, which is quite elevated for a company with mid-teens growth rates. For context, digital advertising peers such as Perion Networks (PERI) are trading at an EV/EBITDA ratio of just 11.66x while posting similar growth rates. I believe the valuation will likely limit its upside potential therefore I rate the company as a hold.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.