Qualcomm's Dividend Increase: A Positive Sign But Not A Silver Bullet

Summary

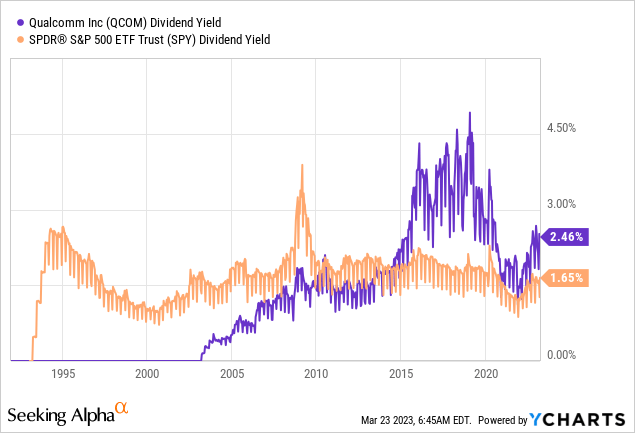

- Following the recent 7% increase in its annual dividend, Qualcomm has appeared on the radar for attractive dividend plays.

- The current yield is among the highest in the sector and also appears safe based on historical data.

- Looking ahead, however, there are a number of important risks that overshadow Qualcomm's ability to consistently increase its dividend.

- Looking for more investing ideas like this one? Get them exclusively at The Roundabout Investor. Learn More »

Justin Sullivan

Semiconductors is rarely the place that comes to mind when it comes to high and stable dividend payments.

It is a highly cyclical industry where most investors are looking for exciting growth opportunities and the next hot product to power-up autonomous vehicles, mobile devices, 5G networks etc.

Qualcomm Investor Presentation

At first, Qualcomm Inc. (NASDAQ:QCOM) growth profile appears very attractive as the company is right in the middle of these trends. In reality, however, with a total revenue of $43bn Qualcomm is one of the largest publicly traded semiconductors companies - following TSMC (TSM) and Intel (INTC).

Thus QCOM is now much closer to being considered a mature company as opposed to a high-growth tech name.

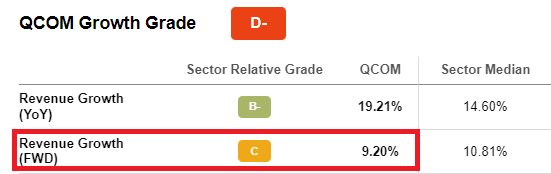

Seeking Alpha

Indeed, a 9.2% forward revenue growth rate is far from being considered low, but given the rapid push towards digitalization in recent years, QCOM's organic revenue growth is far more likely to be below this number in the following years than to be above it.

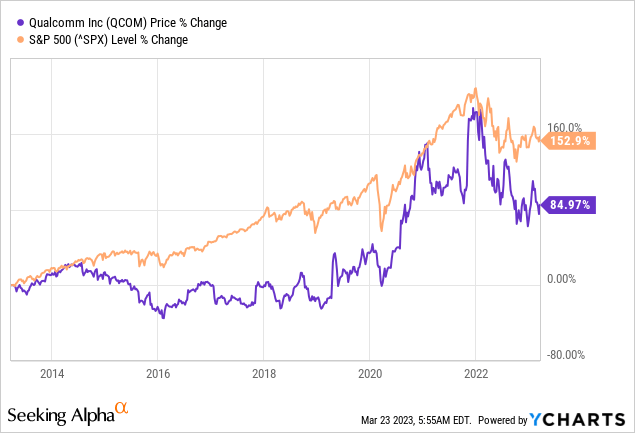

At the same time, QCOM as a stock has not offered an attractive capital appreciation over time. For the past 10-year period, QCOM has lagged the S&P 500 by a very wide margin. Only when the pandemic hit, the company was able to temporarily ride on the wave of a rapid digitalization push, but that didn't last for long.

That is why, the management is now focused on growing the dividend in order to attract investors. The 7% increase earlier this month is hardly a coincidence and provides an anchor for the share price as long as it remains safe.

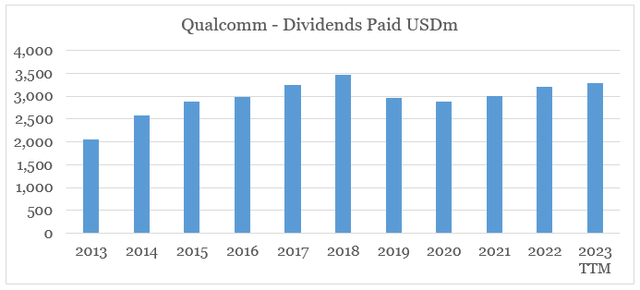

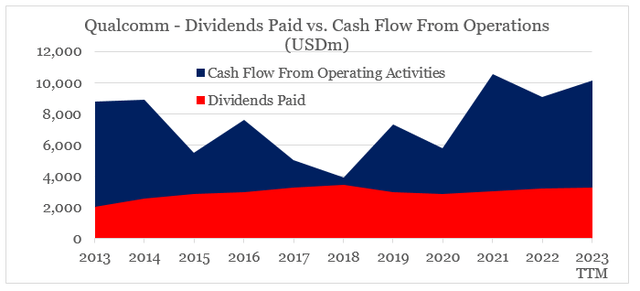

Turning QCOM into an attractive dividend growth company, however, would be easier said than done as management has mostly relied on its share repurchase program to increase the dividend per share. As we see in the graph below, the total annual dividend payments have not changed materially for a very long time.

prepared by the author, using data from Seeking Alpha

How Attractive Is QCOM's Dividend?

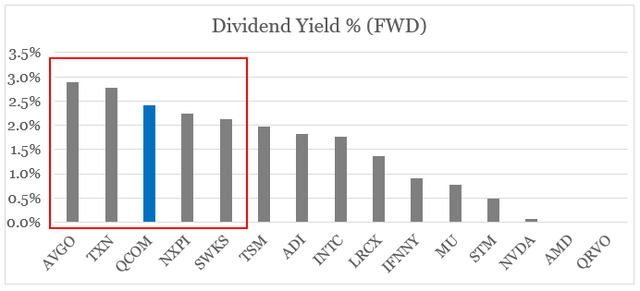

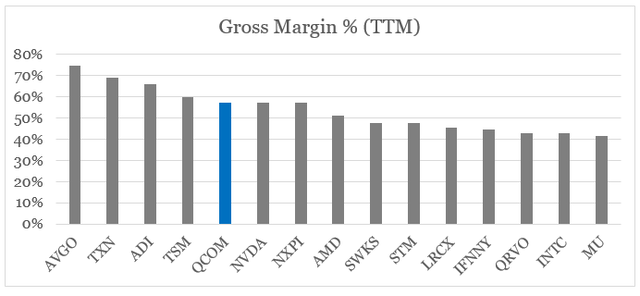

Having said that, we should note that QCOM is now among the most attractive dividend stocks within the semiconductors space when considering yield alone.

The forward dividend yield of almost 2.5% makes the company the third most attractive after Broadcom (AVGO) and Texas Instruments (TXN).

prepared by the author, using data from Seeking Alpha

Although on a historical basis the yield well-below its peaks, it is still much higher than the broader equity market.

When it comes to safety, the interest coverage of nearly 28 times is a strong indicator that Qualcomm's dividend could sustain a major downturn in earnings.

What's more important, however, is that QCOM also has one of the highest gross margins within its broader peer group.

prepared by the author, using data from Seeking Alpha

I have recently showed why gross margins are one of the most important indicators for success in the semiconductors space. When high gross margin is combined with other metrics from the cash flow statement, they could explain why are some semiconductor stocks more protected than others during market downturns.

This also results in Qualcomm's dividend being well-covered by its cash flow from operations, with annual dividend payments currently standing at roughly a third of the company's cash flow.

prepared by the author, using data from Seeking Alpha

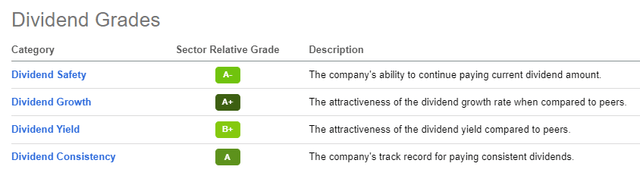

Overall, the dividend appears safe and Qualcomm could be in a good position to continue delivering annual increases for the time being. All that in combination with the current high yield are the reasons why broader dividend grades of are so high.

Why Qualcomm Might Not Be A Dividend Growth Stock For Long?

Overall, semiconductors space remains a relatively high risk area for anyone looking for sustainable long-term dividend.

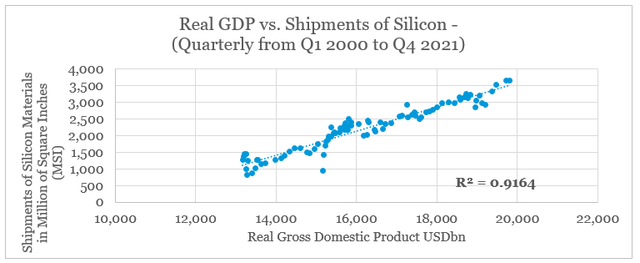

Even though, technology has become entrenched in our daily lives and semiconductors are becoming more of a necessity as opposed to a discretionary item, overall silicon shipments still exhibit very strong relationship with real GDP.

prepared by the author, using data from semi.org and FRED

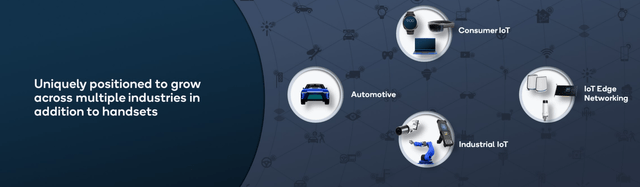

Qualcomm could be at even higher risk of an economic slowdown as the majority of its revenue is related to areas such as mobile devices & other consumer electronics and the automotive industry. These sectors are highly dependent on the overall level of discretionary consumer spending, which is very sensitive to the economic cycle.

Qualcomm Investor Presentation

But that's hardly a reason to simply ignore everything said in the first section.

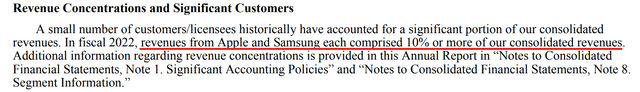

Another area of concern when it comes to the dividend is the high revenue concentration for a company the size of Qualcomm.

The recent truce between QCOM and Apple (AAPL) was very good news for shareholders, but it also was the perfect example of all the risks associated with relying on 1 or 2 large customers.

In spite the fact that the two companies reached a settlement that involves Apple paying QCOM, the latter's revenue from licensing (QTL segment) fell from $7.7bn in 2016 to $6.4bn in fiscal 2022.

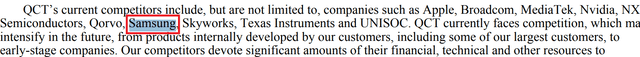

In addition to Apple, Samsung is also among one of the major customers of QCOM that are also its main competitors.

From a revenue standpoint, the two companies represent a major risk for Qualcomm going forward.

And as more countries vie for on-shoring of semiconductors capacity, Qualcomm could face sustained headwinds going forward.

The last point that I would like to raise is regarding Qualcomm's capital allocation, which in my view is the most immediate impediment in front of Qualcomm's sustained dividend growth.

Overall, in fiscal 2022 the company spent roughly half of its free cash flow on dividend payments and another other half on share buybacks.

We executed on our capital return commitments, returning 93% of our free cash flow, including $3.2 billion in dividends and $3.1 billion in stock repurchases.

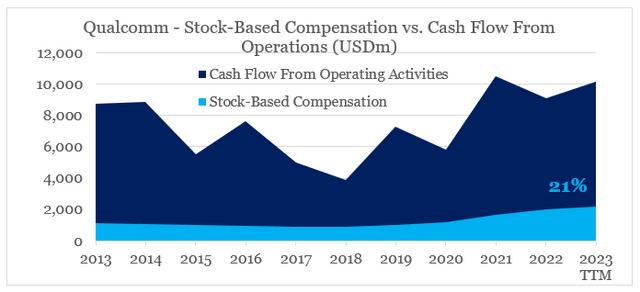

A major problem here stems from the fact that Qualcomm's stock-based compensation of $2.2bn represents more than a fifth of the company's cash flow from operations. At 21% it is one of the highest ratios within the industry.

prepared by the author, using data from Seeking Alpha

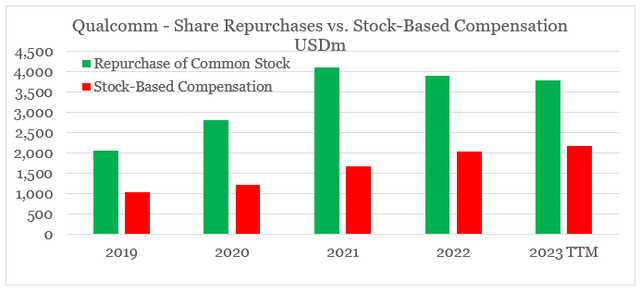

As the stock-based compensation skyrocketed in recent years, Qualcomm's annual share buybacks were increasingly used to offset shareholder dilution.

prepared by the author, using data from Seeking Alpha

All else being equal, this might not be such a pressing issue for the dividend, however, as we saw in the first section of this article - Qualcomm relied heavily on its high share repurchase program to increase its dividend per share. Therefore, should the amount of stock-based compensation remain elevated, QCOM's ability to sustainably increase its dividend is likely to be limited.

Conclusion

Following the recent dividend increase, it appears that Qualcomm's stock could be an attractive dividend growth opportunity. Although the current yield is one of the higher within the industry and dividend payments appear safe, I still have a hard time considering QCOM as an attractive dividend stock. From the Even if the risk of a recession does not materialize and the company does not experience any other difficulties related to its customer base, the high amount of stock-based compensation overshadows QCOM's ability consistently increase its dividend payments over the medium term.

Looking for better positioned high quality businesses in the semiconductors space?

You can now gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

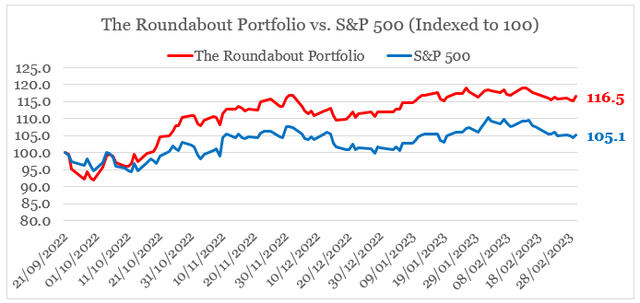

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.

This article was written by

Vladimir Dimitrov is a former strategy consultant with a professional focus on business and intangible assets valuation. His professional background lies in solving complex business problems through the lens of overall business strategy and various valuation and financial modelling techniques.

Vladimir has also been exploring the concept of value investing and in particular finding companies with sustainable competitive advantages that also trade below their intrinsic value. He supplements his bottom-up approach with a more holistic view of the markets through factor investing techniques.

Vladimir made his first investment in farmland right out of high school in 2007 and consequently started investing through mutual funds at the bottom of the market in 2009. In the years that followed he has been focused on developing his own investment philosophy and has been managing a concentrated equity portfolio since 2016. Vladimir is LSE Alumni and a CFA charterholder .

All of Vladimir's content published on Seeking Alpha is for informational purposes only and should not be construed as investment advice. Always consult a licensed investment professional before making investment decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the company's SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.