Tencent: On The Road To Recovery With An Advertising Rebound

Summary

- Tencent is the largest social media and gaming company in China.

- The company reported solid financial results for Q4,22 with a beat on both revenue and earnings, according to Google Finance data.

- Online advertising had a strong recovery in Q4,22 with ad revenue increasing by 15% year-over-year to $3.6 billion (RMB 24.6B).

- Its video subscription revenue rose year-over-year driven by ARPU growth and adjusted membership pricing.

- Tencent is the third largest cloud infrastructure provider in China, with ~16% market share.

VCG

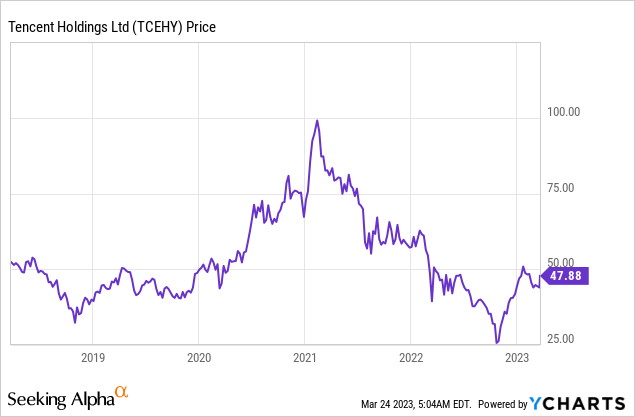

Tencent (OTCPK:TCEHY) is often referred to as the "Facebook of China" and the is largest social media company in the country. But unlike Facebook or Meta (META), Tencent is much more diversified and is the largest gaming company in China, and one of the largest in the world. The company has faced a tough time over the past year due to a variety of headwinds, related to domestic gaming curfews and a tepid advertising market. However, now Tencent's revenue looks to be stabilizing as the company beat both top and bottom line estimates in Q4,22. Tencent also has a plethora of investments in other major technology companies globally which diversifies assets outside of China. This includes owning ~5% of Tesla (TSLA), 6.8% of Spotify (SPOT), 15.1% of NIO (NIO), 10% of Brazils NuBank (NU), and many more. I estimate the value of these long-term investments to be ~$98.5 billion, which is substantial. Given Tencent has a market capitalization of ~$459 billion, ~20% of its value is driven by these investments, which are often overlooked by the market. Many have called Chinese stocks "uninvestable" but JPMorgan recently revealed its "active China" ETF, which has Tencent as the No. 1 holding at 9.44%. Thus in this post, I'm going to break down Tencent's fourth quarter financial results before revealing my valuation model and forecasts for the stock.

Improving Financials

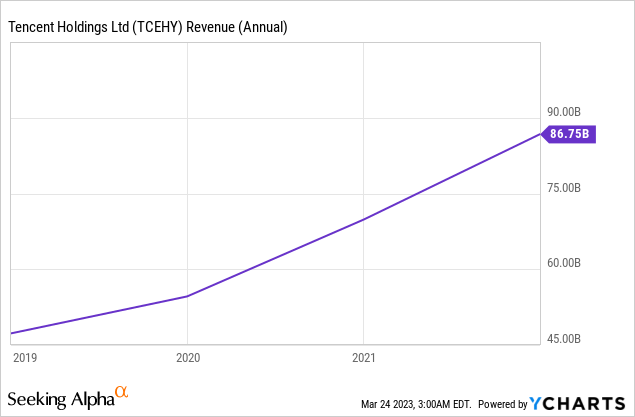

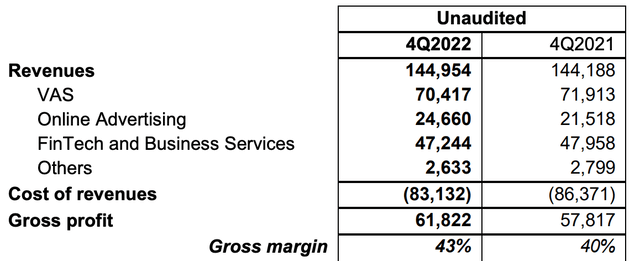

Tencent reported mixed financial results for the fourth quarter of 2022. Total revenues were $20.8 billion (RMB 145B), which rose by 0.5% year over year in RMB, or declined by 7.37% on a U.S. dollar basis. This was despite revenue actually beating analyst forecasts by 0.76%, according to Google Finance data. Another positive is its revenue "growth rate" was not as bad as the negative 10.81% reported in Q3.22. Therefore it looks as though revenue seems to be stabilizing.

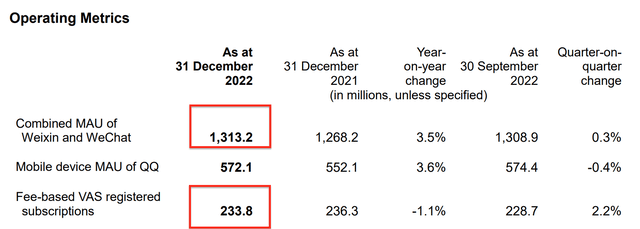

Breaking down revenue by segment, its Value Added Services - VAS - contributed 49% of the revenue and thus I will focus on this segment first. Its overall VAS revenue was $10.3 billion (RMB 70.4B), which actually declined by 2% year over year. This was mainly driven by a 1.1% decline in subscriptions to 233.8 million. Users going through a "subscription purge" is not uncommon during changing economic times and thus I don't deem this to be a major surprise. A positive is its VAS subscriptions are actually up 2% quarter over quarter, which could be an early signal of a recovery.

Tencent also reported a 2% decline in social network revenue, which dropped to $4.2 billion (RMB 29B) and contributed 20% of the total. This was surprising given the company has continued to grow its monthly active users (MAUs) of its WeChat and Weixin platforms which increased to a staggering 1.3 billion, up 3.5% year over year. Therefore I will reason that Tencent must have seen a decline in "sticker purchases" which are often used to enhance the instant messaging of platforms such as WeChat.

Operating metrics (Q4,22)

Its QQ (social messaging app) also reported a 3.6% increase in monthly active users to 572.1 million, which was fantastic. I believe this was driven by new "Metaverse" focused features such as its "Super QQ Show Avatar," This basically enables users to create their own custom avatar and then communicate together in a simulated environment, which looks a lot like the classic game "Sims," in my opinion. The technology uses motion capture and adds an extra element of interactivity to a normal video call. I forecast China to be a strong growth market for the "metaverse" given the huge popularity of gaming in the country and thus Tencent is poised to benefit as a result.

QQ Super Avatar Chat (QQ inf)

Speaking of gaming, which is included in the VAS segment also, its domestic gaming segment contributed 19% of revenue or $4 billion (RMB 28B) which declined by 6% year over year. This was mainly driven by lower "gross receipts" in the prior quarter which "flowed through," according to the earnings call. I believe Tencent's domestic gaming market is still feeling the impact of the government curfew for minors introduced, which only allows three hours of gaming to be played per week. This was introduced to try and stop "gaming addiction" which is prevalent across China and increase the productivity of China's youth. A positive is Tencent's games such as Honor of Kings and Dungeon & Fighter performed positively in the past couple of months. In addition, the company launched the survival game "Undawn" in February 2023. This game has been successful so far and is ranked first (by gross receipts) for new games released in China, in 2023.

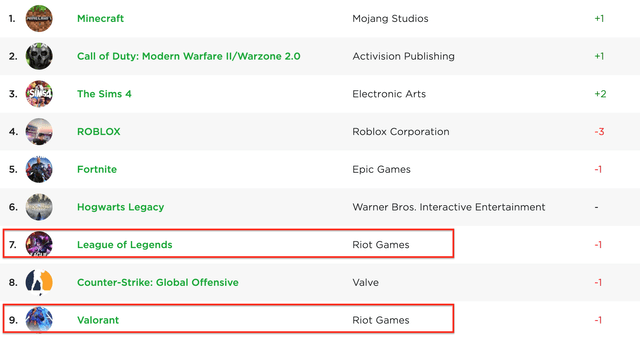

Tencent's international gaming revenue contributed to 10% of its total revenue and increased by a solid 5% year-over-year to $2 billion (RMB 14B). This doesn't surprise me as Tencent is really trying to position itself more as an international gaming provider, given the challenges in its domestic market. Upon further research, I discussed two major franchises League of Legends and Valorant are ranked No. 7 and 9 and the world's most popular games by monthly active users. These games are of course developed by Riot Games, which is a Tencent subsidiary. Tencent also owns stakes in western game publishers such as Ubisoft (OTCPK:UBSFY) (Assassin's Creed Franchise) and Activision Blizzard (ATVI) (World of Warcraft).

Tencent also recently launched Warhammer Darktide, which has fairly good reviews by IGN, at eight out of 10 stars. Its mobile game NIKKE: Goddess of Victory, also has been extremely popular and ranked first internationally by gross receipts for mobile, according to Tencent. The positive reviews don't surprise me. I imagine this game is very popular, especially among the male demographic. It's also differentiated in that it has taken a different spin on the usual male-dominated shooter games. Thus I forecast this game to continue to gain traction, as it was only released in November 2022.

Gaming Tencent (Q4,22 report)

Online advertising has shown a strong recovery in Q4,22 with its revenue increasing by 15% year over year to $3.6 billion (RMB 24.6B). This was driven by a sharp recovery in China's advertising spending as well as strong demand for Tencent's in-feed video ads and "mini program" advertisements. These features were enhanced by improvements in Tencent's AI-based algorithms, which I believe is a competitive advantage. This is because machine learning models are enhanced by "big data" and thus as Tencent is the social networking leader in China, it has more user data than any other company.

Revenue by segment, RMB millions (Q4,22 )

Tencent's third segment, Fintech, and Business Services, reported revenue of $6.9 (RMB 47B), which declined by 1% year over year. A positive is its pure Fintech revenue increased quarter over quarter, which could be early signs that the Chinese consumer is returning, after the "hard lockdown" policy is finally being tempered across China, after a series of protests.

Margins and Balance Sheet

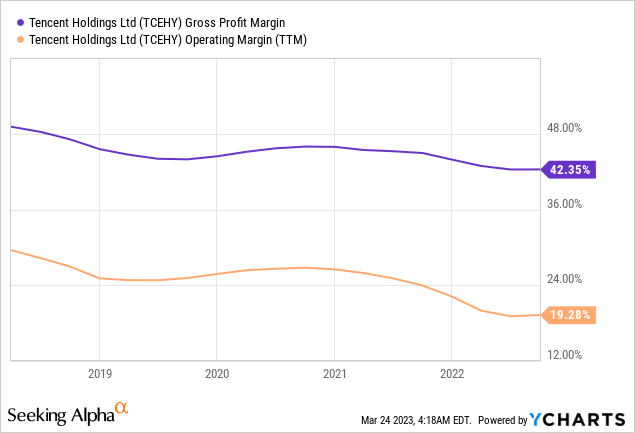

Tencent reported solid profitability improvements in Q4,22. On a non-IFRS basis, its gross profit margin increased by 3% year-over-year to 43%. This was driven by a 6.5% increase in its Fintech and Business Services gross margin to 33.6%, which was driven by efficiency improvements. In addition, its online advertising gross margin rose by 1.5% to 44.2% due to the aforementioned demand for in-feed video adverts.

Its operating profit rose by a rapid 19% year over year to $5.7 billion (RMB 39.4B), which was a positive sign. This was driven by improved focus by management on reducing costs across the board and improving efficiency. Given the current macroeconomic climate, I believe this was positive as investors want to see "more profits" and would happily sacrifice growth in the short term.

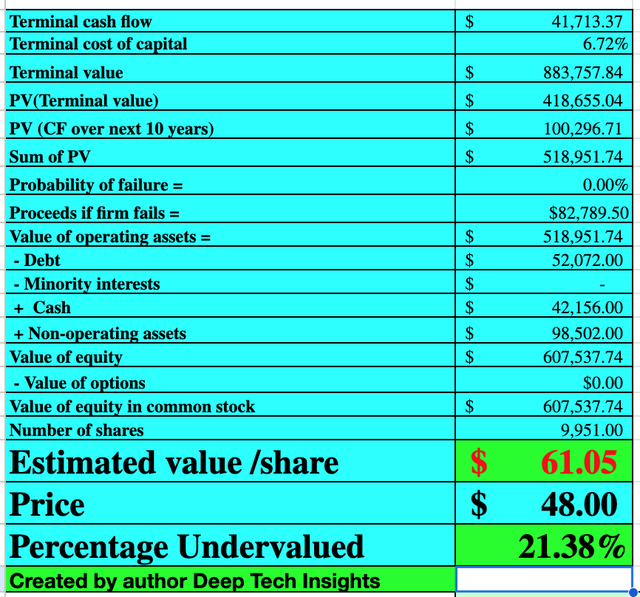

Tencent has a robust balance sheet with $42.16 billion in cash and short-term investments. The company does have ~$52 billion in total debt, but the vast majority of this ~$45.3 billion is long-term debt and thus manageable. Keep in mind, this is not including Tencent's vast range of investments into other stocks (Tesla, NIO etc) as mentioned prior which I estimate to be valued at ~$98.5 billion, which is substantial.

Valuation and Forecasts

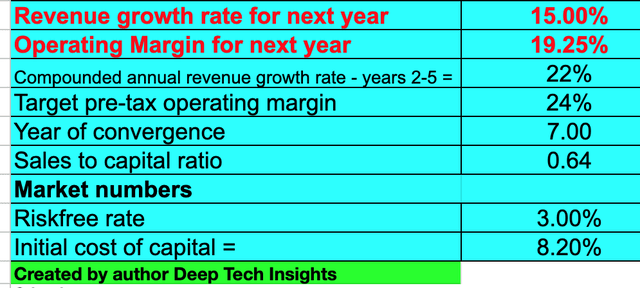

In order to value Tencent I have plugged its latest financial data into my discounted cash flow valuation model. I have forecast 15% revenue growth for "next year," which is for the full year of 2023. I have forecast this to be driven by a more favorable comparison and the current stabilization trends in revenue. In addition, I forecast continued growth in the international gaming segment, as well as a continued rebound in the advertising market, as China eases its hard lockdowns. In years 2 to 5, I have forecast a faster growth rate 22% per year. This may seem optimistic, but keep in mind Tencent grew its revenue by a rapid 36% in 2020, and 19% in 2021, thus I don't deem this to be too crazy. Especially given the tailwinds in the cloud industry, which is still a small part of Tencent's overall revenue but has huge potential.

Tencent stock valuation 1 (Created by author Deep Tech Insights)

In order to increase the accuracy of my model, I have capitalized R&D expenses which has boosted net income. I have forecast a 24% pre-tax operating margin over seven years, which should be achievable if the current efficiency trends we have seen in Q4,22 continue.

Tencent stock valuation 1 (Created by author Deep Tech Insights)

Given these factors I get a fair value of $61 per share, the stock is trading at $48 per share at the time of writing and thus it is just over 21% undervalued, according to my model and forecasts.

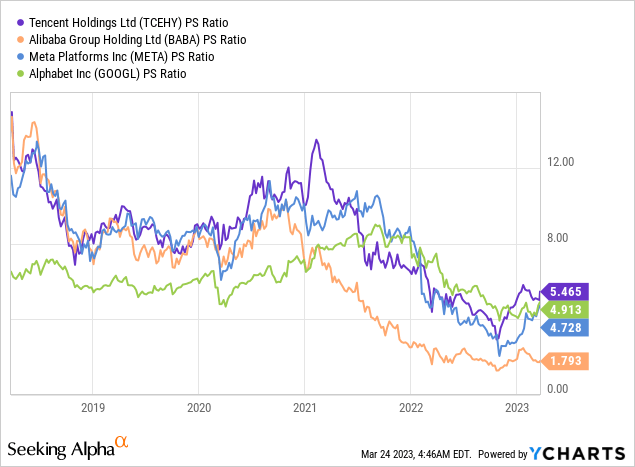

The stock also trades at a price-to-sales [P/S] ratio = 5.67 which is 88% cheaper than its 5-year average. Surprisingly Tencent is trading at a slightly higher valuation than U.S peers Meta and Alphabet (GOOG) (GOOGL), although those businesses are facing major headwinds from a cyclical decline in the advertising market.

Risks

China Country Risk

Any investment into a "Chinese stock" comes with a country risk. This includes political issues, from both the communist party in China, as well as SEC issues for U.S listed companies. Many Chinese stocks also are listed via an ADR or American Depository Receipt. This means you're effectively investing in a shell company (usually based in the Cayman islands) that has a revenue rights contract with the company in mainland China. Often these reasons are why Chinese stocks tend to trade at a discount.

Final Thoughts

Tencent is one of China's greatest companies and a major technology giant. The company has faced a series of headwinds, but it now looks to be on a "road to recovery." Its rebound in advertising revenue is a positive sign and I believe its international gaming segment can be extremely lucrative. I expected its fintech revenue to rebound strongly as China's economy is forecast to grow. Given my valuation model and forecasts indicates the stock is undervalued at the time of writing, I will deem it to be a great long-term investment.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.