General Mills: Recent Quarterly Results Highlight Some Important Areas Of Progress

Summary

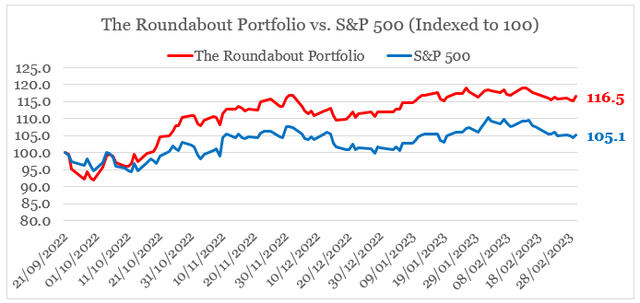

- General Mills continues to perform exceptionally well relative to the broader equity market.

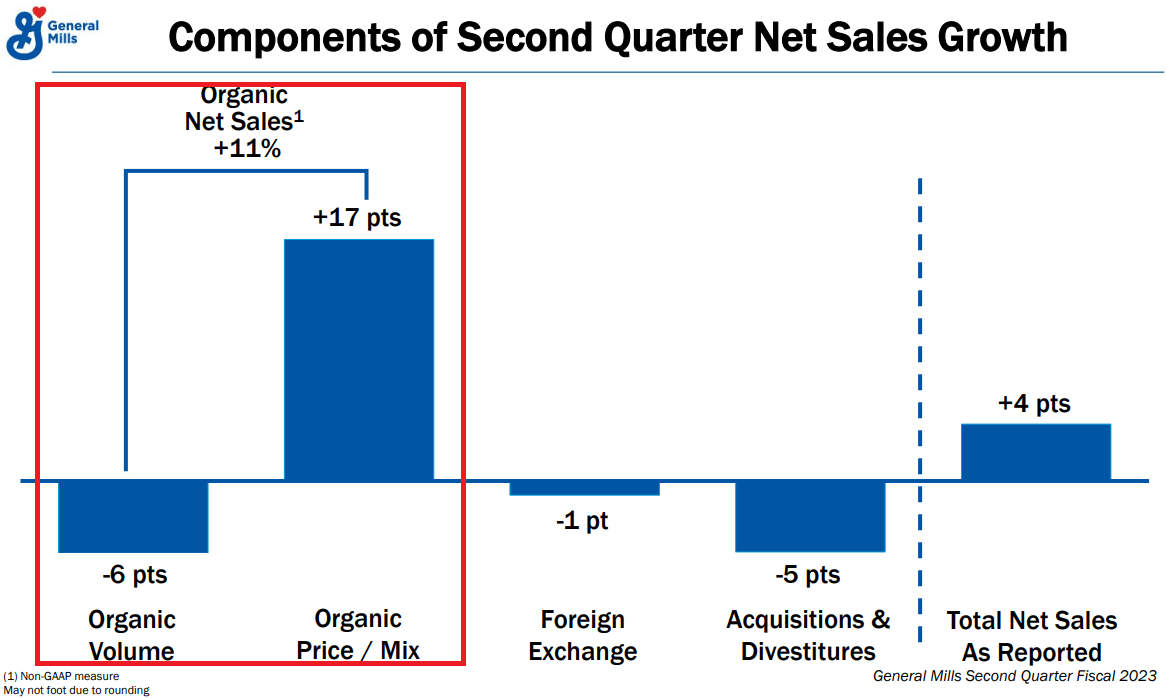

- The ability to offset a record high input cost inflation highlights the importance of a strong brand portfolio in strategic areas.

- As volumes return to positive territory, profitability in the pet food segment remains an area of concern.

- Looking for a portfolio of ideas like this one? Members of The Roundabout Investor get exclusive access to our subscriber-only portfolios. Learn More »

Melissa Kopka

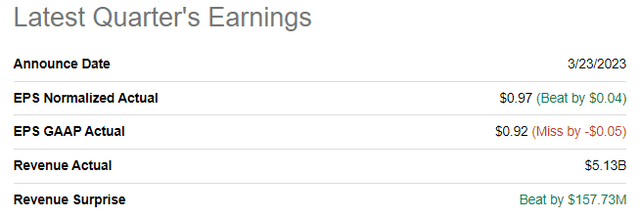

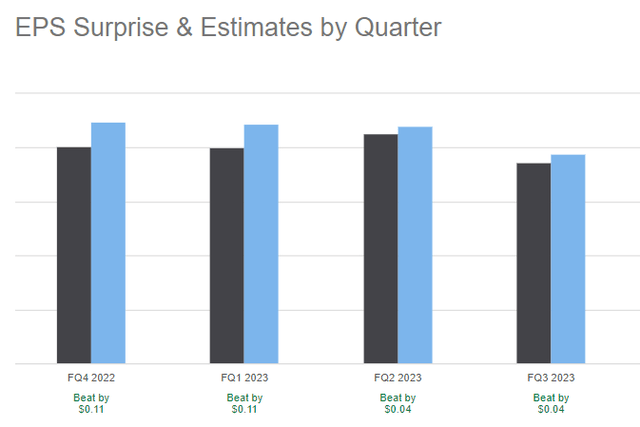

Earlier this week General Mills (NYSE:GIS) delivered yet another strong quarter with both revenue and adjusted Earnings per Share )(EPS) surpassing the consensus estimate.

The business continues to execute well on its strategy, in spite of short-term headwinds related to higher commodity prices. Just a month later since my previous analysis and GIS' share price is already trading with a wide gap between the S&P 500.

For the past two years or so, this performance gap is even more impressive (see below) and as the odds of a recession increase, GIS is likely to remain a solid pick in the Packaged Food space.

What Happened During The Quarter?

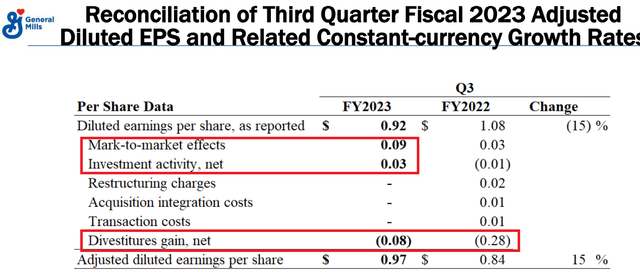

On a GAAP basis, however, the earnings actually missed the estimates and came in lower than previous quarters.

On one hand, the reason for the discrepancy between reported and Non-GAAP numbers has been mark-to-market effects (more on that below).

On the other hand, reported earnings per share came in lower to prior quarters largely due to divestiture gains related to the European yogurt business in the third quarter of fiscal 2022.

General Mills Investor Presentation

The mark-to-market effects were due to outside factors largely related to rising commodity prices.

In the third quarter of fiscal 2023, we recorded a $67 million net increase in expense related to the mark-to-market valuation of certain commodity positions and grain inventories compared to a $20 million net increase in expense in the same period last year. We recorded $20 million of net losses related to valuation adjustments on certain corporate investments in the third quarter of fiscal 2023, compared to $11 million of net gains related to the sale of certain corporate investments and valuation adjustments in the third quarter of fiscal 2022.

Source: General Mills Q3 2023 Earnings Release

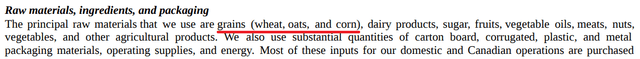

The main raw materials used by General Mills are grains, such as wheat and corn, dairy products, sugar, etc.

From these, wheat has already peaked in the first half of last calendar year and has cooled-off significantly since then.

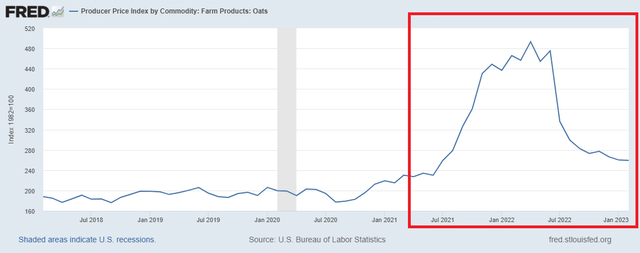

Oat prices have come down even more in the past few months.

Nonetheless, the price of corn remained at its peak levels and as we could see down below this also holds true for a number of other major ingredients.

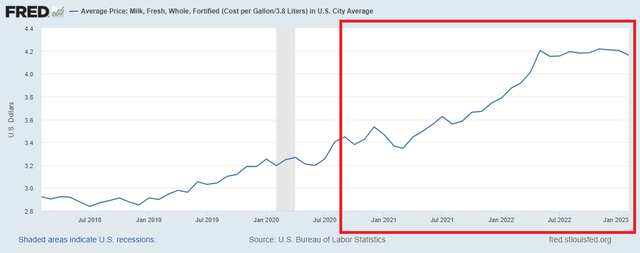

There are different dairy products that are used by GIS, however, the average price for milk has reached its peak around mid-2022 and has stayed at these levels since then.

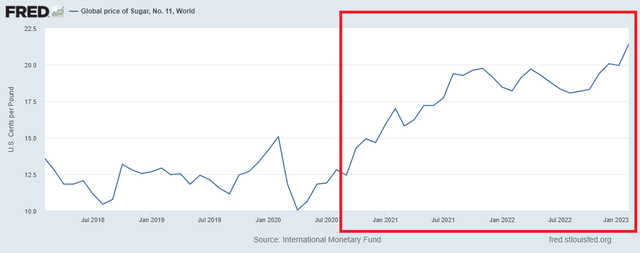

General Mills sources most of its sugar from local suppliers, however, the global price of sugar is now at its highest levels for the past few years.

Overall, even though some commodity prices have come down from their peaks, the synchronized increase in prices of other materials is likely to continue to weigh on GIS earnings.

Looking past the short-term headwinds, however, the company's strong brand portfolio and strategic positioning should allow management to offset these higher input costs through the recently implemented price increases.

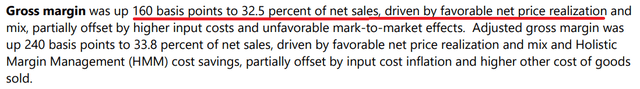

General Mills Investor Presentation General Mills Earnings Release

What About The Red Flags?

Two key areas of concern that I highlighted a month ago, were the falling volumes and issues within the company's pet food segment.

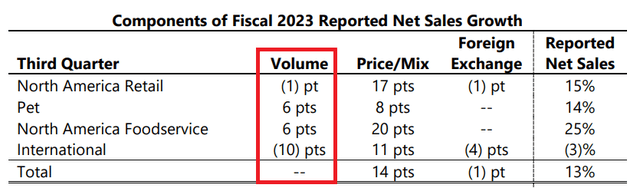

During the last quarter, volumes have stabilized with Pet Food and Foodservice back returning to growth.

General Mills Earnings Release

Thus the overall impact of volumes remained flat for the quarter, but at the same time the effect of price/mix on organic growth remained exceptionally high.

General Mills Investor Presentation

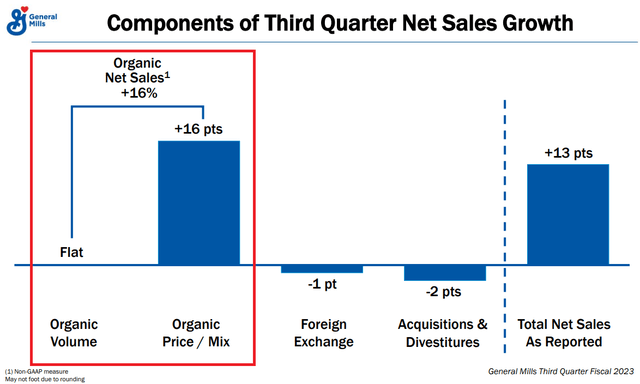

This is now more in-line with other high quality peers and is in stark contrast to the problems experienced during the prior three-month period.

General Mills Investor Presentation

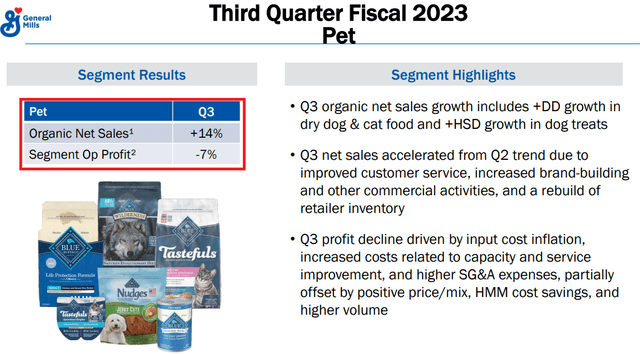

Profitability challenges in pet food, however, remain with the segment operating profit noting a 7% decline during the quarter.

General Mills Investor Presentation

As expected, inflationary pressures were to blame, but capacity expansion is also needed as demand for pet food more broadly remains robust.

On the bottom line, third-quarter Pet segment operating profit declined 7 percent, driven primarily by double-digit input cost inflation, increased costs related to capacity expansion and service improvement, and higher SG&A expenses, including a double-digit increase in media investment.

Source: General Mills Q3 2023 Prepared Remarks

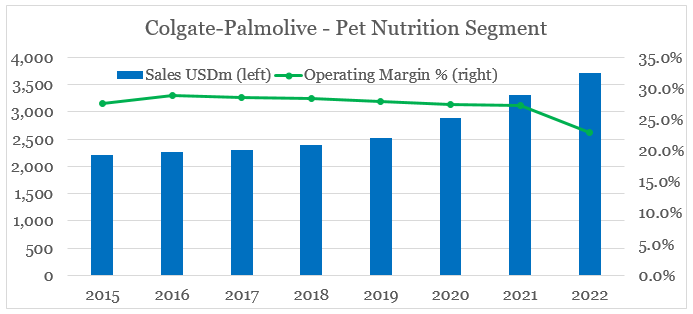

General Mills' major peer in this category - Colgate-Palmolive's (CL) Hill's brand also noted a slight decline in margins during 2022, but seems to be getting ahead in terms of capacity expansion in both dry and canned categories.

prepared by the author, using data from SEC Filings

So far, GIS management does not see a more temporary issue in the category and also attributed recent weakness to broader market dynamics (see below). Nonetheless, capacity expansion, market share and input costs in the pet food segment remain key areas to watch through the rest of fiscal year 2023 and 2024.

And so, we really don't see a lot of trade down to private label, for example, or lower-priced brands. I mean it really is a function if there's a change in the category dynamics is that more people are going back to the office, and so mobility is a little bit higher. And so there's a little bit of feeding of wet dog food, for example, and more dry dog food and maybe a little bit less treating because people, again, are at their place of work more.

Source: General Mills Q3 2023 Earnings Transcript

Conclusion

Uncertainty around future commodity prices and economic activity is likely to remain elevated in the coming months. Nevertheless, GIS is well-positioned to offset the higher input costs through price increases. The only area where this is not yet the case is pet food, hence investors should be laser focused on future profitability in this segment.

Looking for similar high quality businesses in the consumer staples space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.

This article was written by

Vladimir Dimitrov is a former strategy consultant with a professional focus on business and intangible assets valuation. His professional background lies in solving complex business problems through the lens of overall business strategy and various valuation and financial modelling techniques.

Vladimir has also been exploring the concept of value investing and in particular finding companies with sustainable competitive advantages that also trade below their intrinsic value. He supplements his bottom-up approach with a more holistic view of the markets through factor investing techniques.

Vladimir made his first investment in farmland right out of high school in 2007 and consequently started investing through mutual funds at the bottom of the market in 2009. In the years that followed he has been focused on developing his own investment philosophy and has been managing a concentrated equity portfolio since 2016. Vladimir is LSE Alumni and a CFA charterholder .

All of Vladimir's content published on Seeking Alpha is for informational purposes only and should not be construed as investment advice. Always consult a licensed investment professional before making investment decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.