Amgen: Revenue Growth Potentials And Financial Performance

Summary

- Despite lower EPS in 4Q 2022 compared with 4Q 2021, Amgen’s full-year 2022 financial results were strong.

- Amgen increased its free cash flow of $8381 million in 2021 by 4% in 2022 and thus, provided the opportunity for more distributions.

- Due to the acquisition of Horizon Therapeutics, I expect the company’s revenues to increase in the second half of the year.

- The negative effect of the foreign exchange on AMGN’s sales in 2023 is expected to be lower than in 2022.

- AMGN stock is a buy.

hapabapa/iStock Editorial via Getty Images

Amgen (NASDAQ:AMGN) stock price increased from below $230 on 30 September 2022 to more than $290 on 8 November 2022, then dropped to $230 again. Despite higher product sales and flat total revenues, the company's 4Q 2022 net income was 15% lower than its 4Q 2021 net income, driven by increased operating expenses and higher interest expenses. However, on a full-year basis, AMGN's 2022 results were significantly stronger than in 2021. The company's full-year 2022 GAAP EPS increased by 18% YoY to $12.11 and is expected to be between $13.16 to $14.41 in 2023. I expect the negative effect of foreign exchange on AMGN's product sales to reduce in 2023. More importantly, in a few months, the acquisition of Horizon Therapeutics is expected to be completed. The acquisition could increase Amgen's revenues significantly in the international and domestic markets. The stock is a buy.

Quarterly results

In its 4Q 2022 financial results, Amgen reported total revenues of $6839 million, compared with $6846 million in the same period last year. AMGN's 4Q 2022 total revenue benefited from a 4% higher product sales (driven by increased volume sales partially offset by lower selling price and the negative impact of the appreciated USD against other major currencies). However, the company's 4Q 2022 total revenue was negatively affected by lower revenue from COVID-19 manufacturing collaboration. It is worth noting that excluding the 2% negative impact of foreign exchange on product sales, AMGN's 4Q 2022 revenue increased by 2% YoY.

The company's Operating income decreased by 3% YoY to $2230 million in the fourth quarter of 2022. AMGN's net income dropped by 15% YoY from $1899 million in 4Q 2021 to $1616 million in 4Q 2022. Despite impaired quarterly results in 4Q 2022 compared with the same period last year, AMGN's full-year 2022 results were better than in full-year 2021. In 2022, the company's Operating income and net income increased by 25% YoY and 11% YoY to $9566 million and $6552 million, respectively. The company generated $8.8 billion of free cash flow for the full-year 2022, up 5% YoY.

"We executed effectively in 2022, delivering strong volume growth, advancing numerous first-in-class medicines in our pipeline, and staying on track to achieve our long-term growth objectives," the CEO commented. "The announced acquisition of Horizon Therapeutics, which we expect to complete in the first half of this year, represents a compelling opportunity to serve more patients and strengthen our growth profile," he continued.

The market outlook

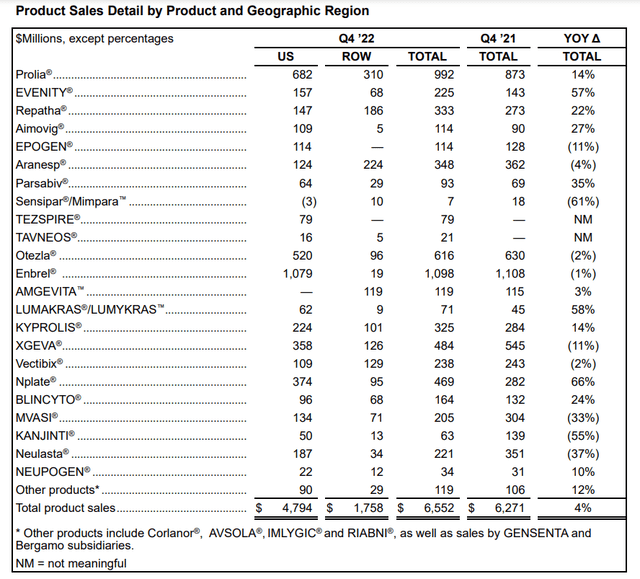

AMGN's 4Q 2022 total product sales increased by 4% YoY. The company's unit volumes increased by 10%, while its average selling price decreased by 3%. It is important to know that foreign exchange changes caused a 2% negative impact on AMGN's sales in the fourth quarter of 2022, compared with the same period last year. AMGN experienced double-digit volume growth in the fourth quarter of 2022 for a number of its products. Figure 1 shows that in the fourth quarter of 2022, AMGN's product sales increased by more than 10% across 10 of its products. On the other hand, the company's product sales decreased by more than 10% across 6 of its products. Figure 1 shows:

- Prolia sales accounted for 15.1% of AMGN's total product sales in 4Q 2022 and increased 14% YoY.

- Nplate sales accounted for 7.2% of AMGN's total product sales in 4Q 2022 and increased 66% YoY.

- Repatha sales accounted for 5.0% of AMGN's total product sales in 4Q 2022 and increased 22% YoY.

- KYPROLIS sales accounted for 5.0% of AMGN's total product sales in 4Q 2022 and increased 14% YoY.

- EVENITY sales accounted for 3.4% of AMGN's total product sales in 4Q 2022 and increased 57% YoY.

- BLINCYTO sales accounted for 2.5% of AMGN's total product sales in 4Q 2022 and increased 24% YoY.

On the other hand:

- Enbrel sales accounted for 16.8% of AMGN's total product sales in 4Q 2022 and decreased by 1% YoY.

- Otezla sales accounted for 9.4% of AMGN's total product sales in 4Q 2022 and decreased by 2% YoY.

- XGEVA sales accounted for 7.4% of AMGN's total product sales in 4Q 2022 and decreased 11% YoY.

- Aransep sales accounted for 5.3% of AMGN's total product sales in 4Q 2022 and decreased 4% YoY.

- Neulasta sales accounted for 3.4% of AMGN's total product sales in 4Q 2022 and decreased 37% YoY.

- MVASI sales accounted for 3.1% of AMGN's total product sales in 4Q 2022 and decreased 33% YoY.

You should know that Nplate sales in the fourth quarter included $207 million related to a one-time order from the U.S. government. Thus, I expect the company's 1Q 2023 Nplate sales to decrease QoQ. Higher Repatha sales were due to increased volumes, partially offset by lower selling prices, which were both impacted by the inclusion of Repatha on China's National Reimbursement Drug List as of January 1, 2022. I expect Repatha sales to remain high in 1Q 2023. Enbrel lower sales were driven by lower volumes and lower net selling prices, and due to increased competition, the company expects Enbrel price to decrease further. Thus, Enbrel sales in 1Q 2023 may be lower than in 4Q 2022. Lower Otezla sales were driven by lower net selling price due to enhancements to co-pay and patient assistance programs to support new patients starting treatment as well as additional rebates to improve the quality of coverage. Lower XGEVA sales were driven by higher competition and unfavorable foreign exchange impact. Due to higher competition, Amgen expects its XGEVA sales to decrease further. Aransep lower sales were driven by unfavorable foreign exchange. Finally, MVASI and Neulasta sales decreased as a result of increased competition that is continuing and causing prices and volumes to decrease further.

Figure 1 - AMGN's 4Q 2022 product sales

According to AMGN's product portfolio, the company's 2023 revenues can be impacted positively by higher demand for some of its products and negatively by the increased competition in the market for some other of its products. The company expects its 2023 total revenues to be between $26.0 to $27.2 billion (excluding any contribution from the announced acquisition of Horizon Therapeutics), compared with $26.3 in 2022 and $26.0 billion in 2022. The company estimates its 2023 capital expenditures and share repurchases to be $925 million and $500 million, respectively.

It cannot be ignored that AMGN's announced acquisition of Horizon Therapeutics can significantly increase its revenue in the following years. AMGN expects the deal to be completed in the next three months. "Acquisition of Horizon Therapeutics will add several additional first-in-class early in life cycle biologic medicines, including TEPEZZA, KRYSTEXXA and UPLIZNA that will add to our growth profile through 2030 and beyond," the CEO stated in the fourth quarter and full year 2022 earnings webcast. Overall, the acquisition of Horizon, combined with the integration of ChemoCentryx (that added Tavneos, to AMGN's portfolio) can increase AMGN's U.S. and international revenues significantly.

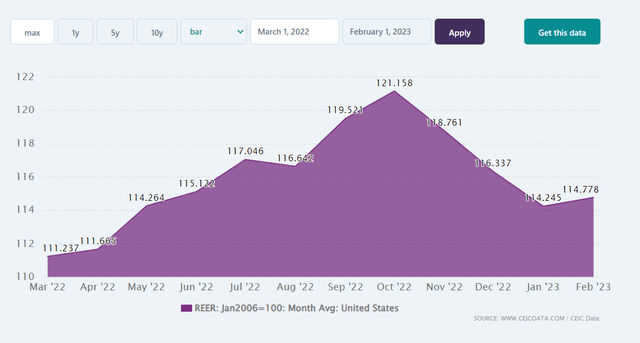

Figure 2 shows U.S. Real Effective Exchange Rate (REER) in the past year. It shows that USD has depreciated against major currencies (on average) in the past few months. Thus, the negative effect of foreign exchange on AMGN's sales in 1Q 2023 is expected to be lower than in 4Q 2022. However, compared with 1Q 2022, AMGN's sales are expected to be negatively impacted by foreign exchange. Due to the recent two U.S. bank collapse, inflation pressures, and jobless claims data, further USD depreciation against major currencies, especially Euro, can be expected, which can affect AMGN's financial statements positively.

Figure 2 - U.S. Real Effective Exchange Rate

AMGN performance

In this comprehensive article, I analyzed Amgen's cash and capital structures to evaluate the company's ability to generate profits and pay off its obligations. Additionally, I compared the data to previous years to provide more meaningful results.

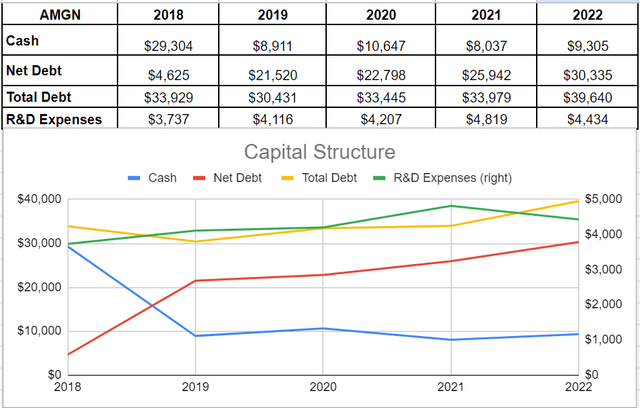

In 2022, the company's cash and equivalents increased by 15% to $9305 million versus its amount of $8037 million at the end of 2021. However, an increase in its debt amount of $39640 million in 2022 from $33970 million in 2021, combined with the increase in cash generation, led to a 16% increase in net debt. In minutiae, AMGN's net debt boosted from about $26 million at the end of 2021 to more than $30 million in 2022. Furthermore, Amgen's research and development expenditures of $4434 million in 2022 declined by about 8% compared with $4819 million at the end of 2021. As the company announced, this was due to higher business development activities and lower market product support (see Figure 3).

Figure 3 - AMGN's capital structure (in millions)

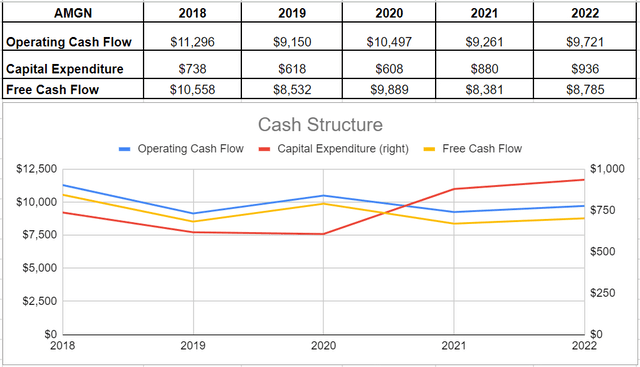

Moreover, considering Amgen's cash structure indicates that the company increased its cash operation by 4% in the full year 2022 to $9721 million versus the previous year's $9261 million. Also, the company's capital expenditures increased slightly by 6% to $936 million in 2022, while it was $880 million at the end of 2021. When all was said and done, the company ultimately could generate $8785 million of free cash flow at the end of 2022, which indicates a 4% improvement versus the amount of $8381 million in 2021. Thus, AMGN's free cash flow amount is sufficient to cater to a scope of capability for more reliable distributions like dividend payments (see Figure 4).

Figure 4 - AMGN's cash structure (in millions)

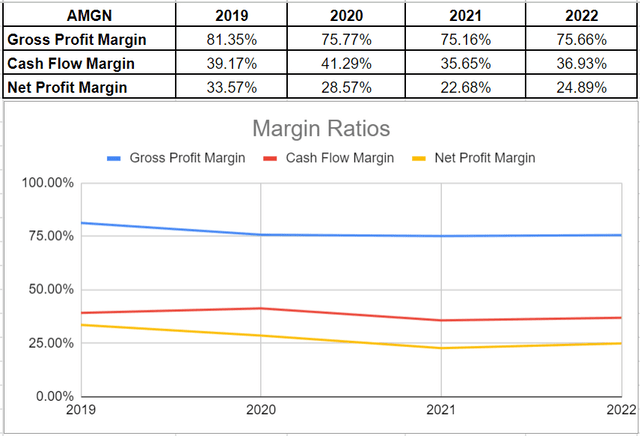

Finally, I analyzed Amgen's profitability across the board of margin ratios to evaluate the capability of the company to bring benefits to its shareholders. Specifically, margin ratios are crucial in assessing a company's ability to convert revenue into profits through various means. Overall, it is evident that AMGN slightly improved its gross profit, cash flow, and net profit margins during 2022 rather than at the end of 2021. In minutiae, for the full year of 2022, total revenues increased by 1% to $26323 million, driven by volume growth and therefore, product sales. Consequently, higher revenue combined with higher profits and cash flow resulted in improved margin ratios in 2022.

AMGN experienced a 50 bps increase in its gross profit margin, reaching 75.6% during 2022. Additionally, the company's cash flow margin rose by 128 bps, reaching 37% in 2022, compared to its previous amount of 35.5% in 2021. Furthermore, Amgen's net profit margin, which provides a final assessment of the company's profitability after all expenses have been accounted for, improved and reached a value of about 25% in 2022. Thus, these positive results indicate that based on the company's 2023 guidance and the previous year's results, it may be able to generate a reliable amount of benefits (see Figure 5).

Figure 5 - AMGN's margin ratios

Summary

Amgen's cash flow margin rose by 128 bps, reaching 37% in 2022, compared to its previous amount of 35.5% in 2021. The company's market outlook is strong, and as a result of the acquisition of Horizon which is expected to be completed in a few months, AMGN's product sales can increase significantly. AMGN is a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.