Independent Bank Corp.: Attractively Valued With A Positive Earnings Outlook

Summary

- Thanks to the recent improvement in the deposit mix and the sizable balance of variable-rate loans, the margin will continue to expand in 2023.

- Loan growth will likely remain below average due to high-interest rates and a lackluster loan pipeline.

- The December 2023 target price suggests a high upside from the current market price. Further, INDB is offering a decent dividend yield.

- Risks are at a normal level because the unrealized losses on the available-for-sale securities portfolio are quite small.

Sean Pavone

Earnings of Independent Bank Corp. (NASDAQ:INDB) will most probably continue to surge this year on the back of further margin expansion and low-single-digit loan growth. As a result, I'm expecting the company to report earnings of $6.34 per share for 2023, up 12% year-over-year. Compared to my last report on the company, I haven't changed my earnings estimate much. The year-end target price suggests a high upside from the current market price. Therefore, I'm upgrading Independent Bank Corp. to a buy rating.

Further Margin Expansion Likely Following Recent Deposit Mix Improvement

Independent Bank's net interest margin grew by 21 basis points in the last quarter, following a cumulative growth of 55 basis points in the second and third quarters of 2022. Unlike most other banks, Independent Bank was able to improve its deposit mix last year, which is commendable because the high-rate environment encouraged depositors to chase yields. Non-interest-bearing deposits increased to 34.3% at the end of December 2022 from 32.4% at the end of December 2021.

Going forward, however, there is a good chance that the deposit mix will deteriorate because depositors will want to shift their funds to higher-rate accounts. My outlook now is worse than before because the Federal Reserve is now projecting the up-rate cycle to last longer than previously expected. The Federal Reserve has increased its forecast for rates in 2024, as mentioned in its projections released this week.

Nevertheless, I'm not too worried because of the asset mix. Around 30% to 35% of loans will re-price soon after rate hikes, as mentioned in the earnings presentation. The management's rate-sensitivity analysis given in the 10-K filing show that a 200-basis points hike in rates could increase the net interest income by 1.4% over twelve months.

Considering the factors given above, I'm expecting the margin to grow by 25 basis points in 2023.

Loan Growth Likely to Remain Below Normal

Independent Bank's loan growth improved to 1.6% in the fourth quarter from 0.2% in the third quarter of 2022. Despite the last quarter's performance, loan growth for the full year was much lower than the historical average. Growth is likely to remain below average for 2023 as well because of the high-rate environment. High rates will hurt the residential loan segment more than commercial loans because commercial borrowers can pass on higher borrowing costs to their customers while residential borrowers can't. Residential loans made up a sizable 22% of total loans at the end of December 2022.

Independent Bank had an approved commercial loan pipeline of $317 million at the end of December 2022, as mentioned in the earnings presentation. To put this number in perspective, $317 million is around 2% of the loans outstanding at the end of last year. Therefore, it seems like loan growth will continue to remain low in the near term.

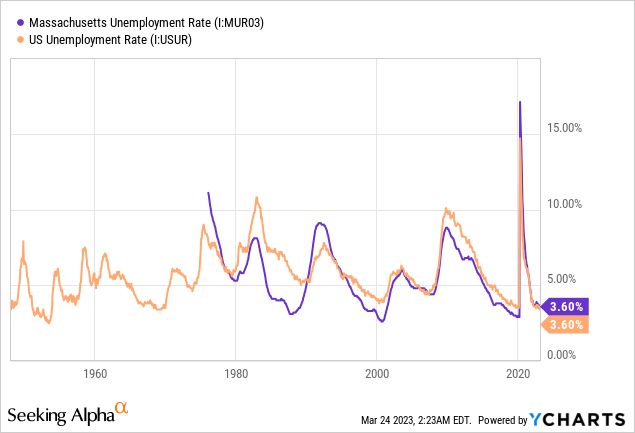

However, the current strength of labor markets gives hope that loan growth won't fall too low. Independent Bank mostly operates in Massachusetts, with some presence in Rhode Island. Massachusetts currently has a very low unemployment rate, which is a positive indicator for commercial loan growth.

Considering the factors mentioned above, I'm expecting the loan portfolio to grow by 3% in 2023. Further, I'm expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 6,842 | 8,806 | 9,279 | 13,440 | 13,776 | 14,194 |

| Growth of Net Loans | 8.7% | 28.7% | 5.4% | 44.8% | 2.5% | 3.0% |

| Securities | 1,075 | 1,275 | 2,348 | 4,789 | 3,313 | 3,380 |

| Deposits | 7,427 | 9,147 | 10,993 | 16,917 | 15,879 | 16,361 |

| Borrowings and Sub-Debt | 259 | 303 | 181 | 152 | 113 | 115 |

| Common equity | 1,073 | 1,708 | 1,703 | 3,018 | 2,887 | 2,879 |

| Book Value Per Share ($) | 38.8 | 49.7 | 51.5 | 74.8 | 63.2 | 62.1 |

| Tangible BVPS ($) | 29.0 | 34.1 | 35.5 | 49.6 | 41.1 | 40.3 |

| Source: SEC Filings, Author's Estimates (In USD million unless otherwise specified) | ||||||

Earnings to Continue on an Uptrend

The anticipated margin expansion and loan growth will lift earnings this year. On the other hand, inflation will drive up non-interest expenses, which will restrict the bottom line's growth. Further, the recent stock market rout can hurt total non-interest income for the first quarter of 2023. Independent Bank Corp. draws a material part of its revenues from investment banking, advisory, and brokerage, which made up 5% of total revenues in 2022.

Overall, I'm expecting Independent Bank Corp. to report earnings of $6.34 per share for 2023, up 12% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 298 | 393 | 368 | 402 | 613 | 695 |

| Provision for loan losses | 5 | 6 | 53 | 18 | 7 | 8 |

| Non-interest income | 89 | 115 | 111 | 106 | 115 | 111 |

| Non-interest expense | 226 | 284 | 274 | 333 | 374 | 411 |

| Net income - Common Sh. | 122 | 165 | 121 | 121 | 264 | 294 |

| EPS - Diluted ($) | 4.40 | 5.03 | 3.64 | 3.47 | 5.69 | 6.34 |

| Source: SEC Filings, Author's Estimates (In USD million unless otherwise specified) | ||||||

In my last report on Independent Bank, I estimated earnings of $6.44 per share for 2023. My updated earnings estimate is barely changed from my previous estimate, as I've decided to not make any big changes to any income statement line item.

Risks are at a Normal Level Due to Limited Unrealized Losses

Independent Bank has a relatively small securities portfolio; therefore, its annualized mark-to-market losses are also limited. These losses amounted to $119 million at the end of December 2022, which is just 4% of the total equity balance. The deposit run that ruined SVB Financial (SIVB) is unlikely to spread to INDB. In case it does, then I'm not too worried because even if Independent Bank sells off its entire securities portfolio, the loss will only be around $119 million. In such a case, the equity, and consequently the fair value, of the stock will fall by around 4% only.

Upgrading to a Buy Rating

Independent Bank is offering a dividend yield of 3.4% at the current quarterly dividend rate of $0.55 per share. The earnings and dividend estimates suggest a payout ratio of 35% for 2023, which is below the five-year average of 43%. Therefore, there is room for a dividend hike. However, to stay on the safe side, I'm not expecting an increase in the dividend level.

I'm using the historical price-to-tangible book ("P/TB") and price-to-earnings ("P/E") multiples to value Independent Bank. The stock has traded at an average P/TB ratio of 1.8x in the past, as shown below.

| FY20 | FY21 | FY22 | Average | |||

| Tangible BVPS ($) | 35.5 | 49.6 | 41.1 | |||

| Average Market Price ($) | 66.4 | 80.0 | 82.4 | |||

| Historical P/E | 1.9x | 1.6x | 2.0x | 1.8x | ||

| Source: Company Financials, Yahoo Finance, Author's Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $40.3 gives a target price of $73.7 for the end of 2023. This price target implies a 12.9% upside from the March 23 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.63x | 1.73x | 1.83x | 1.93x | 2.03x |

| TBVPS - Dec 2023 ($) | 40.3 | 40.3 | 40.3 | 40.3 | 40.3 |

| Target Price ($) | 65.7 | 69.7 | 73.7 | 77.7 | 81.8 |

| Market Price ($) | 65.3 | 65.3 | 65.3 | 65.3 | 65.3 |

| Upside/(Downside) | 0.6% | 6.7% | 12.9% | 19.1% | 25.3% |

| Source: Author's Estimates |

The stock has traded at an average P/E ratio of around 16.1x in the past, excluding the outlier in 2021, as shown below.

| FY19 | FY20 | FY21 | FY22 | T. Average | ||

| Earnings per Share ($) | 5.03 | 3.64 | 3.47 | 5.69 | ||

| Average Market Price ($) | 77.8 | 66.4 | 80.0 | 82.4 | ||

| Historical P/E | 15.5x | 18.2x | 23.1x | 14.5x | 16.1x | |

| Source: Company Financials, Yahoo Finance, Author's Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $6.34 gives a target price of $101.9 for the end of 2023. This price target implies a 56.1% upside from the March 23 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 14.1x | 15.1x | 16.1x | 17.1x | 18.1x |

| EPS 2023 ($) | 6.34 | 6.34 | 6.34 | 6.34 | 6.34 |

| Target Price ($) | 89.2 | 95.6 | 101.9 | 108.3 | 114.6 |

| Market Price ($) | 65.3 | 65.3 | 65.3 | 65.3 | 65.3 |

| Upside/(Downside) | 36.7% | 46.4% | 56.1% | 65.9% | 75.6% |

| Source: Author's Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $87.8, which implies a 34.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 37.9%.

In my last report, I adopted a hold rating on Independent Bank with a target price of $93.4. Since then, the stock price has plunged, leaving a high price upside. Based on the updated total expected return, I'm upgrading Independent Bank Corp. to a buy rating.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.