Alliant Energy: Buy The Drop On This Great Dividend Stock

Summary

- Alliant Energy operates in favorable regulatory jurisdictions and has a strong track record of growth.

- It has a solid outlook thanks to investments in renewable energy sources.

- Recent drop in price presents a great opportunity for potentially strong total returns.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

JuSun

It’s indeed a strange market when even high quality utilities sell off amidst a crisis that’s not of their making. However, this spells opportunities for bargain hunters as they look to capitalize on market irrationality, especially when it comes to income generating stocks that have paid increasing dividends for many years.

Such appears to be the case with Alliant Energy (NASDAQ:LNT), which has grown its dividend annually for 20 years. As shown below, LNT is now again trading near its 52-week low reached in October last year. Let’s explore what makes now a good opportunity to layer into this quality dividend stock.

Why LNT?

Alliant Energy Corporation is a utility company that provides electricity and natural gas services to customers in the Midwest region of the U.S. At present, it serves 995,000 electric customers and 425,000 natural gas customers across Wisconsin and Iowa. It has a long history of providing reliable and affordable energy services to its customers, and has been a steady performer in the utility industry.

It also has a 16% equity interest in American Transmission Company, which is generally considered to be a wide-moat business and offers higher returns compared to other rate-regulated investments. LNT also operates in states that have favorable regulatory environments, as highlighted by Morningstar in its recent analyst report:

Alliant benefits from operating in what we consider two of the most constructive regulatory jurisdictions. To maintain earned returns near allowed returns during this period of high investment, management has worked to reduced regulatory lag, received above-average allowed returns across its subsidiaries, and aims continue to reduce operating costs for the near term.

Moreover, LNT has continued to generate solid returns, as it ended 2022 as the sixth consecutive year during which it achieved 6% or more EPS growth. Also encouraging, LNT is at the forefront of investing in renewable energy. This sets up the company well for the long run, as renewable energy doesn’t come with the input costs that are associated with traditional fossil fuels.

This includes 250 megawatts of solar at various Wisconsin sites that were added this year, and an additional 250 MW of utility-scale solar to be added in the state by the first half of next year. LNT also has an innovative concept called community solar, in which customers are able to buy blocks of solar power to energize their homes and businesses, and in return, received a credit on their electric bill. Management highlighted the traction this is getting with customers during the recent conference call:

Another great success story is the advancement of solar gardens. We are building one near Cedar Rapids, Iowa with Transamerica and Aegon as our main customers. And we're partnering with Mercury Marine in Wisconsin to build a similar solar facility. These projects help advance the sustainability objectives of our customers. And we also use these local investments to advance our focus on the social part of ESG, providing some of the solar energy to partners like Habitat for Humanity.

Meanwhile, LNT is well-prepared for the current high interest rate environment, with an A- rated balance sheet. This includes $407 million in cash and modest leverage with net debt to TTM EBITDA of 5.6x, sitting just slightly higher than the 5.5x ratio from the end of 2021.

This lends support to the 3.6% dividend yield, which comes with a safe 61% payout ratio. Management recently hiked the dividend by 6%, marking LNT’s 20th year of consecutive dividend increases.

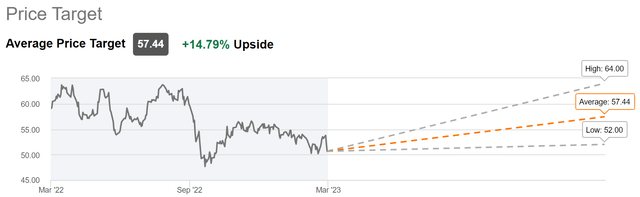

Lastly, while LNT isn’t cheap at the current price of $50 with forward PE of 17.5, it’s reasonably priced considering its steady and moat-worthy business model with analysts expecting 6.5% annual EPS growth in the 2024 to 2025 timeframe.

Morningstar has a fair value estimate of $58, due to growth prospects through renewable energy projects that have regulatory support from constructive jurisdictions. Plus, sell-side analysts have an average price target of $57.44, equating to a potential 18% total return over the next 12 months.

Investor Takeaway

Alliant Energy is a solid utility stock that offers a reasonably attractive value proposition. It has good prospects for growth due to its investments in renewable energy sources and strong operational performance in favorable regulatory environments. With an A- rated balance sheet, modest leverage, and a safe dividend yield of 3.6%, LNT looks attractive for income investors as well as those looking for good capital appreciation prospects.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.