XLRE: It Looks Bad For REITs And It Could Get Worse

Summary

- While so many investors are focusing on the banking system, I'm looking for where the next shoe will drop.

- I think that next shoe may be in the REIT sector, and XLRE is particularly vulnerable, based on its current holdings.

- I rate XLRE a Sell. Its portfolio construction makes it vulnerable to begin with, but the current spillover from the bank crisis adds extra risk now.

ADragan

By Rob Isbitts

Real Estate Select Sector SPDR® (NYSEARCA:XLRE) may look attractive with its yield knocking on the door of 4%. However, there is a lot going on under the hood here. A combination of potential collateral damage from the sudden banking crisis, and structural issues with this ETF which have built up over time, make it a deceiving candidate for income-oriented investors to load up on now. I like the concept of investing in the real estate business, but this ETF and this moment in market history argue against doing much of it. For reasons explained below, I rate XLRE a Sell.

REITS: From hidden S&P 500 sector to bank crisis casualty

REITs have not been part of the S&P 500 for nearly as long as most other sectors. Some real estate companies were added to the S&P 500 back in 2001, but they were grouped with financials. They were first broken out into their own sector in 2016. XLRE invests in all ETFs in the S&P 500 Index, and is weighted by market capitalization. That means that the ETF's managers extract all REITs in the index, then re-weight them as their own sector sub-group. For years, the S&P 500 was comprised of 10 sectors, and REITs became the 11th.

However, since that time, and particularly in recent years, the performance of stocks within the REIT sector has mirrored the broader S&P 500 in one important respect: a small group of technology-oriented stocks have outpaced the rest by a wide distance. That has served to keep the yield of XLRE down, and caused the same "buying yesterday's winners" concern that the broader S&P 500 has with FAANG stocks. Frankly, many REIT ETFs have this issue, thanks to the dominance of cap-weighted indexing versus equal weighting, yield weighting, cash flow from operations weighting or other systems of constructing REIT indexes.

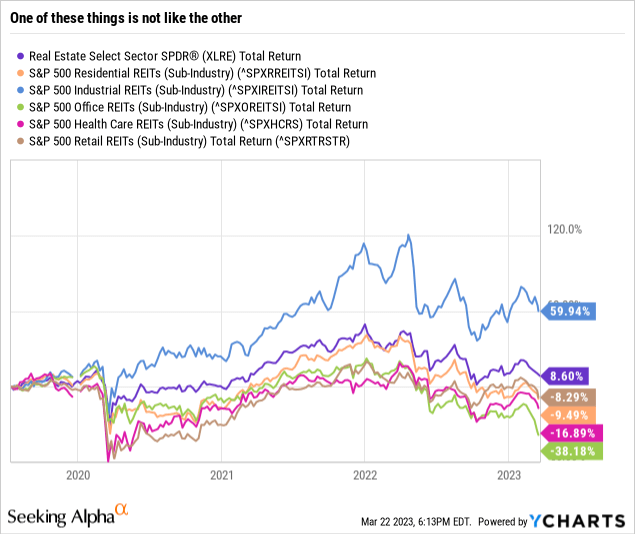

Here is the problem in a picture. Since late 2019, and especially since the recovery from the pandemic flash bear market in 2020, Industrial REITs, one REIT sub-sectors, have accounted for all the performance of the S&P REIT Index, and therefore of XLRE.

XLRE's return has been modest, but as you can see in the chart above, it could have been much worse. Industrial REITs carried the sector for years. Now, with investors starting to draw connections between struggling banks and the real estate companies that make up a large portion of their loans, the REIT sector is starting to feel the pinch by association. A report from FactSet research recently stated that:

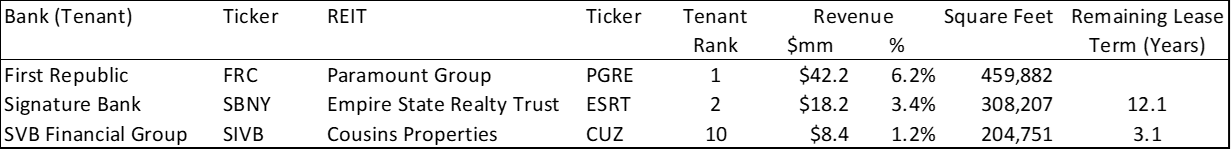

Commercial real estate is the dominant class of collateral in many bank loan portfolios, and while those loans don't get marked to market like (AFS) securities, the sharp rise in rates still has a meaningful impact. Higher interest rates mean higher cap rates, which mean lower real estate values, which mean CRE loan-to-value ratios will have tended to rise significantly over the past year. In other words, the prospective loss in the event of default has increased. Thus far in this crisis, credit quality is the dog that didn't bark, but this risk is growing. One immediate effect of bank stress on commercial real estate can be seen in the banks' role as tenants themselves. As shown in Figure 2, SVB Financial, Signature Bank and First Republic are all among the top 10 tenants for particular REITs. In fact, First Republic is the single largest tenant for Paramount Group.

Figure 2: Troubled U.S. Banks Are Top Tenants for Certain REITs

Banks and REITs tied together (FactSet)

XLRE: It used to about dividend yield; Now it's like the FAANG of real estate

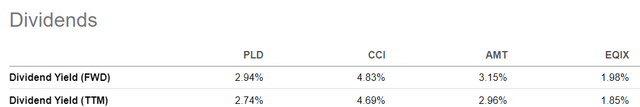

The 4 stocks listed below have something in common: their core business deals with serving the technology and/or telecommunications sectors. Their stock prices have done well in part because those sectors have done well. But as shown, 3 of the 4 do not have very high dividend yields for REITs.

4 largest XLRE holdings (Seeking Alpha)

That's because their prices have done well the last few years, in sync with a tech/telecom-led stock market.

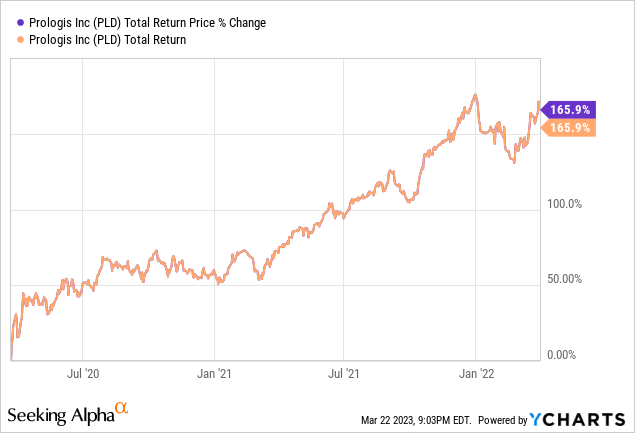

Prologic Inc. (PLD) had a particularly strong run from Q1 2020 through Q2 2022, which vaulted it to the top of this cap-weighted ETF. That is symbolic of how the S&P 500 REIT sector has changed from a core group of stodgy, high-yielding, stable businesses, to having more of a growth tilt.

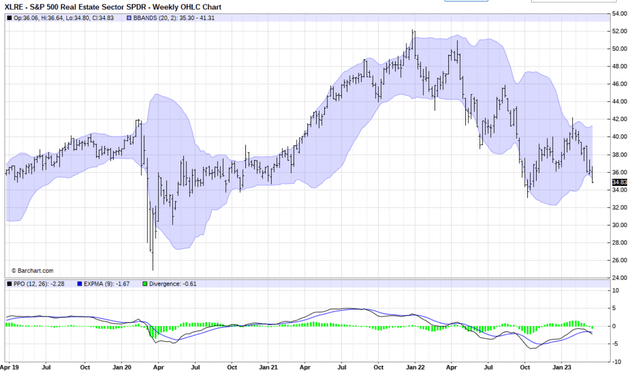

That leaves XLRE in a tough spot. These companies weigh down the yield of the ETF, and their share prices tend to correlate with what are arguably two overvalued segments of the stock market. The technician in me believes that this is part of what is creating an increasingly concerning chart pattern for XLRE. With REITs starting to be grouped in with the banking mess, a downward move has been re-ignited, putting the 2020 low in play. That's about 25% below where it closed on March 21, which is already about 1/3 off its peak price. This is not unusual in a bear market cycle. But it is a real risk here in my view.

XLRE: downside risk (Barchart.com)

XLRE is the S&P 500's REIT sector, which adds yet another risk. Should investors start to sell their S&P 500 index funds and reverse years of accumulating them, the unwinding would directly impact XLRE, since its holdings make up about 3% of the S&P 500 Index. That's not a major impact, but it simply adds another stress point here.

What would make me more bullish on XLRE and REITs in general?

What could turn my opinion on this member of the set of 11 sector SPDR ETFs? The very price decline I believe is likely. At some point, the basic structure of REITs (as securities that distribute the vast majority of their profits as dividends) and a yield in the 5% range, which is about where it could fall to if that 2020 price trough is reached, could make XLRE and/or its REIT brethren an excellent long-term buy. But that's not where we are today.

As I see it, REIT investors expect dividends, and then some growth, in that order. With the combination of factors noted above, they may be in for an unpleasant surprise. I rate XLRE a Sell.

This article was written by

Disclosure: I/we have a beneficial short position in the shares of XLRE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As of this writing, I own put options on XLRE.