HEQT: Hedged Equity Exposure Via This Conservative Fund

Summary

- Simplify Hedged Equity ETF is a hedged equity fund.

- The fund seeks to provide capital appreciation by offering US large-cap exposure while investing in a series of put-spread collars designed to help reduce volatility.

- The fund had a shallow drawdown in 2022 when compared to the index.

- The vehicle represents a more conservative way to gain exposure to the S&P 500, having a more muted downside but also an upside.

- The fund was IPO'd in 2021.

Olena Lishchyshyna

Thesis

Simplify Hedged Equity ETF (NYSEARCA:HEQT) is a new entrant in the exchange traded fund arena, having been issued in November 2021. As per its literature:

The Simplify Hedged Equity ETF seeks to provide capital appreciation by offering US large cap exposure while investing in a series of put-spread collars designed to help reduce volatility. Equities + put-spread collars have become a popular way to create more conservative, lower volatility equity investments. By deploying a ladder of collars, that expire over 3 sequential months, the fund seeks to create a hedged equity experience that is additionally robust to rebalancing luck.

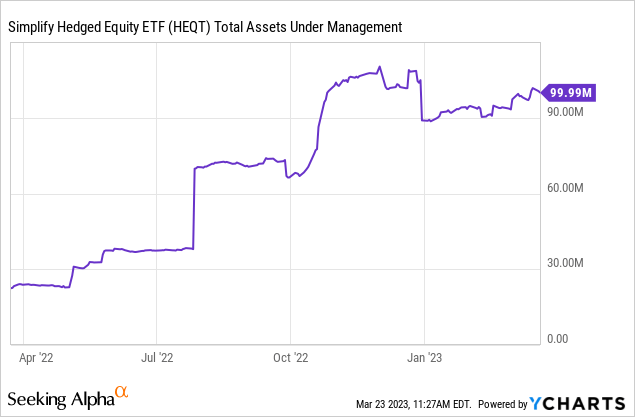

The fund was slow to grow its assets under management in the beginning, but is now close to $100 mm in AUM:

HEQT is a fund that is part of a new cohort of hedged equity vehicles that employ protective collar strategies to buffer the downside in a market sell-off. Among the best known names in the sector one can find:

Ultimately, they all give retail investors access to a more complex options strategy that is designed to protect the downside in a market sell-off. Sophisticated retail investors can they themselves put on collars, but the issues encountered can be around sizing (you have to do a minimum contract size) as well as roll issues (if you choose to do more frequent re-setting collars).

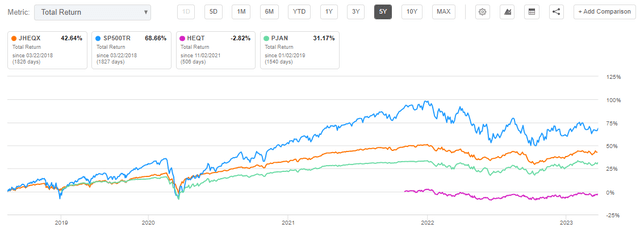

The viability of this strategy speaks for itself:

We can see how in the past year the cohort of hedged equity funds had very narrow drawdowns and far outperformed the S&P 500. You are getting a very conservative risk exposure here, which is suitable when a recession is around the corner. Nothing is for free though, and these funds sell call options (i.e. give away a large proportion of the upside) in order to fund the protective put positions.

Fund Construction/Holdings

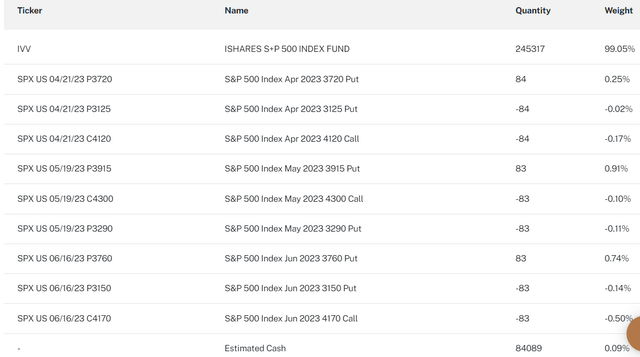

HEQT currently contains only options:

We can see from the above table that the fund contains a ladder of collars. That means that there are several maturity dates for the options. We can see three options for each of the April, May and June maturity dates. Having a ladder reduces the roll risk.

Let us have a closer look at one of the three ladders - let us take for example June. We can see a 3760 Put, a 3150 Put and a 4170 Call. If we look at the positioning we get the following:

- the fund sold a 4170 June Call

- the fund bought a 3760 Put

- the fund sold a 3150 Put

Hence HEQT gives away any upside above 4170 in order to protect for the first loss between 3760 and 3150. If the index really plummets (i.e. goes below 3150), this structure will not protect holders more than the 3150 strike. If we look at how 2022 played out we can see that hedging for a rough 18% to 20% gap-down is fairly effective.

There is no individual name picking here or alpha generation. This is a pure index play, with an option overlay that ensures a reduced fund beta and a protected downside.

What happens in a bull market?

As stated above, nothing is free in financial markets. The fund is able to hedge the downside by giving up a substantial proportion of the index's appreciation potential. HEQT is a new fund, hence we do not have data for more than a year, but we can look at JHEQX as a proxy:

We can see that on a 5-year look-back there is a 30% gap in total returns here versus the index. In a bull market, the structure will always hit the upper barrier, thus limiting gains.

HEQT is therefore an instrument more appropriate for risk-adverse investors, or individuals who are expecting a downturn and still want to have the equity class exposure, but hedged.

Conclusion

HEQT is a new exchange traded fund. The ETF IPO-ed in 2021 and has steadily accumulated assets under management. The fund offers exposure to the S&P 500, with a hedged downside profile. HEQT buys a ladder of put-spread collars in order to hedge for market downturns. The fund had a shallow -8% drawdown in 2022, compared with over -20% for the S&P 500. This approach does not come for free, with the upside being capped at the sold option level. HEQT is appropriate for retail investors who choose a conservative approach, expecting a recessionary environment. The fund lags during bull markets as its upside is capped.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.