The Fed Is Creating A Black Swan Event Of Our Lifetime

Summary

- While the Fed did what the markets expected and hiked rates by 25 basis points, the rhetoric suggests that rate cuts is not the base case in 2023.

- The Fed showed its commitment to its inflation target while commenting that the banking system remains sound and resilient.

- The market and the Fed has diverging views on when the rate cuts will start, and ultimately, only time will tell who is right.

- With the banking crisis ongoing, the Fed sees it as deflationary and acting in tandem with its rate hikes, which may result in fewer rate hikes than needed.

- However, with the Fed's hawkish stance and the tightening of financial conditions as a result of the banking crisis, a black swan event is likely to emerge.

- This idea was discussed in more depth with members of my private investing community, Outperforming the Market. Learn More »

Drew Angerer

This article was first posted in Outperforming the Market on March 23, 2023.

Black swan events

Nassim Nicholas Taleb made popular the term "black swan event", and I do think that while the market seems prepared for a wide range of soft landing, hard landing or no landing scenarios, we are not at all prepared for the events that are impossible to predict.

The collapse of the Silicon Valley Bank (SIVB), Silvergate (SI) and Signature Bank (SBNY) sparked what no one would have expected a few months ago: bank runs and a banking crisis.

Issues that were never brought up before about asset liability management, the accounting treatment of held-to-maturity securities, and the deregulation of medium sized banks with less than $250 billion in assets.

Since then, many other regional banks like First Republic Bank (FRC), Western Alliance Bancorp (WAL), KeyCorp (KEY) and even large-cap companies like Charles Schwab (SCHW) were sold off.

The sentiment also turned sour in other parts of the globe as Credit Suisse (CS) became the next bank to fall. It required a $54 billion loan from the Swiss National Bank and a takeover from UBS (UBS) to control the situation in Switzerland and bring back confidence in the banking system in Switzerland.

I do think that the unpredictable events that will occur in the months to come as a result of rising rates and tighter financial conditions will result in more black swan events to come.

The weak links in the system will start to show as the tide goes down and financial conditions tighten.

Only then will we start to realize what other black swan events will occur and how severe they will be.

The 25 basis points that everyone expected

The Fed announced that it will be hiking rates by 25 basis points in the March FOMC statement. This was widely expected as anything more would have been potentially destabilizing and anything less would have been seen as the Fed is not committed to its inflation target of 2 percent over the longer run.

The rate cut shock

In the March FOMC statement, it was worth noting that the forward guidance was dropped from "ongoing increases" to "some additional policy firming may be appropriate."

This initially seemed dovish given that Dovish start given the change in the forward guidance. On top of that, Jerome Powell also said that he thought that a pause was considered, which was a result of the recent banking crisis we have seen.

Another point worth noting was that Jerome Powell said in the press conference that the credit tightening we have seen as a result of the banking crisis is acting in the same direction as the rate hikes that the Fed were implementing, which could mean that they may then need to hike less than expected to control inflation and bring it back to their target.

He went on to further emphasize that the new forward guidance includes "some" and "may" which implies that there is a lower probability that more rate hikes were coming.

That said, the Fed ultimately still unanimously approved the decision to raise rates by 25 basis points as a result of the stronger than expected inflation data and labor market.

The turning point came and the market started seeing the Fed as more hawkish when Jerome Powell said that he "just don't" see rate cuts this year and also notes that there is the option to hike more than the dots suggests. This means that the Fed will raise rates higher than expected if they need to.

This hawkish tone from the Fed was seen by the market as a shock as the market has been pricing in rate cuts in 2023 as a result of the banking crisis we have seen.

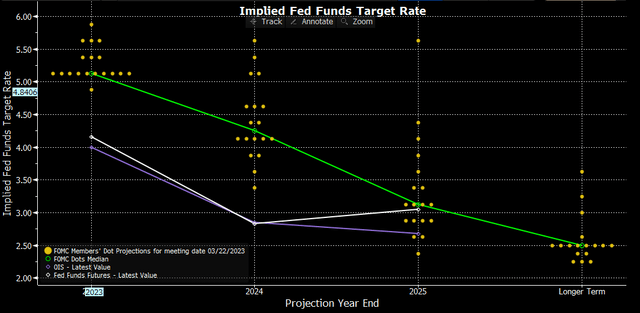

Market pricing in more rate cuts than the Fed

As mentioned, the Fed surprised the market negatively as the market there is a divergence between the market and the Fed on when the Fed will be cutting rates.

As we can see, the Fed is pricing median dots for 2023 were left unchanged in the recent March FOMC meeting at 5.125%. That said, the market is pricing in rate cuts in 2023 to around 4% to 4.125%.

Median Dots vs. Market Implied Expectations (Bloomberg)

Ultimately, whether the market or the Fed turns out to be right remains to be seen.

That said, it does seem the market is mispricing the resolution and commitment of the Fed to bring inflation down to its target as a result of the current banking crisis. The market likely thinks that the Fed will have to cut rates sooner than expected as the United States banking system was at risk.

That said, the Fed maintained the view that they saw the United States banking system as resilient and that the Fed remains committed to bringing inflation down.

The Fed on the United States banking system

While acknowledging the increased risks in the United States banking system in recent weeks, the Fed remains committed to its inflation target.

In fact, I would argue that the Fed is prioritizing bringing down inflation at the present moment as they do think that the United States banking system is more resilient and sounder today than it was in the 2008 financial crisis.

I highlight this paragraph in the FOMC statement:

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.

In addition, Jerome Powell also stated that the Fed was "prepared to use all tools to keep banking system safe".

Market moves

Equities like the SPY and QQQ initially rallied when the market realized that a pause was considered and that the tightening of the credit markets may result in fewer rate hikes. That said, both SPY and QQQ fell more than 2% from the day's high after Jerome Powell went against bets that the Fed will be cutting rates this year.

The 10-year US treasury yields fell from the day high of 3.628% to 3.481%, making a 14.7 basis point move as a result of the FOMC meeting. The 10-year US treasury yields move lower is a result of the market pricing in that there is likely a lower probability for more rate hikes in the future as Jerome Powell mentioned in the press conference that the tightening of financial conditions as a result of the stress in the banking sector was deflationary in nature and helping to work in tandem with the rate hikes.

As a result, longer dated bond ETFs like TLT and IEF rallied more than 1% during the day.

Parallels to 2006

Perhaps where the optimism from the market came from was due to the narrative that was building that a pause in rate hikes was possible.

I would note that the text used in the March 2023 FOMC statement was rather similar to that used in the June 2006 FOMC statement after the Fed made 17 rate hikes.

This was what the Fed said today, in its March 2023 FOMC statement:

The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

This was what the Fed stated in its June 2006 FOMC statement:

In these circumstances, the Committee foresaw the possibility of a need for some further policy firming to address inflation risks but emphasized that the extent and timing of any such firming would depend importantly on the evolution of the economic outlook as implied by incoming information.

I think that what I took away from the March FOMC statement was that the Fed was threading a thin line in trying to communicate that there is potentially a pause in the near-term as a result of the tightened financial conditions that were working in tandem with the Fed's rate hikes.

That said, I do think that the Fed is still not considering a rate cut at this point and pricing in such a scenario in the near-term would not be wise, in my view. The Fed will continue to be data dependent and the data will need to suggest that the Fed is achieving its targets of maximum employment and inflation at the rate of 2 percent over the longer run in order for rate cuts to be considered.

Final thoughts

I think that the base case remains for the Fed to keep inflation within its target and to show the market its commitment in doing so to maintain the Fed's own credibility. This is in-line with what the Fed communicated in the March FOMC as it changed the wording of the forward guidance as it did with its 2006 FOMC statement, while at the same time emphasizing that rate cuts were not the base case in 2023.

I do think that we will be seeing more of the unknowns in the near-term as financial conditions tighten further with the Fed's continued hawkish stance and the tightening of credit conditions as a result of the banking crisis.

The weak links in the markets will start to break as a result of the rising rates and tighter liquidity and we will never know how severe this next black swan event will be.

We have to be prepared for the black swan event that will arise as a result of such tight financial conditions. Inflation will fall, but there will be consequences along the way. It's not a matter of if but when that it appears.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 41% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!

This article was written by

I am a portfolio manager with experience working for a hedge fund and a long-only equity fund with more than $1 billion in assets under management and I have a track record for outperformance in my portfolio. I have been writing consistently, with an article published each day on Seeking Alpha and on my Marketplace service.

Focused on long term investing, I believe in a barbell strategy in a portfolio, where there are both growth and value elements, which will be reflected in my articles.

I will be running a Marketplace service, Outperforming the Market, where I will share with you The Barbell Portfolio, which consists of high conviction growth and value stocks to help you outperform in the long-term, as well as The Price Target Report, which tells subscribers how much discount the stock is trading to intrinsic value and the upside potential. Lastly, subscribers will be able to get direct access to me and can ask me anything about the investment process or stock picks.

CFA charter holder and graduated with degrees in Finance and Accounting.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.