The Hindenburg Block Short Report Examined In Detail

Summary

- Yesterday, Hindenburg issued a long short report on Block and the stock dropped 15%.

- I have read the full report and categorize the accusations in two categories: nothingburgers and more substantial claims.

- Hindenburg points out something Block could do better and a risk, but I don't see any big red flags.

- We're currently running a sale for our private investing group, Potential Multibaggers, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Nastco/iStock via Getty Images

Introduction

Yesterday, famous short seller Hindenburg came out with a short report about Block (NYSE:SQ) and more specifically about Cash App. That's why the stock was down 15% when I started writing this.

I have read the full report, which is very long and I wrote an article as soon as possible for my subscribers, but I also wanted to release this as a public article. Let's look at what Hindenburg writes and if it's something to worry about. But before we start, a short explanation on Hindenburg Research.

Who Is Hindenburg?

Before we go to this short report, I want to look at who Hindenburg Research is. Hindenburg is a small research company, employing five people according to the last stats I saw, founded by Nathan Anderson.

Indian Times

Hindenburg Research specializes in financial forensic research. Usually, their research takes months or even years. In Block's case, for example, it claims to have worked on the report for two years. Hindenburg examines everything it can and interviews ex-employees. It sometimes promises big financial rewards for crucial evidence. For Tether, Hindenburg promised a $1 million bounty.

That also shows that Hindenburg is not a non-profit. Together with its limited partners, it takes massive short positions through derivatives, which means they make millions from the stock price decline, whether the content is true or not. I think this is very questionable behavior and should be regulated. This is information from Unusual Whales:

On March 21 at 11:49 EST a trader opened up new positions (largest for SQ last 7 days) for the SQ $74 Puts expiring 4/14/2023. They exited half of the trade this morning, turning $500k into around $5 million for 1000%."

There's often much black-and-white when it comes to short reports. Some people see short sellers like Hindenburg as market manipulators, others as heroes that uncover frauds. I'm somewhere in the middle. I'm happy that firms like Hindenburg exist, but I don't like the manipulation part.

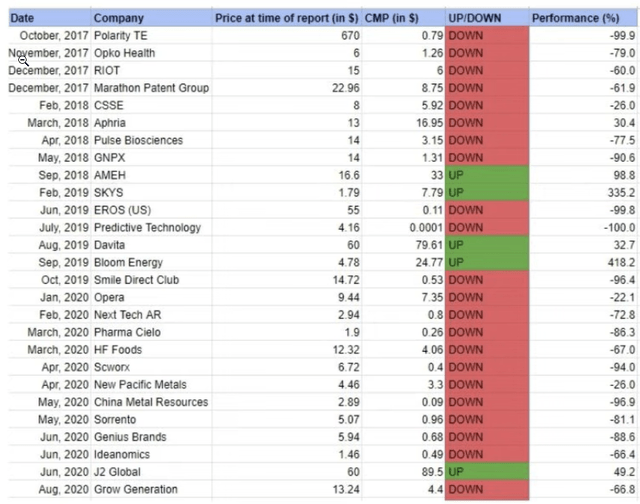

That doesn't mean I don't respect Hindenburg, mind you. The research company has a good track record of uncovering fraudulent companies, which is good for the overall health of the stock market. While this is market manipulation in my book, Hindenburg needs credibility because otherwise, the market manipulation wouldn't work the next time.

That looks scary for Block, right? But this track record doesn't say everything. Most of the companies here are very small companies and the chance for fraud is much bigger there. On top of that, it shorted many companies that were obviously overvalued without having any form of quality. When the bubble in SPACs and other companies of poor quality popped, Hindenburg's returns looked good, of course. But many didn't fall because of the accusations in Hindenburg's reports. But again, I don't want to downplay Hindenburg. Their track record of uncovering fraud is generally convincing as well. And that’s more than an overwhelming majority of short sellers can say.

Square is the biggest aim for Hindenburg so far. That means Hindenburg and its partners can earn more money easier. The big short positions through put options don't weigh so much on the stock price before the report is released. At the same time, taking on a bigger company is riskier and not simple.

Ignore the language

When it comes to short reports, you always have to be careful. As I said, they are meant to make money. That means they use language as spectacularly as possible. Short reports make British tabloids sometimes look like choir boys. With their exaggerated innuendos and screaming headlines, short seller reports often undermine their own credibility. The report mentions the word "fraud" 122 times. It's not used about Block, but using the word so often makes Block look guilty of fraud by association. That's how our human psychology works. And the word fraud is just one example. The report is filled with words describing crimes. None is used directly against Block, as far as I could see. But this kind of framing would make a one-week old baby look like a seasoned criminal.

The first time you read a short report, it may be horrifying, no matter how much or how little substance there is. The sensational language will always make you feel like this is the biggest fraud there is. That's why you must try to strip out all the sensational language to see the real accusations.

Now, what are the allegations? I want to be complete, but I also want to give you my opinion and that's why I have already split up the allegations into two categories, the nothingburgers, and the more serious ones. Let's start with the nothingburgers.

Nothingburgers

Lyrics

Hindenburg takes on Block because Jack Dorsey is proud that Cash App has been named in hundreds of hip-hop songs. The reason is that hip-hoppers rap about illegal things like scams, drug trafficking or even murder. Seriously? Do rappers do that? That's an ironic question, of course. We all know they do.

How about Fendi, a Louis Vuitton - Moët Hennessy brand, the most name-dropped brand in hip hop? Short (OTCPK:LVMHF)?

How many banks do you think hold money of hip-hoppers who were arrested? I quote literally from Hindenburg's report:

CEO Jack Dorsey has publicly touted how Cash App is mentioned in hundreds of hip hop songs as evidence of its mainstream appeal. A review of those songs show that the artists are not generally rapping about Cash App’s smooth user interface—many describe using it to scam, traffic drugs or even pay for murder.

A 2-minute Google search already brought up these examples:

Cook money clean through Merrill Lynch

Accountant just gasp at the smell of it.

(The Clipse, a rap duo; Pusha T raps that he is the "Cocaine's Dr. Seuss"; their manager was sentenced to 30 years of prison)

Don't forget to launder the cream through Wells Fargo

(GZA, arrested for shooting a man)

There are probably many more examples.

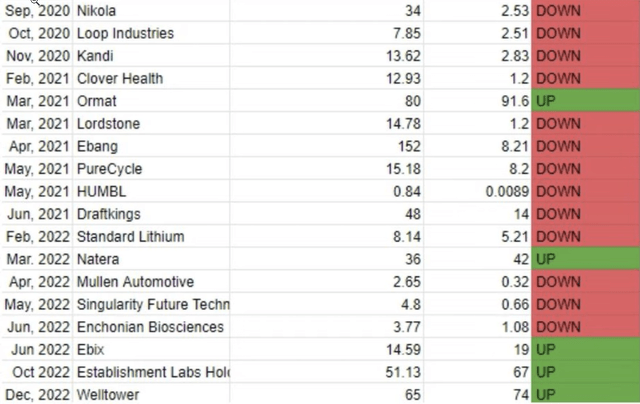

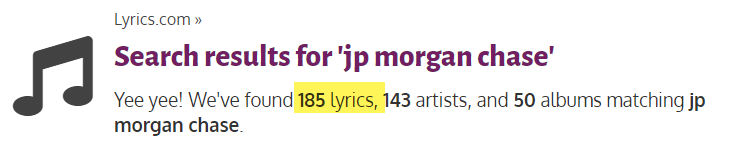

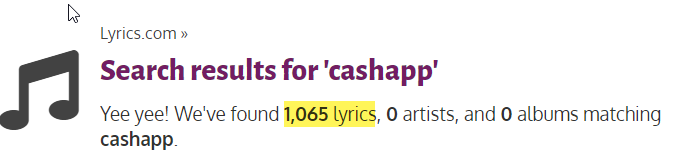

When we go to lyrics.com, and search for Wells Fargo, J.P. Morgan Chase, Bank Of America, this is what we get:

lyrics.com

J.P. Morgan Chase? Yep.

lyrics.com

lyrics.com

lyrics.com

So, yes, there are rappers namedropping Cash App about illegal activities but that's a minority and it can be said for banks as well. Not convincing at all, to say the least.

There are much more allegations like these. For example:

There is even a gang named after Cash App: In 2021, Baltimore authorities charged members of the “Cash App” gang with distribution of fentanyl in a West Baltimore neighborhood, according to news reports and criminal records.

I don't think this has anything to do with Block. Is Cash App used for crimes? I'm sure it is. But so are many other financial solutions. The biggest source of criminal money traffic is probably still cash. Is cash therefore a fraud? No, it’s way of paying, just like Cash App is one.

Now, that doesn't mean that Hindenburg doesn't touch a valid point. But that's not in the lyrics. Maybe the checks are not strict enough, but I'm coming back to that in the part of the more substantial allegations.

Insiders sold shares

Hindenburg writes that founders Jack Dorsey and James McKelvey sold shares during the stock surge. That's obviously true. But Jack Dorsey still owns $3 billion in shares, McKelvey about $800 million. And that's discounting that 15% drop yesterday.

Yes, executives sell shares. Not just when the share price is high, but often also when it's low. It's usually an extra form of income and to diversify their investments a bit more. Of course, it sounds convincing when they sold over $1B combined. But at Square's high, that would have been less than 6% of their ownership stake. McKelvey is less active at the company. Since 2017, he has been an independent director of the Federal Reserve Bank of St. Louis.

The AfterPay acquisition

Hindenburg says the AfterPay acquisition is flopping. It points out a few things, but this has nothing to do with fraud or criminal behavior, of course. One of the things it points out is that delinquencies have increased from 1.7% to 4.1%. But that's still a very low number and this has more to do with the macroeconomic circumstances than anything Block did. Now, don't get me wrong, I won't argue AfterPay was a genius acquisition, but it's actually too early to really judge it. The acquisition only closed in 2022. And in the spectacular short report, it's a nothingburger.

Revenue growth

Block reported a 1% year over year revenue decline and a GAAP loss of $540.7 million in 2022.

Hindenburg knows all too well this revenue drop by 1% was caused by bitcoin. Block has to include this in revenue as it is on their books for a while. But it's totally unsubstantial and therefore, it should not be used in the calculation of revenue. If you exclude bitcoin, which you should if you are honest, revenue was up 36% in 2022, of which 26% was organically, and the rest was from AfterPay.

The valuation

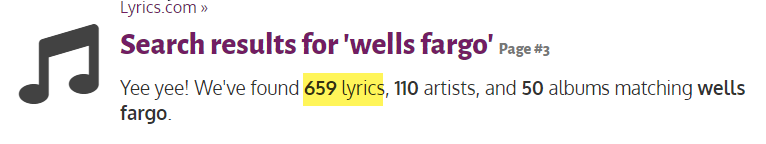

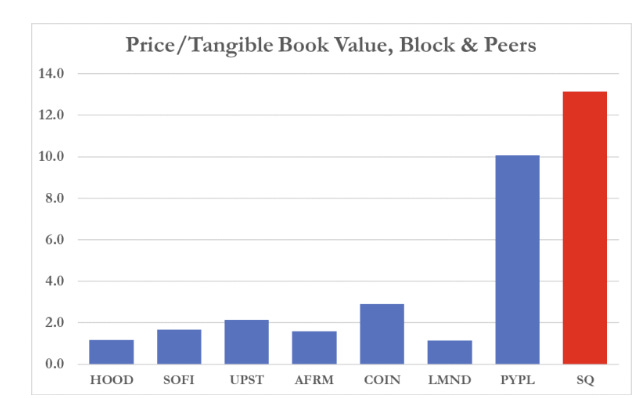

I think this makes experienced investors cringe. Square is compared to what Hindenburg calls ‘peers’ when it comes to valuation. This is the chart it uses.

Hindenburg Block short report

First, tangible book value is a very wrong metric for comparison, and I think Hindenburg knows that. What have your property and equipment to do with how well you do? Little. For capital-intensive businesses like industrials, this makes sense. But for companies that have so much intangible value? This makes Hindenburg look like a research pro and an investment rookie. But of course, it’s on purpose to deceive more naive investors.

Also, I really don’t see these companies as peers. Lemonade? It’s in insurance. Upstart is only in loans, RobinHood is a broker, Coinbase a crypto broker and Affirm is only in buy-now-pay-later. Of course, Block also has those aspects, but that doesn’t make them peers. PayPal is the only real comparison. It grew its revenue by 6.72% year-over-year in the last quarter. Block’s revenue excluding Bitcoin, grew 36% or 26% organically. I think a 30% higher valuation is definitely warranted then. This part of the report was just hilarious.

To be fair and complete, Hindenburg also points out the EV/EBITDA multiple of 60x and a forward PE of 40, which are of course not cheap. I don’t claim the whole valuation part was hilariously wrong, just the comparison on a tangible book value. But then, Hindenburg oversimplifies again:

By comparison, Block competitor PayPal trades at an EV/EBITDA multiple of 16.6x, and 15.1x adjusted 2023 earnings, suggesting 62%-72% downside for Block were it to trade in line with its peer.

Again, Block is growing much faster than PayPal, so why would it have to trade at the same multiple? It makes no sense. Of course, you could argue that Block is overvalued by 25% or so, but that is not spectacular enough for a short report, of course. It’s a pity Hindenburg chooses for sensation here, not quality.

More Serious Allegations

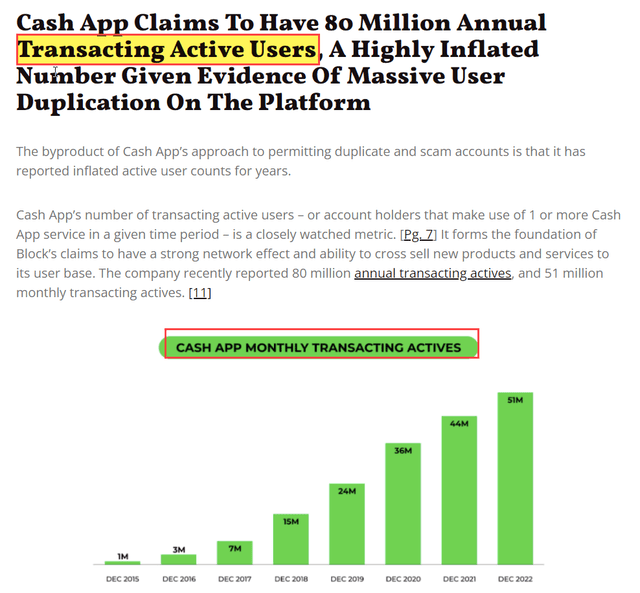

Inflated accounts

There are three more serious allegations. The first is that accounts are not the same as the number of users. In other words, there are people with several accounts.

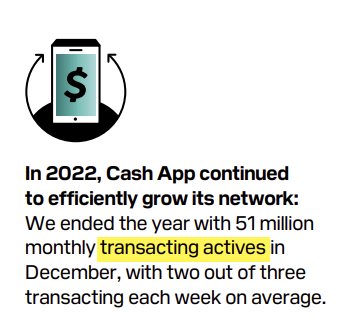

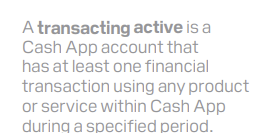

I think that this will be true. But I also think it's not really an issue. The first reason is that Block doesn't talk about users but about 'transacting actives.' In other words, if you have two accounts you both use, yes, you will probably be counted for two 'transacting actives.' This is an example from Block's shareholder letter (my highlight).

Block Q4 shareholder letter

I think the explanation that Block gives in its shareholder letter about what a transacting active is, is also very clear:

Block Q4 2022 shareholder letter

Even in the short report, Hindenburg shows that it came up with an extra word that Block doesn't use. The title is Hindenburg's, the chart is Block's. Do you see the addition of the word 'users' by Hindenburg? Block doesn't use that.

Hindenburg short report

Do you know anything digital where people don't have multiple accounts? I mean, I have three accounts on Seeking Alpha: From Growth To Value, Best Anchor Stocks and a third one to check things as a non-contributor (in short, the layout used to be different at the time).

Will a short seller call that 'inflation of accounts' if they would target Seeking Alpha? You bet! I also have two YouTube Accounts, two Facebook accounts, two Twitter accounts and my wife used my Pinterest account so much that I made a second one as well. This is from my Twitter friend Irish Born Investor:

I think this is not such a big issue as Block used the correct words and because accounts as such are not that important. Revenue, gross profit and other metrics are what I care about, not the exact number of people behind the accounts. And Block doesn’t claim the accounts are all people.

Controls are not strict enough

Hindenburg goes a long way trying to couple Block with illegal behavior. And I'm sure there is illegal behavior on the platform. But you can point that out on every single platform. Banks? Check. Social media? You bet!

Now, of course, when money is involved, there is more sensitivity to this, and rightly so. But we have to acknowledge that illegal money always finds a way. Mostly, cash is still involved. And I think most of us know that hackers also widely use Bitcoin for ransom.

Cash App also lets people trade in Bitcoin, probably attracting more criminals. And I'm not sure if Block can do so much to control these transactions. When it comes to other payments, it probably can. Hindenburg makes no distinction between the two, Bitcoin and regular money transfers.

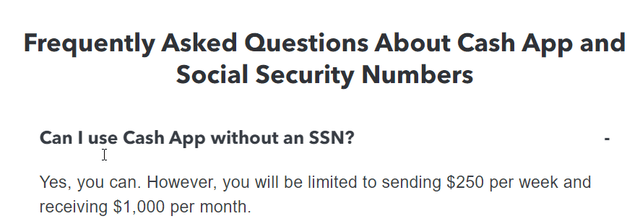

On top of that, Hindenburg claims that you can make fake accounts and freely use those for criminal activities. It doesn't say you need your social security number for more than small transactions. From Block's website:

Block website

The question is if criminals can make dozens of accounts to operate. Hindenburg claims it is possible. As outsiders, we can’t really judge this.

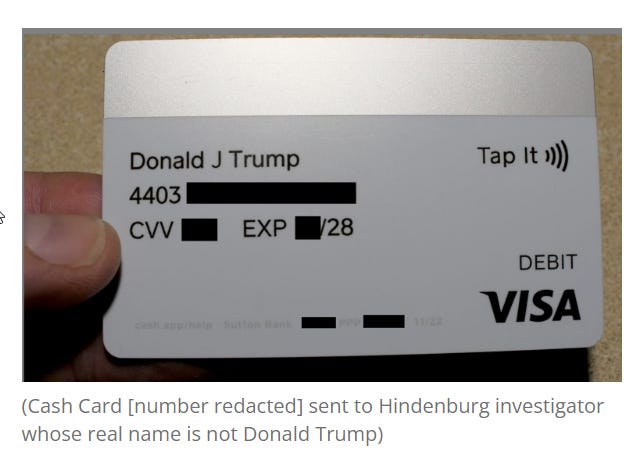

Hindenburg points out you can use a fake name. That's true; you can call yourself Superman, Donald Trump or Elon Musk. That was already known for years. This is a clip from three years ago showing this, for example.

Hindenburg also asked for a Cash Card with a fake name on it, Donald Trump in this case. They could obtain that card.

Hindenburg Block short report

Hindenburg uses this to claim Block doesn't comply with the KYC or know-your-customer, a bank law.

Based on more than a dozen interviews with former employees involved in Cash App, pressure from management has resulted in a pattern of disregard for Anti-Money Laundering (AML) and Know Your Customer (KYC) laws.

But most won't see the little footnote that goes all the way to the bottom of the document, dozens of pages further in this very long report. This is what it says:

Block, as a money services business, is subject to the requirements of AML laws. Block does not have direct obligations under KYC laws

On top of that, Cash App knows very well who the bank card owner is. You must provide your real name and social security number to order a Cash App Card. But you can have an alias. My opinion is that Block should make this stricter. Its terms and conditions are unambiguous that you can only provide accurate information. Users “may not select a $Cashtag that misleads or deceives others as to your business or personal identity or creates an undue risk of chargebacks or mistaken payments.” But there are not enough checks on this. I think this is something Cash App should do better, no doubt about that.

But again, there's no reason to claim Block is a fraud because of this. Does it make scams easier with aliases? Yes, it does. So, that's something they should change. I don't think this should be too hard.

Interchange fees

Merchants pay interchange fees to cover the cost of accepting, processing, and authorizing card transactions. There is a regulation about this. I quote from the Hindenburg report:

In 2010, Congress capped interchange fees under the Durbin Amendment to the Dodd-Frank Act to help ensure the fees were “reasonable and proportional to the cost incurred by the issuer.” The Durbin amendment provides an exemption for small banks, i.e., when the card issuing bank has less than $10 billion in assets.

Block hardly fits that definition of “small”, with $31 billion in assets, per its most recent annual filing. (...)

To qualify, Cash App selected Sutton Bank to issue its prepaid debit card. Sutton Bank is a small bank under the Durbin exemption definition

PayPal (PYPL) does the same thing and it recently disclosed that it's under investigation by the SEC, the Securities and Exchange Commission about the interchange fees structure. Hindenburg is probably right that the situation at Block is pretty similar to that of PayPal, but he acts as if PayPal is already convicted, which is not the case. Hindenburg claims that the category "spend", estimated to be 35% of Cash App's revenue consists "for the biggest part" of interchange fees.

Suppose all of this is true and there would be a conviction, what is the downside? Well, Block would have to go to a capped interchange fee. We don't know how much lower that is; it's also not in Hindenburg's report. Let's take a 10% hit to Cash App's gross profit. I don't think it will be much more. That would mean about a 5% hit to Block's overall gross profit, including Square, the merchant solution side of Block. Let me be clear, this is a guesstimate. It could be a bit more, it could be less. But important to keep in mind that scenario is some sort of worst-case scenario. Up to now, Block is not under investigation for this. The PayPal case will be interesting to follow for Block shareholders as well, of course.

Block's Response

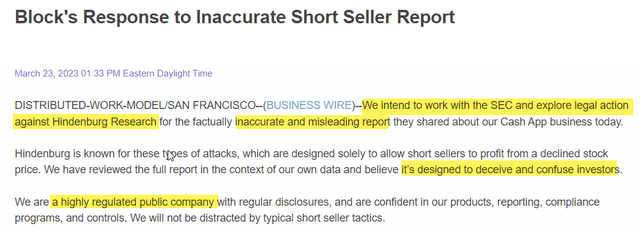

Block came out with a short but pointed statement about the short report. I have highlighted what I think are the most important elements.

Block press release

The answer is short, clear and assertive without being too aggressive. I like the response.

I’m not sure if there’s so much in Hindenburg’s report that Block can use in court, but if it works with the SEC, to me this looks like stock market manipulation. I think this should be regulated much better. For example, a clear rule that if the claims are proven to be false, the company has to pay back the money it has made from shorting and full disclosure of how much the short seller can earn from the stock price drop. But of course, that goes beyond the scope of this article and it’s a whole (interesting) discussion on its own.

Conclusion

Each time I read a short report, I'm always impressed but not in a positive way. The language innuendos are full of insinuations, the use of the word fraud 122 times and multiple other very negative words always leave an impression, no matter how often you read short reports. But once you strip out this language, there are not so many points standing from Hindenburg’s report.

I have highlighted three more or less substantial allegations:

1. The number of accounts, which is a non-item, in my opinion.

2. Controls are not strict enough: Hindenburg does have a point here, but it exaggerates and I don't see a big red flag.

3. Interchange fees: this could become a problem for Block in the future, but overall, the impact should be rather limited. It's not a long-term thesis changer.

I hope I have been able to help you get a better grip on what caused Block's stock to drop 15%. If you read the whole Hindenburg report, you see a lot of negative language, but in my opinion, there are no actual red flags. Yes, Block could do better on the aliases and interchange fees could come under scrutiny, but to me (and maybe you have another opinion; that's OK too), these are not fundamental for the long-term thesis.

In the meantime, keep growing!

Potential Multibaggers focuses on stocks that have the potential to go up 10x or more over the next decade.

With the current big drops in high growth now, there is more fish in the pond, more opportunities for outsized returns.

Potential Multibaggers is for long-term investors who want to fill their portfolio with potentially life-changing returns and have the patience and equanimity to hold through volatility.

Feel free to start the free trial now!

This article was written by

I am a 46-year old investor with a long-term perspective and that means I mainly think about the future when I invest. I try to uncover multibaggers early on. Picks include Shopify ($7.78), Crowdstrike ($98), The Trade Desk ($19.5), Cloudflare ($39) etc.

The strategy is simple but not easy: find disruptors that have a very high quality and hold them for a very long period. I try to identify stocks that have the potential to go up 1,000% and more over the next 10 years. I do deep research for the stocks that I pick to know if the quality is high indeed.

I do not care about what my selection of stocks will do next year, but what the result will be over the long term. To paraphrase Warren Buffett: "You should only have stocks that you would feel comfortable having if the stock market closed up for 10 years."

I appreciate your comments because I believe I can learn a lot from your feedback and I believe in the wisdom of crowds.

Disclosure: I/we have a beneficial long position in the shares of SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.