LQDW: A Covered Call Strategy Based On Popular Bond Index

Summary

- The iShares Investment Grade Corporate Bond BuyWrite Strategy (LQDW) invests based on the Cboe LQD BuyWrite Index.

- The strategy is to hold shares in the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and write one-month forward call options against up to 100% of that position.

- Along with reviewing LQDW, a brief review of the LQD ETF is included since that is the only non-financial holding of LQDW.

- The LQDW only started in August 2022 and the underlying index in May 2022. So far, the results show roughly the same returns with LQDW providing a smoother ride.

- With LQDW working better when the underlying ETF is falling, I would be a seller of LQDW at this point unless the investor thinks rates have not peaked.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

Torsten Asmus

(This article was co-produced with Hoya Capital Real Estate)

Introduction

The available investment strategies using ETFs seems to keep expanding every year. Over 430 entered the ETF universe in 2022; bringing the total to 9000 in the US alone. One of those new launches last year was the iShares Investment Grade Corporate Bond BuyWrite Strategy (BATS:LQDW). While Seeking Alpha Contributors have been reviewing Covered Call Equity ETFs, of which there might be hundreds, this is the first one I came across using that strategy in the bond market. By combining ownership of the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSEARCA:LQD) with an option overlay strategy, they hope to provide investors with more income (and maybe less risk), than the plain corporate bond ETF provides. While only live since August, those goals are being met so far.

iShares iBoxx $ Investment Grade Corporate Bond ETF review

Since the LQDW ETF is dependent on this ETF, reviewing it first made sense to me. Seeking Alpha describes this ETF as:

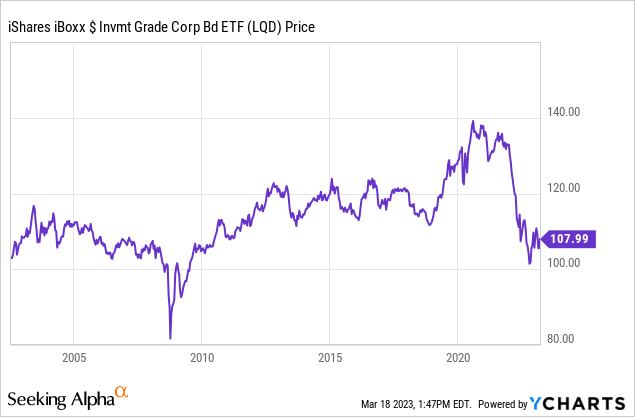

The iShares iBoxx $ Investment Grade Corporate Bond ETF is managed by BlackRock Fund Advisors. The fund invests in fixed income markets of global developed region. It invests in U.S. dollar-denominated, investment grade corporate bonds with at least 3 years to maturity. The fund seeks to track the performance of the Markit iBoxx USD Liquid Investment Grade Index. LQD started in 2002.

Source: Seekingalpha

LQD holds over $34b in assets and comes with 14bps in fees. The TTM yield is 3.42%.

Index review

Understanding this Index is critical for both ETFs reviewed here. S&P Dow Jones provides the following information about the Index.

The Markit iBoxx USD Liquid Investment Grade Index is designed to reflect the performance of US Dollar denominated investment grade corporate debt. The index rules aim to offer a broad coverage of the USD investment grade liquid bond universe. The indices are an integral part of the global iBoxx index families, which provide the marketplace with accurate and objective indices by which to assess the performance of bond markets and investments.

Source: markit.com Index

Index rules include the following:

Only fixed-rate bonds whose cash flow can be determined in advance are eligible for the indices. The indices are comprised solely of bonds.

Only USD denominated bonds are eligible.

With limited exceptions, bonds must be fixed-rate.

Must have an investment grade rating, which is defined as BBB- or higher from Fitch Ratings and S&P Global Ratings and Baa3 or higher from Moody's Investor Service. If a bond is rated by more than one of the above agencies, then the iBoxx rating is the average of the provided ratings. The rating is consolidated to the nearest rating grade. Rating notches are not used.

All bonds must have at the rebalancing day an expected remaining life of at least three years for existing bonds and new insertions must have an expected remaining life of at least three years and 6 months.

The outstanding face value of a bond must be greater than or equal to USD 750 million as of the bond selection cut-off date. The Issuer must have at least $2b in face value outstanding in eligible bonds.

Any bond that enters the Index must remain in the index for a minimum of six months provided it is not downgraded to sub-investment grade, defaulted or fully redeemed in that period.

LQD holdings review

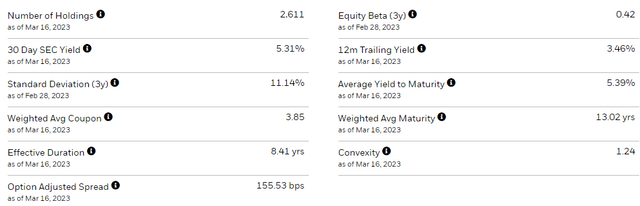

iShares provides the following portfolio characteristics.

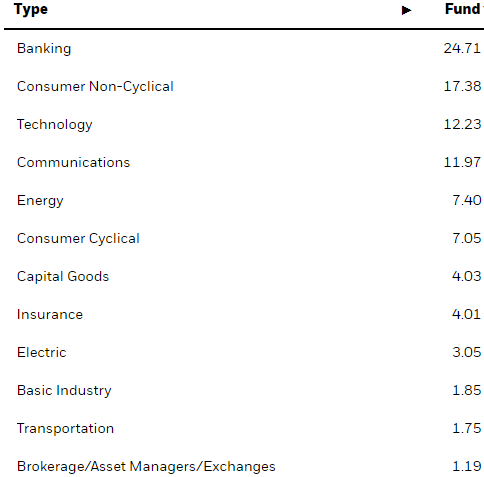

To me, the important factor is the 13-year WAM, which implies that LQD should experience a large 13% price drop if interest rates climb 1%, which is more uncertain now with the recent bank implosions. Bank debt is the largest sector of this ETF, so concerns for that sector could play a big part in LQD near-term results.

ishares.com sectors

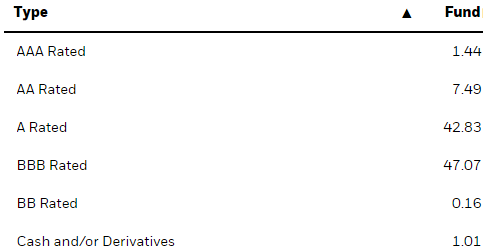

As expected, the ETF holds almost 100% investment-grade rated debt, though almost all of it is in the lower rungs of the IG ratings.

ishares.com ratings

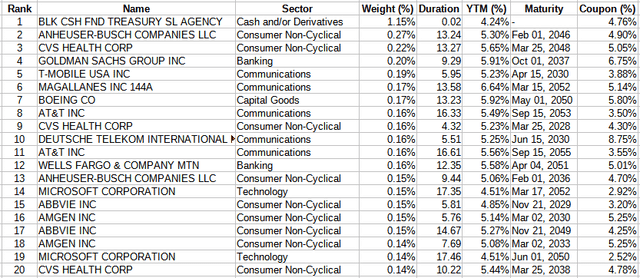

Top 20 holdings

ishares.com; compiled by Author

There is only minor exposure to regional banks as most of that sector's issuers are the major US banks. They do hold five bonds from CREDIT SUISSE, totaling .18% of the portfolio.

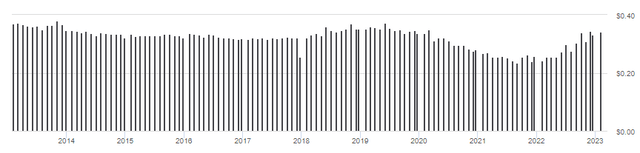

LQD distribution review

Payout level, as expected follows the direction of interest rates as the index updates its holdings.

iShares Investment Grade Corporate Bond BuyWrite Strategy review

Seeking Alpha describes this ETF as:

The investment seeks to track the investment results of the Cboe LQD BuyWrite Index that reflects a strategy of holding the iShares iBoxx $ Investment Grade Corporate Bond ETF while writing (selling) one-month call options to generate income. The fund will seek to write call options up to (but not exceeding) the full amount of shares of the underlying fund held in the fund. The ETF started on August 8, 2022.

Source: Seekingalpha

LQDW has $66.4m in assets and has 34bps in fees. Seeking Alpha lists the TTM yield at 12%, but keep in mind this ETF only started last summer.

Index review

Cboe describes their Index as:

The Cboe LQD BuyWrite Index (BXLB) is designed to track the performance of a covered call strategy with a short iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) Call option expiring monthly. The option written is a model-based option and the strike of the new LQD Call option is the listed option strike closest to100% of the closing value of the LQD on the business day prior to the roll date. The buywrite index consists of a long LQD position and a short at the money LQD Call option position that expires in one month. The expiring Call option is European-Style and PM-settled on the roll date and the expiring LQD Call option is bought back at the theoretical mid price of the LQD Call option at 4:00 p.m. ET on the roll date.

Source: cdn.cboe.com Methodology

The above describes what "option value" is used in calculating the value of the index. The actual trades probably will vary from that theoretical value.

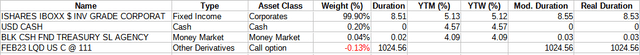

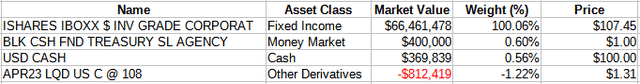

LQDW holdings review

Along with holding the LQD ETF, they hold cash and a Call option, which would have rolled about the time this article is published. LQDW will seek to write call options up to (but not exceeding) the full amount of shares of the Underlying Fund, LQD ETF, as that is true here. The first set of holdings is from when I started writing back in mid-February. This allowed me to capture and show the option strategy over several months.

The use of European Call options is deliberate as unlike American-style options, European-style options can only be exercised on the expiration date. Translation: no risk of ITM options being exercised early against LQDW. The February option expired OTM as LQD closed at $107.04. Based on the next listing, LQDW rolled their option position at least one day early.

On the 16th, LQD traded between $106.67-$107.17, closing at $106.62. Using an option price calculator, I estimate LQDW received between $1.10-1.32 per contract (x 100).

Assuming the mid-price, if the LQD ETF is trading above $108.21 at expiration, the option strategy will loss money. It didn't as LQD closed at $107.99, so it appears the option trade, while expiring ITM, should have been a profitable trade.

Current holdings

ishares.com; compiled by Author

Assuming the premium received matches the current option price, the breakeven for the option trade would be $109.31 for LQD on 4/21/23.

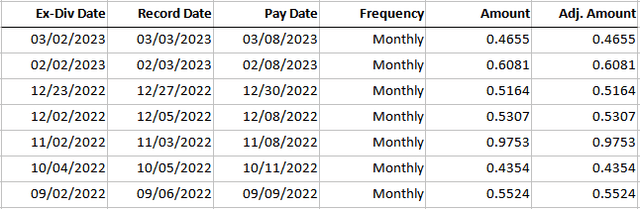

LQDW distribution review

While the first two payouts include a small amount of ROC, none since have.

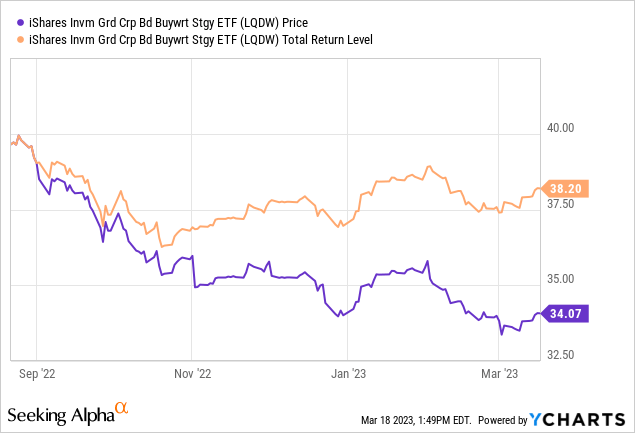

Comparing ETF results

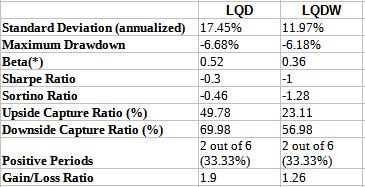

As expected, LQDW outperformed LQD during period where the underlying ETF fell; the reverse when the LQD ETF rose. Using six full months of data via PortfolioVisualizer, we see these risk results.

PortfolioVisualizer.com; compiled by Author

Both Beta and StdDev show LQDW achieved its risk reduction goal. It provided downside protection but cost a large part of the upside potential gains, with LQD capturing more than twice what LQDW did.

Portfolio strategy

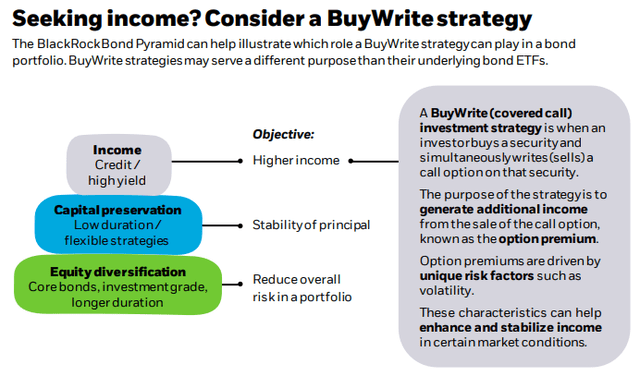

iShares provides the following chart as to why an ETF like LQDW makes sense.

The managers believe the LQDW ETF may outperform the underlying fixed income ETF in periods of rising rates and widening credit spreads. With rate predicting to top out soon, that would not favor LQDW over LQD. With LQDW working better when LQD is declining, I would be a seller of LQDW at this point, as I think rates are nearing their peak with inflation slowing and the current banking crisis.

Final thought

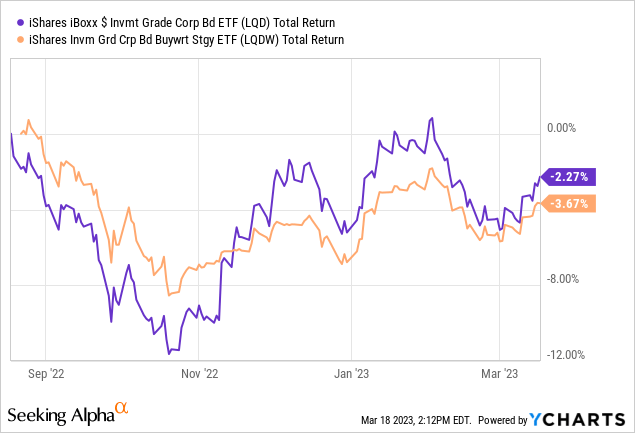

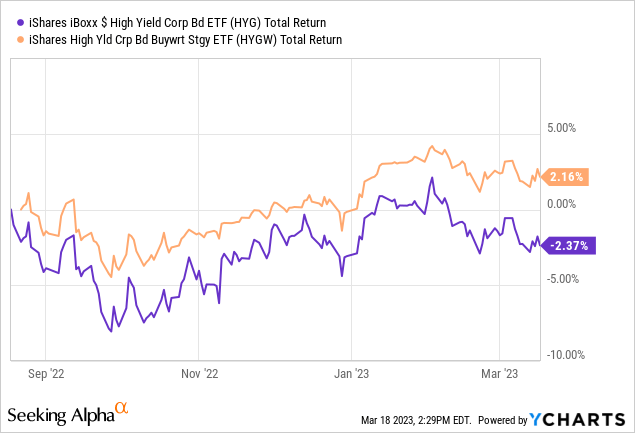

At the same time, iShares launched the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW) and the iShares High Yield Corporate Bond BuyWrite Strategy ETF (HYGW), both recently reviewed by other Seeking Alpha contributors. Below is how the HY-Corp pair have done since August.

When I looked at this pair and the other pair, the same pattern emerges: Own the Buy/Write ETF when the underlying ETF rises; not when it is moving downward.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.