ARDC: This 10.8%-Yielding Credit CEF Remains A Buy

Summary

- We revisit the credit CEF ARDC.

- ARDC features an attractive income profile with significant floating-rate exposure and majority of its liabilities in fixed-rate format.

- The fund has raised its distribution twice over the past year.

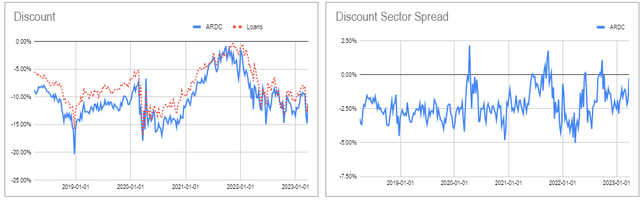

- ARDC continues to trade at a wider discount to the sector average, making for a good entry point.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

In this article, we take another look at the Ares Dynamic Credit Allocation Fund (NYSE:ARDC). The fund has recently released its latest semi-annual shareholder report and we take this opportunity to highlight the key numbers.

In our previous write-up six months ago, we suggested the fund was likely to hike its distribution and this is indeed what happened as the fund raised its distribution another 5%. Although its net income fell somewhat over the second half of the year likely due to a partial deleveraging, the combination of its majority floating-rate portfolio and majority fixed-rate liabilities should support its income profile over the remainder of the year. Inflation remains sticky and well above the Fed's comfort zone which suggests that short-term rates are likely to remain elevated over the medium term - an attractive setup for the fund.

ARDC is trading at a 10.8% current yield and a 11% discount.

Quick Overview

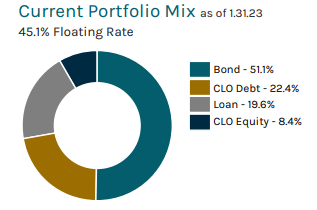

The fund's portfolio is roughly evenly split between floating-rate and fixed-rate corporate assets. The floating-rate side is composed of individual loans as well as both CLO Equity and CLO Debt securities.

Ares

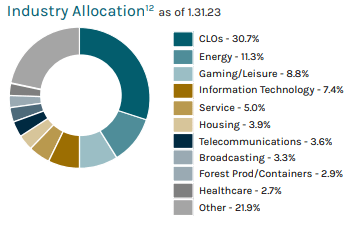

In its bond/loan allocation it is overweight Energy, Leisure and Technology sectors.

Ares

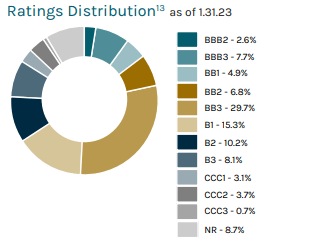

From our previous discussion of the fund about six months ago, it reduced its CCC allocation from about 10.4% to 7.5%.

Ares

Finally, the fund has a duration of around 1.7. Given its mixed bond/loan allocation, this is below the duration profile of bond funds and above that of loan funds

Income Profile

The income profile of ARDC remains very attractive. About half of the portfolio is in floating-rate assets such as bank loans and CLO Debt securities. The recent wobble in the banking sector has unwound expectations of further significant rises in the Fed policy rate. However, since the weekend bailout, the banking sector appears to have stabilized while the CPI continues to come in well above the Fed's comfort zone. This suggests that, at the very least, short-term rates should remain elevated for the medium term, allowing funds like ARDC to generate a very attractive level of income.

A common risk of bank loans is that it puts pressure on the borrowers who have to pay an elevated level of interest expense. This is why the fund's sizable 22% allocation to CLO Debt is attractive as it provides a significant amount of subordination, i.e. it is not on the hook for the first few defaults in the portfolio.

A second key feature of the fund and what truly sets it apart from nearly every other credit CEF is the fixed-rate preferreds it uses as a primary leverage instrument. Specifically, the fund's liabilities are composed of $99m term fixed-rate preferreds and a $69m floating-rate credit facility. The preferreds have maturities of 2026-2028 and a weighted-average interest rate of 2.81%.

It's hard to overemphasize what an amazing deal the preferreds are for the fund. While the generic credit CEF is paying around 6% on its leverage (roughly term SOFR + 1%), ARDC is paying 2.81% for the majority of its leverage. This relatively low cost of leverage allows ARDC to pass on more of its income to shareholders.

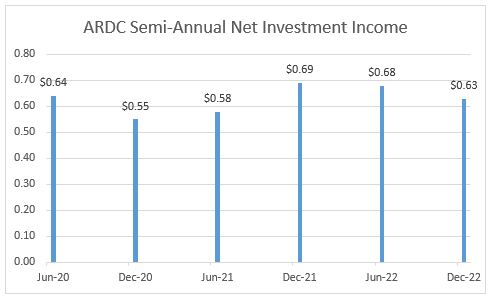

The latest shareholder report showed a drop in net income over the latest semi-annual period. We expected a rise in net income, however, there are a couple of factors that have likely contributed to a slowdown.

Systematic Income

First, is the deleveraging by the fund. ARDC reduced its credit facility to $63m or by 17% of its overall liabilities. Although this reduced the fund's overall income, it also reduced the fund's cost of leverage since the interest expense of the credit facility is more than double what the fund pays on the preferreds.

Another reason for the drop in net income is likely due to its reduction in the CCC allocation by around a third. These lower-quality securities tend to feature higher coupons and so tend to contribute disproportionately to net income. Overall, the fund's distribution coverage is very close to 100%.

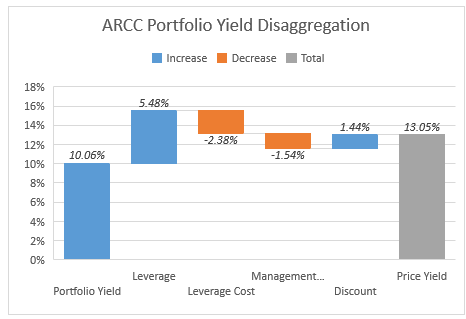

Apart from the fund's income, it's also worth having a look at the fund's portfolio yield profile. This is because net income misses an important contributor to yield which is pull-to-par. Once we take this into account we see that the fund's portfolio yield on price is closer to 13%, well above its 10.9% distribution yield. This spillover yield will accrue directly to the fund's NAV.

Systematic Income

The fund's 11% discount is slightly wider than the loan CEF sector average. ARDC has tended to trade at a wider discount than the loan CEF sector and this is still the case.

Takeaways

Our key takeaway is that apart from cheap leverage and attractive valuation the fund has two features that make it a good fit for the current environment. Specifically, it has a significant allocation to floating-rate assets while half of its liabilities are fixed-rate. And it also has a relatively wide mandate in the credit space, holding bonds, loans and CLOs. This gives it an unusually wide remit to pursue attractive corporate credit opportunities. We continue to hold the fund in our High Income Portfolio.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Disclosure: I/we have a beneficial long position in the shares of ARDC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.