Why Investors Should Hold More Cash After Fed Hiked Rates

Summary

- Markets fell sharply before close after the Federal reserve press conference.

- Regional and big banks are both on close watch after some fell to 52-week lows.

- Continue with an overweight allocation in cash and treasury bonds.

- This idea was discussed in more depth with members of my private investing community, DIY Value Investing. Learn More »

manassanant pamai

Markets formed an unhealthy trading pattern ahead of the Federal Reserve's press conference with Fed Chair Jerome Powell. Stock indices rallied from the year-to-date low of 3,800 in mid-March. The S&P 500 (SPY) then bounced to above 4,000.

Why did market selling accelerate at the end of the day? Before the press conference, retail investors speculated that the shutdown of Silicon Valley (SIVB) and Signature Bank (SBNY) would convince the central bank to pause or even cut rate hikes. Markets ignored the European Central Bank increasing rates by 50 basis points even after Swiss Regulators forced UBS (UBS) to buy Credit Suisse (CS).

Yesterday on March 22, 2023, at 2:30 pm Chair Powell did what he said he would do. He retained a hawkish tone and announced another 25 bps rate hike. This matches the previous hike and is lower than the preceding 75 bps hikes before that.

In less than an hour of trade, the Dow (DJI), Nasdaq (QQQ), and S&P 500 erased days of gains.

Indices close lower on Mar. 31, 2023 (finviz)

Traders may care about stock price movements. How investors should react to the Fed's statement matters more.

More Rate Hikes

Seeking Alpha's Market Currents wrote that the Federal Open Market Committee anticipates some additional policy firming "to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

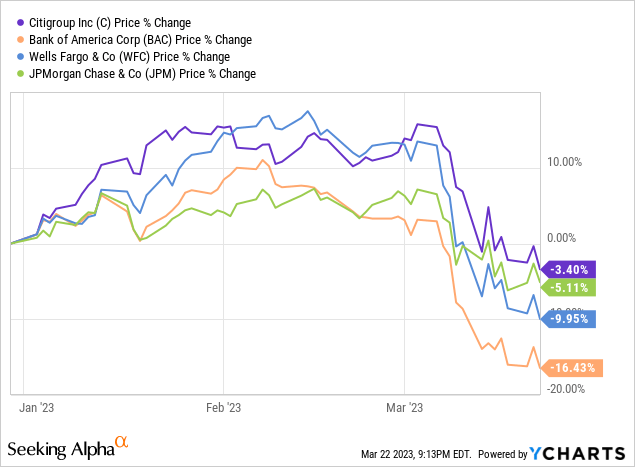

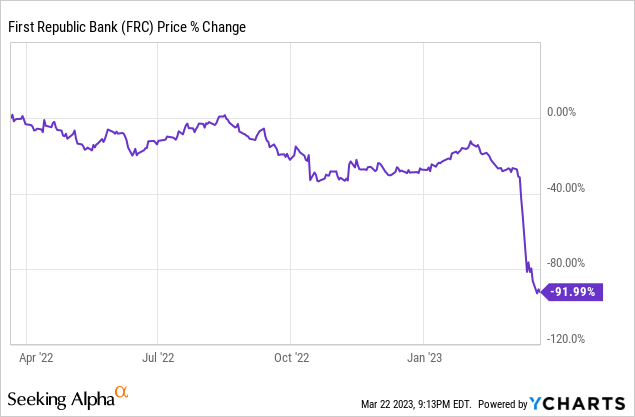

The FOMC recognized that the recent bank run at Silicon Bank risks increasing customer withdrawals at the regional banks. Despite the largest banks including JPMorgan (JPM), Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC) depositing $30 billion into First Republic Bank (FRC), FRC stock is in free-fall.

Investor Action: Be Wary of Regional Banks

Selling in the First Republic accelerated when investors expected the bank to pay a dividend, which it suspended. JPMorgan CEO Jamie Dimon led preliminary talks to stabilize FRC's capital. That also failed to restore shareholder confidence in the regional bank. Investors should not ignore Seeking Alpha's warning:

FRC warning (seekingalpha premium)

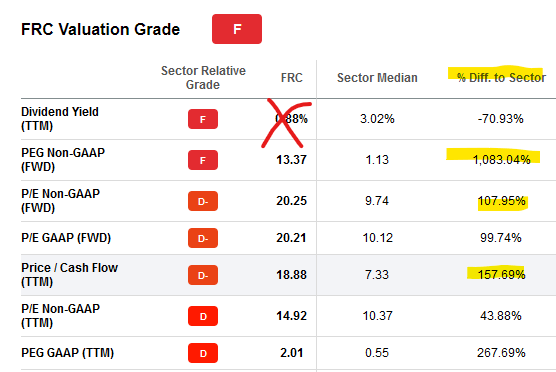

The alert, based on its quant score, cites the relative valuation of the sector as a reason for the prediction of the under-performance ahead.

FRC grade (seekingalpha premium)

The Fed's ongoing fight against inflation will not only add another 25 bps to interest rates, but it will also keep rates at elevated levels.

Although regional banks have advantages like better customer service, the risk of bank runs could shake confidence. Small businesses may transfer their deposits to bigger banks.

Caution on Bigger Banks

Already, Bank of America received over $15 billion in recent days following the collapse of SIVB, Signature, and Silvergate (SI). That does not necessarily suggest that investors should accumulate an overweight position in big banks. The government may insist that they help regional banks by investing in them or depositing funds.

BAC stock closed at a 52-week low on March 22. C stock retested its $43.71 low from Dec. 2022. The stock is still ~ 9% above the one-year low.

Insuring Uninsured Deposits

Investors should not draw a parallel between uninsured deposits at US banks with the Credit Suisse situation. Shareholders received some money back while AT1 bondholders got nothing. The $17 billion of risky AT1 bonds had a clause. S&P Global explained it here.

Investors should monitor The Fed and Treasury statements about coverage for uninsured deposits at U.S. banks. U.S. Treasury Secretary Janet Yellen said the banking system does not need a broad boost in deposit insurance. Yellen said that "shareholders and debtholders of the failed banks are not being protected by the government."

Yellen's statement heightens the risk of investing in small banks at this time.

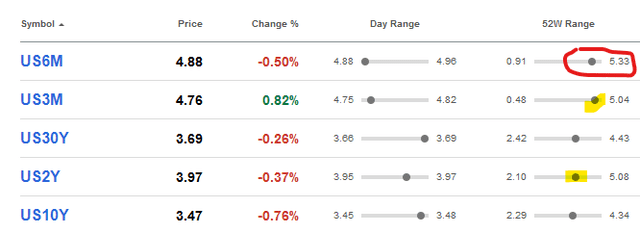

Watch Treasury Yields

Readers should create an "Alert" portfolio on Seeking Alpha tracking Treasury yields. Below, yields fell sharply after the Fed rate announcement. Contrary to Fed Chair Powell's remarks, the bond market still signals expectations of a pause in interest rate hikes. The short-term 6-month (US6M) and 3-month Treasury yields (US3M) closed at the low of the day. The longer-term 2-year (US2Y) and 10-year Treasury yields (US10Y) closed higher.

US Treasury Yields (seekingalpha)

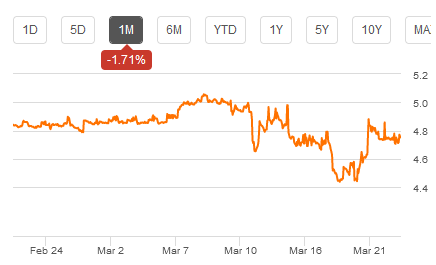

The sharp drop in the 6-month and 3-month lowers the steepness of the yield curve inversion. Still, the 3-month yield needs to fall below 4.5%. This would indicate more confidence in the bond market that the Fed is more likely to pause rates.

US3M (seekingalpha)

For now, investors should once again forget about the idea of a rate cut. Powell had the last word and said that rate cuts "are not in our base case."

Your Takeaway

Investors who did not ignore Fed Chair Powell's warnings avoided only a small loss, thanks to the pre-press conference stock rally. The latest rate hike should not hurt the banking system. The government already increased liquidity, greatly easing fears of a bank run.

Continue to anticipate the Fed's decisions in a data-driven fashion. It targets a 2% annual inflation, so readers should review the Consumer Price Index report each month. The Fed looks at the jobs report. The strong job growth enabled the Fed to raise interest rates at the March meeting.

Investors should continue to allocate more cash that holds U.S. Treasury for the portfolio. Its risk-free return is more attractive than equities at this time.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the "follow" button beside my name. Join DIY investing today.

This article was written by

Join DIY Value Investing. Over two decades of experience in financial markets.

Affiliate partner at StockRover.Chris (diyvalueinvestor@gmail.com) is an Hon B.Sc graduate (with distinction) in Science and Economics. He holds a PMP (Project Management Professional) designation.

Do. Act. Invest.

About Do-it-Yourself Value Investing: Sectors include life science, technology, and dividend-growth income stocks. Through top DIY model holdings, members learn how to manage their trading and investments.

Once you are convinced the ideas have merit, Act on it and put a trading plan together, together with an entry and exit point, based on the DIY Top ideas.

Invest and buy the stock. Then wait for the idea to bear fruit.

I seek undervalued, unappreciated value stock ideas and share them first with DIY members. Follows Warren Buffett's mantra: do not lose money.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.