SPHB: Downgrading To Sell Relative To The S&P 500

Summary

- After being bullish in late 2020, I now turn bearish on the Invesco S&P 500 High Beta ETF relative to the broader equities market.

- An economic slowdown is a near certainty, and I don't think that a recession has been this obviously telegraphed in many decades.

- Heavy concentration in tech and discretionary, including top-ten names that now trade at stratospheric prices, also play against SPHB.

- Looking for a helping hand in the market? Members of EPB Macro Research get exclusive ideas and guidance to navigate any climate. Learn More »

Eoneren

It has come full circle. After turning bullish on the Invesco S&P 500 High Beta ETF (NYSEARCA:SPHB) in November 2020 and downgrading my views to neutral in April 2021, I now turn bearish on this high-volatility fund relative to the broader equities market.

High beta can be a good factor exposure during periods of optimism in the market. I fear, however, that the early stages of economic deceleration may be a bad environment for SPHB. I also dislike the ETF's heavy exposure to pricey tech stocks that have rallied strongly in the first few months of 2023.

Now, let's dig a bit deeper into the bearish argument.

High beta: bad during a downturn

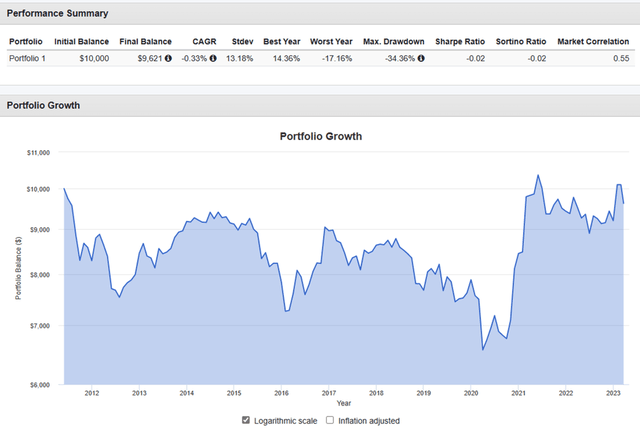

The hand that giveth is the same that taketh away. This is a good way to think about high-beta stocks since they tend to overshoot the broad market (SP500) on the way up and underperform it on the way down. The following graph, which depicts a hypothetical long-SPHB and short-SP500 portfolio, helps to illustrate the point.

Let's walk through the main periods of underperformance and outperformance shown above to understand the dynamics:

- 2011-2012: the markets struggled to gain traction following the peak of the European debt crisis and the downgrade of the US government debt. SPHB lagged the S&P 500 during the two years by about 18 percentage points cumulative.

- 2015-2017: 2015 was the year of (1) the Fed's first interest rate hike since before the Great Financial Crisis, and (2) the infamous flash crash of August. SPHB trailed the S&P 500 by 14 percentage points that year. The recovery came in 2016, followed by a year in which the S&P 500 offered unusually strong risk-adjusted returns. SPHB beat the S&P 500 by 12 percentage points cumulative between 2016 and 2017.

- 2020-2021: relative to the S&P 500, high beta fell off a cliff at the start of the COVID-19 crisis. But starting in November 2020, SPHB rallied viciously through Q1 of 2021 and remained at roughly those same elevated levels through the start of the current year.

SPHB rallied at the beginning of 2023, now up 9% YTD vs. the S&P 500's 5% gains, which I think is a great opportunity to take profits off the table. As I argued in my recent article about the regional bank sector:

An economic slowdown is a near certainty [and] I don't think that a recession has been this obviously telegraphed in many decades. The Fed has been crystal clear about how much it is willing to stall economic activity in order to slow down inflation. The yield curve is inverted like it has not been in 40 years. Not many leading indicators have anticipated previous recessions as well as a negative spread between the ten-year and two-year treasury rates.

I believe that the same dynamic works against SPHB today. If I and many others are right in thinking that substantially tighter monetary policy leading to cautious business spending and plateauing home prices will eventually kick off a recessionary period, it is very likely that SPHB will lag the performance of the S&P 500 coming off an early 2023 high.

Too much tech concentration

The other problem that I see with SPHB is the fund's exposure to the tech sector. There is nothing particularly bad about the industry, in my view. However, I fear that the ETF may suffer from a lack of diversification, should a certain group of stocks, particularly those that have already jumped higher in the past few months, suffer disproportionately.

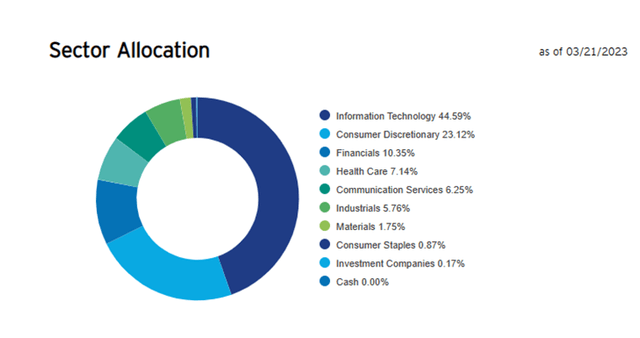

For reference, the chart below provided by Invesco shows SPHB's allocation today. Notice that more than two-thirds of the assets are invested in tech and consumer discretionary stocks, with very little allocated to some of the less cyclical sectors, including consumer staples (less than 1%).

Among the top ten tech and discretionary stocks are names like Nvidia (NVDA), Advanced Micro Devices (AMD), and Tesla (TSLA), all of which are up by at least 50% in 2023 so far and trade at a current-year P/E of 31x at a minimum.

The combination of expected cyclical headwinds, heavy sector concentration, and high valuations following the early 2023 rally are enough reasons, in my view, to support the downgrade of SPHB to sell relative to the benchmark.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.

This article was written by

Daniel Martins is a Napa, California-based analyst and founder of independent research firm DM Martins Research. The firm's work is centered around building more efficient, easily replicable portfolios that are properly risk-balanced for growth with less downside risk.

- - -

Daniel is the founder and portfolio manager at DM Martins Capital Management LLC. He is a former equity research professional at FBR Capital Markets and Telsey Advisory in New York City and finance analyst at macro hedge fund Bridgewater Associates, where he developed most of his investment management skills earlier in his career. Daniel is also an equity research instructor for Wall Street Prep.

He holds an MBA in Financial Instruments and Markets from New York University's Stern School of Business.

- - -

On Seeking Alpha, DM Martins Research partners with EPB Macro Research, and has collaborated with Risk Research, Inc.

DM Martins Research also manages a small team of writers and editors who publish content on several TheStreet.com channels, including Apple Maven (thestreet.com/apple) and Wall Street Memes (thestreet.com/memestocks).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.