Workhorse's Epitaph

Summary

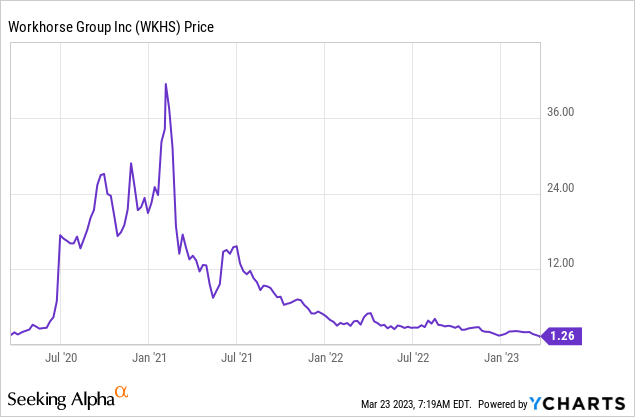

- Workhorse was a short recommendation that fell on average 85%.

- Is WKHS still worth shorting?

- Lessons learned from WKHS.

anankkml

Workhorse Group (NASDAQ:WKHS) is an aspiring electric vehicle manufacturer focusing on the delivery truck market. I have written five short articles on Workhorse on 12/10/2019, 8/5/2020, 8/27/2020, 2/8/2021, and 5/11/2021, with the stock falling on average 85% over those five strong sell recommendations to $1.27 today.

date of WKHS article | price at date of article | price today (3/22/23) | % change |

5/11/21 | $8.20 | $1.27 | -85% |

2/8/21 | $40.61 | $1.27 | -97% |

8/27/20 | $17.43 | $1.27 | -93% |

8/5/20 | $19.18 | $1.27 | -93% |

12/10/19 | $2.91 | $1.27 | -56% |

average % change | -85% |

Workhorse has been a compelling short over the past few years. WKHS market cap was as high as $5 billion in early 2021 with only nominal revenues, highly negative gross margins, a dysfunctional business, and for many years, inexperienced management.

The speculative Workhorse bubble has been deflated. Priced at $1.27 today, WKHS has a market cap of $217M and an enterprise value of $128M. I believe there is more downside in WKHS. The company's operating cash burn accelerated to -$28M in Q4 2022, and WKHS could run out of money by the end of 2023 unless revenues and gross margins ramp significantly and/or a dilutive financing saves the day. So, in my opinion, bankruptcy is a risk and this stock should not be bought.

Current management, however, is a vast improvement over the prior team, in my view. They are trying to do the right things and making the necessary capital and personnel expenditures. Still, the most likely WKHS scenario will be dilutive financings and reverse-stock splits in the coming years that will create negative shareholder returns.

In spite of Workhorse's still-weak fundamentals, the Quan Technology Fund that I manage in the past few days took profits and covered its WKHS short position, along with its other shorts - Lucid (LCID), MicroVision (MVIS), and Blink Charging (BLNK) that we shorted at much higher price levels in 2021. WKHS' short interest of 25% of shares outstanding combined with an enterprise value of $128M makes the risk-reward less interesting, given the alternative uses of our fund's capital. Thus, we have changed our Seeking Alpha WKHS rating from strong sell to sell.

Finally, I recommend that readers review the above-mentioned five Workhorse articles and back-and-forth commentary. This provides a glimpse of how market conditions, hype and false assumptions created a stock bubble and a great shorting opportunity.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.