PICK: Forget Gold, Industrial Metals Are The Real Inflation Hedge

Summary

- Industrial metals prices and equities have been extremely closely correlated with inflation expectations and actual CPI over the past decade, far more so than in the case of gold.

- With 10-year inflation expectations now sitting at just 2.2%, the iShares MSCI Global Metals & Mining Producers ETF offers investors a way to benefit from a recovery in long-term inflation.

- The PICK offers attractive valuations, with a PE ratio of just 6.6x. This should allow the dividend yield to remain around 5% unless we see a recovery in the ETF.

poco_bw/iStock via Getty Images

For investors looking to protect against inflation, the iShares MSCI Global Metals & Mining Producers ETF (BATS:PICK) has been extremely closely correlated with inflation expectations and actual CPI over the past decade, far more closely correlated than gold. While global economic weakness may keep industrial metals and inflation expectations depressed in the short term, PICK offers attractive valuations and a high dividend yield for investors willing to wait for a recovery in inflation pressures.

The PICK ETF

PICK seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver. Iron ore prices are a key driver of PICK, as the three largest companies on the index are BHP, Rio Tinto, and Vale. The ETF closely tracks the performance of the S&P GSCI Industrial Metals Index while paying a high dividend yield of 7.0%. While this is set to fall in line with the underlying ACWI Metals and Mining ex- Gold and Silver index, the yield here is still an attractive 5.3%. The ETF charges a management fee of 0.39% per year.

PICK Is Closely Correlated With Inflation

While investors have flocked to gold over recent weeks amid the heightened instability in the US banking system and an increase in the Fed's balance sheet, gold is typically a very poor way to benefit from rising inflation. Industrial metals prices are far more closely linked with US inflation in the short term, while gold is driven much more by interest rate expectations.

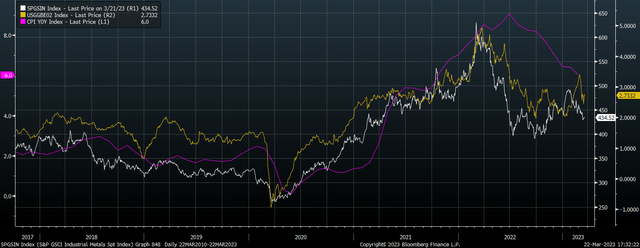

Industrial Metals Index, 2-Year Breakeven, and Headline CPI (Bloomberg)

This can be seen on the chart above, which shows the close correlation between the S&P GSCI Industrial Metals Index and 2-year breakeven inflation expectations as well as actual headline CPI. In contrast, the price of gold shows virtually no correlation with inflation or inflation expectations as interest rate expectations play a much greater role in the price of gold relative to industrial metals.

Gold Price, 2-Year Breakevens, and Headline CPI (Bloomberg)

As industrial metals prices are the main driver of mining stocks, PICK also has an extremely strong correlation with inflation expectations, and this correlation gets stronger the longer the inflation horizon. The chart below shows PICK relative to 10-year breakeven inflation expectations as measured by the difference in yield between US 10-year inflation-linked bonds and regular Treasury bonds. I use this measure frequently as it has a great track record of predicting actual subsequent inflation. In fact, over the past 10 years, 10-year breakevens have been even more closely correlated with the PICK than they have with the industrial metals index itself.

PICK vs 10-Year Breakeven Inflation Expectations (Bloomberg)

With 10-year inflation expectations now sitting at just 2.2%, PICK could be a good investment for anyone looking to benefit from a recovery in long-term inflation expectations. This is particularly the case for anyone who also expects bond yields to rise, in which case industrial metals and the PICK should outperform gold.

I personally believe that bond yields will continue to head lower over the coming months and years as the global economy deteriorates and this may put further downward pressure on in industrial metals prices and inflation expectations. However, 2.2% long-term inflation seems on the low side, and the PICK offers attractive dividend and free cash flow yields which make it attractive even if metals prices decline.

The ACWI Metals and Mining Index trades at a PE ratio of just 6.6x and a price to free cash flow ratio of 10.5x. These strong earnings have allowed dividends to rise rapidly even while payout ratios have remained low. Despite falling sharply from its peak, the index still offers a dividend yield of 5.3%. On a forward basis the yield is lower at 4.8%, but this is still almost 3x more than the S&P500 and factors in a further 25% decline in profits.

Summary

The PICK offers investors a way of benefiting from any recovery in inflation expectations, which are far more closely correlated with industrial metals than precious metals. While weakness in the global economy may continue to put pressure on industrial metals producers over the coming months, PICK's cheap valuations and high dividend yield make the ETF a solid risk-reward play.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PICK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.