Cortigent Seeks $17 Million U.S. IPO For Orion Neurostimulation Device Development

Summary

- Cortigent has filed to raise $17 million in a U.S. IPO, although the final amount may differ.

- The firm is developing a neurostimulation device to assist profoundly blind persons.

- CRGT has seen positive results in small-scale, early feasibility studies.

- I'll provide an update when we learn more about the IPO from management.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

ViktorCap/iStock via Getty Images

A Quick Take On Cortigent, Inc.

Cortigent, Inc. (CRGT) has filed to raise $17.25 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing a medical device for the treatment of profound blindness and potentially other medical conditions.

Management has seen encouraging feasibility results on a small patient population and plans to move to pivotal trials.

When we learn more IPO details, I'll provide a final opinion.

Cortigent Overview

Valencia, California-based Cortigent, Inc. was founded to develop an implantable neurostimulation device to assist patients with various forms of blindness in recovering the ability to process perceptions through specialized training.

Management is headed by Chief Executive Officer Jonathan Adams, who has been with the firm since November 2022 and was previously founder and CEO at BioVie and prior to that was an Associate Director at Searle Pharmaceuticals.

The firm's first system, called the Argus II, was approved years ago through the US FDA's Humanitarian Device Exemption program and has been implanted in hundreds of profoundly blind people.

The company is developing 'a more advanced system for artificial vision' that it calls Orion.

Cortigent has booked a fair market value investment of $475,000 as of December 31, 2022, from investors, including parent firm Vivani Medical, Inc.

Cortigent's Market & Competition

According to a 2021 market research report by Coherent Market Insights, the global market for visual impairment treatment was an estimated $4.4 billion in 2020 and is forecast to reach $7.6 billion by 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 8.1% from 2020 to 2027.

Key elements driving this expected growth are a growing incidence of eye disorders and vision loss due, in part, to an aging global population.

Also, the World Glaucoma Association has estimated that the number of persons with glaucoma will rise from 79.6 million in 2020 to 111.8 million in 2040.

Major competitive vendors that provide or are developing related treatments include the following:

Pixium Vision SA

Nano Retina Inc.

Bionic Vision Technologies

Illinois Institute of Technology

MicroTransponder

Others

Cortigent's Financial Status

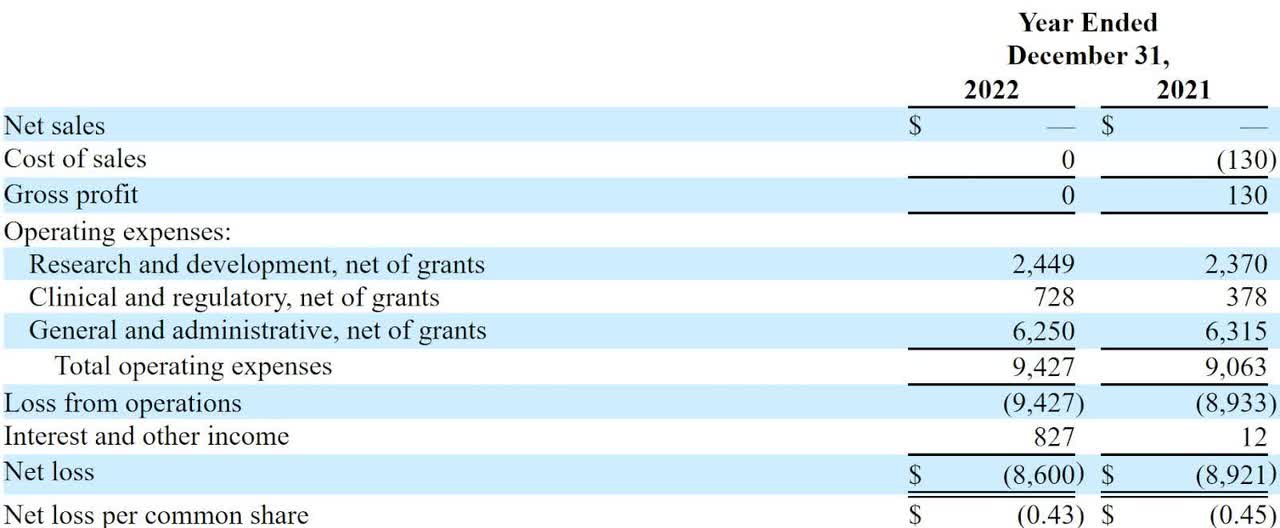

The firm's recent financial results are typical of a development-stage life science company in that they feature no revenue and significant R&D and G&A costs associated with its pre-sales efforts.

Below are the company's financial results for the past two years:

Statement Of Operations (Seeking Alpha)

As of December 31, 2022, the company had $425,000 in cash and $1.7 million in total liabilities.

Cortigent, Inc. IPO Details

Cortigent intends to raise $17.25 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

Immediately after the IPO, the company will still be controlled by parent firm Vivani Medical.

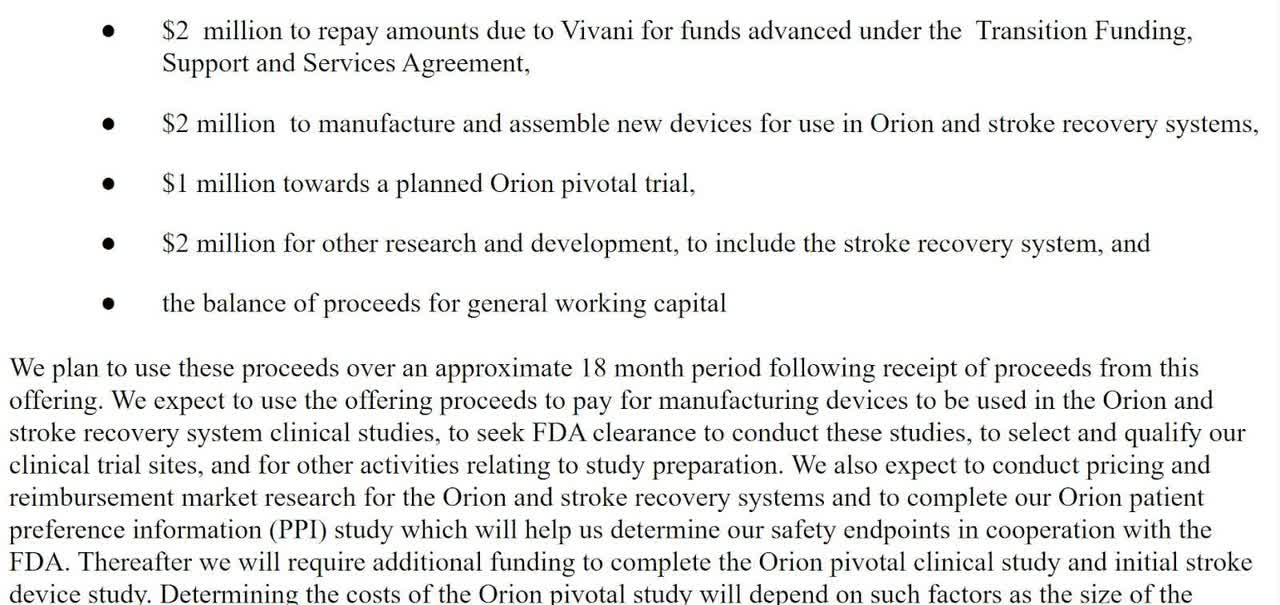

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

Management's presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, as a result of opposition actions by competitor Pixium, the firm has had two European patents invalidated but one patent reaffirmed, although that is subject to appeal.

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary About Cortigent's IPO

CRGT is seeking U.S. public capital market investment to fund further development of its Orion system and to pay amounts due to parent firm Vivani Medical.

The firm's lead product is a second-generation system after the company's first product has been implanted in several hundred patients.

Cortigent is planning a pivotal trial now that its early feasibility results from six patients produced five patients who 'performed significantly better on square localization and direction of motion and 2 of 5 had a measurable improvement in visual acuity.'

The market opportunity for providing assistive devices to the visually impaired is large and expected to grow at a moderately fast rate of growth in the coming years.

Management views its U.S. market size as approximately 82,000 profoundly blind persons, which it estimates is valued at around $4 billion, per a report commissioned by the company and prepared by Fletcher Spaght.

The firm hasn't disclosed any major medical device firm collaboration relationship.

ThinkEquity is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (47.8%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

When we learn more about management's pricing and valuation assumptions, I'll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions. IPO investing can involve significant volatility and risk of loss.