SCHV: Dump Value Over Growth

Summary

- The Schwab U.S. Large-Cap Value ETF does not appear to be the best choice for investors hoping to profit significantly from a potential stock market recovery.

- Economic growth trends are a positive sign for the stock market as a whole, but rising investor confidence is more likely to support hard-hit growth stocks than value stocks.

- The performance of value-driven ETFs like SCHV could also be affected by the possibility of declining earnings growth in the financial, energy, and material sectors.

- Also, valuations suggest that growth stocks have more upside potential than value stocks.

Galeanu Mihai

Value-focused ETFs, such as the Schwab U.S. Large-Cap Value ETF (NYSEARCA:SCHV), outperformed growth ETFs in 2022, but this trend is expected to reverse in 2023. One of many potential reasons for the potential underperformance of value stocks could be faster-than-anticipated economic growth, which might encourage investors to favor growth stocks. The performance of some key sectors, such as finance, healthcare, and energy, which are hotspots for value stocks, is likely to stymie the overall performance of value-focused ETFs. I believe the high beta growth category is better positioned to reward investors looking to capitalize on the market's potential recovery in 2023.

Economic Trends Support Growth Over Value

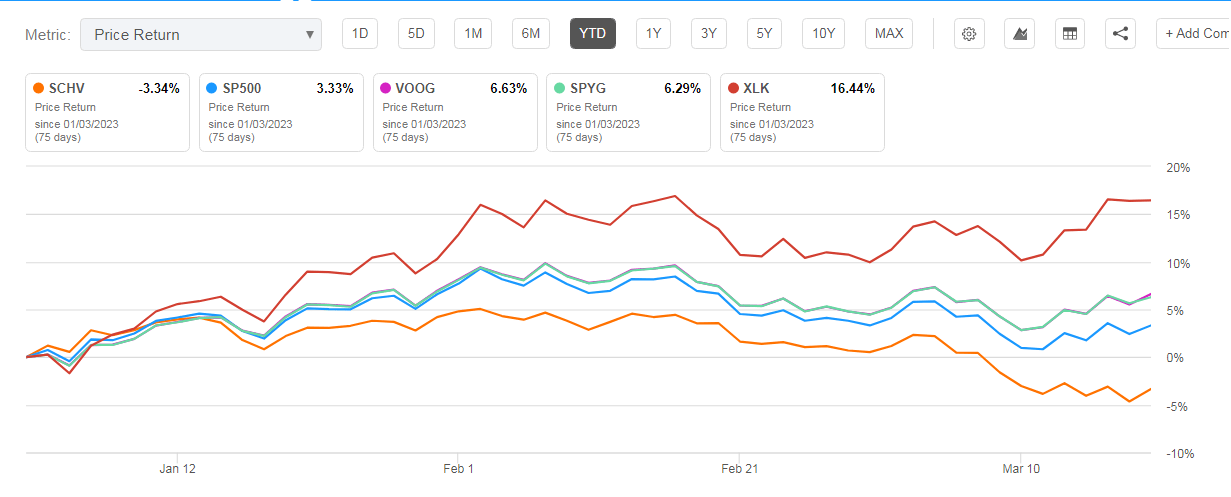

Value and Growth ETFs (Seeking Alpha)

Value stocks and ETFs like SCHV started to lose ground to growth stocks in 2023 after outperforming them in 2022 by the largest margin since the dot-com bubble. Value investments gained traction in 2022, thanks to rising yields, high inflation, and challenging economic conditions. Investors thought their money would be better protected from the broader stock market downturn by investing in lower-priced value stocks. The strategy was successful in 2022, but the market dynamics drastically changed in 2023.

As shown in the chart above, growth ETFs have outperformed a value ETF so far in 2023, as market fundamentals for risky assets have improved. The shift in investor confidence can be attributed primarily to better-than-expected economic data, slowing inflation, and expectations for a lower terminal level than many had predicted. When the economy is expanding and inflation is slowing, growth ETFs perform better than their counterparts.

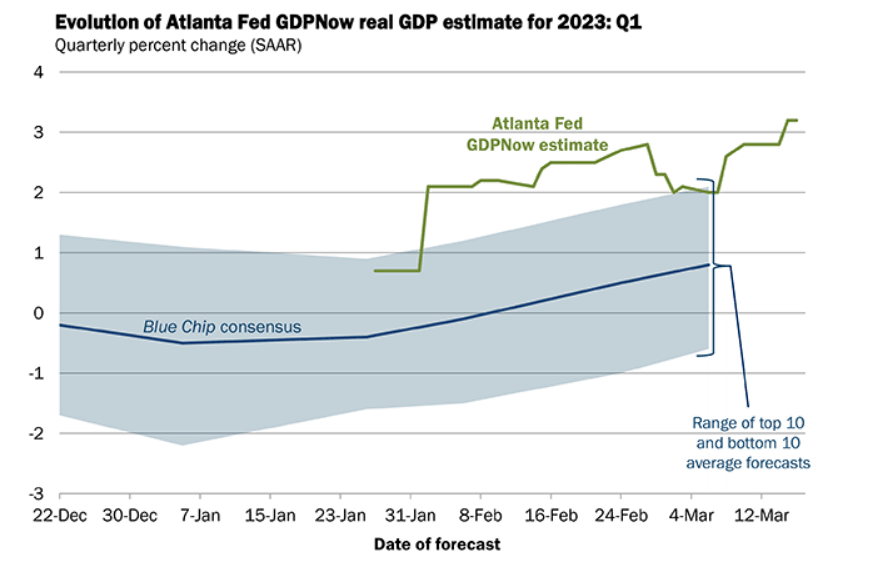

Q1 US GDP Forecast (Fed Atlanta)

Market analysts and credit rating agencies have gradually reduced their forecasts for an impending recession while increasing their GDP projections for the United States and the rest of the world. Over the last two months, the Atlanta Fed has raised its initial forecast for first-quarter GDP from less than 1% to an updated forecast of 3.2%. One of the best tools for analyzing market behavior is credit card transactions. According to Mastercard SpendingPulse, retail sales in the United States increased by 6.9% year over year in February and by 8.8% in January. The e-commerce industry, which is also a haven for growth stocks, increased by 13.2% in February. On a yearly basis, in-store sales rose by 5.5%. Overall, with strong retail sales, solid job growth, and the Fed almost at its median peak federal funds rate of around 5.1%, the likelihood of a hard landing has significantly decreased and the chances of an economic recovery are rising. This situation bodes well for the overall stock market and growth stocks in particular, because better conditions not only support the growth category financially, but also encourage investors to take risks.

Financials, Energy, and Healthcare Sectors Could Hinder SCHV's Performance

Value ETFs typically include stocks from the financial, healthcare, industrial, and energy sectors, whereas the technology, consumer discretionary, and communication services sectors account for the majority of the weight in the growth category. Since the financial sector accounts for about 18% of the SCHV's portfolio, problems there may have an effect on the value category as a whole. The unexpected failure of four US banks, as well as the manner in which Credit Suisse acquired in Europe, have sparked widespread concern. Vanguard Financials Index Fund ETF (VFH), which offers broader coverage of the financial sector, has dropped about 10% since the banking crisis broke out in the last two weeks.

Moreover, key metrics like credit card delinquency, net charge-offs, and provision for reserves, which have a significant impact on earnings, already started deteriorating in the fourth quarter. For instance, Capital One Financial (COF), a consumer finance company, reported a 34% drop in earnings for the fourth quarter, owing primarily to higher-than-expected credit provisions. Goldman Sachs (GS), one of the largest US banking giants, also reported a $972 million provision for credit losses in the fourth quarter, 50% higher than analysts expected. During an earnings call, Goldman's CFO, Denis Coleman, said that the company is observing "early signs of consumer credit deterioration."

Healthcare, the second-largest sector for value-focused ETFs like SCHV, will most likely struggle to grow revenue and earnings in 2023. According to FactSet, earnings in the healthcare sector will most likely fall by a high single-digit percentage in 2023 compared to the previous year. Johnson & Johnson (JNJ), SCHV's largest healthcare stock, has seen its share price fall by more than 10% since the beginning of the year. Other top holdings, such as Merck & Co. (MRK) and AbbVie Inc. (ABBV), have hinted at weaker-than-expected 2023 results. Merck expects full-year 2023 non-GAAP EPS of $6.80 to $6.95, compared to a consensus of $7.39. The forecast also indicates a significant drop from non-GAAP earnings per share of $7.48 in 2022. AbbVie's 2023 outlook calls for $10.70 adjusted diluted EPS, down from $11.68 in the consensus and a decrease from $13.77 in 2022.

The energy sector, which had the best performance in 2022, is likely to lag in 2023 due to a sharp drop in crude oil prices. According to FactSet data, earnings in the energy sector are expected to fall 18% in 2023 from the previous year. The materials sector is also expected to report a 16% year-over-year earnings decline in 2023 earnings due to a drop in commodity prices.

Valuations

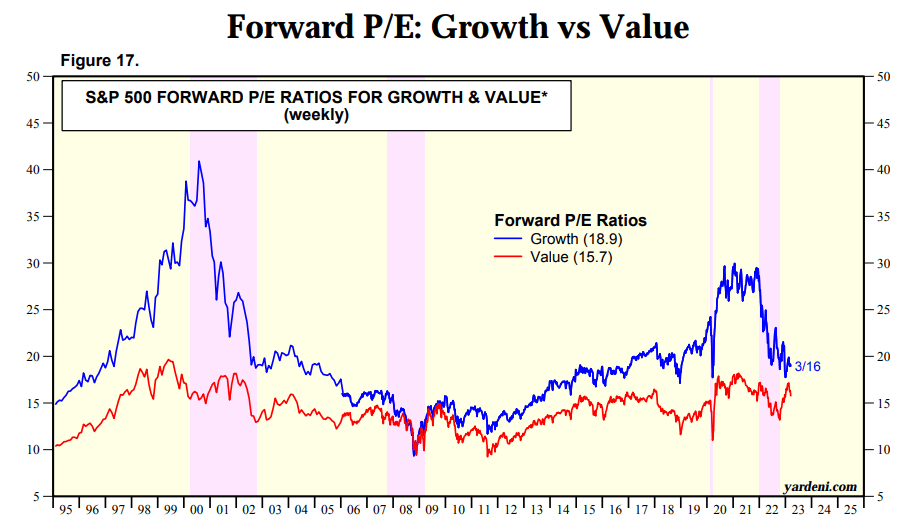

Growth Vs Value Forward PE (Yardeni.com)

When compared to growth companies, value companies typically have low price-to-book and price-to-earnings ratios. As shown in the chart above, the value category's forward PE ratio increased sharply as a result of share price growth and deteriorating earnings expectations, which does not bode well for future price performance. The value category is currently trading above its five- and ten-year averages and close to its all-time high set in 2021. On the other hand, the steep price drop in 2022 made the growth category appear appealing. It is currently trading much lower than its previous highs, as well as lower than its five- to ten-year averages. Overall, it seems that growth stocks have more room for upside than value stocks that are already trading close to their previous highs.

Alternative Options

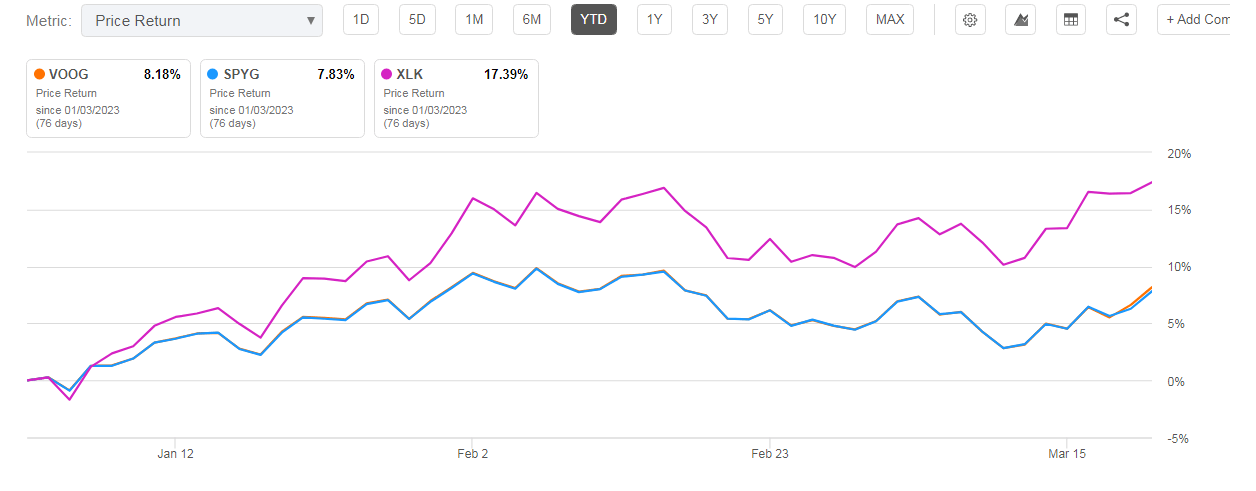

Growth ETFs Year to Date Performance (Seeking Alpha)

As I expect value ETFs like SCHV to underperform compared to growth ETFs, investors can pursue a variety of appealing growth options to capitalize on last year's selloff and potential recovery in 2023. For investors with a high-risk tolerance and a desire for high returns, the Technology Select Sector (XLK), which provides more comprehensive coverage of the technology sector, could be a good option. The share price of XLK has increased by almost 17% so far in 2023 as a result of stronger-than-expected financial results and economic trends. The ETF received a strong buy recommendation from Seeking Alpha's quantitative system, which gave it a quant score of over 4.90. You can read my article "XLK Still Offers A Buying Opportunity" for a more detailed explanation of why XLK and the tech industry are expected to perform well in 2023.

Both the SPDR Portfolio S&P 500 Growth ETF (SPYG) and the Vanguard S&P 500 Growth ETF (VOOG) offer broader coverage of the growth category and include securities from all eleven S&P 500 sectors, with a high emphasis on tech, consumer discretionary, and communication services. Both ETFs earned buy ratings from Seeking Alpha's quant system because of solid grades on momentum and liquidity factors. You can also read in detail about these two ETFs by clicking here and here.

In Conclusion

Schwab U.S. Large-Cap Value ETF earned a hold rating from the Seeking Alpha quant system due to a low score on the momentum factor. SCHV has a slim chance of outperforming the broader market index in 2023 because the financial sector is going through difficult times. The performance of the value category as a whole may also be impacted by the sharp decline in earnings forecasts for the energy and materials sectors. In contrast, strong economic growth trends would boost investors' confidence in high beta growth stocks, prompting them to buy them at much lower prices in order to profit from a potential recovery in 2023.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.