Block Stock Craters On Short Report

Summary

- Block experiences solid business growth, but margins are compressing.

- There is massive dilution.

- SQ stock's valuation remains lofty. Overall, Block does not look too attractive.

- Looking for a helping hand in the market? Members of Cash Flow Club get exclusive ideas and guidance to navigate any climate. Learn More »

Sam Shere

Article Thesis

Block Inc. (NYSE:SQ) has been a highly volatile stock for quite some time. On Thursday, the stock slumped by almost 20% due to a new short report. While I do not agree with some of the things stated in the report, unprofitable Block does nevertheless seem like a stock that might better be avoided in a rising rates environment.

What Happened?

Famous short seller Hindenburg Research came out with a report that alleges that Block Inc. may have overstated its user count. Hindenburg Research states this was the result of a two-year investigation. Seeking Alpha reported that Block was not immediately available with a comment (see the above link), along with other media outlets (see here).

The market reacted very negatively to this news item, as Block dropped by close to 20% following the release of Hindenburg Research's report.

An excerpt of Hindenburg Research's report states:

Our two-year investigation has concluded that Block has systematically taken advantage of the demographics it claims to be helping. The "magic" behind Block's business has not been disruptive innovation, but rather the company's willingness to facilitate fraud against consumers and the government, avoid regulation, dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics.

Those are pretty hefty accusations. Hindenburg Research claims that interviews with former employees, partners, industry experts, and so on have helped it in coming to the conclusions drawn in the report linked above.

Past Coverage Of Block

I last covered Block in June 2022, when I showcased a pair trade idea of going long PayPal (PYPL) and going short Block, Inc. The reasoning for that was that PayPal was better insulated vs. a crypto winter and that PYPL also was a lot cheaper than Block. Since then, PayPal's shares have risen slightly more than those of Square, thus the pair trade idea would have made some money, but the difference in the performance of the two companies was not overly large.

Block Today

Whether the allegations that Hindenburg Research claims in its report are true or not is not known yet, at least to me. It's possible that interviews with former Block employees have given indications for issues, but others will argue that Hindenburg Research has not released any concrete proof yet.

We can look at Block's results, however, in order to gauge where the company is standing today. The company's most recent quarterly results were released on Feb. 23. During the fourth quarter, the company was able to grow its revenue by 14% year over year, which is an attractive growth rate. Considering Block is a highly-valued growth stock, this growth rate is not too great, however. The company also missed earnings estimates widely, by more than 20%, as earnings per share of $0.22 came in well below the expected $0.30. It's important to note that these are non-GAAP numbers - on a GAAP basis, the company reported a considerable net loss for the period.

While one can argue that payment volumes were moving in the right direction during the period, there also were some trends that aren't positive. Block reports that its gross payment volume grew 15% year over year during the most recent quarter, but its transaction-based revenue grew by just 13% over the same time frame. This means that Block's take rate is declining - per dollar in payment volume that it facilitates, its take is shrinking. This obviously isn't good for revenue and profit growth and is likely the result of strong competition in the payment space. If this trend remains in place, Block's future revenue growth will experience headwinds.

At the same time, Block's gross profit in the payment space grew at a slower rate than its revenue, as gross profit was up by 10% year over year during the fourth quarter. Ideally, business growth should go hand in hand with expanding margins, but it looks like Block's gross margins (at least in the payment space) are declining, as expenses are growing faster than revenues. This is far from ideal, as it means that the company will be facing major challenges when it comes to growing net margins and improving profits in the future - after all, that's a lot easier when gross margins are rising instead of compressing.

Block also is showing very strong growth in its operating expenses - which naturally isn't great. From 2021 to 2022, Block's operating expenses rose from $4.3 billion to $6.6 billion, which makes for a growth rate of 53%. For a company that recorded a revenue growth rate of -1% over the same time frame, that's a pretty bad result. Not surprisingly, Block's operating profits which were already rather slim in 2021 completely vanished in 2022, and the company was forced to report a major net loss of $550 million.

Whether the accusations by Hindenburg Research are true or not, it does not look like Block's results are strong and getting stronger. Instead, the actual results reported by the company itself indicate that things have been moving in the wrong direction over the last year, as margins compressed while profits turned to losses.

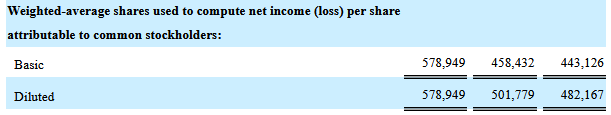

To top things off, Block continued to dilute shareholders at a massive pace:

Block 10-K filing

The company's most recent 10-K shows that its diluted share count has risen from 482 million in 2020 to 579 million in 2022, for an increase of a little more than 20% in two years. From 2021 to 2022 alone, the share count rose by more than 15%. At the current share price of around $60, the 77 million share count increase in 2022 suggests the issuance of $4.6 billion worth of stock in the last year alone. Issuing more than $4 billion worth of shares to management and employees while recording a net loss at the same time is far from value-creating for common shareholders, I believe - although management and employees undoubtedly benefit from Block's generous share-based compensation approach.

The 578 million share count was the average for 2022. According to YCharts, the share count has risen to more than 600 million by now, thus it looks like the dilution shareholders have suffered from continues. Of course, one can argue that it doesn't matter as long as Block is not generating net profits, as non-existent profits can't be diluted anyway. Still, since the company will have to be profitable eventually for the current share price to make sense, dilution shouldn't be ignored.

With SQ trading for around $60 today, shares are valued at 35x this year's expected net profit. It's important to note two things here, however: First, the analyst consensus uses non-GAAP earnings per share, thus Block's massive share issuance, which has a real effect on shareholders, is not accounted for. Second, Block may underperform expectations - it has done so in the most recent quarter, as it missed earnings per share estimates by well above 20%. It's thus not guaranteed at all that Block will report $1.70 in profit per share this year, not even when we focus on non-GAAP results and do not account for the ongoing dilution.

But taking that estimate at face value, Block still isn't cheap. A 35x earnings multiple translates into an earnings yield of less than 3%, in an environment where no-risk fixed-income investments such as treasuries, CDs, etc. offer returns of 4% to 5% in many cases. Buying into a volatile, sometimes unprofitable company like Block that offers a significantly lower earnings yield does not seem especially attractive to me on a relative basis - even if all of Hindenburg Research's claims are wrong.

Block's enterprise value to EBITDA multiple for the current year, using the analyst consensus estimate, is 30. This also indicates that shares are still pricy, even though they aren't as expensive as they were at the peak of the bubble.

Takeaway

Block is seeing some business growth, but there's a lot of competition in the payment space, and market growth has slowed down as the pandemic has ended and since the economic environment has become harsher. Margins in this space thus are compressing, which isn't good for the profit outlook.

Block's recent results were far from strong, and at the same time, massive share issuance makes for a lot of dilution, and the valuation remains lofty. Hindenburg Research's allegations may be right, or they may be wrong - but in either case, Block does not look like an attractive investment to me at the current price, and as long as margins don't improve meaningfully.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Club.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.