British prime minister Rishi Sunak paid over £1 million ($1.2 million) in tax over the past three years. AP File Photo

British prime minister Rishi Sunak paid over £1 million ($1.2 million) in tax over the past three years. AP File Photo

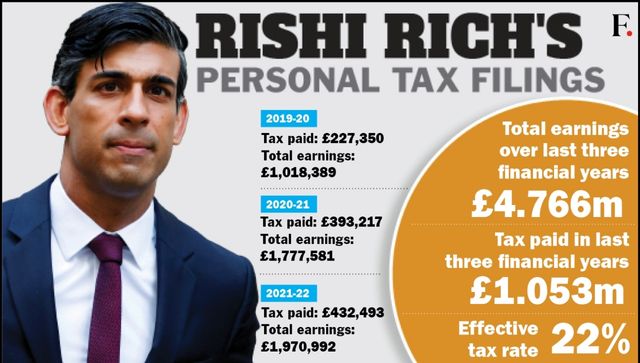

British prime minister Rishi Sunak paid over £1 million ($1.2 million) in tax over the past three years, as per his personal tax filings released on Wednesday (22 March).

The Tory leader earned nearly £5 million from his income and a US-based investment fund between 1 April 2019 and 31 March 2022.

These details come months after Sunak pledged to publish his tax return during his unsuccessful bid against Liz Truss to become the Tory leader last year.

Let’s take a closer look at the British prime minister’s tax filings, the row it has courted, and his past financial controversies.

Rishi Sunak’s tax affairs

Downing Street has published a document titled ‘Personal Tax Returns’ which includes the British prime minister’s taxable income, capital gains and taxes paid.

Sunak, who became the UK prime minister last October, made an income of £4,352,767 over a three-year period from US investments. This is in addition to the Conservative Party leader’s ministerial salary.

Around £410,000 of Sunak’s total earnings over the last three years came from his MP and ministerial salary.

His total earnings amounted to £4,766,962 over the past three years.

Between 2019 and 2022, Sunak received around £600,000 in investment income and £3.8 million in capital gains, Bloomberg reported citing his tax returns.

He paid £432,493 in taxes – £325,826 in capital gains tax and £120,604 in UK income tax – on total earnings of £1.9m in income and capital gains in the last financial year of 2021-2022.

Over the three-year period, Sunak paid £1,053,060 in UK taxes after deductions due to levies paid abroad, reported Bloomberg.

He paid a further $51,648 in US taxes over the past three financial years as America exacts tax due on dividends on non-residents.

According to The Telegraph analysis, Sunak’s effective tax rate slightly dipped from 22.32 per cent in 2019-20 to 21.94 per cent in 2021-2022.

As per the explanation provided by the government over Sunak’s tax records, his investment income and capital gains “relate to a single US-based investment fund”, which is listed as a “blind management arrangement”.

The document says “some of the income of the US-based investment fund is also subject to tax in other jurisdictions (including the USA)”, reported BBC.

Sunak has previously admitted that his investments are held in a financial arrangement called blind trust, under which he cannot access the gains while he is in office but still has to pay taxes on them.

Row over timing

The timing of Sunak’s tax filing is being questioned by some Opposition politicians. The three-page document was released the same day former UK prime minister Boris Johnson appeared before a parliamentary committee over the Partygate scandal.

On the same day, British MPs voted overwhelmingly in favour (515-29) of Sunak’s renegotiated Brexit deal with the European Union.

Raising questions about the timing of the release of the tax filings, Christine Jardine, the Liberal Democrat Cabinet Office spokesperson asked why the UK prime minister “snuck them out” while the “world is distracted” with Johnson’s Partygate grilling.

“People will be much more concerned today about the staggering tax hikes Rishi Sunak has imposed on them,” Jardine was quoted as saying by BBC.

The Labour Party said the Tory leader has published the statements “after much delay”. Sunak said last November he hoped the document will be released by Christmas that year.

Angela Rayner, Labour’s deputy leader, tweeted, “Wonder why he’s chosen today?”

“[The tax returns] reveal a tax system designed by successive Tory governments in which the prime minister pays a far lower tax rate than working people who face the highest tax burden in 70 years”, Rayner said, as per The Guardian.

Tax expert Richard Murphy wrote in a tweet: “What do Sunak’s tax returns tell us? It is that a wealthy person with income beyond their immediate needs can always re-categorise large parts of that income as capital gains to reduce their tax rate on that part to 20 per cent, which is an insult to all who have to work for a living.”

Meanwhile, Sunak said he was “glad” to release his tax statements “in the interests of transparency”.

Rishi Sunak’s past financial rows

Sunak – who is married to Akshata Murty, the daughter of Indian billionaire founder of Infosys Narayana Murthy – has often made headlines for his personal wealth.

Believed to be one of the richest MPs in Parliament, Sunak owns several lavish properties, including a Grade II-listed manor house in his North Yorkshire constituency, along with his wife, as per BBC.

Last May, Sunak became the first-ever politician to feature on The Sunday Times UK Rich List. Akshata and her husband were ranked at number 222 with a reported net worth of £730 million, reported Independent.

The heat was raised on Sunak to be transparent about his finances after it came to light last year that his wife Akshata had non-domiciled status which saved her millions of pounds in UK taxes on foreign income.

Following a backlash, Akshata gave up her non-dom status and said she would pay UK taxes on all her wealth.

Later, Sunak admitted he had a US green card – that allowed him permanent residence in the country – while he was the UK chancellor.

He returned the green card in October 2021.

After the controversy, Sunak referred himself to the prime minister’s ethics adviser for an investigation into his own financial affairs. He was given a clean chit by the ethics adviser on ministerial standards, Christopher Geidt, in April last year.

The couple’s wealth continues to be under political scrutiny amid the UK facing a cost-of-living crisis.

With inputs from agencies

Read all the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.