SPY: I Am Short Again

Summary

- I entered the Fed meeting neutral on SPY, acknowledging the possibility of the 1998-type Fed pivot.

- However, the Fed ruled out the bullish pivot.

- Thus, I am re-establishing the bearish position.

CreativaImages

I closed the short position in S&P 500 after the sharp drop at the onset of the current banking crisis and went neutral, as I outlined in this article. However, after the Fed meeting (March 22), I am reestablishing the bearish bet on S&P 500 (NYSEARCA:SPY).

The prior decision to go neutral

The initial bearish thesis (prior to the banking crisis) was that the Fed's would have to be more aggressive in tightening monetary policy, which boosted the probability of a much deeper and longer recession. At the same time, S&P 500 was still overvalued with the forward PE ratio at 18. Thus, there was a significant downside for S&P 500 (SP500), possibly down to the 2800 level.

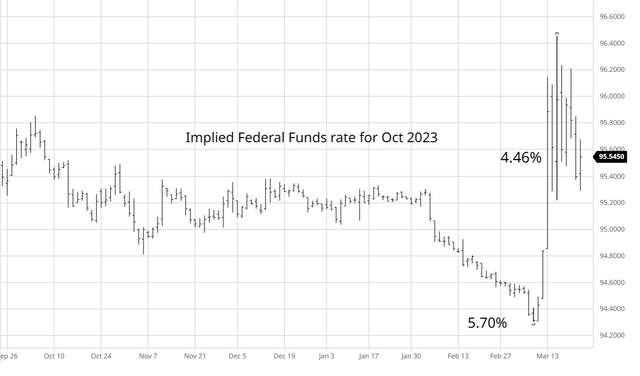

However, with the SVB Financial fallout and the onset of the 2023 bank run the market started to price an aggressive monetary policy easing. The chart below illustrates the marker expectations for the October 2023 Federal Funds futures.

Barchart

Before the SVB Financial collapse, the market was pricing the Federal Funds rate at 5.7% - this was consistent with the thesis that the Fed was still trying to catch up with inflation, and thus likely to induce a deep recession.

However, after the SVB Financial collapse, the market started to price the Fed pivot, whereby the Fed would possibly pause at the March meeting and start cutting thereafter. Thus, the same October contract was showing the implied Federal Funds rate at around 4% at times, currently at 4.46%.

Note, the Fed pivot was expected in an environment of still strong economy, at least by looking at the labor market. In my view, this scenario created a possibility for the stock market to rally, with investors cheering the Fed's pivot (before the recession actually occurred), which would actually decrease the probability of a deep recession.

In fact, this scenario was similar to the 1998 scenario, when the Fed paused-and-cut due to the Long Term Capital Management bankruptcy, which only reignited the dot.com bubble for another 18 months.

Thus, I entered the Fed meeting neutral, willing to establish the long position if appropriate, or to re-short.

The decision to re-short

The Fed increased the Federal Funds rate by 25bpt at the March meeting, which was still OK with the bullish thesis, however, it was a hawkish 25bpt hike - ruling out the bullish Fed's pivot.

Specifically, the Fed acknowledged that the banking crisis is likely to result in tighter credit conditions, which increases the probability of a deeper recession, and it's also deflationary:

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.

The Fed also signaled the possibly of another hike in May (deleting the "ongoing hikes" from the statement and replacing with "some additional"):

The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

At this point the bullish thesis was still in-place. However, the Fed Chair Powell revealed the Fed's true intentions and the focus at the press conference.

Specifically, Powell views the banking crisis as a substate for the interest rate hikes - as the tightening credit conditions slow the consumer demand similarly as the higher interest rates.

Thus, Powell implied that, if the banking crisis proves to have a significant negative effect on the economy, the Fed would be ready to pivot. However, this also suggests that the Fed would wait for the first signs of a recession to cut - this is bearish for the stocks.

Alternatively, if the banking crisis is contained without negatively affecting the economy, the Fed would be willing to resume the aggressive monetary policy tightening - and cause the recession.

This is actually a lose-lose scenario for stock. Either way, the Fed ruled-out the 1998-type bullish pivot. Thus, it makes sense to stay bearish on S&P 500.

The banking crisis is not contained

The current baking crisis is caused by the differential between the interest rate on the savings accounts, which is currently around 0.40% nationally on average, and the yields on Treasury bills, with 6-Month T-Bill yield at 4.80%.

Customers can use their mobile banking/investing apps and quickly withdraw their bank deposits and buy Treasury Bills to take advantage of higher yields. The Fed's decision to increase interest rates only makes the problem worse, as the near-term T-Bill yields increased, which encourages more deposit withdrawals.

Further, it seems like there is not enough political consensus to solve the banking crisis. While the Fed Chair Powell was speaking and "assuring that all bank deposits are safe", the Treasury Secretary Yellen at the same time seemed to suggest otherwise, that the government is "not considering the blanket insurance for all deposits" - which actually caused the markets to tank during the Powell press conference.

SPY Sector Analysis

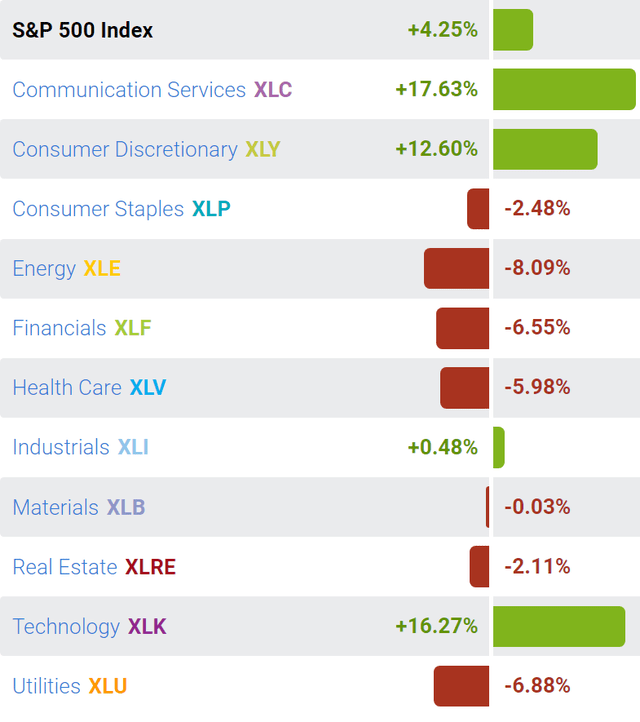

The ETF that closely follows S&P 500 is up 4.25% YTD. However, the analysis of the SPY sectors shows a much different picture, which is quite bearish.

The SPY performance YTD is disproportionally led by speculative sectors that primarily benefit from the 1998-type Fed pivot: Communication (XLC) up by 17.63%, Technology (XLK) up by 16.27% and Discretionary (XLY) up by 12.60%. These gains are likely to reverse as the hopes of the 1998-type pivot fade, and the recession approaches.

However, the Financial sector (XLF) is down by 6.55%, and the financials stocks are leading indicators of the credit tightness and the forthcoming recession.

Energy (XLE) is down by 8.09% YTD, and energy stocks drop in an imminent recession in anticipation of energy demand slowdown.

Consistent with the risk-on sentiment and the Fed pivot hopes, the defensive sectors are down YTD, Staples (XLP), Health Care (XLV),and Utilities (XLU).

SelectSectorSPDR

The most important real-time indictor to follow now is the performance of banks and the financial sector, as it indicates the effectiveness of policy support to solve the current banking crisis.

However, over the intermediate term, the forthcoming recession is now virtually a certainty. Thus, I am still primarily focused on the expected downgrade in corporate earnings, and the PE ratio contraction, which could bring S&P 500 to the 2800 level.

This article was written by

Disclosure: I/we have a beneficial short position in the shares of SPX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.