Greenbrier Is A Classic Value Stock

Summary

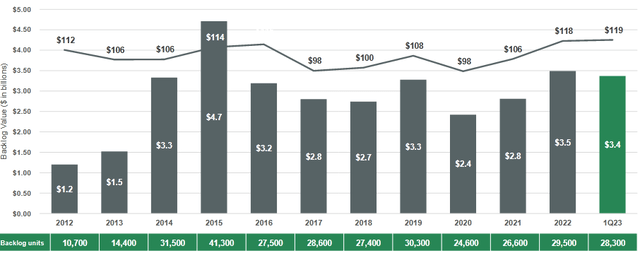

- Greenbrier has a strong backlog.

- Increasing demand from Europe should help increase run rate.

- The valuation makes for a classic value-play.

Norbert Hentges/iStock via Getty Images

Greenbrier Companies (NYSE:GBX) is one of the leading designers, manufacturers, and marketers of railroad freight.

Investment Thesis

Greenbrier has been struggling in the short term, with both revenue and profitability, but continues to have a strong backlog, which is the main source of positivity for the stock. The company has been diversifying its market out of North America, and now is present in multiple continents including South America, Europe, and the Middle East. The valuation of the stock combined with continued growth could result in a small rally for GBX stock.

Backlog (Investor Relations 23')

Railcar manufacturing is more dependent on a couple of sectors than others, specifically the energy and the commodities sector. Both these sectors have been booming in recent times, with increasing demand for commodities and energy continuing to grow at a relatively steady pace. Greenbrier's model has slowly changed over the years, and it has gone from being a pure maker of railcars, to also leasing and owning railcars, which has allowed it to become a lot more profitable.

Market Outlook For Railcars

According to management, the potential addressable market for railcars remains around 2.5 million units. The company has seen up and down a lot in its railcar business, with EBITDA peaking in 14’1-16’, at around $400 per railcar, since then the EBITDA has come down, as market demand has waned. Furthermore, the manufacturing issues from Mexico owing to supply chain problems have been a source of slowdown for the company during the latest quarter.

Freight rail continues to be more efficient than truck transport, and it will be a while until trucks catch up, and demand from both North America and Europe will continue to be the primary source of demand. During the latest call management was optimistic that the European market will continue to perform well, mainly as fleet utilization rates are currently at 100%, and the European economy, specifically Germany, continues to see increased industrial activity, despite rising interest rates and inflation.

The combination of European demand and increased investment in North America, where the Biden administration has allocated increased amounts of capital towards railcars in order to improve efficiency should help improve the company’s profitability going into the next few quarters.

Management further indicated that they received $700 million in new orders in Q1, and 50,000 railcars being scrapped in 2022, which means that the railcar industry will go into a cyclical upturn soon. In general commodity transport, demand seems to be on the upturn along with transportation energy, which is currently benefiting from European demand mainly due to the increasing import of energy, which requires rail service.

After Q2 reports came the company showed results, once again showing that the company is recovering well, on the back of a strong backlog.

During the latest quarter the company received over 4500 new orders for $580 million, adding to an already strong backlog.

Freight rail according to management is facing a number of tailwinds, despite in my opinion it remaining a relatively slow-moving industry. Trucking costs continue to go up, as driver shortages and regulatory issues continue to exacerbate issues related to costs. This means there could be an increasing demand for railcars, as alternatives to trucking are sought. Albeit this won't push up growth by any great amount.

The global freight rail market is expected to grow significantly until 2030, and current estimates for global growth are around 4.5%, up from 3%, previously, with China being the biggest consumer of freight rail. Europe is also expected to see significant growth in freight rail, as the country tries to reduce its energy needs. This should help Greenbrier improve its sales, but also its business related to leasing business, where it will be primarily concentrating moving forward.

Gross margins continue to rise on maintenance service, but the manufacturing division is witnessing increasing cost issues stemming from supply chain shortages, increasing material costs, and general inflationary pressure, which has led to a decline in gross margins.

Why GBX is a Value Stock

Despite the company being in a relatively slow-moving industry, the current projections of forward p/e are currently around 8x, with price-to-sales around 0.33, and as the current issues subside, such as supply chain, and inflationary effects, forward earnings could fall to 6x. As long as Greenbrier continues to see demand, an increased revenue could see the stock increase. Positive single-digit growth companies, which means anywhere from 4-5% growth, assuming increased demand from Europe. This would mean the stock could see a small rally, and the current share price might not stay where it is for long.

During Q2 the company showed strong profitability, with $1 billion in revenue, rising significantly YoY, from $680 million, once again showing that company is well on its way for a strong FY23.

The biggest factor that is in favor of Greenbrier remains its valuation going forward. The stock slumped after losses in the first quarter, as investors reassessed Greenbrier's future. The company currently has a reasonable amount of debt, and if the global economy turns for the worst, the increasing interest rates and the effect of slowing volumes could negatively impact financials.

Freight rail is highly cyclical and Greenbrier has historically struggled through economic cycles. 2023, will likely see increasing unemployment, and increasing interest rates could dampen commodity demand. Greenbrier, therefore, would likely reduce its rail car production, where it's already facing a number of cost-based headwinds.

In conclusion, Greenbrier remains a relatively cheap stock, on a forward basis, with multiple headwinds, but a strong backlog, which should help it weather the current economic environment. Investors who invest in the company should know that the stock is a value play and that it might stay down for a while despite the positives.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.