Endeavour Silver: Patience Required

Summary

- Endeavour Silver had a solid year in FY2022, and it was one of the few producers to beat its upwardly revised output guidance.

- Regarding costs, the company also beat its cost guidance mid-point by ~3% which was especially difficult in a year of inflationary pressures, though the bar was set low at $20.50/oz.

- Looking ahead to FY2023, EXK is expecting to see a similar year, but the bigger news is the much-awaited Terronera financing, which is taking forever like Skouries was for Eldorado Gold.

- Assuming the project is green-lighted, the investment thesis for Endeavour Silver would improve considerably, but at a share price of US$3.50, I don't see enough margin of safety to justify rushing in here.

DarioGaona

The Q4 and FY2022 Earnings Season for the precious metals sector is nearing its end, and it was a disappointing year overall. While many delivered on production estimates, meeting cost guidance proved much trickier than expected, and metals prices didn't cooperate to provide some offset from a margin standpoint. Fortunately, Endeavour Silver (NYSE:EXK) was conservative enough in its guidance to deliver on production and costs, and it actually beat both, a rare feat for a company that has historically struggled to deliver on promises.

This was helped by an exceptional year out of its flagship Guanacevi Mine and timely metal sales helped from a margin standpoint, with AISC margins bouncing back in Q4, though still finishing at some of the weakest levels sector-wide. Looking ahead to FY2023, we should see a similar year from a production and cost standpoint, but the much-awaited news is financing and approving Terronera, a project that will transform Endeavour Silver's ("Endeavour") margin profile by H2-2025. That said, while Endeavour could be a much different company in 2025, I don't see enough margin of safety with the stock near ~1.2x P/NAV and ~13.0x cash flow, so I continue to see patience as the best course of action.

Q4 & FY2022 Results

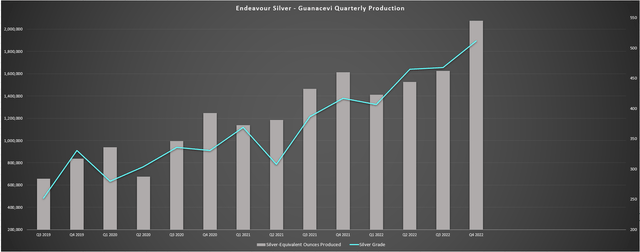

Endeavour Silver released its Q4 and FY2022 results last month, reporting annual production of ~5.96 million ounces of silver and ~37,500 ounces of gold, representing a 22% increase and 11% decline over the year-ago period. The increased output was driven by a massive year from its Guanacevi Mine, where silver grades continued to increase throughout the year, with an incredible Q4 with ~2.08 million silver-equivalent ounces [SEOs] produced helped by grades of 512 grams per tonne. Unfortunately, the increase in production and sales was partially offset by a lower realized silver price ($22.07/oz vs. $25.22/oz), resulting in revenue increasing just 27% year-over-year to $210.2 million despite the increased sales volumes.

Guanacevi Mine - Quarterly Production & Grades (Company Filings, Author's Chart)

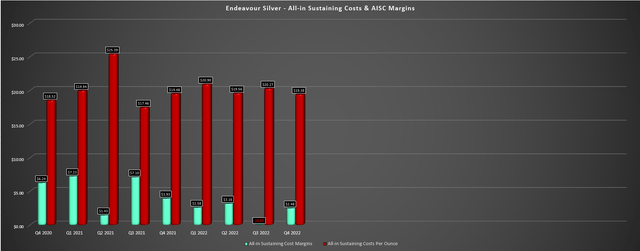

Although the robust Q4 performance helped lift Endeavour's total silver production to a multi-year high (~1.83 million ounces) which helped pull Q4 costs below $20.00/oz, the company still reported razor-thin AISC margins in FY2022. This was related to inflationary pressures experienced sector-wide, with Endeavour calling out labor, power, and other consumables as areas where it saw cost increases, with the additional impact of increased royalty payments because of more mining completed at Porvenir/Porvenir Cuatro which carry higher royalty rates. So, while FY2022 was a solid year from a production standpoint and Endeavour beat guidance, there wasn't a lot to write home about from a margin standpoint, with AISC margins of just $2.10/oz (FY2021: $4.88/oz), and all-in cost margins of [-] $6.03/oz.

Endeavour Silver - AISC & AISC Margins (Company Filings, Author's Chart)

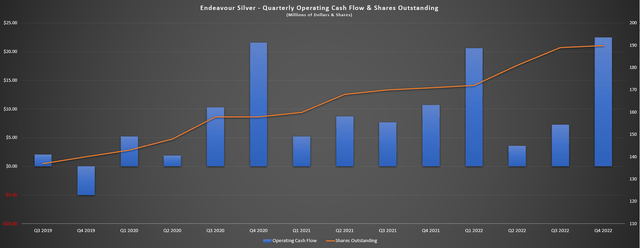

Moving over to cash flow, Endeavour reported operating cash flow of $22.5 million in Q4 2022, a 110% increase from the year-ago period. On a full-year basis, operating cash flow improved to $54.0 million (+68% year-over-year). While this might appear very impressive at first glance, free cash flow was still deep in negative territory for the year. Plus, one of the better barometers to judge companies is whether they can consistently grow on a per share basis, and cash flow per share is still well below FY2015 levels ($0.30 vs. $0.35) given that we've seen the company nearly double its share count in the same period, and the share has increased further from the FY2022 average (now ~190 million fully diluted shares).

For what it's worth, I believe it only makes sense to own a precious metals stock over the metal if it is growing on a per share basis, given that otherwise, one's exposure to the metal has eroded. That said, Terronera could dramatically improve these figures as long as the company sees minimal dilution regarding financing the project (I would expect the company to need to raise at least $160 million) and doesn't continue issuing shares in unnecessary circumstances, such as when it scooped up Pitarrilla last year. Although Pitarrilla is a solid project, I think the better move would have been just focusing on Terronera and keeping dilution to a minimum. Let's look at the FY2023 outlook.

Endeavour Silver - Quarterly Operating Cash Flow & Shares Outstanding (Company Filings, Author's Chart)

2023 Outlook

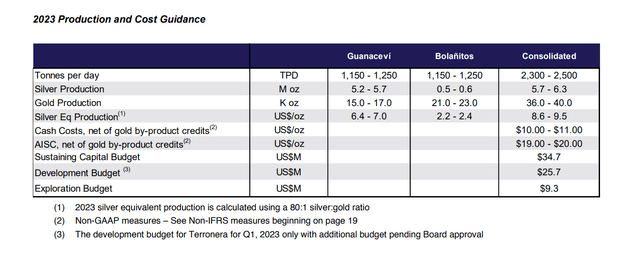

Looking ahead to this year, Endeavour Mining expects another solid year out of Guanacevi, with annual production of 5.45 million ounces of silver and 16,000 ounces of gold at the midpoint. However, it's expected to be another capital-intensive year for the company with $25.7 million budgeted at Terronera for pre-construction activities, ~$35 million in sustaining capital at Guanacevi and Bolanitos, and an additional $9.3 million in exploration. This should result in another year of deeply negative free cash flow unless the silver price takes a run at the $30.00/oz level, especially if Terronera is finally approved for full construction this year.

Endeavour Silver - 2023 Guidance (Company Filings)

So, what's the good news?

While Endeavour Silver will continue to see cash outflows whether Terronera is fully approved or not, green-lightning Terronera would be a major deal for the company given that it would increase annual production by over 70% (assuming Bolanitos can continue replacing reserves) at industry-leading all-in sustaining costs (sub $7.00/oz even adjusted for inflation). The negative to taking so long to green-light the project is that the company will bear the brunt of inflationary pressures across most of the build (with the exception of minor spending to date), and it's possible that costs may come in higher than previously expected. That said, Endeavour is looking to offset any cost increases with a slightly higher throughput rate. Let's dig into Endeavour's valuation to see whether we're getting a reasonable price for this future growth.

Valuation & Technical Picture

Based on ~195 million fully diluted shares and a share price of US$3.50, Endeavour Silver trades at a market cap of ~$682 million. This leaves the stock trading at a premium to its estimated net asset value of $580 million, which assigns a combined $100 million to Pitarrilla and other exploration projects in its portfolio. Although this P/NAV multiple (~1.18x) is relatively cheap compared to other names in the silver sector like First Majestic (AG) at ~2.0x P/NAV and Hecla Mining (HL) at over 1.70x P/NAV, I believe much of this discount for Endeavour Silver is justified, given that it has some of the weakest margins sector-wide and all of its operating and near-term development exposure is entirely to a less favorable jurisdiction, Mexico.

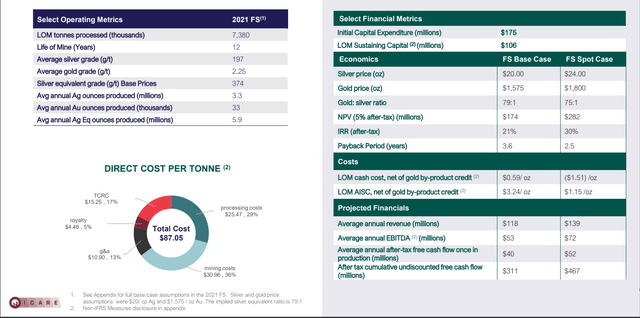

Terronera Project Economics (2021 FS) (Company Presentation)

The good news is that Terronera has the potential to improve the company's margin profile dramatically with AISC that should come in below $7.00/oz over the life of mine even accounting for inflationary pressures, dragging down its consolidated costs. It's for this reason that I believe a fair P/NAV multiple for Endeavour is 1.40x once Terronera is nearing first pour, which is at the low end of its peer group range, but above many other precious metals producers. However, even at a P/NAV multiple of 1.40x for year-end 2024, this translates to a fair value of ~$780 million (18-month target price), or a share price of US$4.12. I don't see this as nearly enough upside to get interested in the stock, with just 17% upside to fair value.

In fact, when I'm entering positions in small-cap producers, I want a minimum of a 40% discount to fair value and applying this discount would translate to an ideal buy zone for Endeavour Silver of US$2.50 or less. Obviously, there's no guarantee that the stock gets here, but if I'm going to take on the risk of owning a small-cap producer based out of Mexico (Tier-2 jurisdiction), I believe in paying the right price or passing entirely. This is especially true when Endeavour has razor-thin margins currently and will only get saved from a margin standpoint once Terronera heads into production (and commercial production is unlikely to start earlier than June 2025).

Summary

Endeavour Silver had a solid year and, thanks to well-timed metals sales, it enjoyed some of the best sales prices sector-wide for silver and gold. That said, the company is coming up against a stronger Mexican Peso this year which could impact costs if the strength continues. This is especially true if we see some of silver's recent gains given back, which is currently saving the company from a margin standpoint. So, with not nearly enough margin of safety baked in at US$3.50 and EXK trading in the upper portion of its support/resistance range, I see patience as the best course of action. If I were looking to deploy capital, i-80 Gold (IAUX) looks like a better option, trading at ~0.70x P/NAV with multiple high-grade mines in a top-3 mining jurisdiction.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of IAUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.