Oil Inventories Turn The Corner As We Approach Q2

Summary

- Global oil inventories are finally starting to turn the corner as we approach Q2.

- US oil demand is better than meets the eye due to the low heating demand component.

- Gasoline and jet fuel are on pace to be above 2022 by summer.

- We see Q2 balances as a small draw of 0.5 million b/d.

- More bullish US oil data is needed.

- Looking for a helping hand in the market? Members of HFI Research get exclusive ideas and guidance to navigate any climate. Learn More »

wakr10/iStock via Getty Images

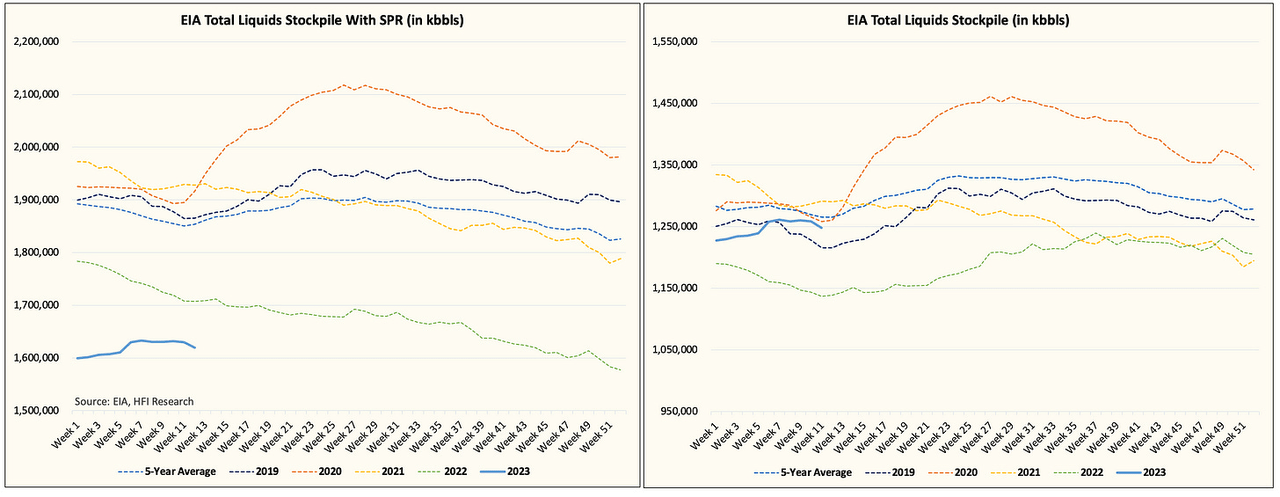

As we approach the end of Q1, global oil inventories are finally starting to turn the corner. EIA's oil storage report today was the most supportive report for the year, with total liquids declining by 10.4 million bbls.

More importantly for us, there were a few hidden bullish variables in this report that were not apparent to the naked eye.

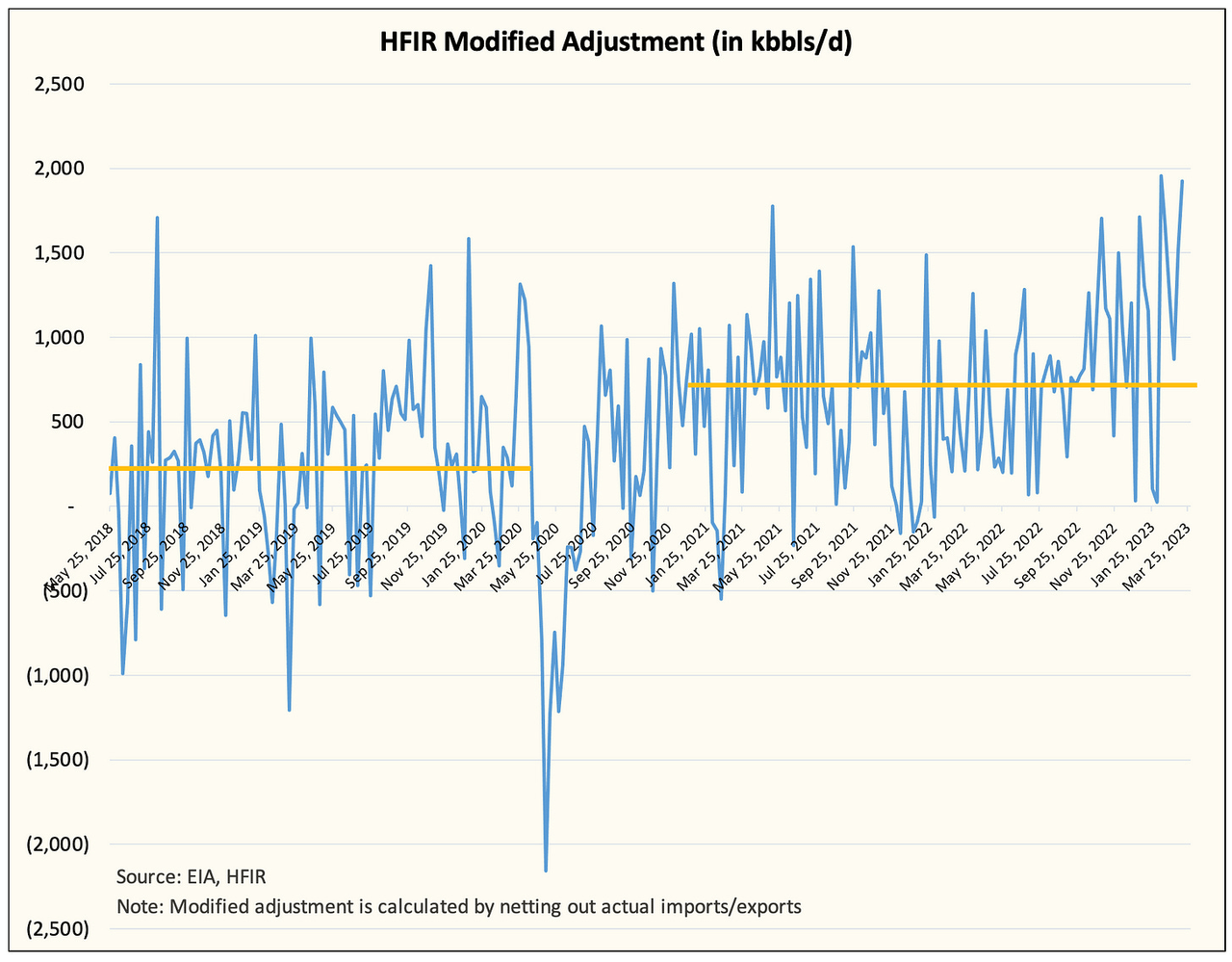

First, despite the large draw of 10.4 million bbls, commercial crude storage actually showed a build of ~1.1 million bbls. This came as a result of the 2nd highest modified adjustment reading in our dataset. The largest came just a month ago, in the week ending Feb 10.

Large jumps in modified adjustments are usually followed by a similar drop. The average normalized adjustment since 2021 is around ~750k b/d, so we should see this figure trend back lower in the weeks/months ahead.

For those of you asking what this implies, elevated modified adjustment is a temporary phenomenon. Assuming the data normalizes, we should see crude draws return if exports remain elevated.

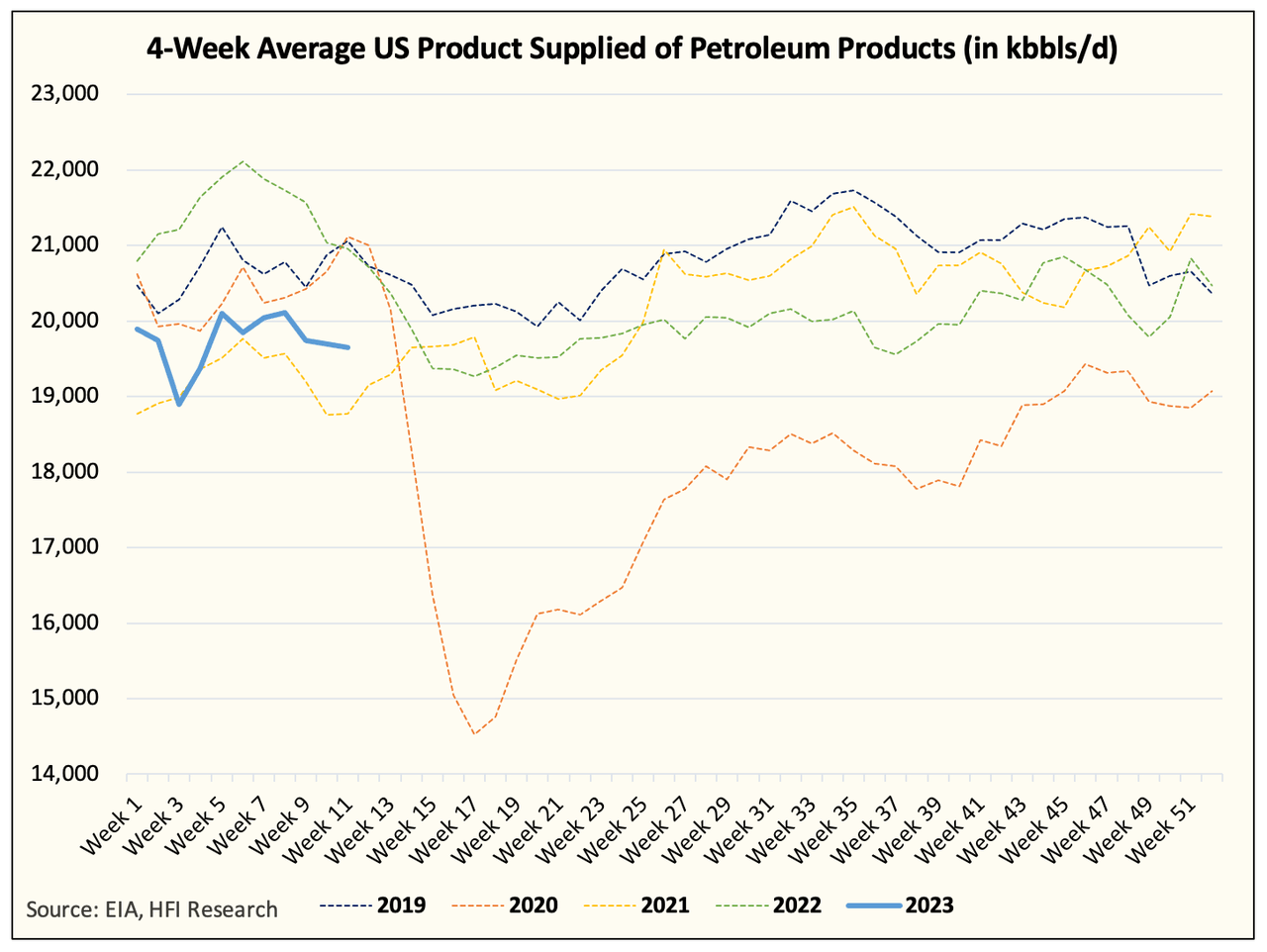

Second, US oil demand looks far better than meets the eye.

Here is a chart of total implied oil demand. At first glance, you may notice how 2023 is coming in well below 2019. But what you may not realize is that the underperformance in demand is mostly related to heating.

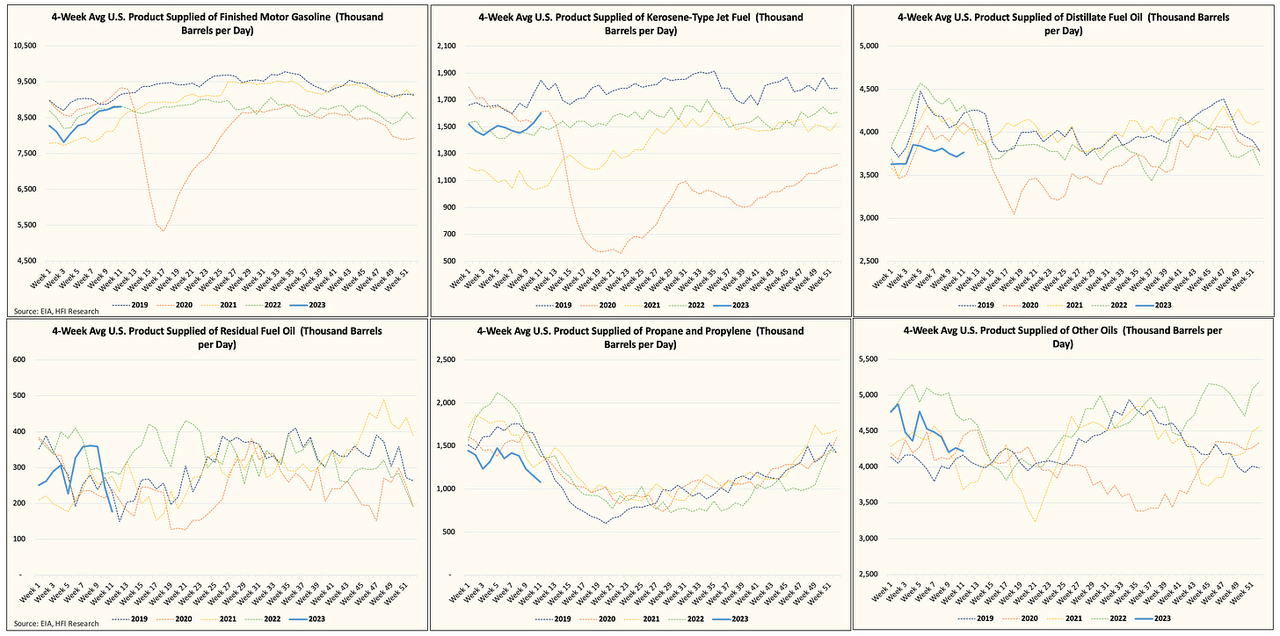

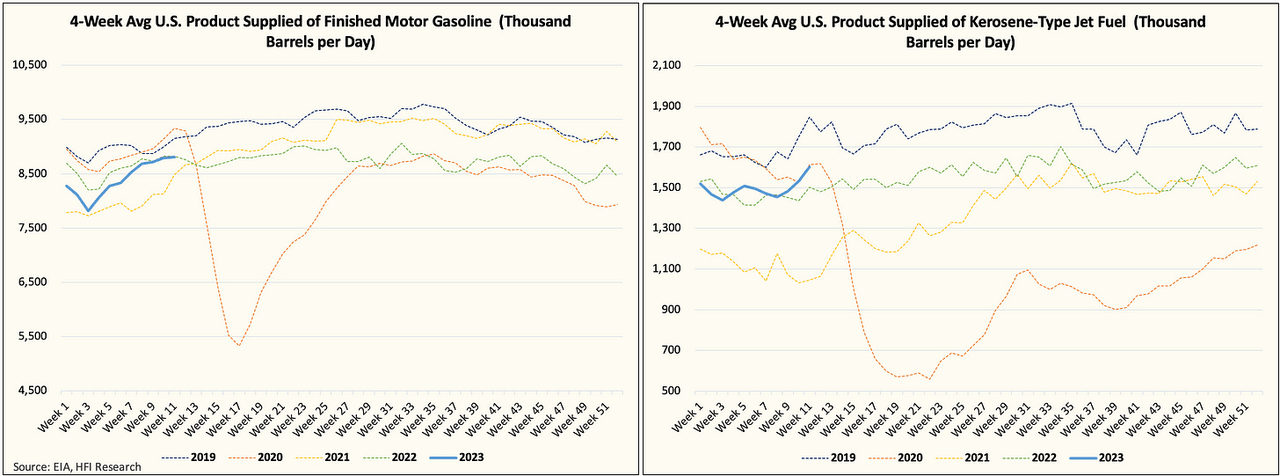

This winter has been one of the warmest on record. So this makes this figure lower than it really appears. For us, the key to determining the overall health of oil demand is by paying attention to gasoline, jet fuel, and distillate. In particular, gasoline and jet fuel demand are on pace to eclipse 2022.

Given the oil price decline since June of last year, oil demand has taken quite a long time to recover. We first pointed this out back in mid-June last year, but with the data turning the corner, we could see this translate into higher product draws and better balances going forward.

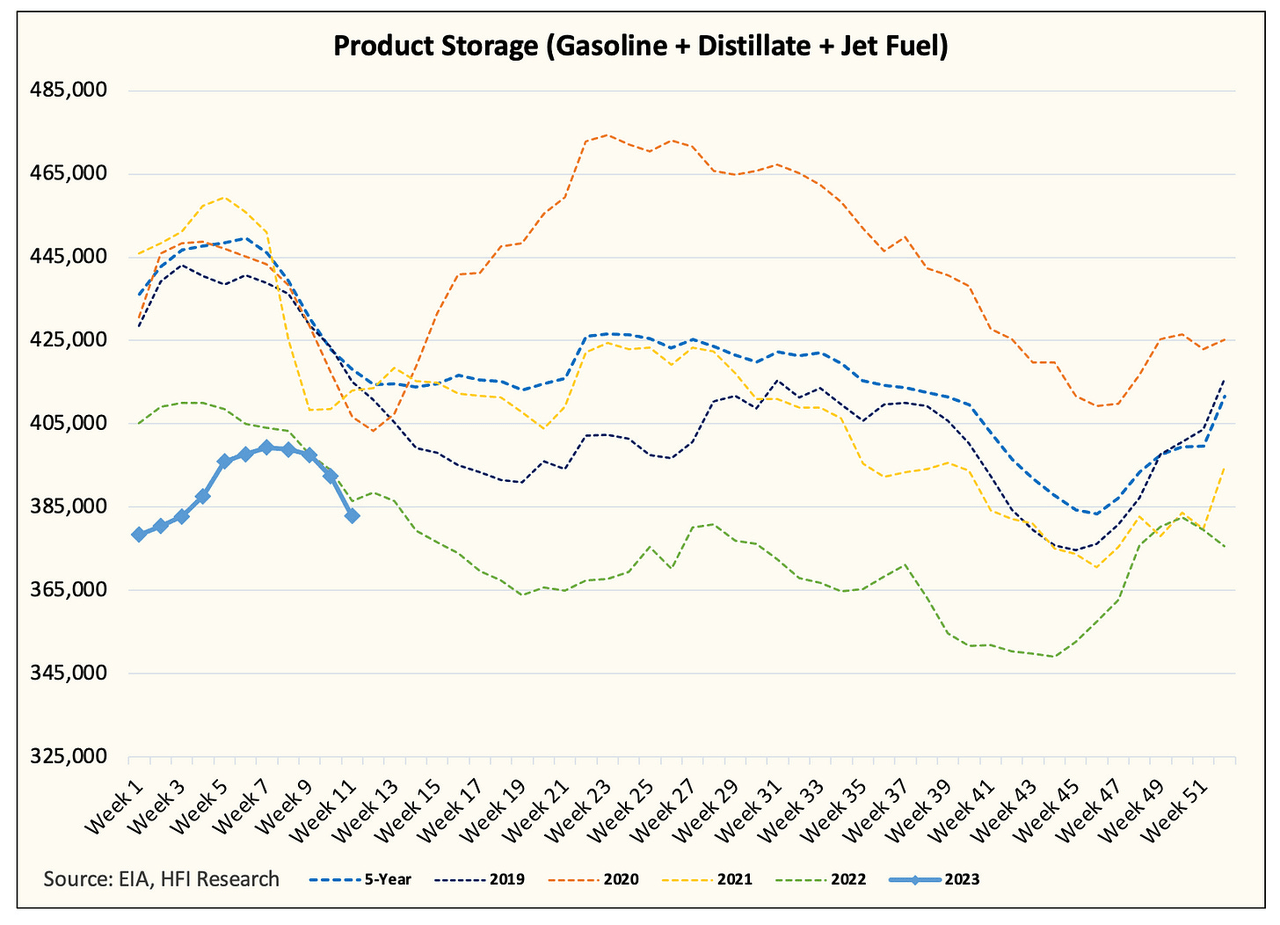

With these two hidden bullish points aside, it is worth noting that product storage is finally following seasonality.

Based on mobility data, gasoline demand is likely going to surprise to the upside going forward. The 3-2-1 crack spread continues to move higher, which is telling me that storage draws should continue.

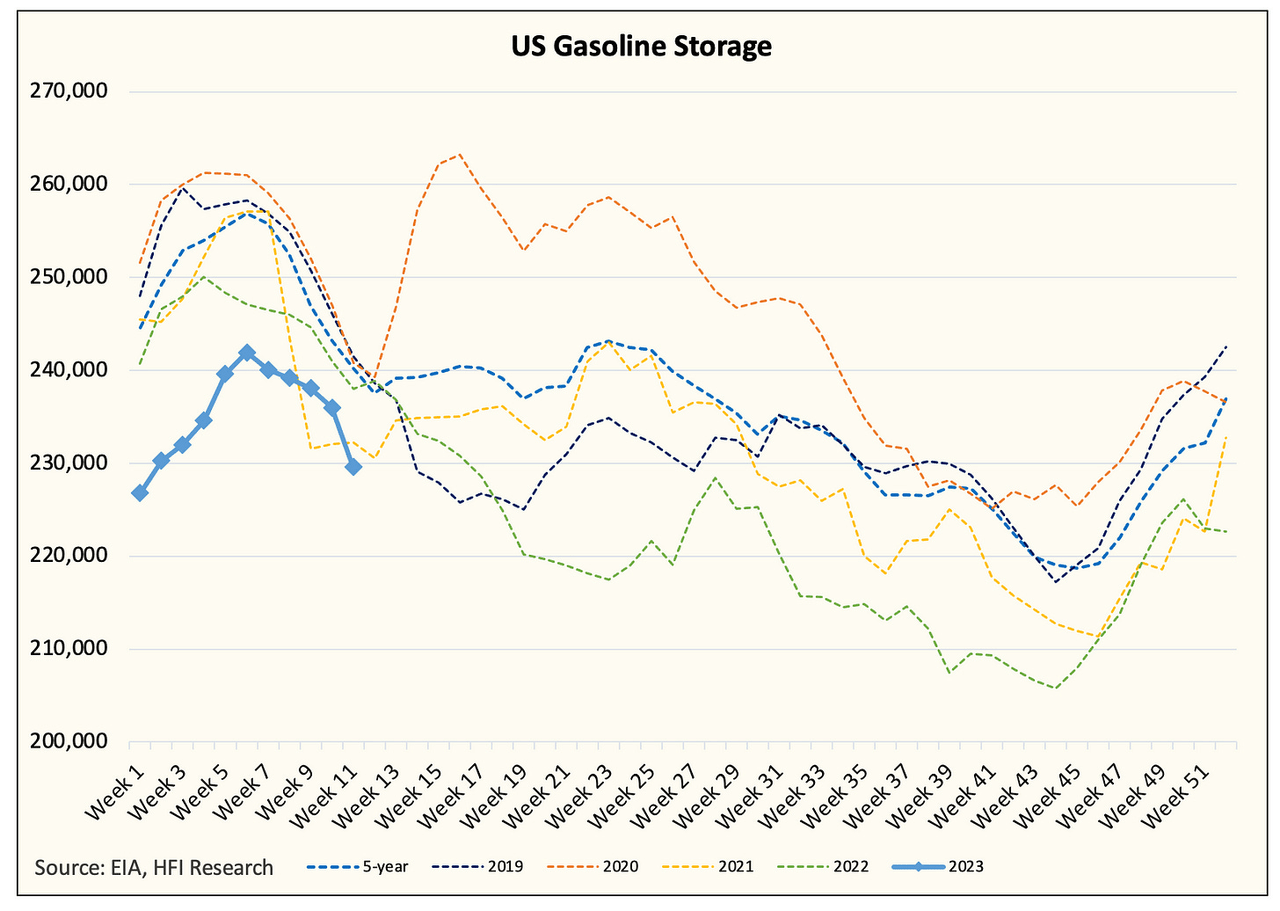

Gasoline storage is currently at the lowest level for this time of the year in recent years. Going forward, gasoline will be a big driver for overall product storage, so it will be important for oil bulls to watch this figure trend lower.

What do we need to see going forward?

With oil inventories finally turning the corner, we see overall Q2 balances shifting into a small deficit. Judging by the market price action in various crude grades, the deficit is expected to be small (~0.5 million b/d).

The key for oil bulls will be to watch not only the total liquids draw but the velocity of change in the implied demand figures. While total demand continues to be lackluster, gasoline demand should meaningfully pick up, which should accelerate total demand higher. If so, we should first see this manifest into higher 3-2-1 crack spreads and then into gasoline inventory draws.

For now, oil bulls can take a sigh of relief. The underlying data is not as bad as the price action suggests, but we can't take our eyes off the wheel. Q2 balances will still need to show inventory draws, and one bullish report does not make a trend.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, "Low commodity prices cure low commodity prices." Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!

This article was written by

#1 Energy Research Service on Seeking Alpha

----------

HFI Research specializes in contrarian investment analysis. We help you to find clarity in a world of uncertainty. We take contrarian thinking very seriously and believe that the only way to obtain a real edge in the market is to possess a contrarian investment thesis. We share our investment analysis with premium subscribers through daily and weekly reports.

----------

HFI Research Premium currently includes:

Oil Market Fundamentals - Our daily oil market report that discusses the current oil market fundamentals and the incoming price trend.

Natural Gas Fundamentals - Our daily natural gas market report that details current trader positioning, fundamentals, weather, and the incoming trade set-up.

Real-Time Trade Notifications - We actively trade oil and natural gas ETNs. In addition, we also issue real-time trade notifications on individual stocks.

Weekly EIA Crude Storage Forecasts - Every Saturday, we give the EIA crude storage estimate for the incoming week's report.

Weekly US Oil Production Forecasts - A weekly tracker for real-time US oil production so subscribers can understand what's happening to US shale growth.

What Research Reports We Read - A weekly report that covers all the research reports we read for the week, so subscribers can understand the market consensus and contrarian viewpoints better.

What Changed This Week - Our flagship weekly report.

For more info, please message us.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.