The Middleby Corporation: Visible Headwinds Ahead

Summary

- MIDD 4Q22 results showed strong performance in the CF and FP divisions, while the RK division faced headwinds due to destocking and a difficult housing environment.

- Management anticipates organic growth and a widening of margins in CF and FP, while RF is expected to improve in 2H23. However, inflationary pressures remain a headwind.

- Despite a low valuation relative to historicals, I recommend a hold rating due to visible headwinds ahead in the near-term.

Jodi Jacobson

Thesis

The Middleby Corporation (NASDAQ:MIDD) is a company that specializes in kitchen appliances. Commercial Foodservice [CF] accounts for 60% of sales, Residential Kitchen [RF] accounts for 26% of sales, and Food Processing [FP] accounts for 14% of sales; all three of these business segments are highly complementary to one another. In order to further strengthen the portfolio, I anticipate that management will actively seek out new brands and technologies to add. Even though MIDD has a low valuation relative to its historical performance, I advise against investing at this time due to the many unknowns in the company's near future. For instance, I expect MIDD to continue facing headwinds from inventory destocking in the RF segment, inflationary pressures across all cost lines, and also supply chain cost inflation. I believe all of these will pressure margins.

4Q22 results

Earnings per share of $2.57 were higher than the expected $2.44. An increase in top-line revenue and a decrease in the tax rate were primary contributors. CF and FP's stronger showings were the primary factors in driving total sales to $1.03 billion, while RF's weaker showing was the main drag. Total adjusted EBITDA for the company was $234 million. EBITDA margins were slightly better than anticipated due to better-than-expected performance in CF and FP offsetting less impressive results in RF. CF margins increased by 234 basis points year over year due to price increases, increased sales of advanced technology solutions, and decreased operating expenses. With more substantial project deliveries and the advantages of operational leverage, FP margins grew. As for RF margins, it contracted by 500 basis points to 14.2%.

Guidance

In the CF and FP divisions, management anticipates organic growth and a widening of margins. New technologies, customer expansion strategies, and healthy order backlogs were cited by management as the main factors contributing to the company's growth. he growth would be further juiced in the range of mid-single-digits percentage. Contrarily, RF will likely experience significant declines as a result of destocking and a difficult housing environment, though things are expected to improve in 2H23.

Backlog

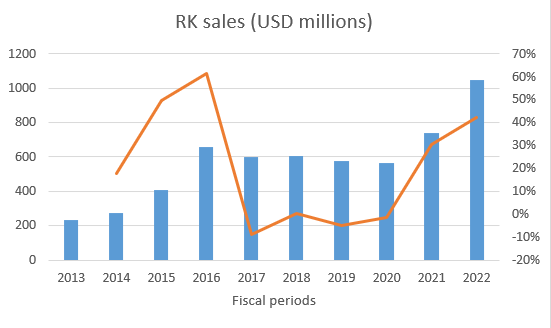

In 2022, MIDD's backlogs were $750 million for CF, $310 million for FP, and $175 million for RK. Based on these figures, I expect the growth outlook for CF to continue being strong for the foreseeable future as MIDD benefits trough demand over the past 18 to 24 months. Specifically, I expect improvement in sectors such as hospitality, schools, casual dining and even lodging as they benefit from a strong comeback in traffic. However, the strength should be somewhat offset by some weakness in the mid to high end dining segment largely due to the recession concern. As for RK, I believe the near-term headwind is as certain as it can be with outdoor grills expected to drive 1Q23 decline as destocking continues. This is a typical “boom-bust” cycle where large amount of demand was pulled forward during covid (MIDD RK sales almost doubled from FY20 levels in FY22), and now it has to face the consequences. Lastly, for FP, the visibility is much better here. Significant growth in large orders, which will take 12-24 months to complete, is primarily responsible for the 2.5-fold increase in backlog compared to levels before COVID.

MIDD filings

Inflation continues to be headwind

Component prices, such as electronic controls, continued to rise in the second half of 2022 despite some commodities coming off their highs for the year, and supply chain and labor inflation remained obstacles. In my opinion, inflationary pressures will soon begin to ease, and the management's decision to implement a price increase in the CF and FP segment in the mid-single digits will help to mitigate this effect. Regrettably, RK will have to absorb the entire cost of this while the industry continues to destock in response to the pulled forward demand in the last 2 years. Increasing prices won't accomplish much and may even backfire by driving away customers. That said, there seems to be no intention to roll back on previous price increases either, which prevents margin from sliding further. Overall, I think price inflationary pressures persist, albeit at a more muted rate than in the previous year. Many investors, I think, are watching to see where margin goes this year. If profits can be held steady despite rising costs, the outlook for the years after FY23 will improve.

Other thoughts

Putting out some interesting thoughts here. A potential upside to the current inflationary climate for MIDD is that it is driving customers to seek out technological answers to help them further automate their operations. As the cost of these technological fixes tends to be higher, it works out well for MIDD.

Conclusion

MIDD 4Q22 results showed strong performance in the CF and FP divisions, while RF faced headwinds due to destocking and a difficult housing environment. Looking ahead, management anticipates organic growth and a widening of margins in CF and FP, while RF is expected to improve in 2H23. The company's backlog for CF and FP also points to strong growth prospects, although inflationary pressures remain a headwind. Despite a low valuation relative to historical performance, I advise against investing at this time due to uncertainties in the company's near future. Overall, I believe MIDD has a strong portfolio of complementary business segments and is well-positioned for growth in the future, but caution is warranted in the short term.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.