Adecoagro Is Going To Get Hit In Crops, Political Concerns On Ethanol

Summary

- Argentina is being hit with weather effects and this is going to affect their crop markets, which matter for about 10% of run rate cash flows.

- Rice prices should continue to improve as countries like India, major exporters, as well as China, focus on protectionism.

- Otherwise, the ethanol business has continued optionality now that they're building sugar inventories again, but peak prices have passed and there are Lula risks here.

- Longer term, Adecoagro is a good play on food security, because while its crops are quite fertiliser intensive, they aren't the most, and they're not on marginal land.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Roman Valiev

Adecoagro (NYSE:AGRO) has high FCF yields and a relatively durable situation in its key market of ethanol and sugar thanks to good optionality for its sugar in several advantaged markets and continuation of decent pricing - the risk is in Lula. Rice should do well too. But its cash flows from crops, around 10%, are exposed to specific weather risks in Argentina and Uruguay. Longer-term however, their geographies in South America position them well for an adverse thesis on food security, because their crops are on less marginal land than wheat, and relatively less fertiliser intensive.

Adecoagro Business Update

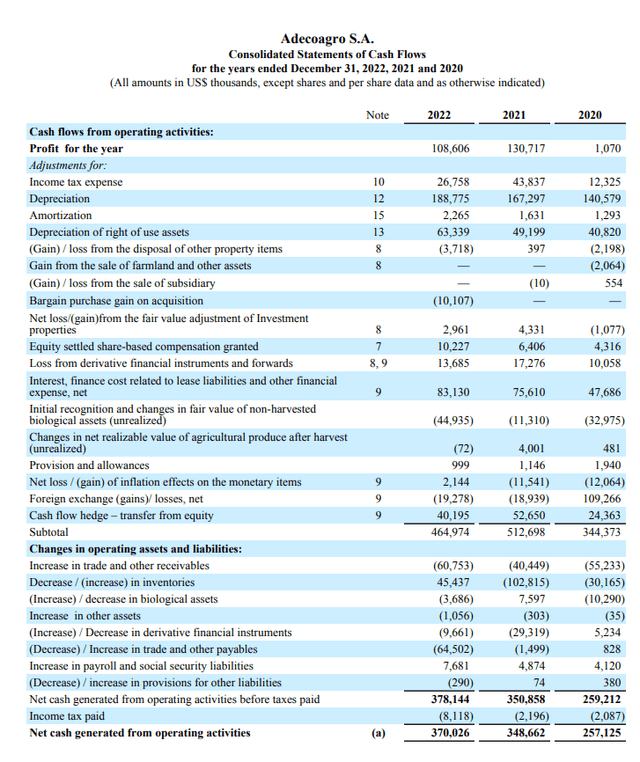

Adecoagro's businesses are more or less 50% between ethanol and 30% for various crops with the residual being for dairy. The company does a lot of natural asset revaluations that confuse EBITDA figures, so we always look at the operating cash flow before WC and revaluation effects are considered to get an idea of performance evolutions. Using post-WC operating cash flows makes comparability more difficult, especially in 2022, because they had some difficulties in building new sugar inventories, although they still managed to liquidate them at very favourable prices. Cash flows are pretty close to last year reflecting a better environment since pre-COVID and COVID-depth levels in terms of inflation and pricing, but with cost side inflation catching up a bit this year (especially in farming) as well as some minor effects in farming in terms of volumes in 2022.

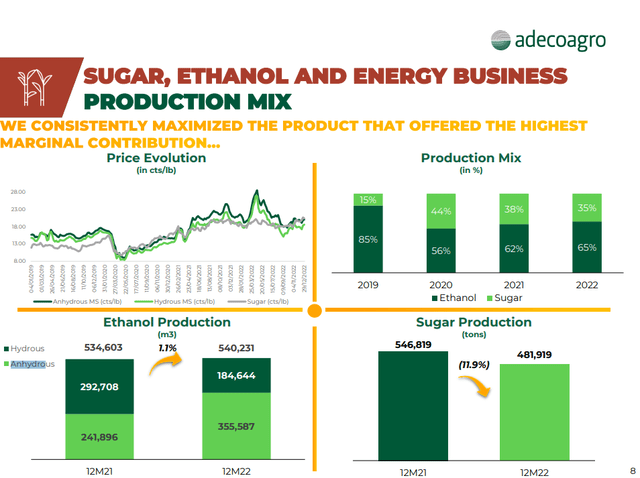

The FY was pretty good as prices held up pretty well. In particular, hydrous and ahydrous ethanol prices were strong in 2022, but where anhydrous was premiumised to sugar prices (despite sugar going up)and allowed for an opportunity to flex dehydration capacity to redirect sugar as an input to that production instead of hydrous, which was at a discount to sugar prices of 7%.

Sugar Optionality (Q4 2022 Pres)

Improving crushing volumes towards the end of the year means that their options continue to be open, and they're still getting pretty good prices in their export markets with continued support for ethanol in local Brazilian markets - although prices are quite clearly passed their peak.

Rice prices should also be pretty solid as India is still in the mode of protectionism as far as rice exports go, and China's decision to stockpile its phosphate production to deal with their own food supply issues is going to put some speculative tailwinds behind rice prices as yield come more into question.

On the other crops there are more challenges because of weather events in Argentina and Uruguay that are meaningful, and volumes and yields should fall substantially there, but the effect is limited to about 10% of cash flows. Indeed, the companies planting volumes are looking worse as weather effects limit options.

Bottom Line

Adecoagro's longer-term farming story is quite good. Its crops are a little less fertiliser dependent and grown on relatively good land compared to wheat, which is more vulnerable to the fact that China reduced its phosphate-based fertiliser exports through quotas due to structural issues with food storage locally, even though it is causing the shuttering of capacity. These restrictions were in place till the end of 2022, and while they're not currently in effect, this protectionism is a very important speculative concern for global food markets. Sanctions on Russia and Belarus are also a big issue for other mineral fertilisers, and in general fertilisers are something that everyone, not just investors, need to be thinking about. Adecoagro's crops will fall in yields less sharply compared to other food crops, and as substitute crops the prices of their farmed crops and rice should go up as this becomes a longer-term geopolitical issue. While Adecoagro is more resilient in its crop profile, the effects of fertiliser shortages could still be a problem for them in absolute terms depending on the exact order of events that play out, as higher fertiliser prices may trigger hoarding effects that could mean margin compression, where crop prices may not rise as quickly, and of course yields will also fall creating a volume issue that would need to be offset again by prices.

While the sugar and ethanol businesses are doing pretty well now, investors need to be concerned with risks in Brazil with Lula. Lula's political moves in support of consumers could create sugar oversupply as imported ethanol producers lose a tax break, and there is speculation about caps on ethanol broadly for Brazilian consumers, who are a massive ethanol market, which would limit any benefits from lower sugar prices as an input.

Because that's quite a high-leverage risk we choose to stay away, but we recognise that the FCF yields which are at around a 10% normalised level, are pretty attractive. Moreover, with geopolitics needing to be an important theme for portfolio construction, concerns around fertiliser and food as a strategic issue makes a pick like Adecoagro pretty good as a food insecurity play, although it will be a spicy moment in markets because their crops will also be affected by lessened fertiliser supply, especially corn. Still, we don't think the time is right for any plays with earnings volatility or that are too commodified considering the demand shifts we may see in markets as the effects of a global monetary tightening and continued inflation remain at play.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.