KBA: China Reopening Momentum Remains Intact Post-NPC

Summary

- The post-COVID Chinese rebound is in full swing.

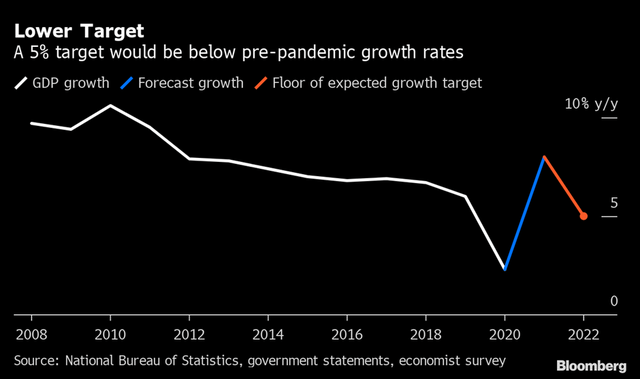

- The lowered GDP growth target seems conservative, particularly in light of the ongoing monetary easing and PMI strength.

- KBA is worth a look for investors looking to ride the China reopening theme via A-shares.

AerialPerspective Works/E+ via Getty Images

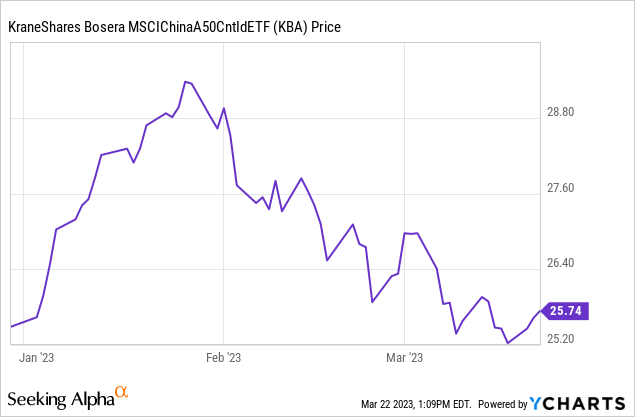

President Xi Jinping kicked off his third term at the National People's Congress earlier this month with a lower-than-expected GDP growth target of ~5%. This contrasts with economic data points out of China indicating expansion - the Purchasing Managers Index (PMI), an early indication of economic momentum in manufacturing, showed strength across the board, with the construction PMI impressively surging to >60. And while the government stopped short of major fiscal easing measures, targeted policy support seems likely, given the emphasis on 'high-quality' growth and urban job creation. With the PBoC ('People's Bank of China' or the Chinese central bank) also in easing mode, the growth momentum should continue to spread throughout the economy. Net, remaining overweight a broad-basket of mainland China equities (A-shares) via the low-cost KraneShares Bosera MSCI China A ETF (NYSEARCA:KBA) makes sense here, particularly given the prospect for the incremental inclusion of A-shares in global indices over the coming months.

Fund Overview - Diversified, Low-Cost Exposure to Chinese A-Shares

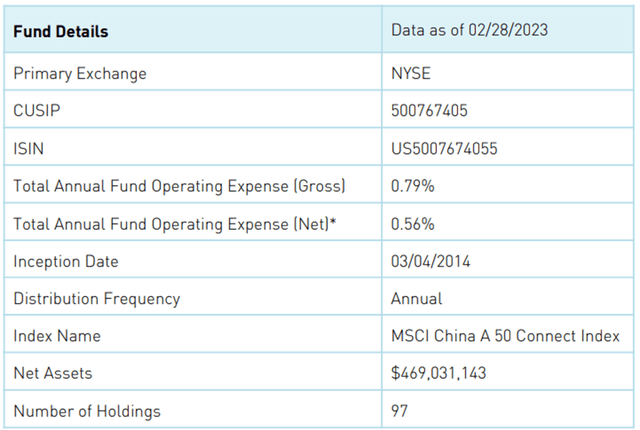

The US-listed KraneShares Bosera MSCI China A ETF seeks to track, before fees and expenses, the performance of the MSCI China A 50 Connect Index, which tracks a group of fifty large-cap stocks available through Stock Connect on the Shanghai and Shenzhen exchanges (i.e., A-shares). The ETF held ~$469m of net assets at the time of writing and charged a 0.8% gross expense ratio (0.6% net of contractual fee waivers in effect through August 2023), making it a cost-effective option for US investors looking to access China-listed equities. A summary of key facts about the ETF is listed in the graphic below:

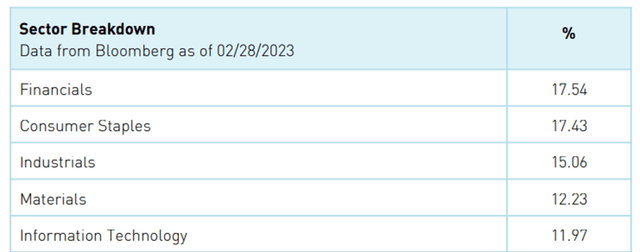

Per its latest factsheet, the fund's assets are spread out across 97 holdings, with no single-stock weightage exceeding 8%. The sector allocation is, however, relatively top-heavy, with the top-five sectors accounting for a cumulative 74.2% allocation. Leading the way are the Financials (17.5%) and Consumer Staples sectors (17.4%), followed by Industrials (15.1%), Materials (12.2%), and Information Technology (12.0%).

The single-stock allocation is more spread out, with the top holding Kweichow Moutai, a producer, and distributor of baijiu (a distilled Chinese spirit), contributing 7.8% of the portfolio. Other key holdings include leading chemical product supplier Wanhua Chemical Group at 7.4%, battery producer Contemporary Amperex Technology at 6.5%, and leading mining group Zijin Mining at 5.1%. In total, the top five holdings account for ~31% of the overall portfolio.

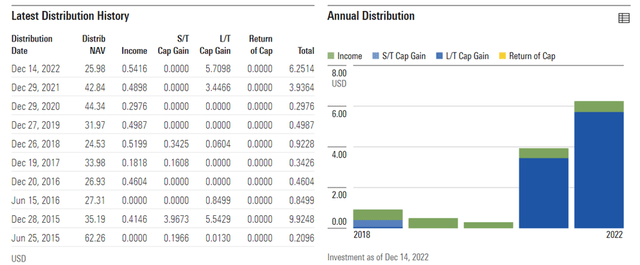

On a YTD basis, the ETF has risen by 0.5% and has compounded at an impressive 6.2% rate in market price and NAV terms since its inception in 2014. Fund performance has been volatile, however, with last year's double-digit percentage drawdown being a case in point. Investors willing to digest the volatility have been well-rewarded - the fund has done well through the cycles, with the annualized three and five-year returns at 4.2% and 1.3%, respectively. The overall distribution has also been exceptionally strong in recent years, reflecting the realization of capital gains. The income portion has generally been steady as well, as the portfolio skews toward defensive, cash-generative names. At a trailing twelve-month income yield of ~2%, KBA offers a nice income bonus to supplement the earnings growth across its key holdings.

Lowered Growth Target Post-NPC, but There are Silver Linings

The annual National People's Congress took place earlier this year, with key highlights being President Xi Jinping's third term and Premier Li Keqiang's final Government Work Report outlining the development goals and tasks for the year. Somewhat surprisingly, this year's growth target has been pegged at ~5%, well below market expectations heading into the event. Given the strength of economic data in recent weeks, however, the updated target seems conservative, likely serving more as a 'floor' for growth rather than a base case scenario. The favorable base effect should make achieving this target fairly straightforward as well - the weak 2022 numbers imply a ~4% average growth for 2022/2023, well below the ~5% through the COVID-impacted 2020/2021 period.

Another key takeaway from the event is the lack of government-led infrastructure initiatives to drive growth this year. Instead, the emphasis seems to be on self-sufficiency, with President Xi emphasizing the tech sector (likely semiconductors), as well as a 'high-quality' growth model over the push for 'growth at all costs' in prior years. Expect to see more support for the private economy and services sectors going forward as the government looks to generate higher value-added employment.

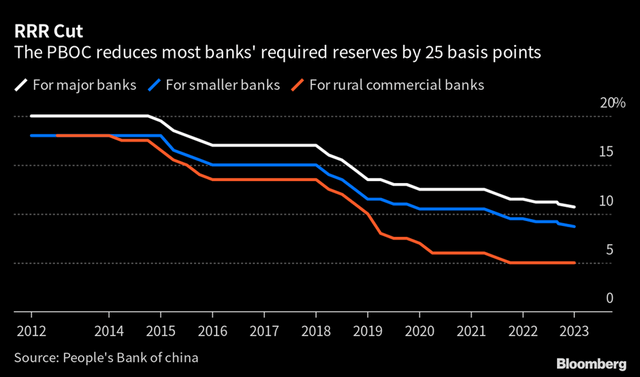

PBoC Easing Cycle Continues to Support Growth

This month's economic data out of China started with a bang, as the Purchasing Managers Index (PMI) numbers came in well above expectations in February, most notably the construction and manufacturing PMIs, which reached new highs. The PBoC followed up with another round of reserve requirement ratio (RRR) cuts, this time by 25bps, effective later this month. The move also comes on the heels of a medium-term lending facility (MLF) operation to inject long-term liquidity, implying significantly accommodative monetary policy amid the financial stress overseas.

In contrast with the lowered NPC growth target, the recent PBoC move signals that growth remains a priority for the new government. After all, it is early days for China's post-COVID recovery, and with inflationary pressures also under control, the easing runway likely still has legs. Alongside fiscal policy support, all signs point to growth upside; progress here will, in turn, shore up investor confidence in Chinese assets and support the CNY in the near to mid-term.

China Reopening Momentum Remains Intact Post-NPC

On paper, the updated ~5% GDP growth target post-NPC might seem a tad disappointing. Yet, a closer read suggests a shift toward targeted policy support (vs. major fiscal expansion) to areas of strategic importance as China looks to move higher up the value chain. Over the near-term, economic data points are also still surprising on the upside, with China's PMI indicating strong expansion and the PBoC actively supporting financial conditions with another round of rate cuts. Thus, I would view the growth update as a 'floor' to account for potential challenges from the external environment, with the overall macro policy environment remaining supportive of growth. For investors looking to ride the Chinese reopening wave at a low cost and without the regulatory risk of opaque structures like VIEs, adding A-share exposure via the KraneShares Bosera MSCI China A ETF is worth considering. Key near-term catalysts include progress on the new government's policy implementation post-NPC, as well as expanded A-share inclusion in global indices alongside the Chinese earnings recovery.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.