IWY: Still Relatively Expensive Compared To Historical Average

Summary

- IWY invests in large-cap U.S. stocks that exhibit growth characteristics.

- The fund has outperformed the S&P 500 index in the long run.

- It has a high exposure to information technology sector.

- However, its valuation is still quite elevated to its historical average.

Khaosai Wongnatthakan

Introduction

Investors of growth stocks have endured tremendous losses since the beginning of 2022. Will this trend continue in the rest of 2023? Should investors be buyers of these growth stocks instead? In this article, we will analyze iShares Russell Top 200 Growth ETF (NYSEARCA:IWY) and provide our insights and suggestions.

The fund basically invests in the growth stocks of the top 200 large-cap stocks in the Russell 1000 index. These are large-cap stocks that exhibit strong growth characteristics and they have outperformed the S&P 500 index in the long run. However, valuations of its major sectors in its portfolio appear to be expensive. Therefore, we think investors may want to wait for a better entry point.

YCharts

Fund Analysis

IWY has outperformed the S&P 500 index in the long run thanks to its strong growth characteristic

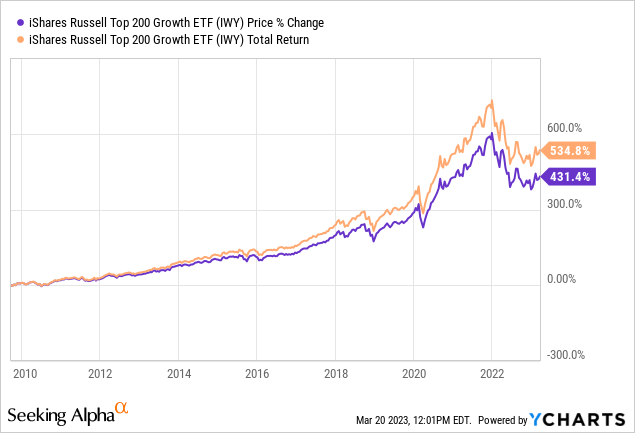

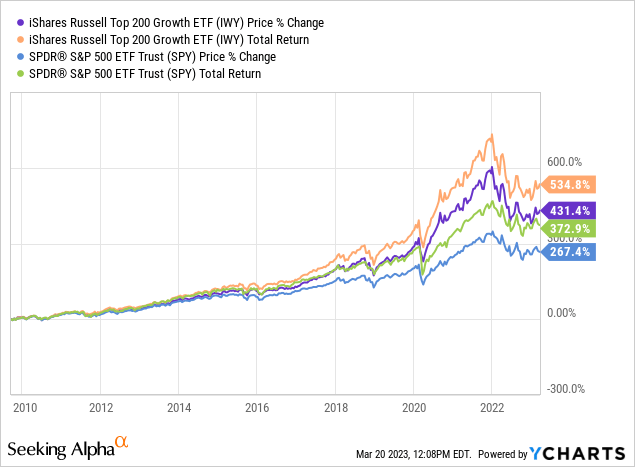

Investors who have owned IWY for the long run should be very happy with their investments. In fact, this fund has outperformed the S&P 500 index by a wide margin. As can be seen from the chart below, the fund's total return of 534.8% since its inception in late 2009 was much better than the total return of 372.9% of the SPDR S&P 500 ETF (SPY) which tracks the S&P 500 index.

YCharts

This growth is due to its strong growth characteristic in its portfolio. As can be seen from the table below, IWY's sales growth rate of 14.87% is better than 11.43% of the S&P 500 index. IWY's cash-flow and book-value growth rates of 10.5% and 11.29% are also better than S&P 500's 8.06% and 4.67%, respectively.

IWY | S&P 500 Index | |

Sales Growth (%) | 14.87% | 11.43% |

Cash-Flow Growth (%) | 10.50% | 8.06% |

Book-Value Growth (%) | 11.29% | 4.67% |

Source: Morningstar

However, it has underperformed in this bear market since the beginning of 2022

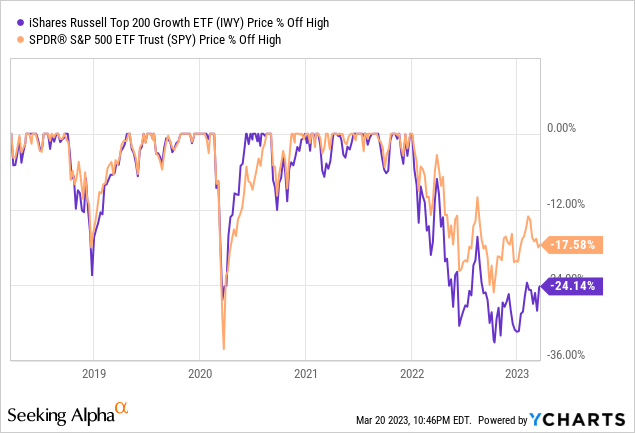

Despite its strong growth characteristic, the fund has underperformed the S&P 500 index. As can be seen from the chart below, IWY has declined over 24% since the beginning of 2022. In contrast, SPY only declined by about 18%. This wide margin between the two was probably because growth stocks have outperformed the broader market during the pandemic and therefore suffered a much larger decline than the broader market.

YCharts

IWY's valuation is still elevated

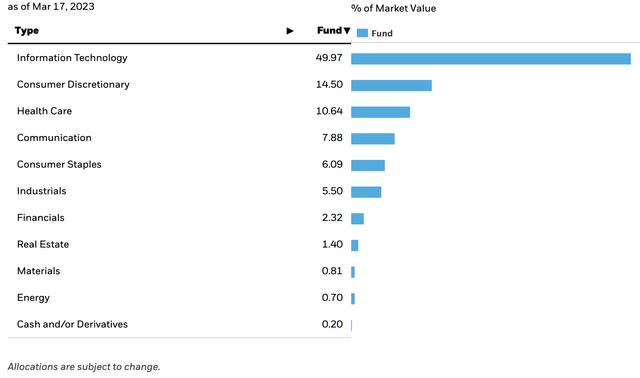

Given that IWY has fallen much harder than the S&P 500 index since the beginning of 2022, one may wonder whether this a good time to invest or not? We will first look at its portfolio composition and then examine the valuation of its top sectors to figure out. As can be seen from the chart below, information technology represents about 50% of the total portfolio. This is followed by consumer discretionary sector's 14.5% and health care sector's 10.64%. Together, these 3 sectors represent about 75% of IWY's portfolio.

Since the Russell Top 200 index and the S&P 500 index both consists of large-cap stocks, there is quite a bit of overlap between the two. Therefore, we will look at the valuations of information technology, consumer discretionary, and healthcare sectors in the S&P 500 index. This will give us a good feel of whether the valuation is still expensive or not.

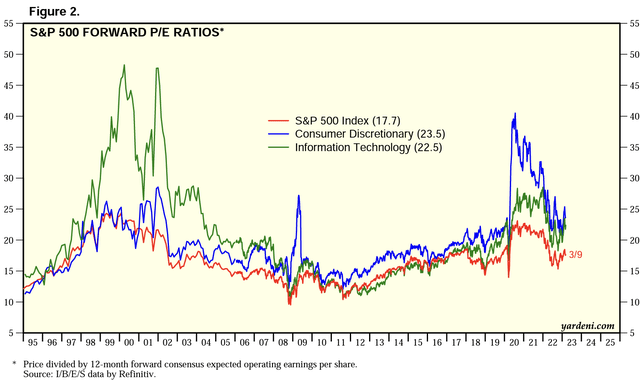

As can be seen from the chart below, forward P/E ratios of information technology and consumer discretionary sectors are currently 22.5x and 23.5x, respectively. They have fallen quite a lot since the beginning of 2022. However, it is still quite expensive relative to the historical average in the past 10-15 years.

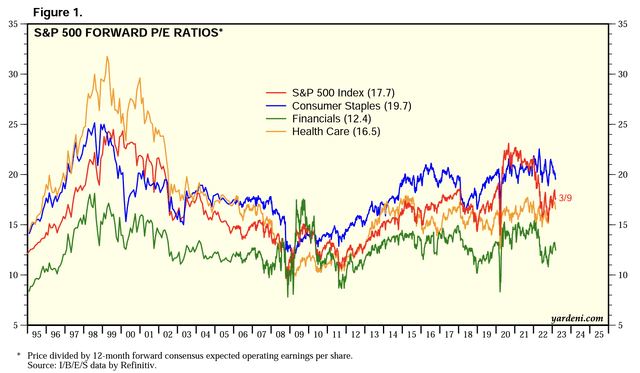

On the other hand, health care sector has stayed rangebound in the past 10 years and has not seen any significant decline last year. However, its current forward P/E ratio of 16.5x is still higher than the 10-12x forward P/E ratio range seen between 2008 and 2010. Based on our findings of the valuations for these 3 major sectors, IWY appears not cheap enough.

Investor Takeaway

IWY should continue to outperform the S&P 500 index in the long run given its strong growth characteristic. However, its valuation is still not cheap enough even after the dramatic decline in 2022. Since 2023 will likely be a year full of macroeconomic uncertainties, we think investors should stay on the sidelines.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.