Roblox: Set Up For Take Off, What You Must Know

Summary

- Roblox's prospects are likely to improve in 2023. In fact, I argue that H2 2023 could positively impress the Street.

- The one question mark I have over its business is its free cash flow profile; what you need to know.

- On balance, I find myself tepidly bullish on its prospects.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

Drazen_/E+ via Getty Images

Investment Thesis

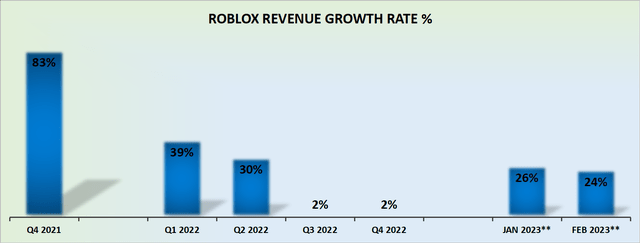

Roblox (NYSE:RBLX) has one very bullish aspect and one negative aspect. The bullish consideration is that its revenue growth rates are not only accelerating, but I believe that H2 2023 could actually be primed to positively impress investors.

The negative consideration is that Roblox's free cash flow appears to be moving in the wrong direction.

Hence, I'm only tepidly bullish on this stock.

Why Roblox? Why Now?

Roblox allows people to play in 3D digital worlds created by users, built by its community of developers. Roblox seeks to provide a platform where users can enrich the way they connect and express themselves seamlessly in 3D digital worlds.

Furthermore, as we eye up 2023 and beyond, we are now way past the Covid period. What you see looking ahead now is a more sustainable and predictable environment.

Revenue Growth Rates Could Improve in H2 2023

Here's what we know, the first two months of 2023 are pointing to approximately 25% y/y growth rates. What's more, keep in mind that Q1 of last year was the toughest comparable quarter.

Simply put, what this means is unless March truly disappoints, I suspect that Q1 could actually come in a smudge higher than analysts expect.

SA Premium

Before one gets too bullish, we must recall that FX impacts Roblox's revenue growth rates by at least 2% y/y.

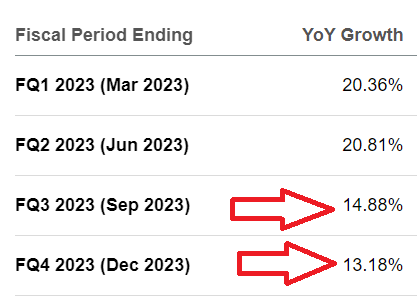

Nevertheless, if Roblox is able to grow by 20% against last year's Q1, that will mean that Roblox's momentum will allow it to deliver at least 20% CAGR against its easier comparable periods, particularly Q4 2023.

Put another way, I believe that over the coming months, investors will be busy upwards revising their financial revenue targets for Roblox. And as an investor, probably one of the best ways to invest is with the sell-side on your side of the table, drumming up interest for your company.

Indeed, I'll go so far as to state that provided the valuation is reasonable, there are few instances that an investment makes more sense, than when analysts are pumping your stock.

Next, we'll address the bearish aspect facing Roblox.

The Blemish Factor

There are two aspects overhanging the stock.

In the first instance, management spends a lot of energy on its earnings call discussing the fact that it hardly burnt any cash in 2022. Here's a quote from the earnings call:

Amazingly, well, not really amazingly because we're so focused on innovation, we burned almost no cash in 2022, roughly negative 0.5% cash, which we're really, really proud of.

Before we get further into that quote, let us for a moment drill down into the following table.

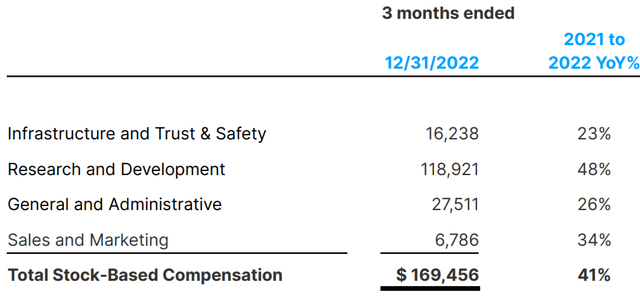

What you see here is that SBC is growing at 41% y/y in Q4, during a quarter that saw nearly no topline growth.

Naturally, this begs the question, with SBC growing at such a rapid clip, why aren't revenues also climbing as quickly?

The next consideration I believe we should note is this:

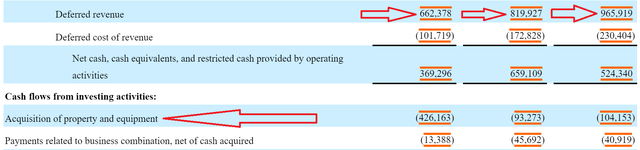

I understand that the table above may appear like an overload. But I believe this will be insightful to investors.

In the first instance, we see three red arrows that point toward declining ''deferred revenues''. Deferred revenues are monies that Roblox gets upfront for the purchase of virtual currency (''Robux'') that provides users with virtual items to enhance their social experience.

And what we see here is that deferred revenues were down 19% y/y in 2022. So there's clearly less cash flow coming into the business.

The second aspect that's important to consider is that at the same time as Roblox has less cash coming into its platform, the business is dramatically ramping up or capitalizing its expenditure.

The Bottom Line

In summary, Roblox gives developers the tools to create, publish, and operate in 3D. My assertion is that the stock has seen its multiple compress as its already down substantially from its highs.

In essence, the time to get bearish on RBLX was at any point in the past year. Today, looking ahead, I believe that Roblox is primed to positively impress investors.

That being said, I urge investors to be mindful of its free cash flow profile, so I'm only going to be tepidly bullish on this stock.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.