Mammoth Energy Services: Putting More Pressure Pumping Fleets Into Operation

Summary

- Mammoth's well completion services division continues to perform well.

- It also expects to put two more pressure pumping fleets into operation in 2023.

- This could allow it to generate around $85 million in adjusted EBITDA (excluding interest on PREPA accounts receivables) during 2023.

- Mammoth's 2023 capex budget is $64 million, up from $13 million actuals in 2022 as it upgrades its pressure pumping fleets.

- PREPA accounts receivables (including accrued interest) is up to $379 million, although recovery remains highly uncertain.

- Looking for more investing ideas like this one? Get them exclusively at Distressed Value Investing. Learn More »

JoelLago/iStock via Getty Images

The results for Mammoth Energy Services (NASDAQ:TUSK) have improved significantly since the start of 2022 with high utilizations and solid rates for its pressure pumping fleets. It expects to put two more fleets into operation in 2023, which should result in a further increase to its EBITDA.

Mammoth is also spending a significant amount to upgrade some of its pressure pumping fleets, aiming to have four dual fuel fleets by the end of the year. Mammoth is budgeting $64 million for capex in 2023, compared to $13 million in actual capex in 2022. This means that it may only generate around $12 million in free cash flow in 2023 if it ends up with $85 million in adjusted EBITDA.

This projected free cash flow for 2023 is lower than I previously expected for Mammoth, largely due to its capex budget. As a result of the lower free cash flow expectations and a slightly more conservative outlook for well completions services, I am trimming my estimate of Mammoth's value to $6 to $7 per share. This is still well above Mammoth's current share price though.

Q4 2022 Results

Mammoth reported $24.1 million in adjusted EBITDA for Q4 2022. This included the impact of $3.5 million in bad debt expense related to a previously disclosed legal settlement.

Excluding that bad debt expense and also the $10.8 million in interest on PREPA accounts receivables for the quarter would have resulted in Mammoth reporting $16.8 million in adjusted EBITDA for Q4 2022. This would be a more accurate picture of how Mammoth performed during the quarter.

Mammoth's well completion services division continued to perform strongly, recording $12.6 million in adjusted EBITDA in Q4 2022. Their natural sand proppant services division generated $2.9 million in adjusted EBITDA in Q4 2022 after excluding the bad debt expense.

Meanwhile, Mammoth's other services division reported $1.3 million in adjusted EBITDA while its infrastructure services division only reported $0.1 million in adjusted EBITDA in Q4 2022 after excluding the interest on PREPA accounts receivables.

Well Completion Services Division

The well completion services division is currently contributing most of Mammoth's EBITDA. It noted that it had four of its six pressure pumping spreads operating at the end of 2022 and announced in mid-January 2023 that it put its fifth spread into operation. Mammoth intends to put its sixth spread into operation in 2H 2023 after upgrading it to Tier 4 dual fuel, while also upgrading two existing spreads to Tier 2 dual fuel. This would bring it up to four dual fuel fleets. However, the timing of upgrades may be hampered by supply chain issues.

Mammoth said that its annualized adjusted EBITDA per fleet was approximately $15 million at the end of 2022. Mammoth had an average of 3.4 fleets active during Q4 2022 and an average of 3.5 fleets active during Q3 2022.

Debt And Cash Flow

Mammoth ended 2022 with $66 million in net debt, down slightly from $71 million in net debt at the end of Q2 2022. I had expected Mammoth's debt paydown to be around zero in the second half of the year due to items such as its MasTec settlement payments (which it paid off in full by the start of December 2022) and backloading of capex. Mammoth's debt paydown in the second half of the year was slightly better than I expected, although that appears to be due to it only spending $13 million in capex in 2022 compared to its $20 million budget.

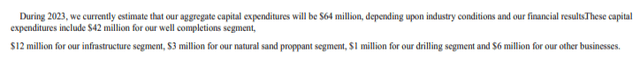

For 2023, Mammoth expects significantly higher capex and is budgeting $64 million. Much of this is going towards its well completions division as it upgrades its fleet.

Mammoth's Capex Budget (mammothenergy.com)

Due to the increased capex budget, Mammoth may not be able to pay down its debt by a huge amount during 2023.

Mammoth's annualized adjusted EBITDA (excluding bad debt expense and interest on PREPA accounts receivables) from Q4 2022 was approximately $67 million. It may be able to generate around $85 million in adjusted EBITDA (excluding bad debt expense and interest on PREPA A/R) in 2023 with its added fleets.

After Mammoth's capex budget and interest costs, this would leave it with around $12 million in free cash flow in 2023, which would help it reduce its net debt to $54 million by the end of 2023. Mammoth's credit facility matures in October 2023, so it will likely need to get that extended or otherwise refinance its debt. Unless it gets a significant payment from its PREPA accounts receivables, it doesn't look capable of paying off that facility via cash flow.

Notes On Valuation

I am now estimating Mammoth's value at around $6 to $7 per share. This is an EV/EBITDA multiple of approximately 4.0x to 4.5x based on $85 million in adjusted EBITDA and its projected year-end 2023 net debt of $54 million.

This also does not include the money Mammoth is owed by PREPA. At the end of 2022, PREPA owed Mammoth $227 million for services plus $152 million in accrued interest. Mammoth ability to recover this money is highly uncertain, so I believe it is best not to include the debt PREPA owes to Mammoth in the calculations of Mammoth's estimated value.

Conclusion

Mammoth's well completion services division continues to perform well, with an average of 3.4 fleets active during Q4 2022. It expects to have six fleets in operation by the end of 2023.

The increased number of operating fleets plus the solid environment (despite weaker commodity prices) for well completions may allow Mammoth to reach around $85 million in adjusted EBITDA during 2023. This would give Mammoth a modest amount of free cash flow as its capex budget is fairly high in 2023 due to fleet upgrades.

I believe that Mammoth is worth around $6 to $7 per share in the current environment, not including any potential PREPA recoveries. Mammoth has a relatively modest amount of debt, so I'm assuming it can deal with its October 2023 credit facility maturity through refinancing or an extension of the maturity. However, that is something to watch since the maturity date is relatively near.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

This article was written by

Elephant Analytics has also achieved a top 50 score on the Bloomberg Aptitude Test measuring financial aptitude (out of nearly 200,000 test takers). He has also achieved a score (153) in the 99.98th percentile on the WAIS-III IQ test and has led multiple teams that have won awards during business and strategy competitions involving numerical analysis. In one such competition, he captained his team to become North American champions, finishing ahead of top Ivy League MBA teams, and represented North America in the Paris finals.

Elephant Analytics co-founded a company that was selected as one of 20 companies to participate in an start-up incubator program that spawned several companies with $100+ million valuations (Lyft, Life360, Wildfire). He also co-founded a mobile gaming company and designed the in-game economic models for two mobile apps (Absolute Bingo and Bingo Abradoodle) with over 30 million in combined installs.

Legal Disclaimer: Elephant Analytics' reports, premium research service and other writings are personal opinions only and should not be considered as investment advice. Only registered investment advisors can provide personalized investment advice. While Elephant Analytics attempts to provide reports that include accurate facts, investors should do their own diligence and fact checking prior to making their own decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.