Viavi: 5G Transition To Drive Growth But I Remain On The Sidelines

Summary

- New OSP facility would contribute an additional 100-150 basis points to OSP gross margins, with further increases of 50-100 basis points in subsequent quarters.

- With the slowing demand outlook, Viavi’s topline is expected to decline by ∼10% in 2023.

- Amidst a worsening macro environment, I believe the risk/reward at this point is not attractive enough, and I remain on the sidelines for now.

jamesteohart

Thesis

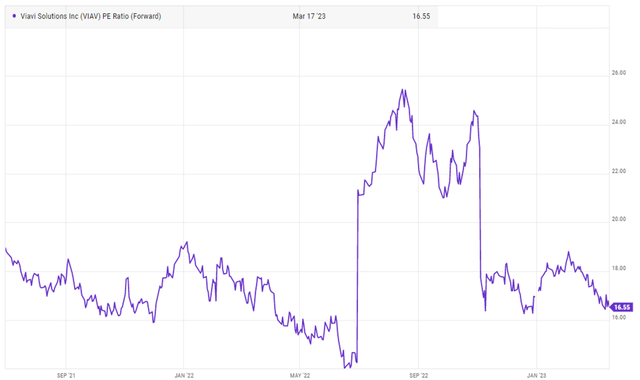

Viavi (NASDAQ:VIAV) appears to be well-positioned for the gradual deployment of 5G technology, but macroeconomic conditions could slow down this process. The company has shown strategic wisdom, operational excellence, and the ability to execute successful acquisitions. There are growth opportunities in 3D Sensing, Test and Measurement, and currency security products, but these businesses are subject to macro risks. Viavi's growth prospects remain limited with economic conditions affecting the company in the near-term, and I anticipate a decline in revenue in 2023 before a slow recovery in 2024, resulting in a significant drop in earnings per share. With the stock trading at 16.6x forward PE, the valuation is not compelling enough for me, given the limited growth prospects in the near term, which is why I remain on the sidelines for now.

Post Q4 Outlook

Viavi had previously lowered its forecast for the fourth quarter, but the company’s results exceeded expectations. The management has given conservative guidance for the next quarter. Viavi has also announced a restructuring plan to reduce OpEx by $25 million/$6.5 million per quarter, which could lead to better margins in the coming quarter. Although the company was expecting a decline in 4QCY22, the business seems to have stabilized towards the end of the last quarter, and Viavi is optimistic about the future after a period of overreaction in late 2022.

Viavi also announced a restructuring plan which will affect around 5% of its workforce globally. The plan is expected to be mostly completed by the end of the current fiscal year. Viavi does not expect to see any benefits from the restructuring in the upcoming March quarter and only a partial benefit of $6.5 million per quarter in the June quarter. The full benefit is expected to be seen in the September quarter, but it's important to note that annual merit pay increases are typically made in July, which may offset the benefits in a quarter-to-quarter comparison.

Moreover, the company seems to be taking a more cautious approach toward its 3D Sensing business for the rest of the fiscal year. The management noted that there is a softening in end-customer demand due to macroeconomic factors, and they anticipate a decrease in inventory levels as supply chains improve.

Management Confident in Resiliency Amidst Macro Downturn

Viavi claims that its business is less affected by economic fluctuations compared to other companies. The company has cited its strong performance during previous economic downturns and the nature of its different business units. For example, its OSP currency solutions business is not affected by macroeconomic conditions. Its Test and Measurement business is connected to long-term projects that are crucial for Service Providers and Cloud customers. Moreover, Viavi asserts that its fiber and wireless businesses are unlikely to experience significant declines during a recession.

Viavi finished investing capital expenditure on a new OSP facility in Phoenix during the December quarter. It is projected to start gradually increasing production and meeting quality standards in the first half of 2023. The initial advantages of the plant are anticipated to be noticeable in the June quarter, which would contribute an additional 100-150 basis points to OSP gross margins, with further increases of 50-100 basis points in subsequent quarters. Additionally, the plant provides flexibility to accommodate any surges in currency printing demand in the future.

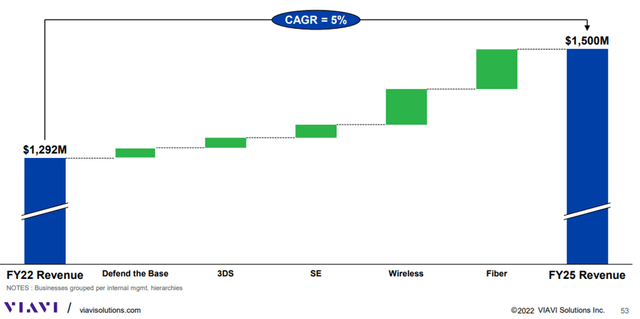

Fiber and 5G Wireless Remain Key To Growth

Viavi provided growth forecasts for its different segments over the next three years in its last Analyst Day Meeting. Its base business is projected to grow between 1% and 3%, while 3D sensing is expected to grow slightly better at 2-5%, with most of the growth expected to occur later in the three-year period. Similarly, SE is expected to experience accelerating growth over the same period as more customers adopt analytics, software, and AI capabilities. Although Viavi's management was cautious in its expectations, the Nitro platform, which represents a significant investment in cloud-native architectures, microservices-based coding technologies, and Kubernetes Orchestration over the past five years, enables quick updates and the addition of new features based on CI/CD pipelining. Additionally, Viavi has invested in data uplift, curation, and AI analysis technologies, which are important and unique skills. As a result, SE is expected to deliver an average growth rate of 7-13% over the next three years, with growth likely to be between 15% and 20% in the final year and much slower upfront. Viavi believes it can achieve growth of 7-9% in its 5G and Fiber T&E segment over the same three-year period.

Key Secular Revenue Growth Drivers (Company Presentation)

Valuation

Viavi Solutions Inc. has been experiencing low to mid-single-digit growth even before the current quarter. With the economic conditions expected to worsen, we anticipate a decrease in revenue in 2023, followed by a slow recovery in 2024 and a significant decline in EPS. Considering the current market price of $10.3, Viavi's forward PE of 16.6x is not compelling, and I believe that there are better investment opportunities available in the industry. Overall, the risk/reward ratio of investing in Viavi appears to be less attractive compared to its peers.

VIAV valuation metric (Ycharts)

Final Thoughts

Viavi is focused on cost-saving and announced a restructuring plan to reduce OpEx by $6.5 million per quarter. Fiber and 5G Wireless segments are key to growth, with the company expecting growth of 7-9% in the next three years. Viavi believes its business is less affected by economic fluctuations than other companies. However, I remain conservative on the stock, with the revenue expected to decline by ∼10% in 2023, I remain cautious and believe that the stock’s valuation is not compelling enough given the limited growth prospects in the near-term. Therefore, I maintain a Hold rating on VIAV stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.