Discover Financial: Enjoy Superior Profitability, While Rate Remains High

Summary

- Discover Financial Services provides digital banking and payment services to customers in the US.

- The company is operating in a highly competitive industry, which is being disrupted by Fintech, but our view is that DFS is doing a great job.

- Higher rates are earning the business outsized profits, with this forecast to continue. Delinquencies are marginally up, but we are yet to see a net negative impact from this.

- DFS is far more profitable than its peers and is rewarding investors with buybacks and dividends. Our view is that investors can seriously gain from buying while rates remain high.

GaryPhoto

Company description:

Discover Financial Services (NYSE:DFS) provides digital banking and payment services to customers in the US. The business operates through 2 segments, Digital Banking, and Payment Services. The Digital Banking segment provides traditional credit services to consumers, such as credit cards, personal loans, etc. The Payments segment provides a credit card payment network through the Diner Club International brand, as well as fund transfer services.

DFS is competing primarily with far larger businesses in the payments space, namely Visa (V), Mastercard (MA), and American Express (AXP). Not only this, but as a digital bank, they are now facing pressure from the wave of new-age fintech banks.

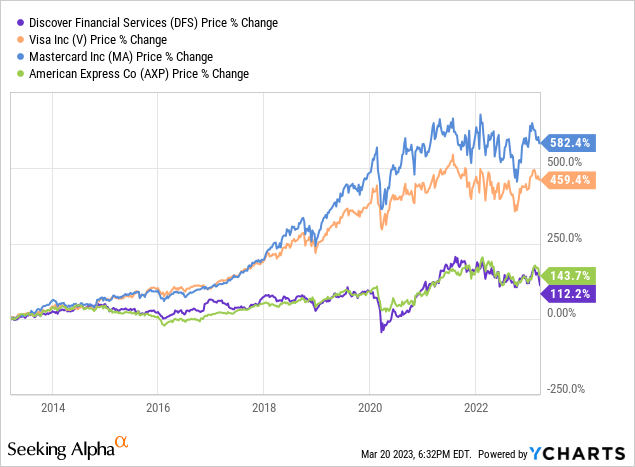

DFS's share price performance in the last decade has been impressive, gaining 112%. This is, however, the weakest performance in the payments space, with their larger competitors performing far better. This exemplifies the struggle the business faces. It is almost impossible for DFS to reach the scale of V/MA due to the current payments infrastructure in place, which allows them to compound at a far greater rate than DFS.

Does this mean DFS is a poor investment and readers should just park their money in V/MA? Not necessarily. DFS provides investors with exposure to traditional banking services also, and so is more comparable to businesses such as Amex, SOFI, LendingClub (LC), and Ally Financial (ALLY). This gives investors a different angle for generating alpha, the primary one being interest-bearing gains. The purpose of this paper is to assess just this, should investors consider DFS as a business that can outperform in the coming 12-24 months relative to its current valuation and peers. We will assess this by considering the company's profile, how current economic conditions will impact the business, and importantly, how the digitization of banking is impacting DFS.

Digitization of finances:

Consumers are increasingly digitizing their lives, with greater technology being incorporated into everyday aspects of life. Unsurprisingly, this has transitioned into their finances. Consumers are placing far greater value on being able to bank conveniently, this involves having a user-friendly app, good customer service, and the ability to provide all the services a bank branch can. DFS has done a fantastic job with this as they currently have the 3rd most credit cards in circulation. DFS has been successful by offering everyday Americans rewards superior to many alternatives, enticing them to choose DFS. With this, they have gained a loyal customer base, creating word-of-mouth marketing and sticky revenue. All of their credit cards boast a review of 4.4/5 or higher. Roger Hockschild, DFS's CEO explained this perfectly in the following quote:

We might be more like Toyota and American Express may be more like Mercedes,

Any income can drive and buy a Toyota.

This is the key here as DFS is not necessarily looking to carve out a specific niche but rather looking to entice the bulk of consumers with attractive perks. Traditional card issuers will struggle to compete with rewards to the same degree as they have costs that a digital bank lacks. For this reason, DFS does not have a tangible moat per se, which is why markets tend to overlook the business, but good old-fashioned customer service and understanding their target audience is a pretty good way to keep and grow their sales.

The digitization wave does also pose a threat to DFS. DFS is an established player in the market, with shareholders it is beholden to. Many of the new entrants in the market are spending substantial amounts of money to market their services and gain market share quickly. This can come in the form of attractive rates with DFS may not be able to match. DFS cannot be so price aggressive as although marketing spend can increase, the business must keep an eye on margins and its overall profitability. We see this as a risk to the company's growth, with consumer choice increasing.

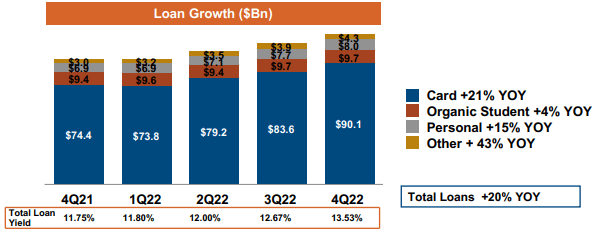

So far at least, this has yet to make a substantial impact. In 2022, DFS achieved 20% loan growth and is forecasting low double-digits in 2023 (driven by weaker market conditions). Given its far large scale relative to new entrants, this is very impressive. DFS clearly has a value which consumers are not willing to forego.

Economic consideration:

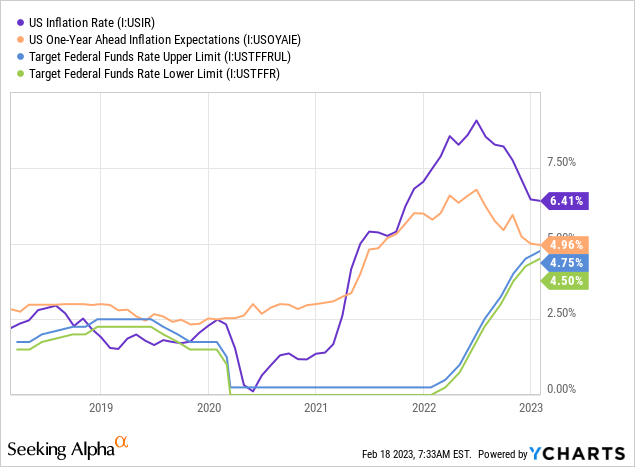

Current economic conditions can be best described as uncertain. Inflation grew persistently in 2022, with the FED slow to respond with the use of interest rates. Inflation only began to taper off at the back end of 2022, and again we have seen stubbornness in its decline, with inflation remaining higher than expected on Jan23. This has contributed to said uncertainty as questions once again begin as to whether the FED must raise rates further and to what degree. All the while Economists debate whether we will experience a recession in 2023. Our view is that rates will need to increase again and the avoidance of a recession is far more likely than the media is portraying. US employment is surprisingly sticky and retail demand looks surprisingly good given the circumstances. Consumers are somehow navigating the current conditions well, although we cannot be sure this can continue.

Inflation has risen on the back of supply chains struggling to ramp up post-lockdown, supply-chain shocks such as the Russian invasion of Ukraine and China's zero-COVID policy, and arguably incorrect fiscal and monetary policy in recent years. Given the level of inflation relating to supply-side factors, our view is that inflation will remain persistent until the end. Just because it has trended down in recent months does not mean this trend will continue at the pace it has, the FED still has a lot to do to get it before 4%. Unsurprisingly, US inflation expectations and consumer sentiment are not at the level expected of an economy ready to turn itself around.

As a Financial Services business, this has a complex impact on DFS and so we will break this down in parts.

Demand for goods and services:

As we have established, it is highly likely that inflation will remain a problem in the coming year, and thus interest rates must stay elevated to combat it. This will compound financial problems for businesses and consumers, as their costs continue to increase. This naturally encourages conservative spending, which is usually why such conditions are followed by a recession as spending beyond necessities falls off a cliff. This is a problem for DFS, who in a simplistic sense make money from consumers and businesses spending. If the average balance on a credit card decreases, and fewer loans are applied for, DFS's earning potential falls. Using 2020 as an example, total revenue declined by 27%. This is an extreme case that will not be repeated but is indicative of what happens when demand declines.

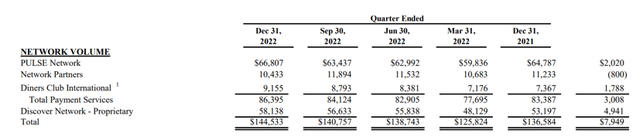

On the other hand, consumers' finances are declining in real terms and so they may not have the opportunity to reduce spending. Their costs are increasing to the extent that the majority of their income is being spent regardless, thus keeping payment volume up. Payment volume data from Q4-22 seems to support this, with the Total Network Volume up 6% Y/Y.

Interest-led earnings:

The bullish aspect of current conditions is that for the first time in a decade, interest rates are at a level where DFS can earn outsized returns. FY22 net income is 46% higher than FY19, driven purely by far superior trading conditions. With rates forecast to remain high, DFS can continue to earn these superior returns. Not only this but rates will only come down once inflation is under control, which could be over a year from now. For this reason, management is guiding improved Net interest margin in 2023.

Product delinquencies:

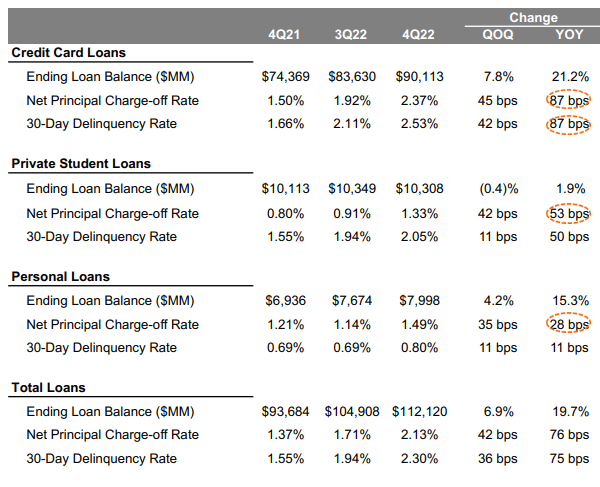

DFS cannot just benefit from heightened rates without experiencing the opposing downside, which is delinquencies. As rates rise, more consumers and businesses find themselves in a position where they are unable to meet their borrowing obligation, thus delaying payments and may eventually default. This creates the potential for greater provision for loan losses. DFS is highly exposed to this area, with its key operations revolving around various loan products.

DFS Loan book (DFS)

This has contributed to a noticeable uptick in 30-day delinquencies across the board, with the Q-on-Q increase looking slightly concerning.

Credit Metrics (DFS)

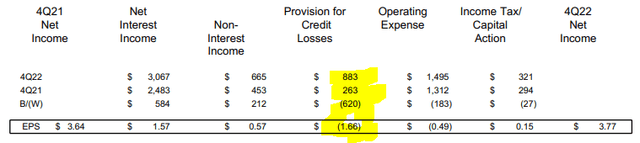

For this reason, Management has recognized a provision for credit losses of $883M in Q4-22, significantly higher than the same level in the year prior.

Financial performance and profile:

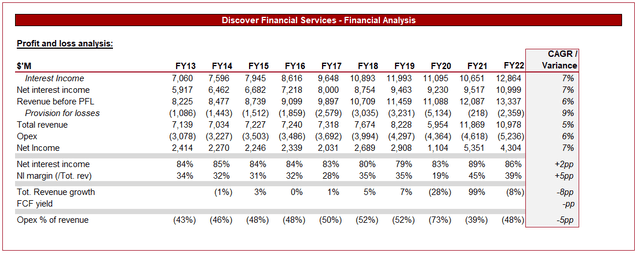

DFS has performed well in the last decade, with consistent revenue growth, even before the COVID-19 pandemic.

Net interest income has noticeably improved since rates have increased, with a 700bps improvement since FY19. Our view is that this will continue in FY23. As this is by far the company's largest income stream, this will likely drive further growth.

The business has struggled with achieving scale economies, experiencing an uptick in costs as a percentage of revenue across the historical period. This has impacted the company's ability to achieve improving bottom-line margins. The recent uptick in opex is attributable to wage inflation and increasing personnel, which has not depressed margins with rates as high as they are, but could do so once they come down.

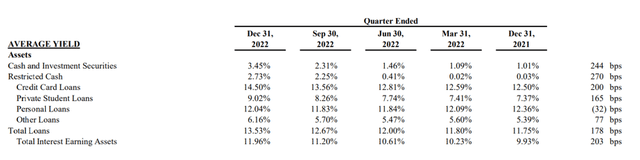

Improving interest income is derived primarily from credit card and private student loans, which have both seen yields increase by over 200bps.

Moving onto the network services segment of the business, this has also seen impressive growth. Transaction volume has increased 5.8% Y/Y, with no evidence to suggest volume is slowing in recent quarters. This further supports the assertion that spending is remaining resilient, thus Q1-23 may be more of the same.

| $'m | Dec22 | Sep22 | Jun22 | Mar22 | Dec21 |

ROE | 28% | 29% | 32% | 37% | 32% |

| Payout ratio | 72% | 36% | 67% | 89% | 84% |

| EPS ($) | 3.77 | 3.54 | 3.96 | 4.23 | 3.64 |

| Liquidity | 67,278 | 61,508 | 56,179 | 54,558 | 52,863 |

DFS has seen a marginal decline in ROE as EPS has increased by 3.6%. The large increase in provision for losses is partially the reason for this. DFS is continuing to grow its dividend payments but represents a more manageable level of income. This is due to the business continuing to fund significant share buybacks, as well as deleveraging.

Presented above are DFS' balance sheet and capital ratios. The business has seen its risk-based ratios and leverage decline since 2021, which marginally reduces its exposure should delinquencies rise.

Relative performance and valuation

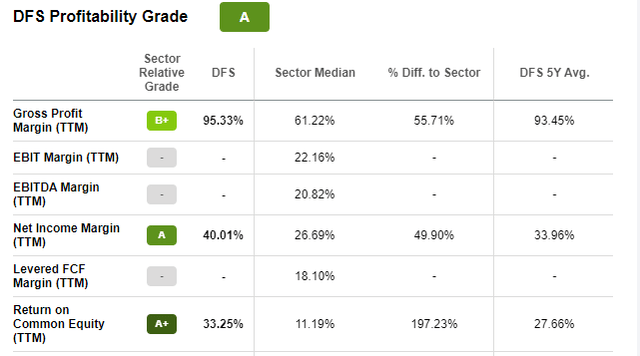

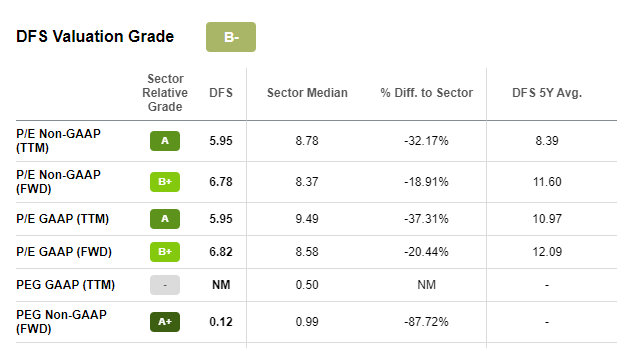

Profitability (Seeking Alpha) Discovery (Seeking Alpha)

Presented above is a comparison of DFS to a cohort of other similar businesses. DFS performs well relative to the cohort, with a far superior net income margin.

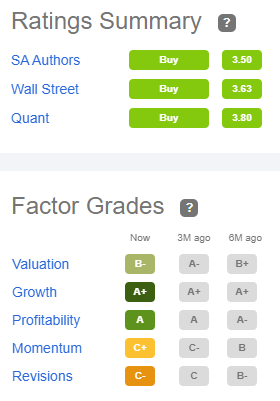

When looking at this data, it is difficult to justify investing in a business like Amex at its respective valuation (NIM 14.8%, P/E 15.9x), when an investor can buy DFS who has a history of a NI margin above 30%. With DFS trading at 8x its forward earnings, we consider this to be an attractive opportunity. Seeking Alpha's quant rating concurs with this assessment, rating the stock a "Buy".

Quant Rating (Seeking Alpha)

Final Thoughts:

DFS has done a great job of carving out market share in what is an incredibly competitive industry with significantly larger players than themselves. Fintech businesses are innovating and gaining market share, but this has yet to impact DFS with its users remaining loyal. Economic conditions are problematic for consumers and businesses alike, but DFS is doing well to take advantage by maximizing its profits. The business is seeing delinquencies tick up but we would hesitate to suggest this will become an issue before seeing more evidence. When comparing DFS to its peers, the business appears undervalued, with the market punishing its inferior growth and lack of moat without appropriately valuing its profitability. Our view is that while rates remain high, which are offsetting the greater delinquencies and rising costs, DFS represents a good investment opportunity.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.