Market Getting Ahead Of The Fed After Latest Rate Hike

Summary

- The Federal Reserve raised the Fed funds rate 25 basis points to a target rate of 4.75% to 5% on Wednesday.

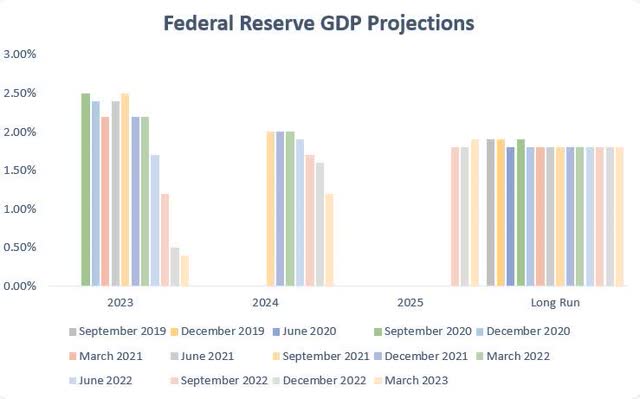

- The Fed also updated its economic projections for the next few years.

- It appears a broader crisis is being priced in based on the market's reaction.

Douglas Rissing

On Wednesday, the Federal Reserve defied some equity analysts and raised the benchmark Fed funds rate by 25 basis points to a targeted rate of 4.75% to 5%. In addition to the rate increase, the Fed also updated its economic projections for pricing, growth, unemployment, and interest rates. The markets reacted by getting ahead of the Fed and are pricing significant cuts compared to the Fed’s forecast.

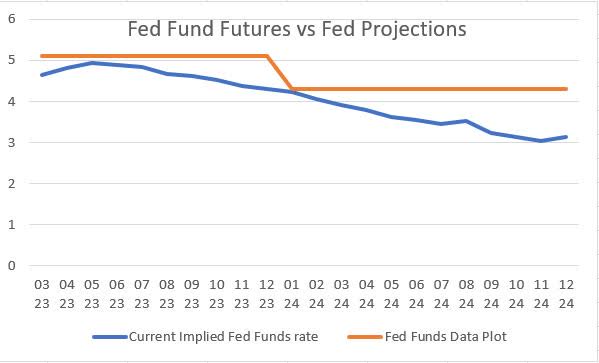

The significance of this meeting was based on the Fed’s updated economic forecasts. First, the Fed affirmed its 5.1% Fed funds forecast for 2023. This would indicate one additional rate hike in 2023 followed by a hold of interest rates for the rest of the year. Surprisingly, the Fed took a rate cut off the board in 2024 by raising its Fed funds forecast from 4.1% to 4.3%. Essentially, the events of the last two weeks have led the Fed to think the pace of its rate cuts will be slower than previously thought.

Federal Reserve Data Plots

Federal Reserve Data Plots

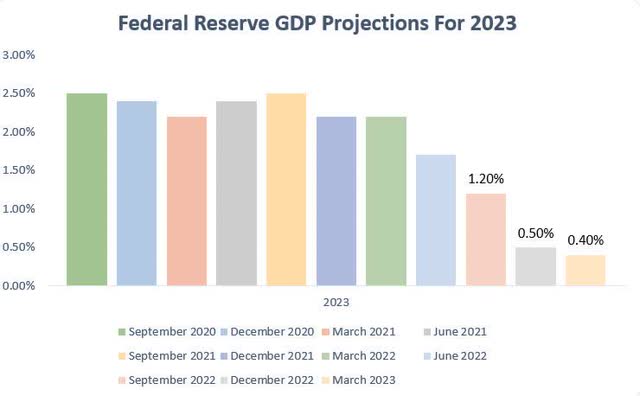

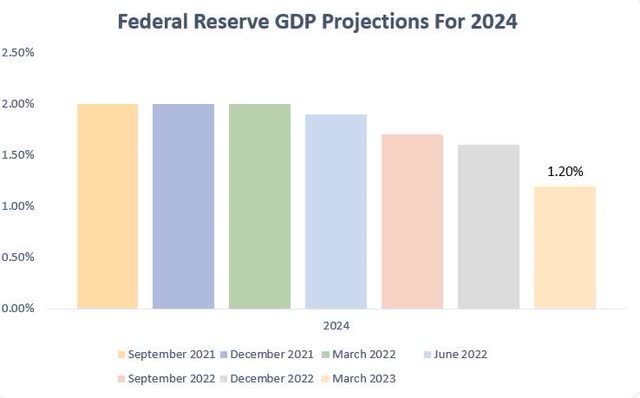

In addition to eliminating a near-term cut from its forecast, the Fed also continued to lower its growth forecast. For 2023, the Fed is now anticipating GDP growth of 0.4%, down from 0.5% estimated in December. They also lowered their 2024 growth expectations from 1.6% to 1.2%. The Fed seems poised to push real growth towards zero to achieve price stability.

Federal Reserve Data Plots

Federal Reserve Data Plots

Federal Reserve Data Plots

The Fed also does not seem to have a problem with the labor market changing as well. The committee eased its unemployment projections for 2023 from 4.6% to 4.5%, likely due to three straight months of robust labor growth. An unemployment rate of 4.5% would imply 1.5 million people becoming unemployed over the next nine months. Again, it demonstrates the lengths that the Fed will go to achieve price stability.

Federal Reserve Data Plots

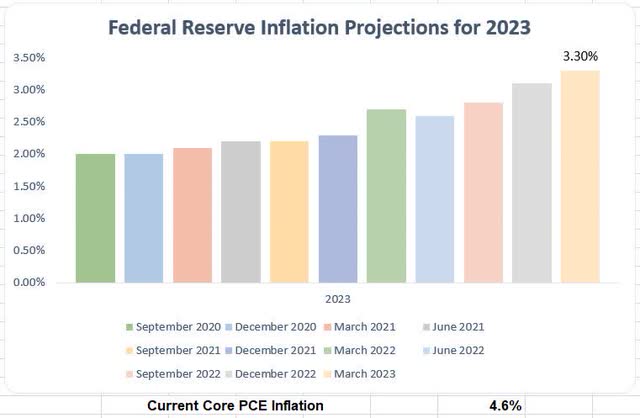

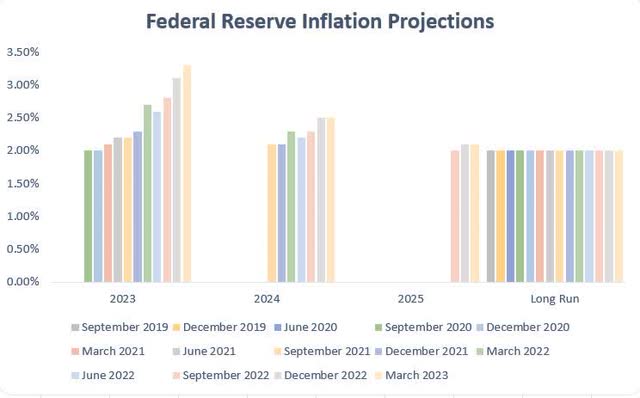

The Fed also seems prepared to tolerate higher inflation. The committee adjusted its core PCE projections for 2023 upwards from 3.1% to 3.3%. The forecast remains 130 basis points higher than the current 4.6% reading. For 2024, the Fed kept its core PCE forecast at 2.5%. The Federal Reserve is essentially telegraphing that it expects inflation to remain higher, growth to remain lower, and for interest rates to be elevated longer for everything to be stabilized.

Federal Reserve Data Plots

Federal Reserve Data Plots

But did the market get the message? Not exactly.

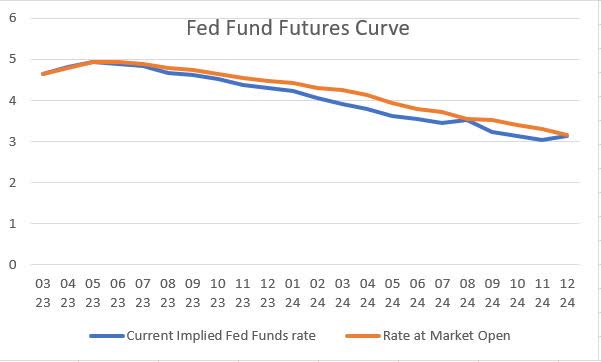

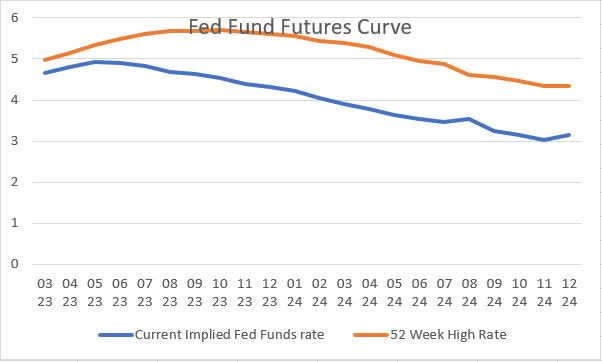

Fed fund futures, which have already sold off since the start of the regional banking crisis, pushed lower after the Fed’s decision, dropping many 2024 futures contracts by 25 basis points. The curve overall has dropped by 100 to 125 basis points for the period of fall 2023 through the end of 2024 in just the past couple of weeks. Fed fund futures for 2024 are trading at 130 basis points lower than the Fed’s own projections, a variance I have not seen in this business cycle.

Barchart

Barchart

Barchart & Federal Reserve Data Plots

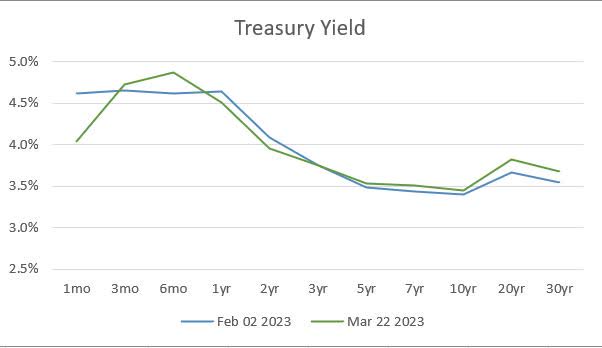

Fortunately, Treasury yields seem to be responding in a saner fashion with long-term Treasuries trading slightly higher than they were after the last Fed meeting. Six-month T-bills remain elevated but are far off their highs attained prior to the SVB collapse. To highlight the volatility in the Treasury markets, current yields in 2-year Treasuries are 109 basis points lower than the day before the regional banking crisis hit the news.

St. Louis Federal Reserve

St. Louis Federal Reserve

While the Fed admitted that credit will be affected by the challenges in the regional banking sector, its projections and demeanor reflect a committee that will continue to stay the course until pricing pressures are under control or data from the credit markets presents a deflationary threat to the economy. Whether it’s a credit crisis or higher interest rates, neither outcome for this business cycle is bullish for the near-term equity markets and traders should move with caution.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.