USA Shale Drilling Set for 20 Percent Drop at Current Prices

The US shale patch may lose as much as 20% of its activity over the next year if energy prices hold at current levels, according to one of the biggest private equity players in the industry.

Crude would need to rise by about 15% to $80 a barrel, and gas would have to climb by more than a third to $3 per million British thermal units for drilling and frack work to maintain its current pace, Quantum Energy Partners Chief Executive Officer Wil VanLoh said in an interview Tuesday. Oil and natural gas prices have slid since mid-2022 on fears of a global economic slowdown.

“There’s a risk of a pretty big rollover this year at these current prices,” said VanLoh, whose Houston-based firm has managed more than $20 billion since its 1998 inception. While publicly traded explorers and closely held drillers both would drop rigs and frack crews, the private companies would cut back more because their balance sheets aren’t as strong, VanLoh said.

The number of rigs drilling for oil and gas has slipped 3% since the start of the year, according to Baker Hughes Co., as the biggest shale explorers stick to commitments to keep production growth flat and return profits to shareholders.

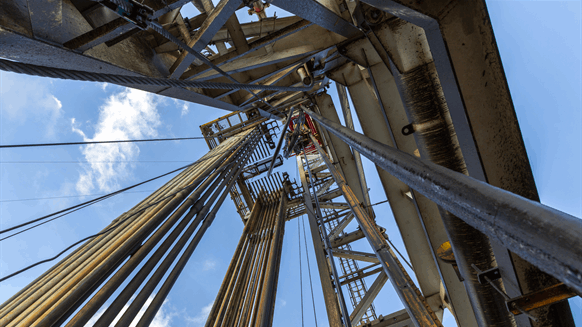

Photo Credit – iStock.com/Fatih Ispir

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

- Carbon-Sucking Tech To Use More Energy Than All Homes

- California Win in Bid to Curb Oil Profits

- Russia Becomes China's Biggest Oil Supplier

- Chevron Asks Venezuela to Dredge Lake to Double Its Oil Exports

- Venezuela's Oil Minister Resigns

- Saipem and Garbo to Bring Forward New Plastic Recycling Technology

- Pimco Sees Banking Turmoil as Threat to USA Oil, Gas Production

- Russia To Keep Oil Cuts Until June

- Biggest Oil Traders Avoiding Russian Business

- Oil Rebounds as US Assures Bank Crisis Containment

- Oil Prices Won't Hit $100 This Year

- Russia Oil Trade Starting to Show Signs of Clogging Up

- Canada Faces $15 Billion Loss on Oil Pipeline

- Oil Headed For Biggest Weekly Drop In A Year

- Biden Admin Decision to Approve Willow Dubbed a Sign of the Times

- UN Buys Very Large Crude Carrier for FSO Safer Operation

- Fitch Solutions Reveals Latest Henry Hub Price Forecast

- Iran Oil Exports Reportedly Surge Despite USA Sanctions

- Biden Is In No Rush to Fill Petroleum Reserve

- 88 Energy Spuds Hickory-1 Well in Project Phoenix

- Back of WTI Oil Price Curve Has Collapsed

- Will There Be a Hiring Boom in Oil and Gas in 2023?

- Offshore Is Back

- Fifth of Oil, Gas Workers Feel Like Outsiders at Work

- Where Is the Safest Offshore Region for Oil, Gas Right Now?

- Global Electric Vehicle Market Reeling

- North America Loses 26 Rigs

- Oil Prices Won't Hit $100 This Year

- USA EIA Cuts 2023 Oil Price Forecasts

- Global Liquid Fuel Production to Outpace Demand