IBHD: 8% Yielding ETF With Lowest Duration Risk

Summary

- 2021 gave you the worst of all worlds, where you got paid nothing for taking credit risk and duration risk.

- 2023 is paying you to take some credit risk but not so much on the duration front.

- IBHD gives a great setup for that.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

AHPhotoswpg/iStock via Getty Images

Investors would have to be living under a rock to be unaware of the ETF offerings from BlackRock. They offer investment funds covering the globe and securities across the spectrum. We recently came across a group of their funds which, in our opinion, provided a unique twist on bond laddering. This concept may not be familiar to fixed income investors. It is essentially staggering out your fixed income maturities to diversify, regulate cash flow, and manage interest rate risk. Of course, cherry-picking securities, combined with active management of the said ladder by a fixed income expert, is always preferable versus passively following an index in this endeavor. The aforementioned BlackRock, or products akin to it, could be an alternative for those that do not have a choice, provided they pass the smell test.

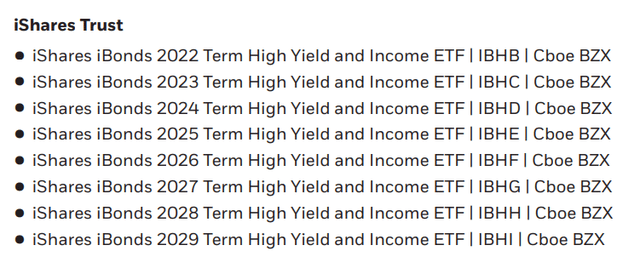

The iShares ETFs brought to us by BlackRock that we are talking about above provide exposure to high-yield or junk bonds maturing in a specific year (noted in their name).

Note: IBHB was liquidated on schedule and ceased trading on December 15, 2022.

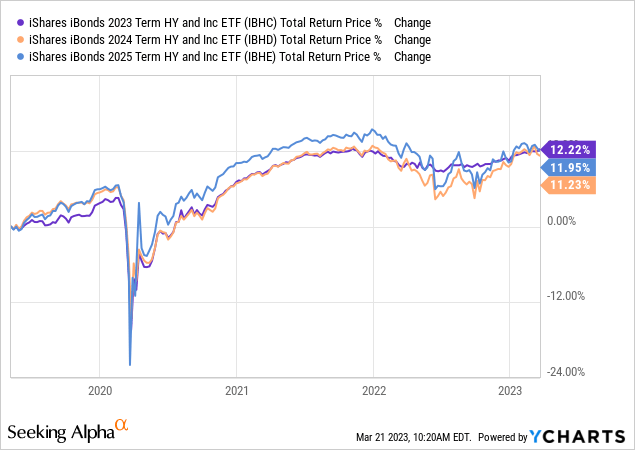

We have included the 2023-2025 ETFs in the chart below, as the three started at the same time in May 2019. There is very little difference between the performance of the three.

One would have expected some differences in the relative performance, with the longer duration perhaps underperforming. We believe the ETFs have tracked each other for a simple reason. The longer duration on the later maturing ETF was compensated by the higher starting yields on the underlying holdings. Today, we will delve deeper into iShares iBonds 2024 Term High Yield and Income ETF (BATS:IBHD), the ETF holding fixed rate, high-yield bonds maturing in 2024.

Methodology Overview

We already know what the fund invests in, high-yield bonds maturing in 2024. The ETF was started in 2019 and passively tracks the investment results of the Bloomberg 2024 Term High Yield and Income Index. The index rebalancing occurs on the last day of each month, with the last one scheduled for June 30, 2024. After this point, monies from the maturing bonds will not be reinvested but held in cash and cash equivalents. The fund applies representative sampling, which means that the majority (at least 80%) of its portfolio will be comprised of securities from the index. Additionally, at least 90% of the portfolio will comprise securities of the same features as those that make up the index.

Portfolio Overview

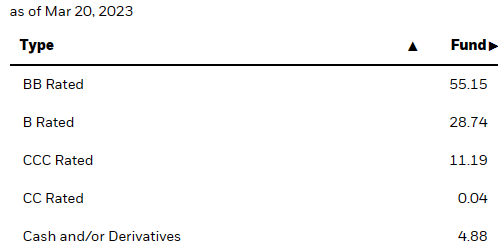

Most of the portfolio is rated within two rungs of the investment grade rating.

Fund Website

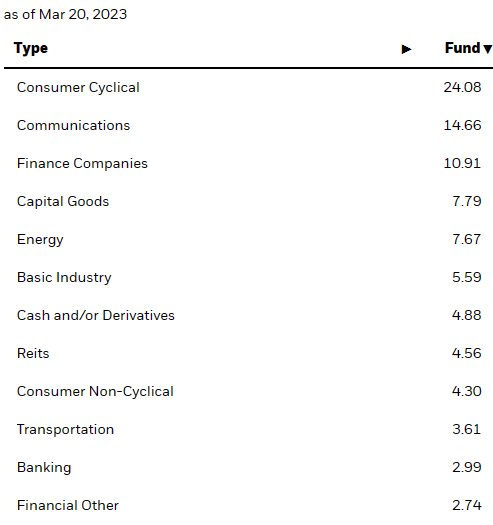

With consumer cyclicals leading the charge, followed by the communications sector.

Fund Website

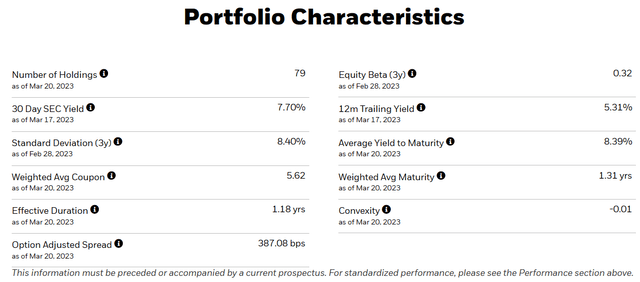

There is hardly any interest rate risk with the scheduled liquidation happening next year. That is reflected in the 1.18 years' effective duration for the portfolio. Since the fund will stop reinvesting maturing bond proceeds after June 2024 and instead hold them in cash and cash equivalents until liquidation, the interest rate sensitivity of the portfolio will only decline from here on out.

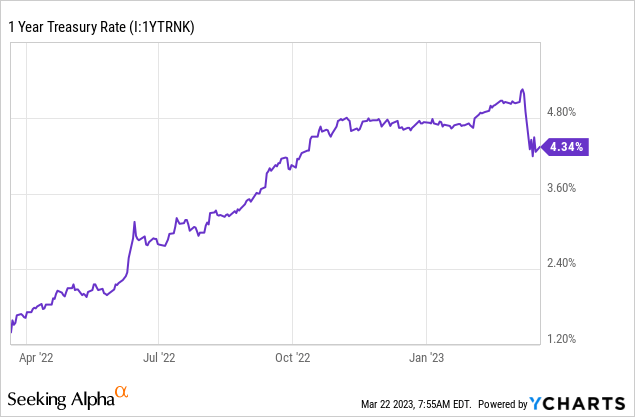

The 8.39% average yield to maturity or YTM is not a surprise considering the current equivalent risk-free rate.

After accounting for expenses, the fund earned a net 7.70% as reflected in the 30-day SEC yield. The annual expenses of the fund are reported as 0.35% whereas the difference between the YTM and the 30-day SEC yield is higher. Some small differences can be attributed to income/expense timing differences. We can note in the portfolio characteristics graphic from above that the data date for the two is also different. There is nothing wrong with using the 30-day SEC yield as a ballpark for the future yield. But here, we differ to the real earning power of the fund as closer to 8.00% (YTM minus the expense ratio).

Distribution

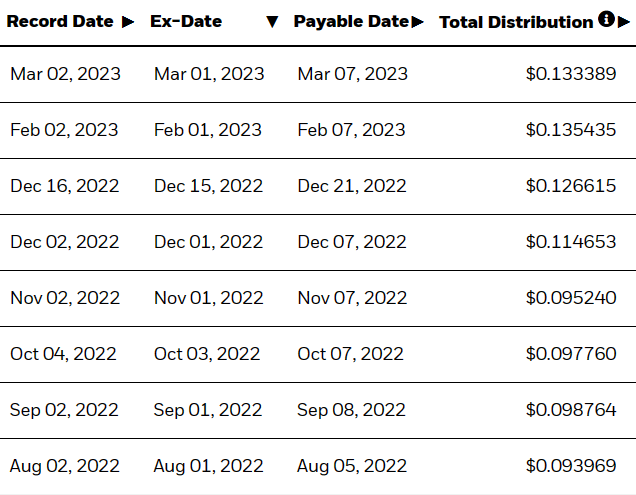

IBHD distributes monthly like most funds serving the income purpose. Based on the most recent distribution and current price, it yields 7%. The trailing yield noted under the portfolio characteristics graphic is not indicative of the future yield. The current yield of 7% is closer.

Fund Website

We expect the distributions to rise in the next few months, since the net income retained by the fund as reflected under the 30-day SEC yield and our calculated 8%, is way higher than what it is currently distributing.

Verdict

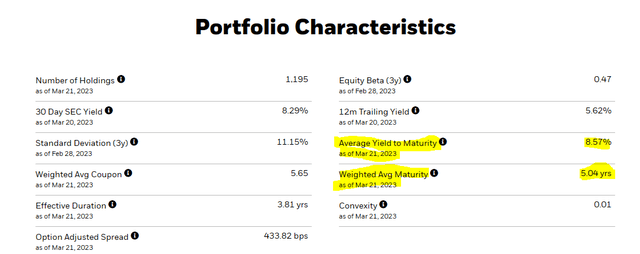

2021 gave you the worst of all worlds, where you got paid nothing for taking credit risk and duration risk. Those that went into either, got hurt pretty bad. Currently, the bond market is pricing in aggressive rate cuts and if those are not delivered, longer and mid-rate duration bonds could get hurt. The flat yield curve extends to junk bonds as well. IBHD's yield to maturity is 8.39%. That is with a 1.31 average bond maturity. Now, look at iShares iBoxx $ High Yield Corporate Bond ETF (HYG). Here, you quadruple the weighted average maturity but get only 18 basis points more.

So by buying these longer-duration junk bond funds, you are again explicitly betting that those rate cuts will materialize. You are also betting that the yield compensates you enough for those longer-duration bonds in a recession. We don't think that is the way to go. So for us, IBHD looks like one of the few bets we would consider placing on junk bonds. At present this is on our watch list, and we may make a move if we get a big market selloff.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.