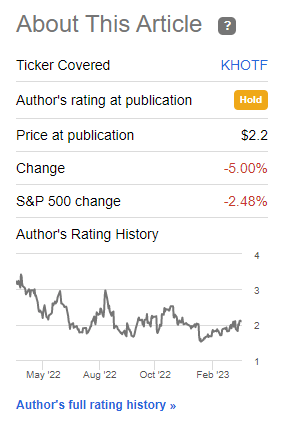

Kahoot!: Underperformance Justifies 'Hold' Thesis, And Future Looks Dubious

Summary

- You may recall I wrote an article on Norwegian business Kahoot! a few months back. The shares have underperformed not only in real terms, but also compared to index performance.

- This justifies my negative Thesis on Kahoot!. I do not view the company as a "BUY". In fact, I think you should be extremely careful with this company.

- I'm updating my thesis for 2023E - and I don't see a whole lot of positives, despite the company's cheery name.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Lock Stock/DigitalVision via Getty Images

Dear readers/followers,

The last time I wrote on Kahoot! (OTCPK:KHOTF), we were still somewhat in the midst of ZIRP policy. At least, the interest rate hikes still hadn't taken a toll from the company's bottom line and muddled the thesis. This is, I argue, what we see today. While Kahoot is perhaps to be considered not as "bad" as some of its ZIRP-era competitors, the company is still, I argue, to be valued with this in mind. The market has pushed the company's share price into the negative.

Seeking Alpha Kahoot (Seeking Alpha)

I believe that the dangers of investing in this company at this stage are still quite understated at this point. The articles, when looking at the contributors that have been positive over time, have seen the destruction of capital to the tune of some 55-85% from the company's ATHs.

In this article, I will show you why I believe we're going lower, and why even if we are not, this isn't the sort of business I would invest in.

Updating on Kahoot! for 2023

So, Kahoot!. If you recall my article on the company, you'll know that the business has been around for 10 or so years. That may sound like quite some time, but the fact is that this is part of the company's problem. Kahoot! has never really had to face an environment like this, characterized by a lack of ZIRP or close to ZIRP.

The company started out as a quiz-based game in order to capture attention in classrooms and make it easier for educators to provide knowledge. Already in a fairly early stage, it was one of the top 3 tools in US education - and that only with 50 employees. However, I happened to know this sector quite well, and the education/learning sector, given how schools and procurements are structured, means that it's one of the harder sectors around to "make money" in and get these institutions to commit. So when you look at the company's active user numbers or traffic numbers, or presentations like this...

Kahoot! IR (Kahoot! IR)

...consider that all of one of those numbers have any sort of relevance for the top/bottom line of the company and the number doesn't even state the actual revenues generated by the company. It's endemic of this sort of business - stating opportunities, without stating potential costs and CaC, or customer acquisition costs.

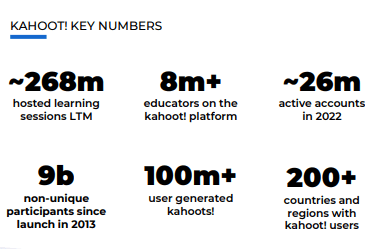

It's unfair to say that Kahoot! hasn't managed to generate some success. When you dig down into numbers, you'll quickly note that people do seem willing to pay for the service - at least, that was the trend until late 2020. Also, in their latest presentations, the company is strategically omitting the number of actual paying subscribers as part of their "Key numbers", focusing instead on numbers that have absolutely nothing to do with hard bottom-line dollar profits.

Kahoot! IR (Kahoot! IR)

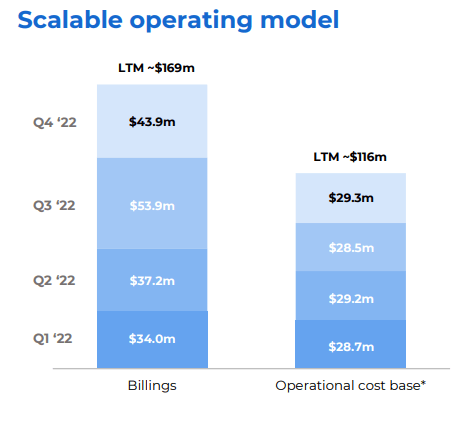

This doesn't mean revenue is bad. But the company, which can be characterized as "world-leading" has invoiced less revenue than a small industrial company close to where I live that manufactures parts for the automotive industry. The total invoiced revenue reported is below $170M for the 2022 fiscal. Total billings are up 10% for 4Q, and 21% YoY for the full year. Retention numbers are good, paid subs are above 1.3M at this point, and the company's various partnerships seem to be working well - at least insofar as the app/platform usage works.

Kahoot! IR (Kahoot! IR)

I'll be honest - I'm probably one of the hardest investors for a growth/tech company to "win over" in terms of my rating and view, because unless a 10-year+ old company is GAAP Profitable, I don't view it as a valid business or valid business model.

So, is Kahoot! profitable?

Yes.

For the first time in its history, Kahoot! managed to generate positive net earnings.

Kahoot Net earnings (TIKR.com)

That means that the company, at least for the 2022, has proven that its business model can add profit/value, not just be a drain on resources. The question becomes if this is a non-recurring, or actually the beginning of a trend.

The fact that it managed a positive net is also part of the reason why I believe Kahoot! has actually not dropped as much as other tech. On a 1-year basis, the company is "only" down about 20%, which is significantly better than most. Kahoot! has also generated quite good billings, EBITDA, and FCF over time. I will recognize, at this time, that Kahoot! has proven its business model is profitable.

The company has shown that company billings next to the actual operational cost base can result in profits and that this is technically scalable.

Kahoot! IR (Kahoot! IR)

This is a pretty big thing for a company like this, in a sector that's mostly occupied by GAAP/Net-unprofitable business ideas. Kahoot! manages upwards of 25% adjusted EBITDA margins and its profitability is, for the moment looking okay. At least, if you don't account for share-based comp, or SBC. SBC expenses have continued to be high in the face of reported EBITDA, amounting to between $2M to $6.3M for the latest 4Q quarters, with $6.3M being the SBC expense alone, ex-payroll, for the quarter.

The company believes it can wind down SBC expenses in 2023 based on current vesting schedules, but this does not mean a significant sudden improvement to the historical trend, and the company needs to handle something like this.

Remember, the company has been operating under negative GAAP numbers for years. It is not unprofitable any longer, and 2022 seems to mark a turning point where margins have started to go from blood-red to slowly going into the white/black - very slowly.

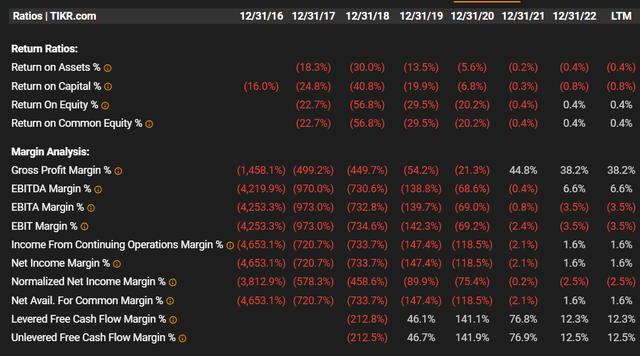

Kahoot! Ratios (TIKR.com)

When I analyze a company, it is a mix of looking at filings, analyzing ratios, listening to earnings calls, modeling earnings and forecasting trends, and looking at the risk/reward potential. In many of these perspectives, Kahoot! scores substantially better than its growth/tech-ZIRP peers.

It seems to be that this may be a company that can show us a business model that over time, can actually generate solid earnings and become a solid investment as a result of it.

At least, once it gets its SBC more under control.

Kahoot! SBC (TIKR.com)

The positive thing that we can say about this is that the growth in SBC at least is very minor compared to 2020 to 2021. if the company does manage, through vesting schedules, to ratchet this down, then we may be looking at a company that could be potentially valued at an attractive price for a "BUY".

Until then, this is my valuation for Kahoot!.

Company valuation - still issues once you look at the whole picture

The ability to navigate with ease, the various income statements, balance sheets, capital stacks, and considerations that a company has is fundamental to successful, conservative stock analysis. My question in my last article was when the company was going to be a profitable business. This question now has an answer - net profit is now positive, and ratios are slowly going into the black.

That in itself is a victory, but only a victory in the context of its segment and tech companies as a whole. I invest across sectors and markets, and when a company isn't profitable, I mostly ignore it. It's not a badge of honor to be profitable - it's a fundamental requirement.

Kahoot! has managed to check that box. However, we still need to keep an eagle-sharp focus on unadjusted numbers. All of the numbers presented that matter on a quarterly basis - EBITDA, expenses, are excluding/adjusted to SBC, payroll taxes, and M&A/expense listing costs. This makes adding these costs back incredibly important to get a fair picture of where the company is.

We still have a number of analysts following the company - 5 of them, as a matter of fact. But despite managing its first profitable year ever, these analysts have shown Kahoot! the short end of the stick, likely due to interest rates rising and macro growing much more complicated. What was once a 26-27 NOK average for the native KAHOT ticker is now a price target of 22-23 NOK, from a range of 16 NOK to 30 NOK. Not one analyst is at a "BUY" any longer - they're split between "HOLD", "SELL" and various states of performing expectations. This is a difference from early 2022 when 50% of analysts had a "BUY" recommendation when the stock was trading closer to 50 NOK.

Not a pretty story from that point onward, no.

Kahoot currently trades at a 6x sales multiple. Its P/E is no longer negative - but it's now at 445.78x as per 2022A results. This development should tell you exactly how much you can trust these sorts of multiples in this case. They don't work, simply put.

While the company's revenues and earnings have grown, the company's BV/share has dropped due to the massive amounts of dilution that SBC and other things are causing to the company. These problems do not disappear simply because of Kahoot! went GAAP-positive for a single year in its lifespan.

I view this as proof of concept. The company has shown us that they can earn money - and this is neither small nor insignificant. But it's not as much of a victory as Kahoot! Bulls would like to make it.

Until I see a repeat of this performance during this fiscal, and I'll be keeping an eye on the quarterlies, I don't see a reason to become more positive here.

We could still use a tech-sort of analysis. if you recall, across tech/growth, analysts tend to value companies at a multiple or percentage to revenues, which compared to other tech businesses with success would imply undervaluation here. However, I view this method as too flawed and too insecure to actually give you a price target based on this.

I am not against investing in tech. I have tech/IT positions in companies like Qualcomm (QCOM) and NetApp (NTAP), among other things. Common for every single investment I make, however, is that they are all profitable businesses with significant upsides. Remember, the purpose of your business is to make money. If you do not make money, you're not a (successful) business. In fact, I would argue it's not even a business.

Kahoot, as of this point, is a business, and I can actually give you a price target - though you probably won't like it.

Still, it's an objective improvement on my last article on the company.

Thesis

- Kahoot! is an interesting and market-dominating learning and engagement business, with very impressive top-line trends. However, like many tech businesses, it has failed to generate a single cent of positive operating income and net income - which means that I do not view it as a successful or investable business at this price.

- I could be convinced to, as of profitability pay a SOTP-100% value at 10 NOK/share, around half of the current share price, provided trajectories continue to show positive momentum in 2023.

- For now, though, this company is a "HOLD", and I would not buy it here.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills none of my investment criteria. It's a "HOLD", and if I held it, I would "SELL" it.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of NTAP, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. The author's intent is never to give personalized financial advice, and publications are to be viewed as research and company interest pieces.

The author owns the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in the articles. The author owns the Canadian tickers of all Canadian stocks written about.