Deere Should Benefit From Solid Agricultural Fundamentals

Summary

- DE should benefit from solid agricultural fundamentals, technological innovations, and an aging equipment fleet.

- Any misstep in the near term would likely come from its Turf & Utility business, which is more tied to the general economy.

- DE stock looks appropriately valued.

Ballygally View Images/iStock Editorial via Getty Images

Deere (NYSE:DE) is riding some gentle tailwinds in the agricultural sector and is a great company. However, the stock looks appropriately valued at current levels.

Company Profile

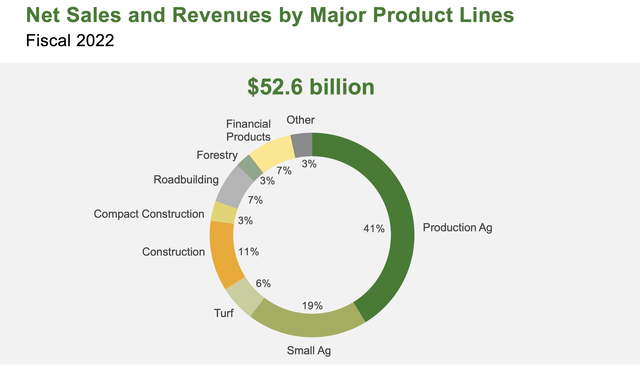

DE manufactures and distributes equipment for the agricultural, turf, and construction industries. The company operates in 4 segments.

In its Production & Precision Agriculture segment, the company sells equipment to large-scale farmers. Its products include combines, cotton pickers, tractors, sugarcane harvesters and loaders, and soil preparation, seeding, application, and crop care equipment.

In the Small Agriculture & Turf segment, it sells equipment to turf and utility customers, as well as dairy farmers and high-value crop producers. Among the equipment it sells includes commercial lawn equipment, golf course equipment, tractors, and hay and forage equipment.

In its Construction & Forestry segment, DE sells equipment such as excavators, crawler dozers and loaders, skid-steer loaders, four-wheel-drive loaders, milling machines, and log harvesters.

DE also has a finance segment where it finances sales and leases of equipment by its network of independent John Deere dealers. The segment also offers wholesale financing to dealers.

DE owns and operates 22 factories in North America and operates and leases an additional two. It also operates 47 manufacturing facilities outside of North America. In North America it markets products to independent dealer locations, while elsewhere equipment is sold to distributors and dealers for resale.

Company Presentation

Opportunities and Risks

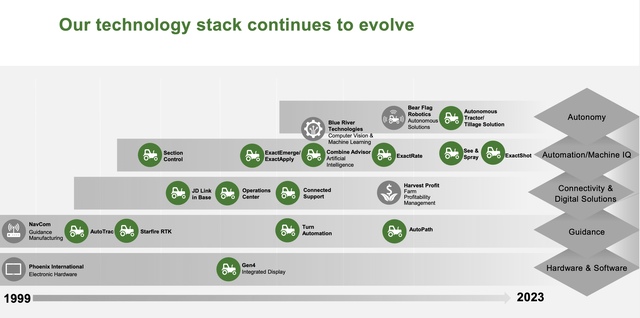

DE reorganized how it does business a few years ago into what it calls its smart industrial strategy. Its focus now is to do business how its customers think around specific types of crops, such as corn, soy, cotton, sugar, and small grains. As part of its plan, it centralized technology development to progress proprietary solutions to best help its customers’ unique requirements.

One area the company has focused on is plant-level management. In the past, farming decisions have mostly been made at the field level, but DE has been working to change that through technology such as machine learning, computer vision, geospatial positioning, autonomy, and connectivity. This technology can help farmers save money in areas such using less herbicide or needing less labor or even helping with decisions like seed depth, variety, population, and which starter fertilizer to use. In other words, DE is pushing technology to helps its farmer customers optimize their crops.

At its analyst day last year, CEO John May said:

“We mapped out every job a customer does. And then we determined the areas where John Deere solutions could unlock value both economic and sustainable. The result was $150 billion identified as incremental adjustable market. That figure includes every drop of herbicide or pound of fertilizer that our machines saves through precision application, every extra bushel our customers get from achieving uniform emergence in their crop and every dollar saved on a job site due to less rework from smart grade technology. That's an enormous opportunity for John Deere, and building solutions to address it will underpin our revenue growth through the balance of the next decade.

“And that's what our smart industrial strategy is all about. It's about more value per unit, not just driving more units. Today's focus will be more about the long-term growth than the particulars of the cycle, and we're going to dive into several technologies that will drive this growth. But don't think of these technologies in isolation. It's the combination of these technologies on top of the best-in-class machines. Our product pipeline is full. The innovation we'll bring to the market over the balance of the decade will rival the transformation that took place when John Deere first began making tractors in 1918.”

DE has a strong product roadmap in place across its three equipment segments, with connectivity a big priority. By 2026, it is looking to triple its number of connected ag equipment and reach 500 million engaged acres, which is acreage where farmers actively upload data into its digital tool that go to its operations center. It had over 340 million engaged acres when it last reported the number a year ago. It’s also looking to ensure that all new Small Agricultural equipment will be connectivity enabled by 2026.

DE is also looking to offer more electric options to customers. It plans to offer a fully autonomous, battery-powered electric ag tractor by 2026 in the Small Ag & Turf segment, as well as have an electric option for each Turf and Utility Tractor product family. In the Construction & Forestry segment, it is looking to offer 20+ electric and hybrid-electric product models by 2026.

Company Presentation

Other areas that can impact DE are agricultural fundamentals, fleet equipment age, and channel inventory. Farm economics are currently strong, with fertilizer prices down and crop prices lower than last year but still well above historical levels. Given the ongoing conflict between Russia-Ukraine (lessening crop yields in the region) combined with China re-opening (and exporting some urea), I'd expect this dynamic to remain in place for a while.

Meanwhile, the ag fleet age is getting advanced according to DE. On its FQ1 call, Director of IR Brent Norwood said:

“If we meet our production goals, this year tractors will sort of maintain their rate. They won't age out further, but they really won't get younger. We pointed this out before in the past. Our production levels in 2023 are still 20%, 25% below prior replacement cycles. So as a result, we'll likely just maintain large tractor age in 2023.

We'll make a little bit of progress on combines pulling down the age a bit, but I'd note that where the ending point for this year is still above sort of the average fleet age over a longer period of time. For construction, it depends on the end market we're talking about, to some degree. That age is normalizing in some pockets. But we also have, I would say, the rental channel is really refleeting right now. And this is because they obviously had lower CapEx budgets in 2020, '21. And then in 2022, they weren't able to get maybe as much allocation as they wanted, given how earlier in the year, that market was so strong. So I think there's probably a longer way to go when we think about rental fleet age and that may be a multiyear journey there.”

Elevated channel inventory was a theme across industries this past earnings season. Turf and Utility, which can be more tied to the general economy and housing, is one place where DE is monitoring channel inventory. In its other segments, though, DE noted that channel inventory remains below historic levels.

Valuation

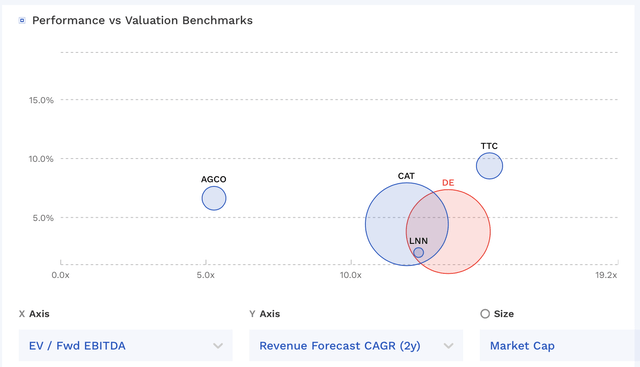

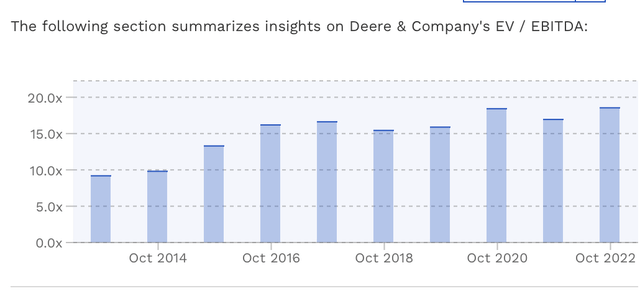

DE currently trades around 13.2x the FY2024 (ending October) consensus EBITDA of $12.85 billion and 13x the FY2025 consensus of $12.98 billion.

It trades at a forward PE of 12.8x the FY24 consensus of $31.57.

Revenue growth is expected to be around 3% a year over the next few years.

DE trades at one of the higher multiples in the machinery space, although a bit below its recent history, where it has often had a trailing multiple above 15x.

DE Valuation Vs Peers (FinBox)

DE Historical EV/EBITDA (FinBox)

Conclusion

DE is a great company that should continue to benefit from solid ag fundamentals, technological innovations, and an aging equipment fleet. If it were to stumble in the near term, it would likely be more from its Turf & Utility business, which can be a bit more economically sensitive, and where its channel inventory is not in as good of shape.

The stock trades at a pretty good multiple given its projected slow but steady revenue growth. It trades a bit below recent historical levels, but the risk free rate has also gone up a lot, so it should trade at a lower multiple now compared to when rates were much lower. As such, I think the company looks appropriately valued at current levels.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.