EMB: EM Bonds In A Sweet Spot Amid Fed Policy Reversal

Summary

- With monetary policy shifting into easing mode, the EMB looks set to benefit from lower UST yields and narrower credit spreads in the near term.

- Lower rate expectations have strengthened the case for USTs while also undermining the dollar and stabilizing risk appetite, which should have a double positive impact on EM dollar bonds.

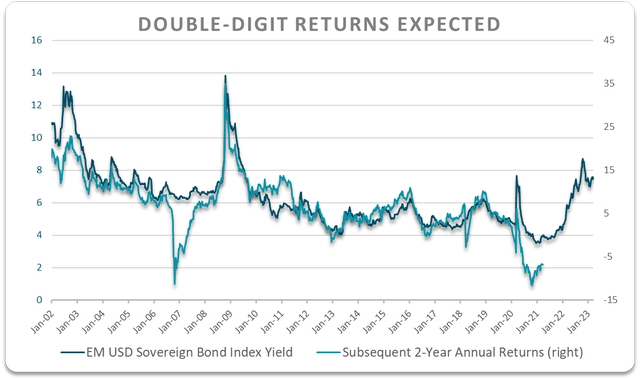

- If we look at historical returns on EM USD Sovereign bonds versus the prevailing yield on the index, the correlation suggests annual returns of 11% over the next 2 years.

aluxum

The iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) seeks to track the investment results of an index composed of US dollar-denominated emerging market bonds. The ETF offers an average yield to maturity of 7.4%, reflecting elevated UST yields and above average credit spreads. With monetary policy shifting into easing mode, the EMB looks set to benefit from lower UST yields and narrower credit spreads in the near term, which should allow the ETF to generate 20%+ returns over the next 2 years.

The EMB ETF

The iShares J.P. Morgan USD Emerging Markets Bond ETF seeks to track the investment results of an index composed of US dollar-denominated, emerging market government and government-backed bonds. EMB holds bonds of governments with more than USD1bn outstanding and at least two years remaining in maturity. The largest issuer in the ETF is Mexico, with a 5.9% weighting, followed by Saudi Arabia, Indonesia, and Turkey, which all have weighing of over 5%. In terms of credit quality, just over half of the issuers are investment grade, while the average maturity is 12.4 years. Despite the high maturity, duration is relatively low at 7.3 years, with most of the volatility in the ETF coming from credit risk. The EMB tends to move more closely in line with emerging market stocks than it does with US Treasuries as credit spreads are the dominant short-term driver of returns. The fund charges an expense fee of 0.39% which is relatively high for a bond fund but is still low compared to the current yield to maturity of 7.4%.

11% Annual Returns Likely

I last wrote about the EMB in early January, arguing that improving credit risk and lower bond yields would trigger a breakout in the index. Since then, while 10-year UST yields have moved slightly lower, EM credit spreads have widened, causing the EMB's average yield to maturity to rise. At the same time, breakeven inflation expectations have also fallen, and sit at just 2.1%. As a result, the expected real yield on offer on the EMB has risen to 5.3%.

This increase in the real yield has occurred despite an aggressive shift in Fed policy expectations. Over the past two weeks December Fed funds futures have fallen 140bps, with the Fed now expected to lower rates by the end of the year. Not only has this strengthened the case for US Treasuries, it also appears to have stabilized risk appetite in the near term, with interest rate sensitive sectors like Technology seeing a recovery in line with lower bond yields, and the dollar resuming its weakening trend. As Fed tightening has been a major driver of rising EM credit spreads over the past year, there is significant scope for narrowing as the Fed's policy reversal supports liquidity and eases default concerns.

If we look at historical returns on EM USD Sovereign bonds versus the prevailing yield on the index, the correlation over the past 20 years suggests current yields are consistent with annual returns of 11% over the next 2 years. The 2-year underperformance of the EMB relative to what would have been expected based on the yield reflects the fact that yields have risen sharply over this period, which suggest future returns could be even stronger as has been the case in the past.

Bloomberg, Author's Calculations

From a longer-term perspective, there is an even closer correlation between the yield on EM bonds and total subsequent returns as one would expect, with the current yield consistent with annual returns of around 7-8%. Interestingly, EM USD Sovereign bonds have actually lost money over the past 5 years for the first time on record going back 30 years. Previous periods of significant underperformance relative to return expectations have given way to periods of subsequent outperformance.

Bloomberg, Author's calculations

Global Recession A Risk, But EMB A Great Risk-Reward Play

The main risk is that Fed easing measures fail to stabilize liquidity and risk appetite and the ongoing trend of declining global economic activity accelerates. As we saw when the EMB lost 33% decline during the global financial crisis, rising credit spreads can cause significant losses in the ETF even when UST yields head lower. However, the risk-reward outlook for the EMB is increasingly compelling as real yields move higher and interest rate outlook moves lower. The 7.4% yield on the EMB is ample reward for the risk of a spike in credit spreads, particularly with 10-year inflation expectations just above 2%. I expect to see returns of over 20% over the next 2 years in the EMB as yields move lower in line with lower UST yields.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of EMB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.