How Big Can PDD Holdings' Temu Get?

Summary

- Shop like a billionaire - Temu's value proposition set it apart from other competitors and unlocks discretionary e-Commerce demand in the US.

- Temu's success is not only its e-Commerce profits but also its advertising revenue as an emerging Retail Media Network.

- Temu's success relies on continued efforts around 1) product quality, 2) supply chain management, and 3) analytics capability.

piranka

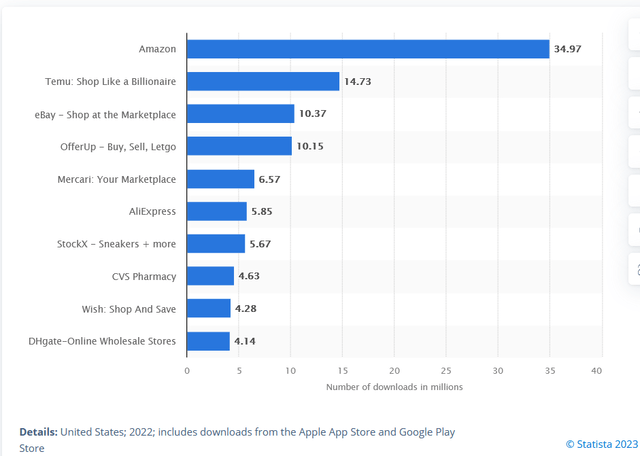

PDD Holdings (NASDAQ:PDD) is a global eCommerce player, founded in 2015, operating a Consumer-to-manufacturer (C2M), a.k.a. Direct-to-Customer (D2C) eCommerce platform Pinduoduo in China, and a cross-border eCommerce platform Temu in North America since 2022. Pinduoduo has over 750 million Monthly Active Users, and ~15% GMV share (roughly an equal share of JD.com). Temu aspires to offer the most affordable quality products to enable consumers and sellers to fulfill their dreams in an inclusive environment. Most of the US consumers got to know Temu from their Super Bowl Ad - "Download the TEMU app and shop like a billionaire." Since then, Temu has been one of the most downloaded apps in the US on App Store and Google Play.

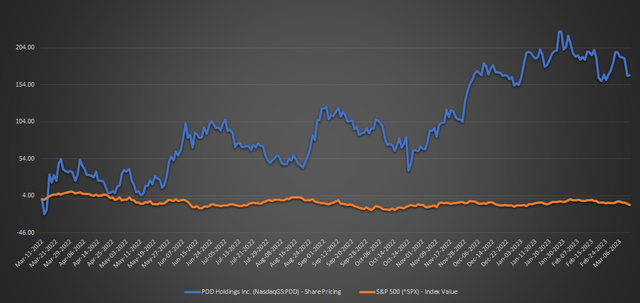

PDD is currently traded at $91.94 (up by 180% TTM, vs S&P 500 -8% TTM). Its share price growth is supported by its skyrocketing financial performance. As of Q3-22, Pinduoduo's Op Margin was nearly 30%, up from -9% in Q3-20, benefiting from its scale and advertising growth. PDD's 80% revenue came from advertising, and it generated $1.5B in Op Income in Q3-22.

Temu platform went live in Sep-22, representing a key milestone for PDD to serve the demand in North America. I think how big Temu can be is an important topic for PDD stock investors. In this article I would mainly talk about the opportunities and risks of Temu's future growth.

How Big Can Temu Be

In this section, I want to explain three points. First, the US e-Commerce market has massive untapped consumer discretionary demand, and Temu is well positioned to serve that market. Second, Temu's future success is not only about its e-Commerce commissions but also its rising Retail Media Network. Finally, I will cover the risks and opportunities about Temu.

The e-Commerce Competitive Landscape in the US

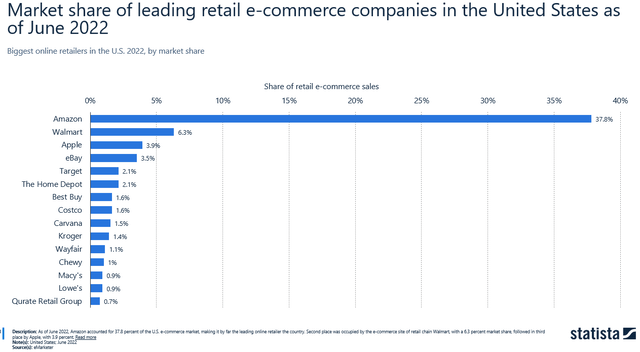

As a generation witnessing three-decade development of China's Internet and e-Commerce, Taobao was a life changer for our generation. I no longer needed to spend one day in the shopping mall and exhaustively carry merchandise home. Instead I was able to use fragmented time shopping on my cell phone every day, and more importantly I had access to a variety of products that I could not easily locate in brick-and-mortar stores, such as fresh lilies from North West China, customized Silk quilt from South China, and Tailored Couture, etc. e-Commerce accounted for ~90% of my discretionary spend because of its enormously wide selection and affordable prices. In contrast, the e-Commerce in the US has a much higher mix in Consumer Staples. Major platforms include domestic e-Commerce such as Amazon, eBay, and domestic retailers serving customers via e-Commerce channels such as Walmart, Costco, and Dollar Tree. Discretionary spend, to some extent, is discouraged or muted because of 1) higher price; 2) limited selection; 3) slow shipping, or a combination of all.

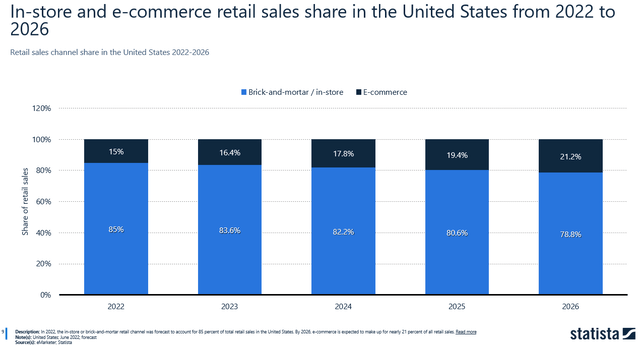

The e-Commerce penetration in the US is 15% in 2022, expected to reach 21% by 2026. For comparison, the e-Commerce share in China was 27% in 2022. Looking at the e-Commerce market shares of main plays in the US, and what each platform sells and what demand each serve, I think Temu's future growth is less about competing shares with current players, but more about unlocking new consumer discretionary demand and taking shares from brick-and-mortar spend or other recreational household budgets.

Temu's emerging growth in the US

PDD is determined to succeed in the US. Besides the Super Bowl ads, Temu's marketing budget in 2023 reportedly is over $7B depending on market conditions. Temu's traffic acquisition now is about 1) 30% from Instagram accounts; 2) 30% from Facebook accounts; 3) 20% Google accounts; and 4) the remainder from TikTok, YouTube, and other.

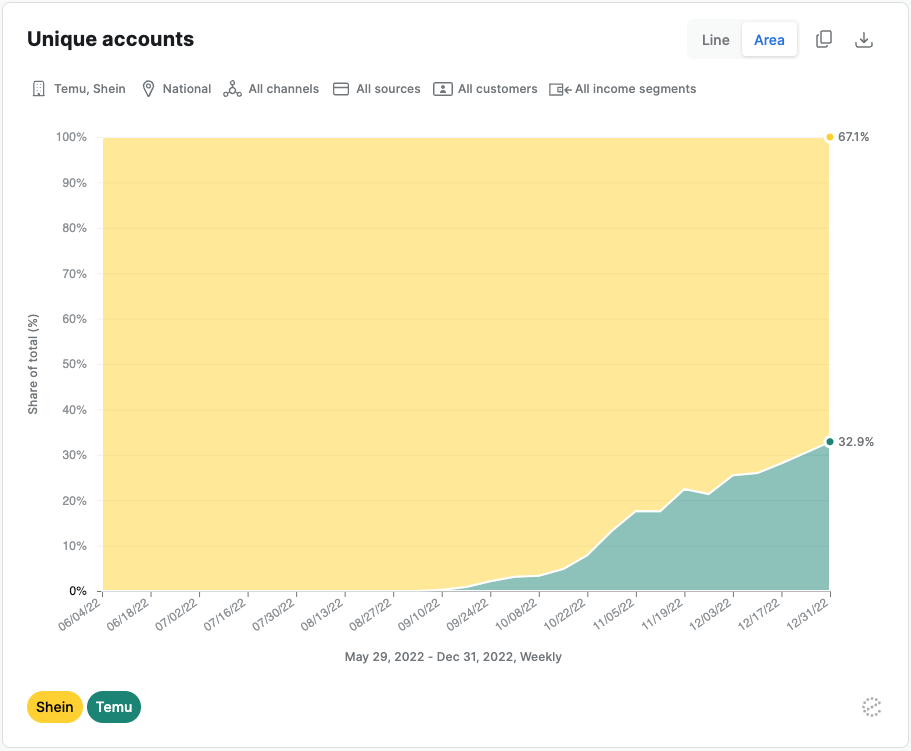

The following charts shows the growth of Temu relative to another cross-border e-Commerce platform Shein.

Earnest

The potentials we should look at are not just the e-Commerce profits but also the opportunity as Retail Media Network. For reference, Walmart has $4B advertising revenue (see my previous article Walmart Doubling Down in Retail Media Network). PDD has over 750 million MAU (over 50% of Chinese population), and 11 million MAU in US (below 5% of total US population). If we assume 20% MAU penetration, and $20 ARPU (Advertising Revenue per user per year), this represents ~$1B Advertising revenue opportunity.

Opportunities and Risks of Temu

Before talking about Temu's opportunities and risks, we should be clear about Temu's unique business model.

1.Temu is 100% 3P e-Commerce, as opposed to a mixed 1P/3P or 1P we typically see in other US based players.

2.Temu does not have a US warehouse, and all products are shipped from Guangzhou, China, with an expected delivery time of 8-15 business days.

3.Temu's sellers operate with a unique process from most of other 3P businesses. The key differentiation is that Temu and the seller negotiate the cost price of the product, and then Temu sets the selling price of the product. This means Temu locks its gross profit but it does not carry the inventory management risks (because Temu pays the supplier only when the product sells).

This business model means that Temu is leveraging an efficient and competitive market to pick the factories that offer best-priced quality products at scale. Being able to sell quality budget products with a broad selection will help drive Temu's flywheel. This is why I believe Temu can continue to grow rapidly. For reference, PDD had 140k merchants in China as of Apr. 2022, within the same tier as Taobao (>100k). I think PDD has proved this as a successful model.

In terms of risks for Temu, I would call out three things: Temu has tightened up its merchants policies regarding product quality, which is critical to ensure the flywheel runs in a robust way. For supply chain, the sellers have to commit to both low prices and sustainable volumes. Consumer trust may be ruined when orders are delayed or cancelled. Finally, Temu has to relentlessly analyze the performance of current SKUs and test Consumer elasticity in order to pricing optimally.

Lastly, although Temu is tapping into the under-served discretionary demand in e-Commerce, the competition from other cross-border plays is increasingly fierce.

Conclusion

Temu is the No.1 driver for PDD stock in 2023. Investors can closely follow Temu's developments especially in the following areas:

1) growth in GMV and Monthly Active Users

2) shopper sentiments around product quality and shipping services

3) strategic partnerships overseas that help with Temu's supply chain or traffic acquisition

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.