BKT: Interest Rate And Duration Risk Mar This Otherwise Safe Bond Fund

Summary

- Investors are desperate for income today, as it is needed simply to maintain our lifestyles in the face of the highest inflation in forty years.

- BlackRock Income Trust invests in a portfolio consisting mostly of mortgage securities issued by major government-sponsored entities.

- These securities are almost certainly free of default risk, but they will fall in value if the Federal Reserve continues to raise interest rates.

- The fund is failing to cover its distribution through capital gains and NII, so may be forced to slash the payout again.

- The BlackRock Income Trust closed-end fund is currently trading at a reasonably attractive valuation.

- Looking for more investing ideas like this one? Get them exclusively at Energy Profits in Dividends. Learn More »

arsenisspyros

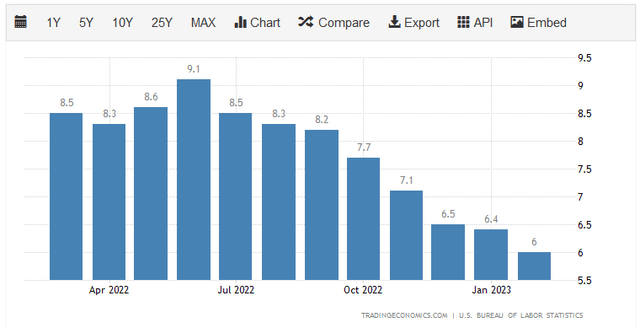

It is unlikely to come as news to anyone reading this that one of the biggest problems that have been facing many Americans today is the incredibly high rate of inflation that has permeated the economy. Over the past year, there has not been a single month in which the consumer price index was not at least a year higher than in the previous year:

This is the highest rate of inflation that we have seen in more than forty years, and it has resulted in real wage growth being negative for 23 straight months. As two of the areas that have been most affected by this inflation are food and energy, which are necessities. Thus, inflation has had a particularly devastating effect on people of limited means and has forced many of them to take on second jobs simply to keep their bills paid. I discussed this in a recent blog post.

Fortunately, as investors, we have other methods that we can use to generate the extra income that is needed to pay our bills and maintain our lifestyles in the current environment. After all, we are able to put our money to work for us so that we do not have to work ourselves. One of the best methods to do this is to purchase shares of a closed-end fund, or CEF, that specializes in the generation of income. These funds are not often discussed in the investment media, which is a shame because they provide a lot of potential benefits. In particular, these funds provide a very easy way to add a portfolio of assets to an investment account that can, in many cases, deliver a higher yield than just about anything else in the market.

In this article, we will discuss the BlackRock Income Trust (NYSE:BKT), which is one such fund that investors can use to earn income. As of the time of writing, the fund yields 8.31%, which is certainly a reasonable level that will appeal to anyone seeking income. It is also above the inflation rate, so this is one of the few things in the market that actually has a positive real yield. We have discussed this fund before, but as a few months have passed since that time several things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund's finances.

About The Fund

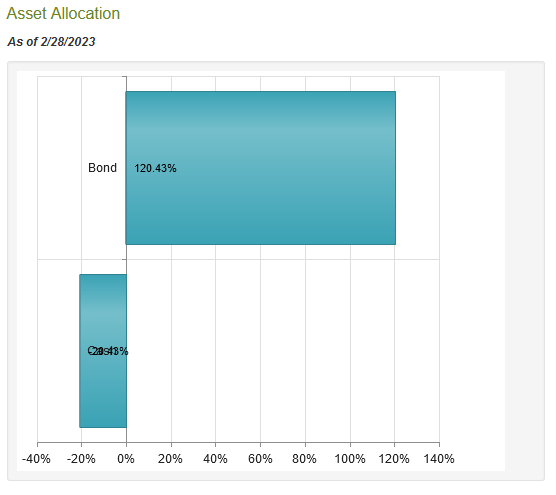

According to the fund's webpage, the BlackRock Income Trust has the objective of providing its investors with a high level of current income while preserving the value of its assets. This is a very common objective for fixed-income funds, and this one certainly qualifies as such. As we can see here, the fund is entirely invested in bonds:

CEF Connect

One of the defining characteristics of bonds is that they return the principal at maturity. Thus, an investor that holds a bond until maturity will not lose their money unless the issuer defaults. That is a fairly rare occurrence, so in general, bonds are a fairly good way to preserve capital. This thus achieves the fund's goal of preserving capital.

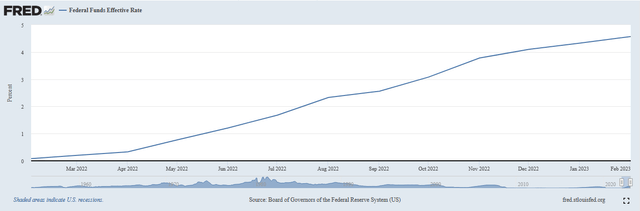

However, the price of bonds does vary from day to day just like other assets. Their price does not depend on the performance of the issuing company though since bonds have no inherent link to the growth and prosperity of their issuer. After all, a company does not pay its creditors a higher interest rate just because its profits have increased. Rather, bond prices vary based on interest rates. It is an inverse relationship, so when interest rates go up bond prices generally go down. As everyone reading this is no doubt well aware, the Federal Reserve has been aggressively raising rates in the United States over the past year in an effort to combat the incredibly high inflation rate in the economy. We can see this by looking at the federal funds rate, which has risen from 0.08% in February 2022 to 4.57% today:

Federal Reserve Bank of St. Louis

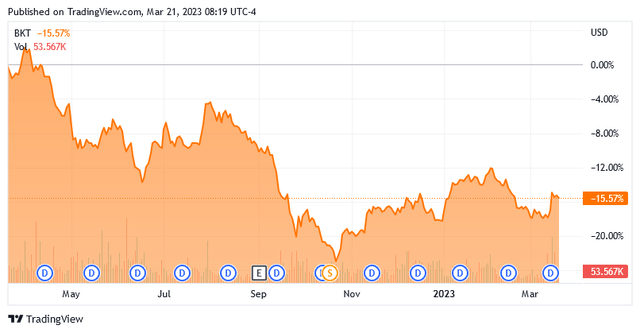

This has had a devastating effect on bond prices over the time period. Indeed, as of today, the Bloomberg U.S. Aggregate Bond Index (AGG) is down 7.17% over the trailing twelve-month period. The BlackRock Income Trust has certainly not been spared from this as it is down 15.57% over the same period:

Thus, the BlackRock Income Trust has underperformed the index over the period, although the fact that it has a higher yield helps to close the gap somewhat. One of the biggest reasons for the underperformance is that the BlackRock closed-end fund uses leverage, and the index does not, which we will discuss later in this article.

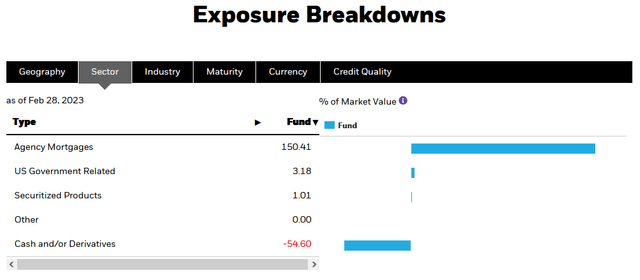

One thing that we frequently see closed-end bond funds do is purchasing high-yield bonds as a way to boost the yield of their portfolios. This fund does not do that, however. In fact, the portfolio of the BlackRock Income Trust consists almost entirely of government bonds and agency securities:

The agency mortgage component listed above refers to those mortgages that are issued by Fannie Mae and Freddie Mac, which are the two government-sponsored entities operating in the housing market. While they are not explicitly backed by the United States government, as we saw during the 2008 financial crisis, the Federal government will backstop these organizations and prevent defaults in an emergency situation. Thus, for all purposes that matter, these securities are free of default risk. This is one reason why government money market funds are allowed to include securities issued by these entities. This is something that may be comforting to those risk-averse investors that need income.

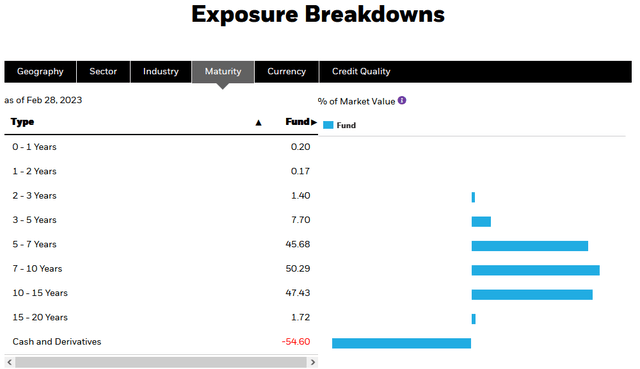

It is important to note though that it was supposedly "risk-free" U.S. Government bonds that comprised the toxic securities that resulted in the collapse of Silicon Valley Bank. This is because these securities are only free of default risk. As already mentioned, bonds decline in price when interest rates rise. This is because the interest rate paid by most bonds does not increase when rates in the broader economy go up. Thus, older bonds are paying a below-market rate in such an environment. Nobody will purchase such a bond when they could purchase an otherwise identical brand-new bond that pays a higher rate. Thus, the price of existing bonds needs to decline so that they will pay the same yield-to-maturity as an otherwise identical brand-new bond. Bonds whose maturity date is far into the future typically decline much more than bonds whose maturity date is in the near future. This comes from the fact that bonds pay out their face value at maturity so an investor in a long-term bond needs to wait much longer to get their money back than an investor in a near-term bond. Thus, it is a good idea to look at the maturity schedule of the bonds currently held by the BlackRock Income Trust as part of our effort to determine our risk. Here is a summary:

As we can clearly see, the BlackRock Income Trust primarily holds intermediate-term and long-term bonds. That is discouraging since these bonds will decline in price much more than short-term bonds should the Federal Reserve keep raising interest rates. At the moment, it is uncertain what the Federal Reserve will do as estimates are anywhere from a 0.25% cut to a 0.50% increase tomorrow. The central bank has previously said that a pivot is not likely to happen anytime soon, but that was before we started to see bank runs and failures. In short, though, we may see the bonds held by this fund decline in value a bit more going forward, which will likely exert negative pressure on the fund's share price. However, it is unlikely that we will see the Federal Reserve hike rates anywhere near as aggressively as it did over the past year, so the worst is probably behind us in this respect.

Leverage

As stated earlier in this article, closed-end funds like the BlackRock Income Trust have the ability to provide their investors with a higher yield than any of the underlying assets possesses. One method that is used by this fund to accomplish that is the use of leverage. In short, the fund borrows money and then uses that borrowed money to purchase bonds. As long as the borrowed money has a lower interest rate than the yield of the purchased securities, this strategy is pretty effective at boosting the overall yield of the portfolio. As this fund is capable of borrowing at institutional rates, which are considerably lower than retail rates, that will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. This could be one reason why this fund outperformed the aggregate bond index over the past year. As such, we want to ensure that the fund is not employing too much leverage, since that would expose us to too much risk. I do not normally like to see a fund's leverage exceed a third as a percentage of its assets for that reason. As of the time of writing, the BlackRock Income Trust has levered assets comprising 29.01% of its portfolio. As such, it appears to be fulfilling this requirement and striking an acceptable balance between risk and reward.

Distribution Analysis

As stated in the introduction, the BlackRock Income Trust has the stated objective of providing its investors with a high level of current income. In order to achieve this, the fund invests in a portfolio consisting primarily of agency mortgage securities. These are, admittedly, not the highest-yielding bonds available on the market, but the fund applies a layer of leverage in order to boost the effective yield. In addition to this, the fund can distribute any capital gains that it may be able to get via trading to its investors and thus boost the yield of the fund's shares.

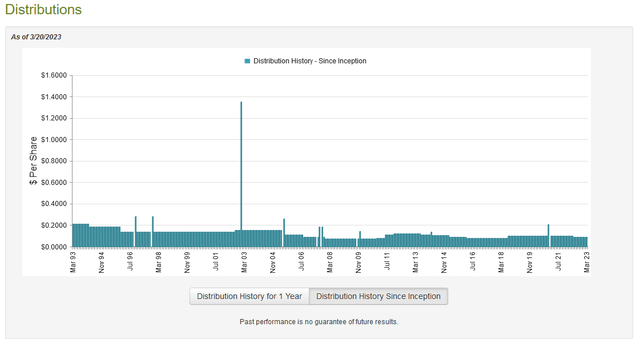

We can therefore assume that the fund will have a respectable yield. This is certainly true as the BlackRock Income Trust currently pays out a monthly distribution of $0.0882 per share ($1.0584 per share annually), which gives it an 8.31% yield at the current stock price. Unfortunately, this fund has not been particularly consistent in its distribution over the years. In fact, it has varied considerably over time:

The fact that the fund's distribution has varied so significantly over the years will likely prove to be something of a turn-off for those investors that are interested in a safe and secure source of income that they can use to pay their bills or finance their lifestyles. However, it is not surprising to see a bond fund's distribution vary like this with the passage of time. This is due to the fact that bond performance is heavily dictated by interest rates. When interest rates are high, bonds will generate a higher level of income than when interest rates are low. However, rising rates also reduce the value of the bonds in the fund's portfolio and force it to eat capital losses if it is to sell its current bonds to get those higher yields. It is better to see a fund cut its distribution rather than send out money that it cannot afford to distribute, despite the fact that some investors would prefer a stable distribution. However, the fund's past is not necessarily the most important thing for someone buying today. After all, anyone purchasing the fund today will receive the current distribution at the current yield and does not really have to worry about the fund's past record. Thus, the most important thing today is determining how well the fund can maintain its current payout.

Fortunately, we do have a very recent document that we can consult for our analysis. The fund's most recent financial report corresponds to the full-year period that ended on December 31, 2022. This is a much newer report than we had available the last time that we discussed the fund, which is nice since this one should give us a pretty good idea of how the fund navigated the challenging environment for bonds that dominated in 2022. During the full-year period, the BlackRock Income Trust received $130,377 in distributions along with $14,199,208 in interest, which gives it a total income of $14,329,585. The fund paid its expenses out of this amount, which left it with $9,190,557 available for investors. As might be guessed, this was not nearly enough to cover the $21,947,669 that the fund paid out in distributions over the year. This is something that could be concerning at first glance since we usually like to see a fixed-income fund generate sufficient net investment income to cover its distributions.

With that said, the fund does have other methods through which it can obtain the money that it needs to cover the distribution. As already mentioned, it might be able to earn sufficient capital gains to accomplish this. As we can guess from the turbulence in the bond markets caused by rising interest rates, the fund generally failed at this task over the year. The fund had net realized losses of $2,021,958 along with net unrealized losses of $67,003,293. Overall, its assets declined by $81,717,403 after accounting for all inflows and outflows during the year. This is concerning as the fund clearly cannot afford the distributions that it paid out. The fund did cut its distribution in June 2022 to attempt to compensate, but it appears that this may not have been enough. It would not be surprising if we see another distribution cut in the near future, especially if the Federal Reserve remains steadfast in its refusal to pivot.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Income Trust, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund's assets for less than they are actually worth. This is, fortunately, the case today. As of March 20, 2022 (the most recent date for which data is currently available), the BlackRock Income Trust had a net asset value of $13.44 per share but the shares currently trade for $12.64 per share. This gives the shares a 5.95% discount to net asset value at the current price. That is a bit better than the 3.91% discount that the shares have had on average over the past month, so the price seems to be reasonable today.

Conclusion

In conclusion, the BlackRock Income Trust appears to be a reasonable way for investors to earn a high yield today. The portfolio is largely free of default risk as it consists mostly of things that will almost certainly be backed by the United States government in a worst-case scenario. However, the Federal Reserve's current interest-rate hiking campaign will likely continue to push down the price of the fund's securities, particularly since it is mostly invested in things with fairly high durations. The fund may also be forced to cut its distribution again in the near future since it appears that it is not earning nearly enough to maintain the current payout. Investors could certainly do worse than The BlackRock Income Trust closed-end fund, though.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.