ETB: Better Call-Writing Funds Elsewhere

Summary

- The ETB fund provides high current income by writing calls against a diversified portfolio of stocks.

- Call-writing funds trade off upside for premiums, which could lower long-term returns.

- Comparing ETB against peers, it has underperformed while charging higher fees. I would recommend investors look elsewhere.

MicroStockHub/iStock via Getty Images

The Eaton Vance Tax-Managed Buy-Write Income Fund (NYSE:ETB) offers high current income by writing call options against a diversified portfolio of stocks. Call-writing strategies generally trade off upside for premium income, which lowers long-term total returns. The ETB fund has historically underperformed peer funds that use call-writing strategies while charging higher fees. I recommend investors consider those funds instead of the ETB.

Fund Overview

The Eaton Vance Tax-Managed Buy-Write Income Fund ("ETB") is a closed-end fund ("CEF") designed to offer high current income from a diversified portfolio of stocks and selling S&P 500 Index call options to generate income.

Due to federal income tax considerations, the ETB fund does not replicate the holdings in the S&P 500 Index. Instead, the ETB fund limits overlap with the S&P 500 Index to 70% and supplements exposure from mid-cap stocks and international stocks.

The ETB fund aims to continuously write call options on substantially the full value of its portfolio, with a goal of above 80% option exposure under normal market conditions. The fund aims to sell call options that are 'slightly' out-of-the-money ("OTM"), to balance capital gains of the underlying stock portfolio and income from selling options.

The ETB fund has a sizeable $388 million in net assets and charges a 1.12% total expense ratio.

Portfolio Holdings

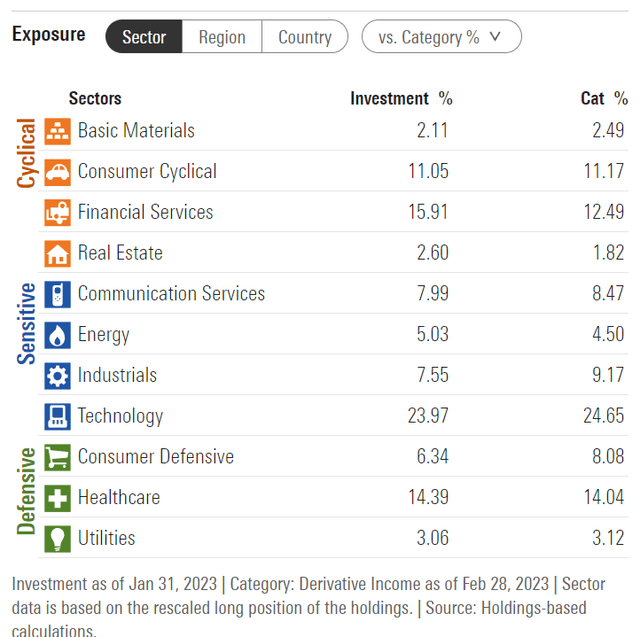

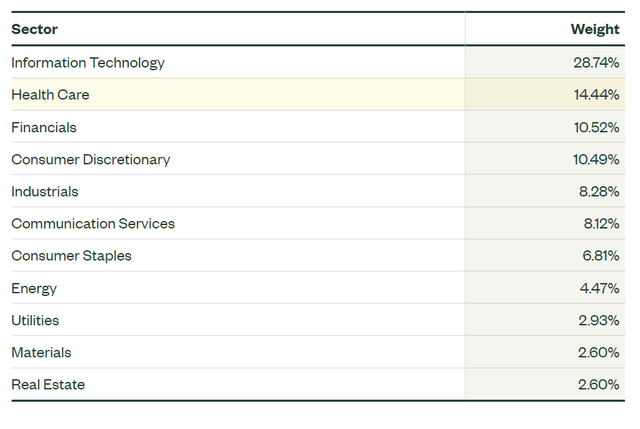

Figure 1 shows the sector allocation of the ETB fund. Overall, the fund's sector allocation is similar to that of the S&P 500 Index, as represented by the SPDR S&P 500 Trust ETF's (SPY) allocation (Figure 2). The main difference between the two is an overweight in Financials (15.9% for ETB vs. 10.5% for SPY) and an underweight in Information Technology (24.0% vs. 28.7%).

Figure 1 - ETB sector allocation (morningstar.com)

Figure 2 - SPY sector allocation (ssga.com)

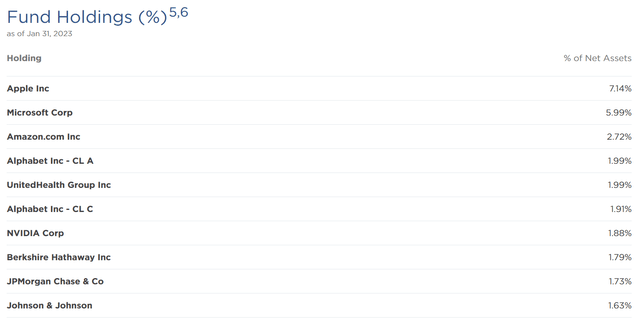

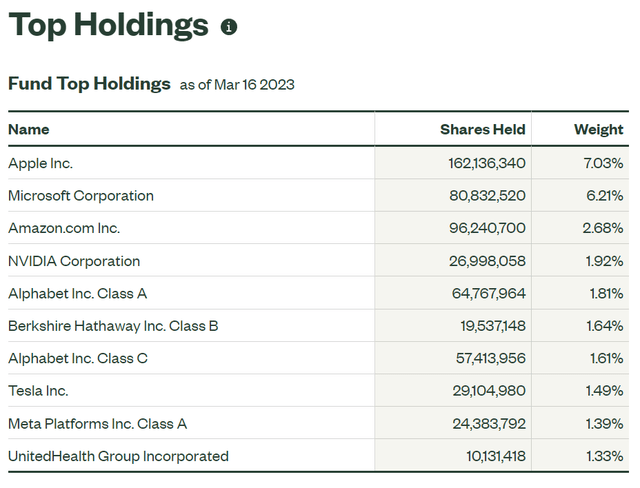

Figure 3 shows the top 10 positions of the ETB fund, which has a significant overlap with the top holdings of the SPY (Figure 4).

Figure 3 - ETB top 10 holdings (eatonvance.com) Figure 4 - SPY top 10 holdings (ssga.com)

Distribution & Yield

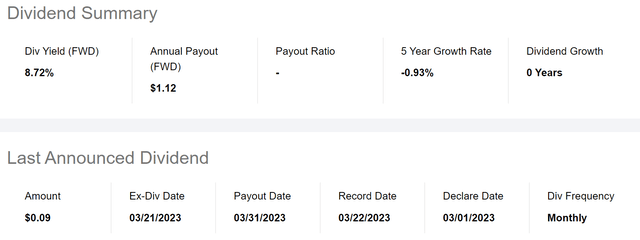

ETB's call selling strategy allows the fund to pay an attractive managed distribution, currently set at a monthly $0.0932/share or a forward yield of 8.7% (Figure 5). On NAV, the ETB fund is yielding 8.4%.

Figure 5 - ETB distribution (Seeking Alpha)

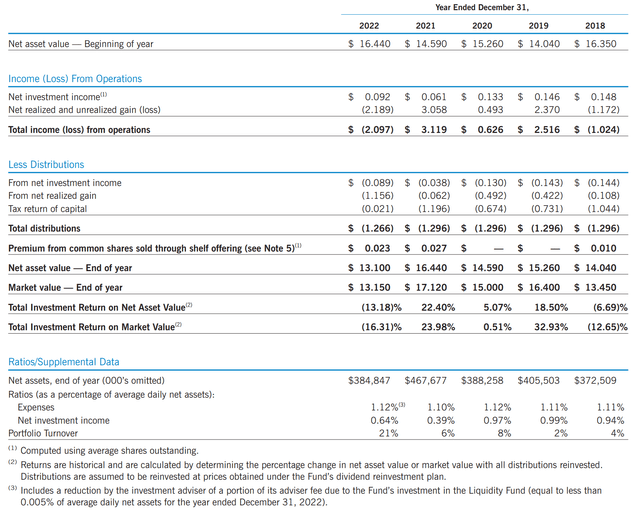

Investors should note a significant portion of historical distributions have been funded by return of capital ("ROC"), including 92% of 2021's distribution (Figure 6). Normally, I get concerned when I see high usage of ROC, however, ROC for the ETB fund could also be high because of the 'tax advantage' of ROC distributions, which reduces an investor's cost basis and is not taxed upfront.

Figure 6 - ETB has historically used significant amounts of ROC to fund distributions (ETB 2022 annual report)

Returns

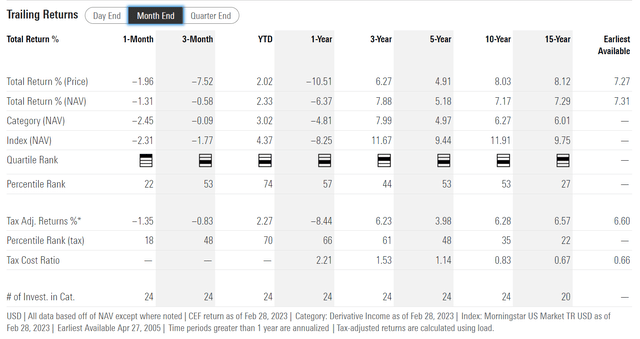

Figure 7 shows ETB's historical returns. Overall, the ETB fund has generated solid historical average annual returns of 7.9%/5.2%/7.2%/7.3% on a 3/5/10/15Yr time horizon to February 28, 2023. This roughly covers its distribution yield, if not much else.

Figure 7 - ETB historical returns (morningstar.com)

Trading Upside For Premium

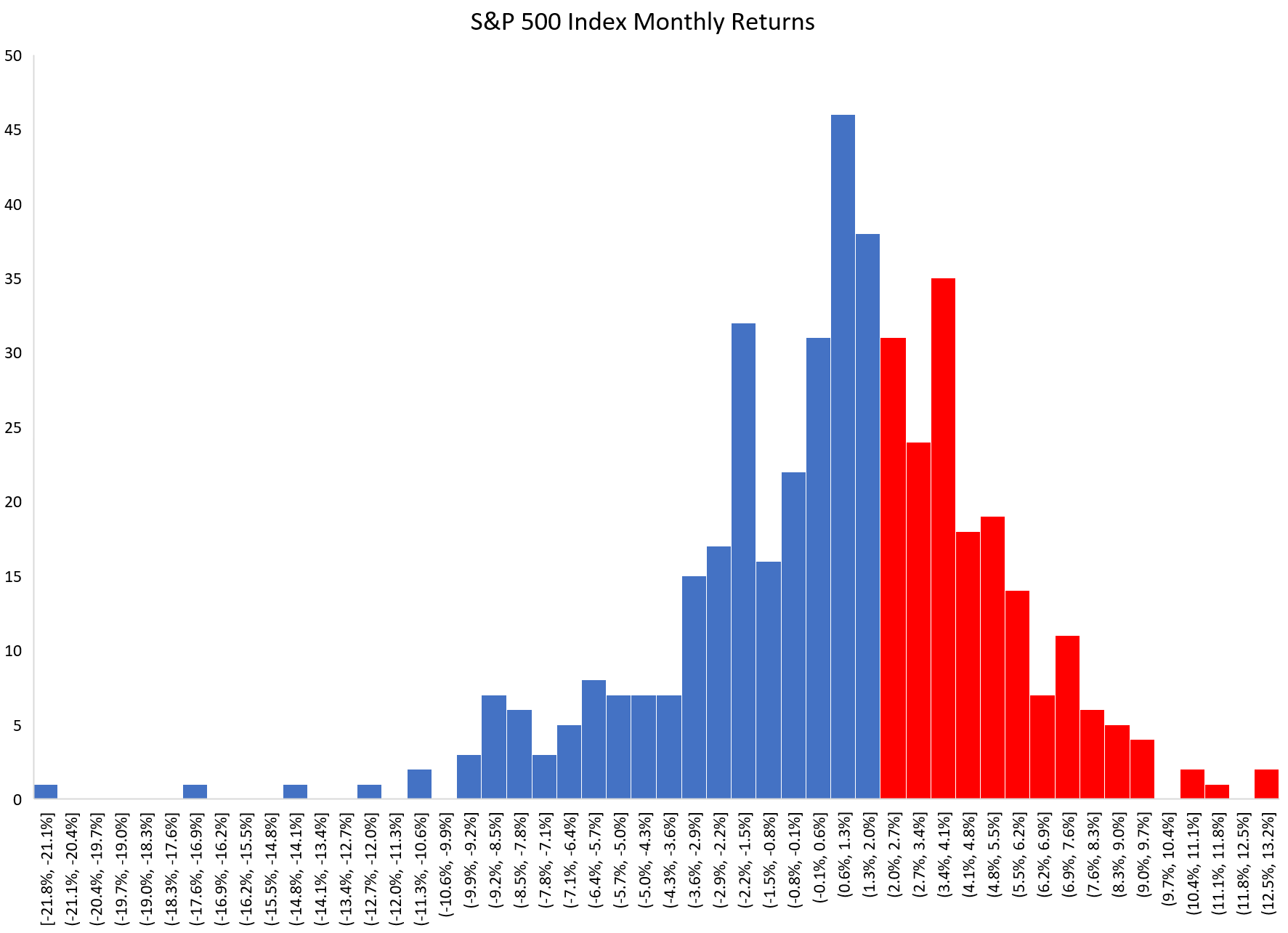

In general, I have a negative view of call-writing strategies as they tend to trade away upside returns in exchange for premium income. For example, assuming the ETB fund sells 2% monthly OTM calls on the S&P 500 Index, then 39% of the time, the fund would have underperformed, as the options would expire in-the-money ("ITM"), requiring cash payment from ETB to settle (Figure 8).

Figure 8 - 39% of monthly returns on S&P 500 have been greater than 2% (Author created with data from Yahoo Finance)

On the other hand, selling calls does not improve downside capture, since call premiums received are usually small compared to negative monthly returns during crashes.

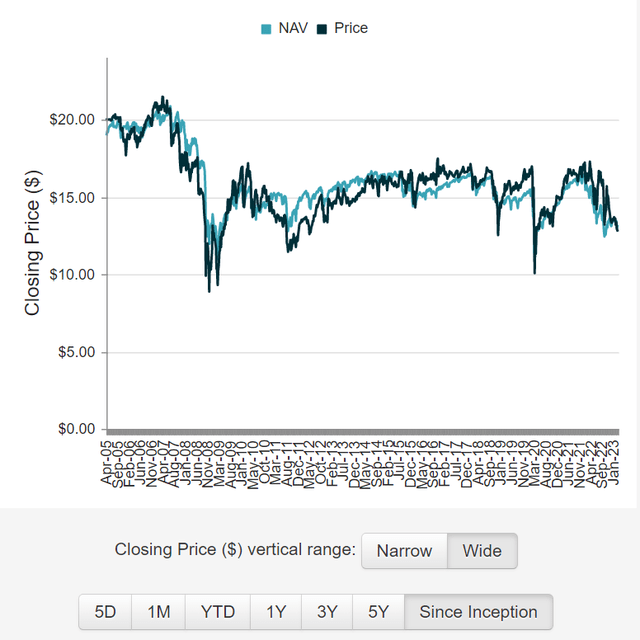

Therefore, investors are left with the NAV profile in figure 9: capped upside and periodic crashes during market panics.

Figure 9 - ETB's NAV profile shows capped upside with periodic crashes (cefconnect.com)

There May Be Better Alternatives To ETB

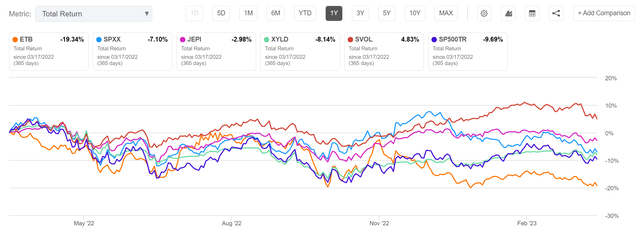

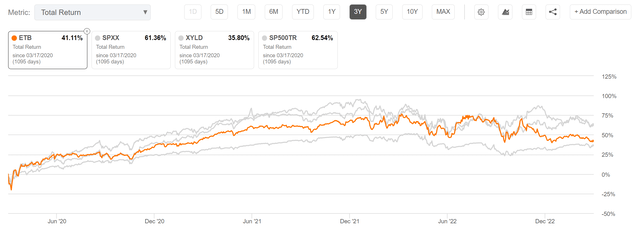

Another problem with the ETB fund specifically is that it appears to significantly underperform other call writing strategies. For example, Figure 10 and 11 compares the 1Yr and 3Yr total returns of the ETB fund vs. call writing peers like the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), the JPMorgan Equity Premium Income Fund (JEPI), the Global X S&P 500 Covered Call ETF (XYLD), and the Simplify Volatility Premium ETF (SVOL).

Figure 10 - 1Yr comparison between ETB, SPXX, JEPI, XYLD, SVOL (Seeking Alpha) Figure 11 - 3Yr comparison between ETB, SPXX, XYLD (Seeking Alpha)

On a 1Yr basis, the ETB fund lags behind all of its peers, as well as the S&P 500 Total Return Index. On a 3Yr basis, the ETB fund significantly lags behind the SPXX fund (note JEPI and SVOL do not have 3Yr operating history) and the S&P 500 Total Return Index.

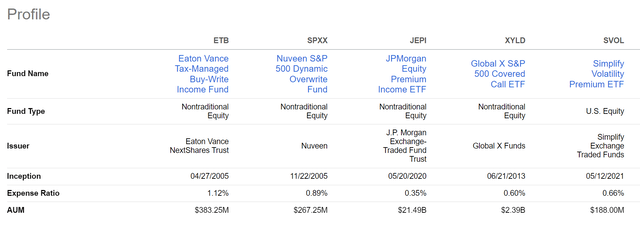

Meanwhile, the ETB fund is the most expensive out of the peers (Figure 12).

Figure 12 - ETB charges the highest expense (Seeking Alpha)

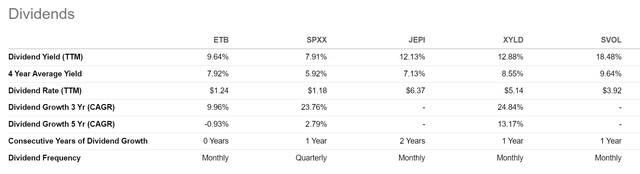

Furthermore, it also does not have the highest distribution yield (Figure 13; note ETB's distribution was cut in the past few months, so the forward yield is lower than the trailing yield).

Figure 13 - ETB does not have the highest yield (Seeking Alpha)

So even if investors were interested in a call-writing strategy, I believe there are better alternatives in the marketplace than ETB.

In particular, I would recommend investors consider the Simplify Volatility Premium ETF, which shorts a moderate amount of VIX futures to generate income instead of selling upside calls. In my opinion, the SVOL ETF does not have the upside tradeoff that call-writing strategies suffer from. For readers interested in the SVOL, I wrote in-depth articles here and here.

Conclusion

The Eaton Vance Tax-Managed Buy-Write Income Fund offers high current income by writing call options against a diversified portfolio of stocks. Call-writing strategies trade off upside for premium income, which lowers total returns in the long run. The ETB fund has historically underperformed peer call-writing funds like SPXX, JEPI, and XYLD, which suggests poor stock selection and/or option strike/maturity selection. I recommend investors look at peer funds instead of the ETB.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SVOL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.