Just Eat Takeaway: Grubhub Divestment A Negative Event

Summary

- The sales growth outlook for Just Eat Takeaway is subdued, with consensus forecasting single-digit growth.

- We believe the highly probable divestment of Grubhub will highlight underlying weakness in the balance sheet and result in negative sales growth.

- Grubhub is temporarily deflating valuation multiple, but its exit will make the shares more expensive on PBR and EV/Sales. We reiterate our sell rating.

alvarobueno/iStock Editorial via Getty Images

Investment thesis

We reiterate our sell rating on Just Eat Takeaway (OTCPK:JTKWY) (OTCPK:TKAYF), given the company's slowing growth profile, cash burn, and weak balance sheet. We believe the divestment of Grubhub will be a negative event, resulting in major goodwill impairment that will erode equity, and place the company with an unattractive negative sales growth profile.

Quick primer

Just Eat Takeaway is an online food order and delivery service headquartered in Amsterdam, operating in 22 countries and serving 94 million customers. The company stems from a merger between Takeaway and Just Eat in January 2020, and the USD7.3 billion acquisition of Grubhub in June 2021. The core geographic markets are North America, Northern Europe, and UK and Ireland.

Key peers include Delivery Hero (OTCPK:DLVHF), Deliveroo (OTCPK:DROOF), DoorDash (DASH), and Uber Eats (UBER).

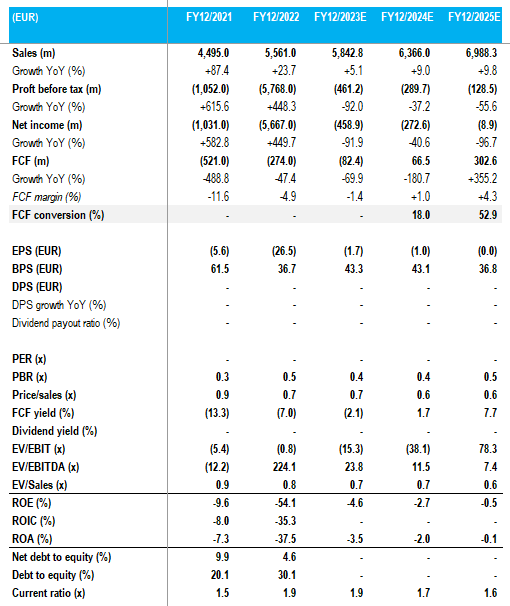

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv (Note: FCF excludes capex on intangible assets))

Our objectives

Post FY12/2022 results, we revisit our sell rating from November 2022 and highlight any opportunities and risks for investors for the short to medium term.

A subdued outlook for growth

What is notable in consensus forecasts (see key financials above) is the expectation of a sudden deceleration in sales growth in FY12/2023 and onwards. With the need to continually increase its scale of operations to boost any chance of delivering profitability, the outlook for the company is not positive. Bearing in mind that sales growth in FY12/2022 was driven primarily by the 12-month impact of the Grubhub acquisition, it is negative to see that the North American market experienced only 3% revenue growth, with gross transaction volume falling 9% YoY under constant currency (page 27). In effect, the largest geographic market experienced negative underlying growth, pointing to either a loss in market share or a market still in normalization mode post-pandemic. Whichever it may be, the company delivered underperformance.

Management talks to investors chiefly based on "adjusted" earnings, but we care about actual value being generated for shareholders, chiefly free cash flow. The company disclosure points to a cash burn of EUR526 million in FY12/2022 (page 22); we calculate a simpler one from the cash flow statement (page 21) of EUR455 million - either way, the company continues to destroy value and expectations are that cash burn will continue into FY12/2023.

Whilst the pandemic sped up people's shift towards online food deliveries, the fact remains that nobody is making any money from this model currently, and it remains a tough business to be in. M&A looks to be off-limits given the unattractive state of the balance sheet, and if Grubhub is divested sales growth will actually become negative, making the case for any growth premium to valuations a moot point.

Balance sheet risks abound

Management state that the company is well capitalized to meet all its future debt obligations (page 24). This may be the case, but this does not detract from the fact that their balance sheet looks very weak (page 19).

Whilst shareholders' equity is said to be EUR7.89 billion in FY12/2022, the largest assets held by the business are other intangible assets worth EUR5.22 billion, and goodwill worth EUR3.93 billion. These are not exactly providing an investor with tangible assets and a margin of safety.

As management continues to look for whole or partial disposal of Grubhub (page 2 under 'Outlook'), there is evidence to suggest that this could be a negative risk event. A rough estimate sale price based on an EV/sales multiple of 0.7x on historic sales (USD2.1 billion in FY12/2021) results in a EUR1.5 billion valuation. This will be followed by impairing the remaining goodwill EUR3.5 billion, which will cut equity by over 40%. As mentioned previously, negative topline growth will be an unwelcome optic. Whilst there will be a 'cash in' from the sale, the likelihood is that cash burn will increase as operating cash flows weakens.

Intangible assets are normally software that is capitalized, as well as licenses, and trademarks (which are usually acquired, not self-generated) - we do not view the company as a leading-edge technology business, hence we do not understand why the company has EUR5.22 billion worth of software on its books. We believe this asset is also at risk of impairment, which would erode equity further.

Valuation

On consensus estimates, the shares are trading on PBR 0.4x and EV/sales 0.7x. We believe the PBR multiple is higher than illustrated given the impairment risk, and the EV/sales multiple is artificially low given management's focus to divest Grubhub.

Risks

Upside risk comes from the market already being aware of the potential impairments and the Grubhub divestment and has priced in the negative impact on equity and sales growth profile.

The divestment of Grubhub will provide the company with cash, making it more liquid. The cash could be utilized for shareholder returns, or to pay back debt early.

Downside risk comes from continuing sales growth deceleration as the cost-of-living crisis pushes down demand for meal deliveries. There is also substitution risk from other delivery services such as meal kits and 'instant' grocery deliveries.

There is the risk of material erosion of equity with the divestment of Grubhub at a low price, together with writedowns for its large intangible assets.

Conclusion

Some progress is being made to turn around the company, but we believe there is little upside risk to the shares. With a slowing growth profile, cash burn, and a weak balance sheet, we reiterate our sell rating. We are not surprised that the company has voluntarily delisted its ADRs - it is expensive, but low trading volumes due to lack of investor interest speak volumes about its outlook.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.