Performant Financial Faces Multiple Near-Term Headwinds - Sell

Summary

- Last week, the company reported mixed fourth quarter and full-year 2022 results with core Healthcare revenues slightly above expectations and profitability coming in below management's original guidance.

- Due to a number of near-term headwinds, core Healthcare revenue growth is expected to decrease from 2022 levels while profitability will continue to be impacted by required growth investments.

- Ongoing lack of profitability required the company to proactively amend its credit agreement with MUFG. In exchange for some limited covenant relief, available liquidity has been substantially reduced.

- Assuming execution in line with management's projections, liquidity should remain sufficient over the course of the year, but the company won't be able to afford any major hick-ups, particularly with the implementation of the long-contested CMS RAC Region 2 contract now close at hand.

- Considering near-term execution risks, renewed growth headwinds, ongoing profitability issues, and substantially reduced liquidity, risk/reward has become increasingly unfavorable for investors. Given these issues, I am downgrading Performant Financial's shares to "Sell" from "Hold".

courtneyk

Note:

I have covered Performant Financial Corporation (NASDAQ:PFMT) previously, so investors should view this as an update to my earlier articles on the company.

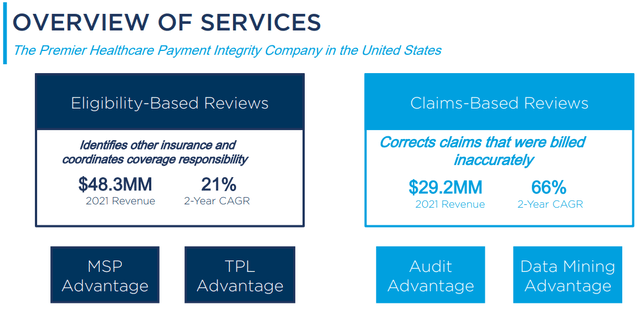

Two years ago, I praised Performant Financial Corporation ("Performant Financial") for its decision to abandon its legacy student loan recovery business and focus on the rapidly growing healthcare segment:

Unfortunately, the performance of the new core business has also been impacted by the pandemic, as hospital utilization rates have remained below pre-COVID levels well into 2022.

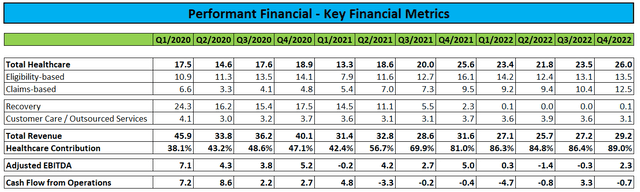

Last week, the company reported mixed fourth quarter and full-year 2022 results with core Healthcare revenues of $94.7 million slightly exceeding the $90 million to $94 million range provided by management at the beginning of the year. On the flip side, Adjusted EBITDA was just slightly positive on an annual basis, below the original guidance range of between $2 million and $4 million:

Company Press Releases and SEC-Filings

For 2023, management expects core Healthcare revenues to increase between 11% and 16% on a year-over-year basis which would be down substantially from the 22% growth rate achieved in 2022.

In addition, profitability continues to be impacted by the company's growth investments (emphasis added by author):

Looking ahead to 2023, we are excited to keep building upon the momentum of our historical and current pipeline of implementations, whilst investing into speed to revenue and margin expansion opportunities. We are introducing full year 2023 healthcare revenue guidance to be in the range of $105M to $110M.

In terms of EBITDA, we anticipate full year 2023 EBITDA in the range of $2 - $5 million, which is inclusive of $10M to $14M of expected investment spend, consistent with our investment in growth initiatives and improving our operational efficiencies.

On the conference call, management pointed to some delays in implementing and expanding contracted programs as well as the transition to a new CMS MSP contract as near-term headwinds for revenue growth.

The lack of improvement in Adjusted EBITDA actually required Performant Financial to proactively amend its credit agreement with MUFG which was originally scheduled to mature on December 17, 2026 as stated in the company's annual report on form 10-K (emphasis added by author):

On December 17, 2021, we entered into the Credit Agreement with MUFG Union Bank, N.A. The Credit Agreement originally included a $20 million term loan commitment, which was fully advanced at closing and a $15 million revolving loan commitment, which was undrawn as of December 31, 2022. (...)

On March 13, 2023, we entered into a First Amendment to the Credit Agreement to amend the Credit Agreement, to among other things, terminate the revolving loan commitment in full and to establish a new maturity date for the term loan of December 31, 2024. As a result of the First Amendment to the Credit Agreement, we do not have any further borrowing capacity under the Credit Agreement.

As of December 31, 2022, $19.5 million was outstanding under the Credit Agreement. The Company’s annual interest rate at December 31, 2022 was 7.5%. In connection with the First Amendment described above, we voluntarily prepaid $7.5 million of the outstanding principal of the term loan, which reduced our outstanding cash and cash equivalents.

In exchange for the $7.5 million prepayment, termination of the revolving loan commitment, higher applicable margins and advancing the maturity date by two years, MUFG agreed to modify certain covenants to provide the company additional time to improve profitability and move closer to management's targeted Adjusted EBITDA margin of 20%+.

As a result, available liquidity will be down substantially in the company's upcoming Q1/2023 report.

Assuming no material cash burn, Performant Financial's cash and cash equivalents would be reduced to approximately $16.0 million while remaining debt under the term loan facility amounts to $12.0 million. Taking into account the term loan's $2.0 million minimum liquidity requirement, available liquidity at the end of Q1 would be down to $14.0 million.

Judging by the company's Adjusted EBITDA guidance for 2023, liquidity should remain sufficient over the course of the year but the company won't be able to afford any major hick-ups, particularly with the implementation of the long-contested CMS RAC Region 2 contract now close at hand.

Adding insult to injury, Performant Financial will already be required to refinance the term loan at some point next year rather than in 2026 as originally stipulated.

Bottom Line

Considering near-term execution risks, renewed growth headwinds, ongoing profitability issues and substantially reduced liquidity, risk/reward has become increasingly unfavorable for investors.

Given these issues, I am downgrading Performant Financial's shares to "Sell" from "Hold".

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.