Weekly Closed-End Fund Roundup: March 12, 2023

Summary

- Three out of 22 CEF sectors positive on price and 5 out of 22 sectors positive on NAV last week.

- Delaware/Abrdn mergers are closed.

- New: adding tables of highest yielding, cheapest and most expensive funds from our screener to the Weekly Roundup.

- Looking for a helping hand in the market? Members of CEF/ETF Income Laboratory get exclusive ideas and guidance to navigate any climate. Learn More »

cemagraphics

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 15, 2023. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers, rights offerings, or mergers. Data is taken from the close of Friday, March 10th, 2023.

Weekly performance roundup

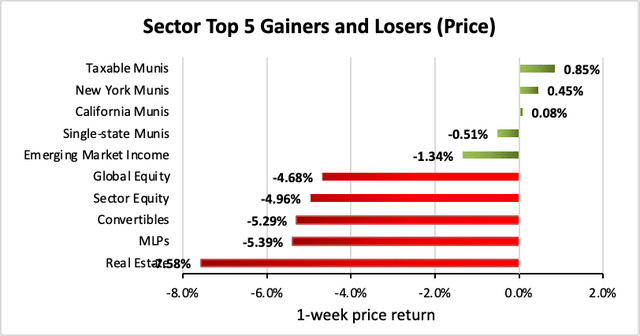

For CEFs, 3 out of 22 sectors were positive on price (down from 19 last week) and the average price return was -3.21% (down from +1.01% last week). The lead gainer was Taxable Munis (+0.85%), while Real Estates lagged (-7.58%).

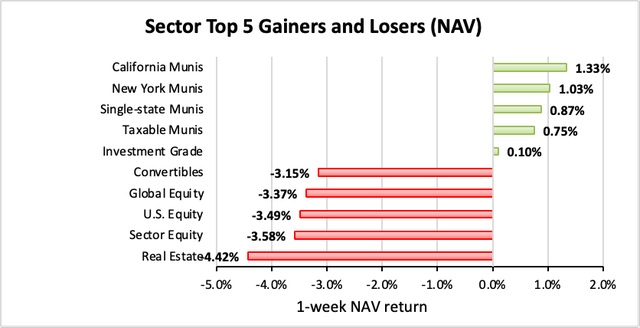

5 out of 22 sectors were positive on NAV (down from 12 last week), while the average NAV return was -1.49% (down from +0.25% last week). The top sector by NAV was California Munis (+1.33%) while the weakest sector by NAV was Real Estate (-4.42%).

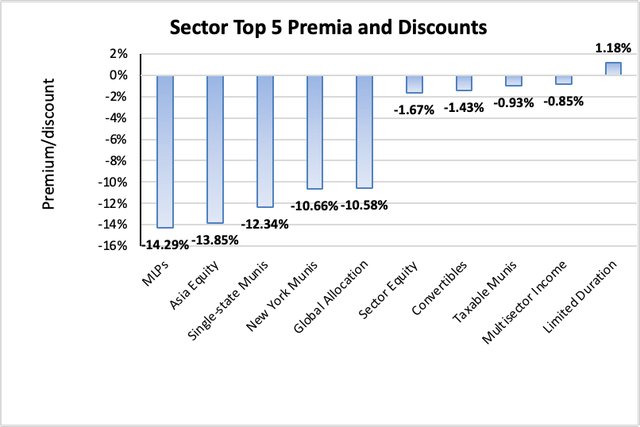

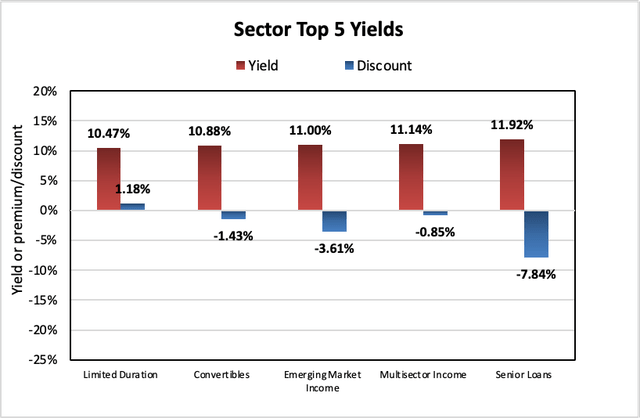

The sector with the highest premium was Limited Duration (+1.18%), while the sector with the widest discount is MLPs (-14.29%). The average sector discount is -6.44% (down from -5.84% last week).

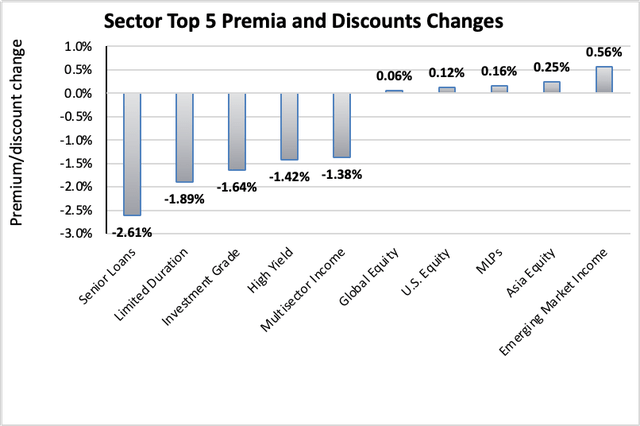

The sector with the highest premium/discount increase was Emerging Market Income (+0.56%), while Senior Loans (-2.61%) showed the lowest premium/discount decline. The average change in premium/discount was -0.59% (down from +0.19% last week).

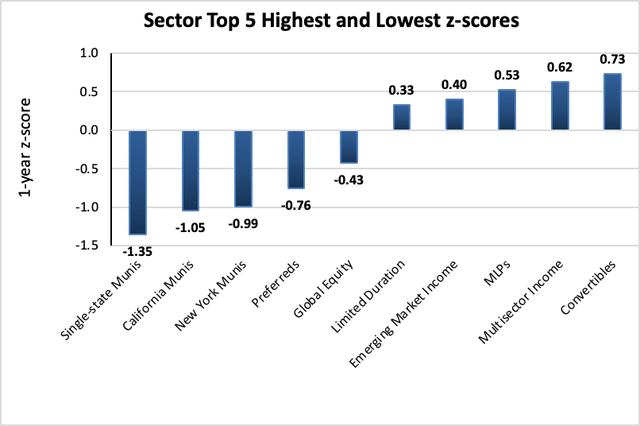

The sector with the highest average 1-year z-score is Convertibles (+0.73), while the sector with the lowest average 1-year z-score is Single-state Munis (-1.35). The average z-score is -0.22 (down from +0.03 last week).

The sectors with the highest yields are Senior Loans (+11.92%), Multisector Income (+11.14%), and Emerging Market Income (+11.00%). Discounts are included for comparison. The average sector yield is +8.29% (up from +7.97% last week).

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| Oxford Lane Capital Corp | (OXLC) | -18.31% | 17.31% | 7.36% | -0.3 | -10.65% | -2.46% |

| Herzfeld Caribbean Basin | (CUBA) | -9.62% | 18.37% | -18.91% | -1.0 | -6.90% | 2.44% |

| PIMCO Municipal Income | (PMF) | -7.07% | 5.28% | -0.62% | -2.0 | -4.98% | 0.87% |

| abrdn Australia Equity Fund Inc | (IAF) | -6.75% | 12.24% | -10.53% | -1.1 | -12.01% | -0.45% |

| CBRE Global Real Estate Income | (IGR) | -6.64% | 12.83% | -9.46% | -2.1 | -14.61% | -0.94% |

| Virtus Convertible & Income Fund | (NCV) | -6.10% | 15.36% | -9.64% | -0.5 | -13.09% | 0.00% |

| XAI Octagon FR & Alt Income Term Trust | (XFLT) | -6.05% | 13.46% | -1.36% | -1.2 | -5.92% | -1.88% |

| BlackRock Science & Technology Trust II | (BSTZ) | -5.00% | 11.57% | -16.81% | -1.0 | -6.85% | -1.28% |

| Eagle Point Income Co Inc | (EIC) | -4.79% | 13.49% | 7.74% | -0.2 | -6.32% | -0.36% |

| Eaton Vance National Municipal Opprs Tr | (EOT) | -4.75% | 4.46% | -5.33% | -0.7 | -5.45% | 1.49% |

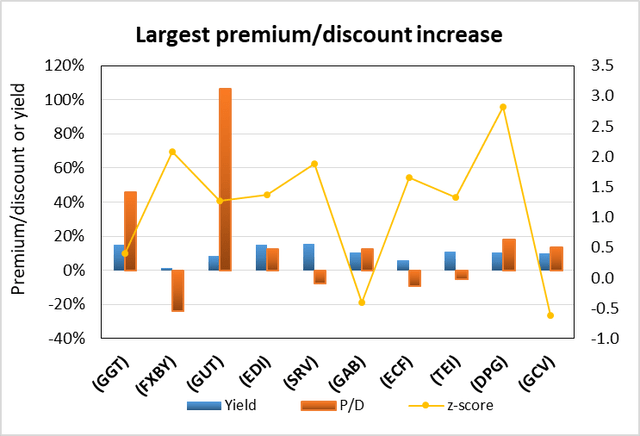

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| Gabelli Multi-Media | (GGT) | 9.93% | 14.86% | 45.81% | 0.4 | -1.66% | -1.69% |

| Foxby Corp. | (OTCPK:FXBY) | 9.06% | 1.31% | -23.93% | 2.1 | 5.36% | -3.84% |

| Gabelli Utility Trust | (GUT) | 7.81% | 8.60% | 106.51% | 1.3 | 0.36% | -1.77% |

| Virtus Stone Harbor Emg Mkts Total Inc | (EDI) | 4.88% | 15.16% | 12.43% | 1.4 | -0.18% | -1.04% |

| Cushing® MLP & Infras Total Return | (SRV) | 4.74% | 15.63% | -7.96% | 1.9 | -1.29% | -3.81% |

| Gabelli Equity | (GAB) | 3.17% | 10.45% | 12.55% | -0.4 | -3.37% | -1.26% |

| Ellsworth Growth and Income Fund | (ECF) | 2.92% | 6.06% | -9.49% | 1.7 | -1.27% | 0.00% |

| Templeton Emerg Mkts Income | (TEI) | 2.83% | 10.81% | -4.98% | 1.3 | 2.88% | -0.27% |

| Duff & Phelps Utility and Infra Fund Inc | (DPG) | 2.56% | 10.29% | 17.88% | 2.8 | -2.30% | -0.92% |

| Gabelli Conv Inc Secs | (GCV) | 2.50% | 9.84% | 13.49% | -0.6 | -1.41% | -1.02% |

New!

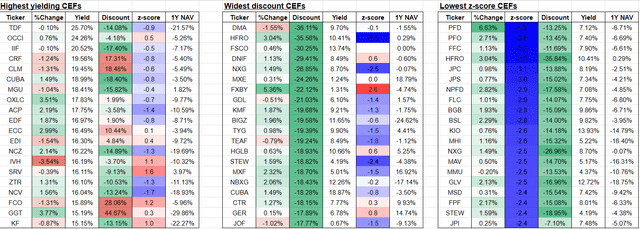

From our screener, here are the CEFs with the highest yields, widest discounts, and lowest 1-year z-scores:

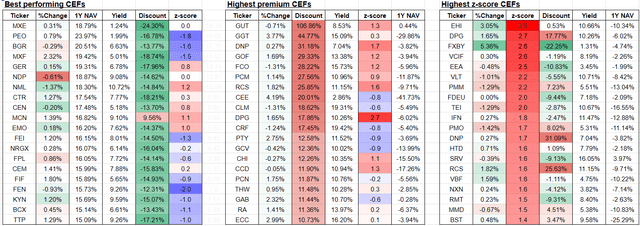

From our screener, here are the CEFs with the best 1-year performance, highest premiums, and highest 1-year z-scores:

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

March 13, 2023 | abrdn's U.S. Closed-End Funds Announce Closing of Reorganizations.

February 17, 2023 | KKR Income Opportunities Fund Announces the Results of Its Rights Offering.

February 16, 2023 | Delaware Enhanced Global Dividend and Income Fund Announces Final Results of Tender Offer.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

February 27, 2023 | CBRE Global Real Estate Income Fund (NYSE: IGR) Announces Terms of Rights Offering.

November 9, 2022 | Eaton Vance Closed-End Funds Announce Proposed Merger.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

------------------------------------

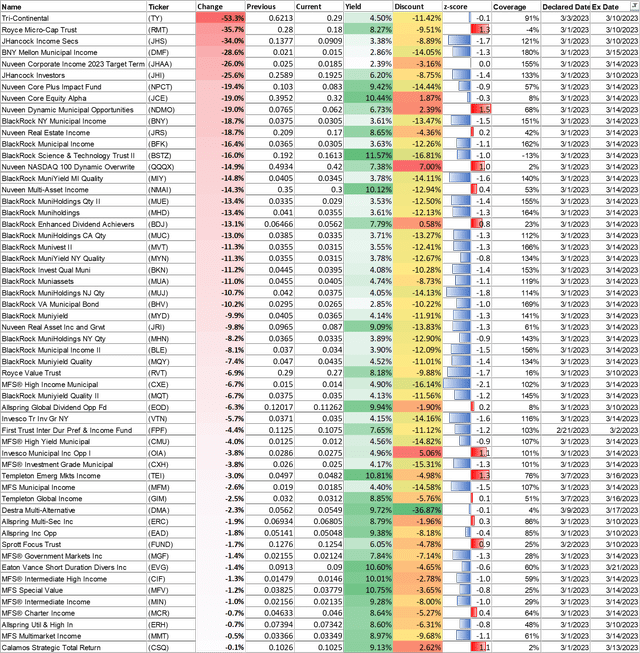

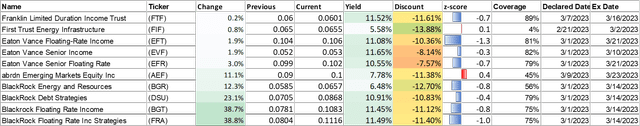

Distribution changes announced this month

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. Any distribution declarations made this week are in bold. I've also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I've separated the funds into two sub-categories, cutters and boosters.

Cutters

Boosters

Strategy Statement

Our goal at the CEF/ETF Income Laboratory is to provide consistent income with enhanced total returns. We achieve this by:

- (1) Identifying the most profitable CEF and ETF opportunities.

- (2) Avoiding mismanaged or overpriced funds that can sink your portfolio.

- (3) Employing our unique CEF rotation strategy to "double compound" your income.

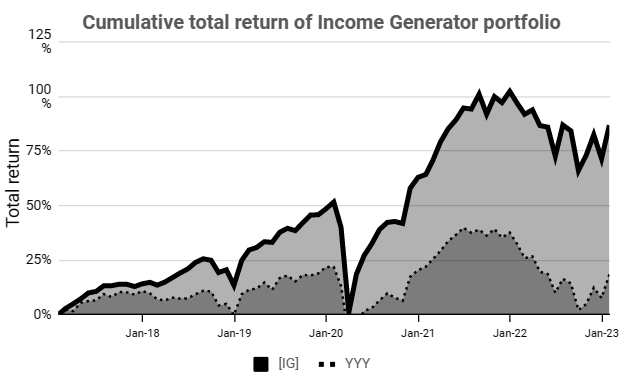

It's the combination of these factors that has allowed our Income Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) whilst providing growing income, too (approx. 10% CAGR).

Income Lab

Remember, it's really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Don't know what to do about CEF corporate actions?

Closed-end fund corporate actions such as rights offerings and tender offers present both significant opportunities and risks. We cover these regularly for members of CEF/ETF Income Laboratory, allowing them to profit or avoid losses.

Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

CEF/ETF Income Laboratory is a premium newsletter on Seeking Alpha that is focused on researching profitable income and arbitrage ideas with closed-end funds (CEFs) and exchange-traded funds (ETFs). We manage model safe and reliable 8%-yielding fund portfolios that have beaten the market in order to make income investing easy for you. Check us out to see why one subscriber calls us a "one-stop shop for CEF research.”

Click here to learn more about how we can help your income investing!

The CEF/ETF Income Laboratory is a top-ranked newsletter service that boasts a community of over 1000 serious income investors dedicated to sharing the best CEF and ETF ideas and strategies.

Our team includes:

1) Stanford Chemist: I am a scientific researcher by training who has taken up a passionate interest in investing. I provide fresh, agenda-free insight and analysis that you won't find on Wall Street! My ultimate goal is to provide analysis, research and evidence-based ways of generating profitable investing outcomes with CEFs and ETFs. My guiding philosophy is to help teach members not "what to think", but "how to think".

2) Nick Ackerman: Nick is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. Since then he has continued with his passion for investing through writing for Seeking Alpha, providing his knowledge, opinions, and insights of the investing world. His specific focus is on closed-end funds as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long term financial goals.

3) Juan de la Hoz: Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He is the "ETF Expert" of the CEF/ETF Income Laboratory, and enjoys researching strategies for income investors to increase their returns while lowering risk.

4) Dividend Seeker: Dividend Seeker began investing, as well as his career in Financial Services, in 2008, at the height of the market crash. This experience gave him a lot of perspective in a short period of time, and has helped shape his investment strategy today. He follows the markets passionately, investing mostly in sector ETFs, fixed-income CEFs, gold, and municipal bonds. He has worked in the Insurance industry in Funds Management, helping to direct conservative investments for claims reserves. After a few years, he moved in to the Banking industry, where he worked as a junior equity and currency analyst. Most recently, he took on an Audit role, supervising BSA/AML Compliance teams for one of the largest banks in the world. He has both a Bachelors and MBA in Finance. He is the "Macro Expert" of the CEF/ETF Income Laboratory.

Disclosure: I/we have a beneficial long position in the shares of BSTZ, ECF, OXLC, XFLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.