Occidental Petroleum Might Become A Berkshire Hathaway Asset

Summary

- Warren Buffett clearly has a price at which he's willing to invest in Occidental Petroleum Corporation.

- Berkshire Hathaway Inc.'s preferred stock and call options increase its financial ties to Occidental Petroleum.

- We expect Berkshire Hathaway to continue opportunistically investing in Occidental Petroleum until the company is eventually acquired.

- We're currently running a sale for our private investing group, The Retirement Forum, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Vladimir_Timofeev

Occidental Petroleum Corporation (NYSE:OXY) is back in the news. The company's share price decline to less than $60 per share from a peak of almost $80 / share has resulted in new investments from Berkshire Hathaway Inc. (BRK.A, BRK.B). The company has approval to build its Occidental Petroleum stake towards 50% from the 23.1% currently, as it recently bought hundreds of millions in more stock.

Fair Value

Last November, when the company's share price was at more than $70/share we talked about how it was overvalued. When it dropped to less than $60 / share we discussed how that changed and the company's stock had become interesting again. Berkshire Hathaway's first investment in months might highlight that the titan of investing agrees.

Occidental Petroleum Investor Presentation

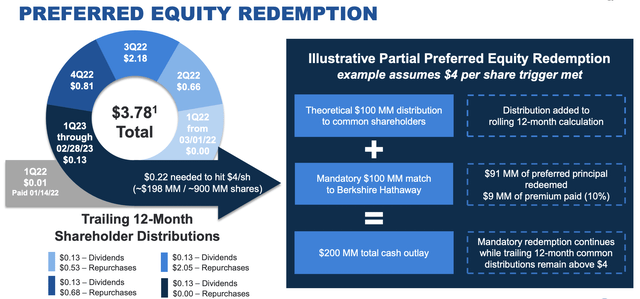

However, there are several parts of Occidental Petroleum's unique capital stack and the deal it made with Berkshire Hathaway that are worth paying attention to. The first is that the company has options to purchase 84 million shares for $5 billion, a price of just under $60 per share. There's also OXY.WS, the warrants the company issued to shareholders which have paid off well.

However, that'll dilute the shareholders by a factor of 1/8 as well and, unlike Berkshire Hathaway's options, there won't be much cash flowing into the company for these. Our expectation is the net result for the company is that Occidental Petroleum's stake goes from 23.1% to 26.1% should both the warrants and options be exercised.

The company also has $10 billion in preferred equity outside of all that paying $800 million a year. The unique dynamic above is once the company's annualized shareholder returns hit $4 / share, it has to spend half its cash repurchasing that equity at a 10% premium. At a 8% yield, it's not the end of the world if it has to repurchase shares.

It also substantially cleans up the company's capital stack.

Occidental Petroleum and Oil Prices

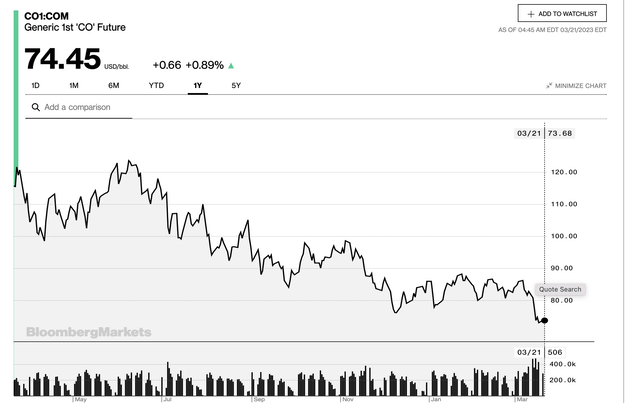

Occidental Petroleum is fundamentally susceptible to crude oil prices.

Occidental Petroleum Investor Presentation

That's not very helpful when those prices have been trending downwards and are at roughly $75 / share. The decline in Occidental Petroleum's share price is with good reason in regards to crude oil prices. However, Berkshire Hathaway, which can easily be insulated from long-term price variation, could take advantage of lower share prices to buy for the long run.

We do expect crude oil prices to be volatile for the remainder of the year, or even drop down with correction fears. However, it's worth noting that demand is expected to remain strong, especially from China reopening. With minimal projects providing additional supply, that could help keep prices lower for longer.

Occidental Petroleum Shareholder Returns

Occidental Petroleum has the ability to provide substantial returns for shareholders.

Occidental Petroleum Investor Presentation

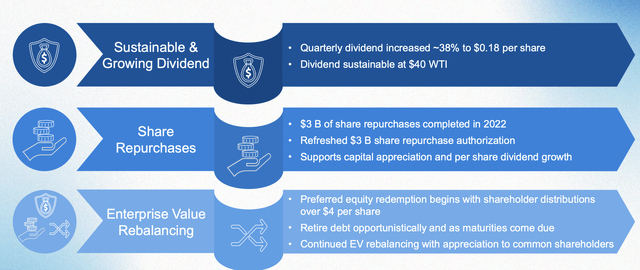

The company highlighted the need for additional preferred equity redemptions at >$4 / share in annual returns but the company needs very strong WTI prices for that. That's because the company is planning $5.4 billion in capital spending, an almost 25% YoY increase. For perspective, in 4Q 2022 the company's average WTI prices were $82.65 / barrel.

From that, the company generated $2.6 billion in free cash flow ("FCF"), a strong number, but also equivalent to $26 / barrel. With current WTI prices $14 / barrel lower we expect a strong drop in the company's FCF. To hit the company's $4 / share in rewards, it needs to buyback more than $700 million of stock per quarter, on top of its dividend.

However, we do see this as a strong benefit for Berkshire Hathaway which sees its ownership stake grow as shares are repurchased along with dividends and preferred equity repurchased at a 10% premium. For shareholders we see this as a rough cap on direct shareholder returns of ~7%. At $70 WTI average, the company's ability to reward shareholders brushes up on that $4 / share cap.

Our View

Berkshire Hathaway stepping in once again to invest in Occidental Petroleum, despite the substantial decline in crude oil prices, agrees with our long-term view that Berkshire Hathaway is a buyer of the company at <$60 / share. The company doesn't need to rush as it continues to collect on preferred equity and maintain its substantial option position.

Given Berkshire Hathaway's ability to expand its stake towards 50%, and Occidental Petroleum's commitment to shareholder returns, we have no expectation that Berkshire Hathaway will rush to make an offer. However, for interested investors, it's unique to be able to buy a strong oil company with substantial cash flow generation and a capped downside.

Thesis Risk

Occidental Petroleum's share price of course provides a strong baseline for the company's stock as long as oil prices remain modestly high. We expect Berkshire Hathaway to slowly build up towards having a 50% stake in the company as long as share prices remain lower and the company's stock remains interesting.

However, the company, as we discussed, is still dependent on oil prices and as long as they remain lower we expect returns to drop.

Conclusion

Berkshire Hathaway has shown it hasn't forgotten about Occidental Petroleum Corporation. It has a price it's clearly willing to pay. And why rush to buy when every shareholder's money pays your 8% preferred equity, you have strong call options, and the company continues to aggressively repurchase its own stock. Berkshire Hathaway is rewarded if it can get the preferred bought at +10%.

Still, at <$60 / share, it seems like Occidental Petroleum Corporation is clearly worth buying stock in. While we do expect oil prices to remain volatile, it's unique to see an oil investment like Occidental Petroleum Corporation that has downside protection in the form of another company's acquisitions. As a result, we recommend investing in Occidental Petroleum Corporation even with its recent share price weakness.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Disclosure: I/we have a beneficial long position in the shares of OXY, OXY.WS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.