U.S. Bancorp: My Biggest Purchase This Week

Summary

- I see a huge buying opportunity in the battered shares of U.S. Bancorp.

- U.S. Bancorp is a deposit-strong U.S. regional bank and recently pledged $1B in deposits for First Republic Bank.

- The bank reaffirmed its dividend at the height of the crisis as well, sending a strong signal to the market that the bank has confidence in its liquidity.

- The Fed’s deposit backstop and U.S. Bancorp’s strong balance sheet provide support.

- I can see a total return potential of 40%, including dividends, over a 1-year period!

Sundry Photography

U.S. regional banks have seen major declines in their market caps in the last two weeks after Silicon Valley Bank of SVB Financial Group (SIVB) imploded on March 9, 2023. I believe there are amazing bargains to be found in the U.S. regional bank market right now, which includes U.S. Bancorp (NYSE:USB). This regional U.S. bank also suffered greatly from a panic sell-off last week, but U.S. Bancorp's price appears to have stabilized lately. Since the Fed has taken decisive action to make extra liquidity available to the banking sector, I believe U.S. Bancorp as well as other U.S. regionals are set for a major rebound!

Why the current banking crisis is not the same as the one from 2008

Ever since Silicon Valley Bank (and two other banks) failed in March, investors have become increasingly concerned that we might be standing at the cusp of a bigger financial crisis. Silicon Valley Bank's implosion was clearly a major shock to (financial) markets, but I don't believe that the crisis is going to get much worse.

This is because the current crisis differs fundamentally from the financial crisis of 2008. First, Silicon Valley Bank did not fail because it made risky mortgage-backed security investments which so many financial institutions invested in back in 2008. SVB failed because it invested in the safest off all bonds (U.S. Treasuries) which it was forced to liquidate at a $1.8B loss in order to fund deposit withdrawals. Second, the Fed has moved very fast this time and provided a first line of defense that consists chiefly of liquidity. The Fed essentially backstopped all deposits at the failed banks in order to prevent further deposit runs.

These two factors -- the Fed's aggressive provision of liquidity to stem deposit outflows and the fact that SVB failed due to a forced liquidation of a high-quality bond portfolio to meet liquidity needs -- are what sets this crisis apart from 2008, in my opinion.

U.S. Bancorp is a deposit-strong regional bank with expansion drive

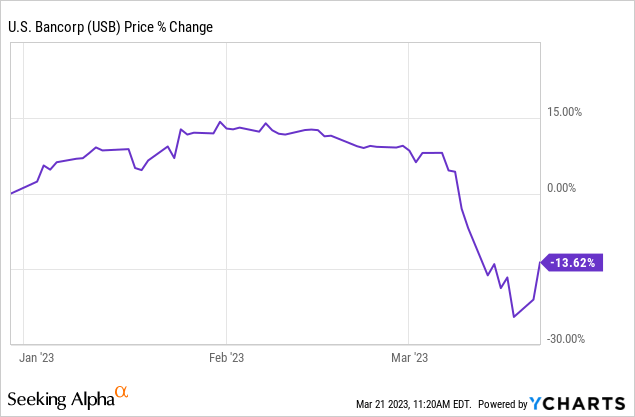

One bank that I have been buying on the drop is U.S. Bancorp which is a well-run, acquisitive regional bank with a market cap of $58.2B. Just like other U.S. regionals, USB has sold off since March 9, 2023. Since the share price appears to have stabilized in recent days, however, I believe there is potential for continued recovery gains.

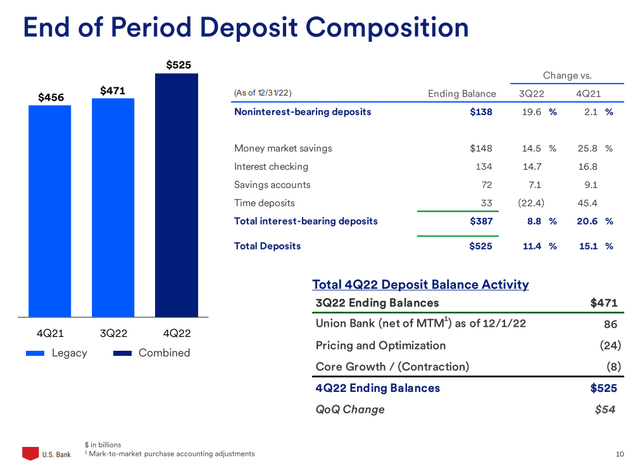

One reason I like U.S. Bancorp is that the regional bank has a strong deposit base. The regional bank had $525B in deposits at the end of the December quarter and U.S. Bancorp was the fifth-largest bank in the United States regarding total assets ($585B) at the end of FY 2022, according to the Fed (Source). Due to deposits moving over from Union Bank, U.S. Bancorp's deposit base grew 11% quarter over quarter in Q4'22. U.S. Bancorp acquired Union Bank's regional banking franchise from Mitsubishi UFJ Financial Group in FY 2022 in a bid to grow its regional footprint in California.

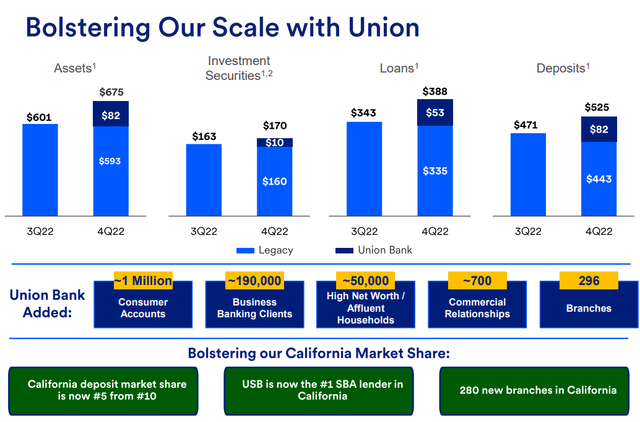

The Union Bank acquisition is truly transformative for U.S. Bancorp. It added $82B in deposits to the bank's balance sheet and $53B in, mostly commercial, loans. By adding close to 300 branches to its branch network in California, U.S. Bancorp also moved from a 10th place deposit market share before the acquisition to a 5th place.

Signs that the banking market is stabilizing and that U.S. Bancorp could recover

Moody's Investor Service recently downgraded the U.S. banking sector, but U.S. Bancorp itself has not been put on ratings watch. Fitch also placed a couple of regional banks on ratings watch, though not U.S. Bancorp.

Additionally, U.S. Bancorp contributed $1.0B in deposits in a $30B deposit deal for First Republic Bank. The deal was supported by all major banks in a bid to convey confidence in the U.S. regional banking system as well as in First Republic Bank. U.S. officials have said that deposit outflows have stabilized in recent days, suggesting that the worst may already be over for U.S. Bancorp.

U.S. Bancorp's valuation

U.S. Bancorp has seen its market cap decline from $48 to $36 in the last two weeks, but the share price has already started to stabilize. This is because, I believe, the Fed's unprecedented intervention in the form of a deposit backstop has succeeded in calming the market.

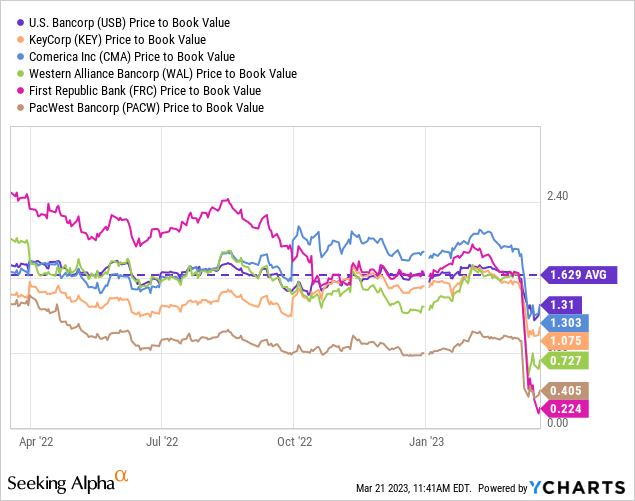

Since U.S. Bancorp is perceived as one of the less vulnerable U.S. regionals given its sizeable asset and deposit base, the valuation drawdown was not as severe as it was with other community banks. U.S. Bancorp's shares are currently valued at a price-to-book ratio of 1.3 X while during the peak of the crisis the stock sold at a larger discount to BV.

Still, USB stock is cheap compared against its historical standard: U.S. Bancorp has traded at an average price-to-book ratio of 1.63 X in the last twelve months, meaning investors currently get a discount of 20% to U.S. Bancorp's pre-crisis valuation.

Dividend declaration in the midst of the crisis

U.S. Bancorp announced the payment of its regular $0.48 per share quarterly dividend on March 14, 2023. Because of U.S. Bancorp's depressed share price, investors can now get a 5.3% dividend yield. Considering that U.S. Bancorp declared its dividend in the midst of the crisis, I believe the regional bank sent a strong signal of confidence in its liquidity position to the market.

Risks with U.S. Bancorp

I don't want to minimize the risks that the U.S. financial system is dealing with, after all we had bank runs happening on large financial institutions in March. My key point is that the Fed has done an excellent job and moved quickly as well as decisively by providing essential liquidity to U.S. depository institutions at a time of crisis. I believe the Fed's actions have been instrumental in preventing a potential disaster. Further deposit runs, however, especially on larger institutions, could make things worse.

Final thoughts

Key to my reasoning why I am aggressively purchasing U.S. regionals including U.S. Bancorp is the notion that I don't believe the Fed is going to want the crisis to spiral out of control. The Fed has learned its lessons from 2008 and the institution has moved quickly to provide additional liquidity in order to assure investors and depositors that it is going to support the industry no matter what.

U.S. Bancorp also participated in a rescue mission for First Republic Bank by providing $1.0B in deposits and declared its regular dividend at the height of the market panic last week, indicating that U.S. Bancorp has confidence in its liquidity situation as well as the Fed deposit backstop. I believe the risk profile here is very attractive and I am looking forward to seeing a rebound to U.S. Bancorp's pre-crisis price of $47-48. Since U.S. Bancorp investors can now also get a 5.3% dividend yield, I see potential upside potential of 40% over a 1-year period!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PACW, FRC, SCHW, USB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.