NIO: The Bottom Could Be In

Summary

- NIO Inc. disappointed in Q4, but 2023 promises to be a better year.

- There are tailwinds for both growth and profitability.

- Technical Analysis suggests we could be near a significant bottom.

- Looking for a helping hand in the market? Members of Technically Crypto get exclusive ideas and guidance to navigate any climate. Learn More »

z1b

Thesis Summary

NIO Inc. (NYSE:NIO) is trading at under $9/share, but the stock looks ready to start heading higher. Both fundamentals and technicals support this.

Despite unimpressive Q4 results, I still believe NIO is a good long-term hold and has become a bargain at these prices.

As liquidity flows back into stocks, NIO could surpass its previous all-time high of $60 and could potentially 10x from here.

Latest Results

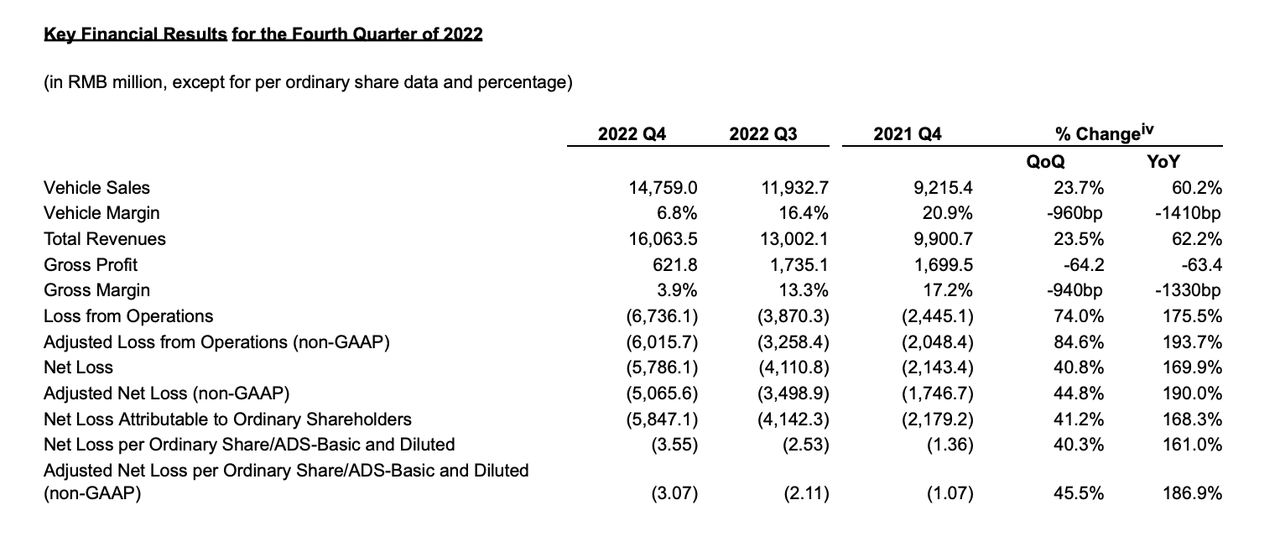

NIO missed on both earnings and revenues in Q4, but still provided solid YoY growth. Let’s have a look at some key financial metrics from the earnings release.

Financial Metrics (NIO earnings)

Electric vehicle ("EV") sales were up 60% YoY, and a decent 23.7% QoQ. The big outlier, though, was vehicle margin. VM was 16.4% in the previous quarter compared to 6.8% in this one.

The company explained this in the report:

The vehicle margin in the fourth quarter of 2022 was negatively impacted by 6.7 percentage points due to inventory provisions, accelerated depreciation on production facilities, and losses on purchase commitments for the existing generation of ES8, ES6 and EC6.

Source: NIO results.

Looking ahead, the company expects deliveries of between 31,000 and 33,000 vehicles in Q1, which would imply a YoY growth rate of 20.3% to 28.1%.

In terms of profitability, William Li had this to say in the earning call:

So, for the gross margin for the full year of 2023, we are confident that in the Q4 of 2023, the vehicle gross margin will go back to 18% to 20% due to several factors. The first one is of our product portfolio. Starting from the second quarter of this year, we are going to start the delivery of vehicle models with higher vehicle gross margins.

The second factor is just like you mentioned, recently, we have witnessed the cost reductions of the raw materials, including the lithium carbonate, chips and other commodities.

Source: Earnings Call.

Management seems to be confident that this recent fall in profitability was a one-off, and if NIO can continue its current growth path, then the next earnings report should be much more encouraging.

Growth Outlook

We should definitely see an increase in profitability in the coming months, but what about growth? The Chinese slowdown narrative has been in play for some time now, but we are now getting some evidence that 2023 could be a better year than expected.

First off, China’s PMI for February hit an 11 year high. Following the Chinese new year, and with the covid lockdowns now a thing of the past, the Chinese economy is off to a surprisingly good start.

This is also being aided by an accommodative monetary policy. The PBoC has been one of the first banks to turn the liquidity tap back on. Last Friday, the Central Bank reduced the Reserve Requirement Ratio by 0.25%. This could theoretically add 500 billion to 600 billion yuan to the financial system. A liquidity boost should help boost stocks like NIO.

Though things look good in China, I will say that the growth trajectory in Europe is still far from impressive. This was also addressed in the earnings call.

For this year, we believe the sales are not of top priority. To be honest, our target in terms of the sales volume for the European market this year is probably less than 10,000. And we believe the most important thing for us is actually the user satisfaction rate.

Source: Earnings Call.

NIO is taking a big risk moving into the European market, and despite seeing a “high user satisfaction rate,” the company is barely making any sales in the continent.

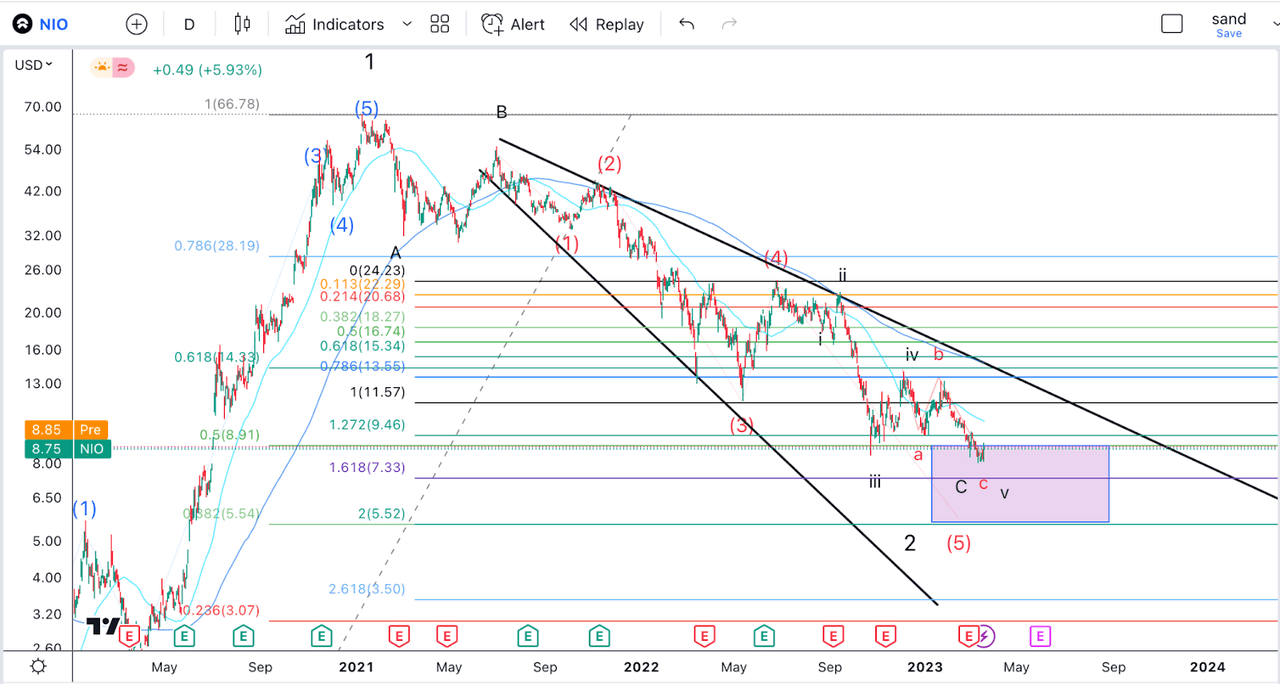

Technical Analysis

With the latest selloff in NIO, which took the stock price below 8$, we could begin to consider that a bottom could be in place.

With that lower low, we could consider that wave C of v of (5) has ended. We do have some more room to run. The ideal target for our wave (5), based on the 1.618 ext of wave (4) would be $7.33. Below that, the 61.8% retracement of the large degree wave 1 projects is towards $5.54. If NIO entered this range, then I would buy aggressively.

Takeaway

The tides are turning. Liquidity is once again entering the market, both domestically and abroad, and electric vehicle manufacturers will benefit from lower input prices and easier financial conditions. NIO Inc. is still, in my opinion, a best-in-class EV manufacturer, and I fully expect the price to perform very well in the coming 12 months.

This is just one of many exciting cryptocurrencies you can buy right now!

Join Technically Crypto to stay ahead of the latest news and trends in the crypto space. Learn the ins and outs of blockchain technology and how you can profit from it. Here's what you will get with your subscription:

Here's what you will get with your subscription:

- Access to our Crypto Portfolio.

- On-chain analysis of Bitcoin and Ethereum.

- Deep dive reports on Altcoins.

- Technical Analysis of major cryptocurrencies.

- News updates.

Crypto is changing the future, don't just watch it, be a part of it!

This article was written by

The Value Trend is now The Digital Trend.

We believe the greatest opportunities of the next decade will be in innovative technologies and cryptocurrencies, so this is where we focus our analysis.

We felt a brand update would help our readers better understand our work.

The world is turning digital and so should your portfolio!

Disclosure: I/we have a beneficial long position in the shares of NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.