A 75% Decline In Vicor's Share Price Presents A Compelling Investment Opportunity

Summary

- Vicor's share price has plummeted from a high of $164 to a current price of around $41.

- This dramatic decline in share price presents an excellent opportunity to buy shares at a very attractive price.

- Vicor’s technology lead is widening, and AI processors require Vicor’s enabling products.

- Existing design wins and the ability to meet customer demand ensure accelerating growth.

- GMs, cash flow, and EPS will rise significantly due to the new streamlined, vertically integrated ChiP fab.

Nikada/E+ via Getty Images

What happened

Vicor Corporation (NASDAQ:VICR) lost credibility with investors after they announced their Q4 results. Revenue increased slightly to a record $105,500,000.00, but bookings declined more than expected. The bookings decline could have been anticipated because customers previously placed larger-than-normal orders scheduled out over multiple quarters to ensure delivery, as for all last year, Vicor was capacity constrained.

Vicor announced it was no longer capacity-constrained, and investors were expecting an increase in shipments when this happened. Their large backlog supported this expectation, but the revenue and the forward look disappointed investors, and they ran for the exits in a weak and nervous market. The large $304,000,000 backlog is still scheduled out over several quarters.

As I have pointed out in several previous Seeking Alpha articles, Vicor has a technically superior product, and its competitive lead continues to expand. However, with the new ChiP fab factory late, especially the plating, Vicor could not guarantee delivery of their converters. This delay forced Nvidia (NVDA), their biggest customer, to seek an alternate but inferior solution for their H100 GPU. Nvidia is now shipping their new H100, and they don't need as much product from Vicor, which contributed to the bookings decline. I believe this is a temporary situation, as an updated version of the H100 is expected with the Vicor parts.

As per the last conference call, it is clear that bookings are now the gating factor for Vicor to reach its stated goal of $1,000,000,000 in revenues with 65% GMs.

Investment Thesis

With record revenues, enabling technology, an expanding competitive position, new game-changing products, and a new vertically integrated factory, the market has discounted the investment opportunity in Vicor's shares.

Vicor now has the production capacity to guarantee delivery to its customers. As a result, and because of Vicor's technically superior product, they expect Nvidia to announce a new version of the H100 using the Vicor converters. Vicor has at least six additional design wins with their vertical power solutions that use existing gen four converters, and increases in bookings and incremental revenue is expected this year from these opportunities.

For the next quarter, I expect flat results and then a slow ramp in Vicor's revenue and EPS, supported by their still substantial backlog. I expect revenue, margins, turns, cash flow, and EPS to accelerate in the second half when their generation 4 Vertical solutions start to ship. In late 2023 Vicor will roll out its front-end products, then in late 2023 or early 2024, Vicor's gen five products will hit the market, and in 2024 Vicor will start production deliveries into the automotive market. With these new products and the efficiencies created by Vicor's vertically integrated factory, the afterburners get turned on, and Vicor will record accelerating numbers.

With the small share count and Vicor's volatile history, Vicor is poised for a significant rebound in its share price, and with some time and momentum, we could see it overtake its old highs.

Background

Vicor designs, markets, and sells power converters. Most of their advanced product sales come from data centers and high-performance computing, and sales for co-packaged optics are expected. Customers include Nvidia, AMD (AMD), Intel (INTC), IBM (IBM), Google (GOOG) (GOOGL), Cray, now Hewlett Packard Enterprise (HPE), Marvell (MRVL), and Broadcom (AVGO).

These companies selected the Vicor solutions because they enable higher-performance processors with cost-effective solutions.

Nvidia, Vicor's biggest customer

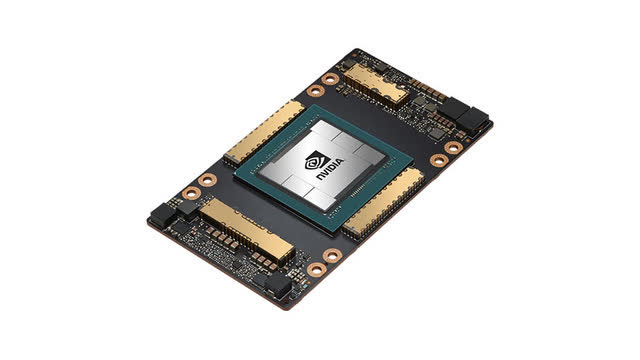

For years, Vicor has delivered their lateral converters to Nvidia originally for the V100 and then for their flagship A100 data center AI accelerator. Nvidia picked Vicor because of its cost and, more importantly, its enabling performance.

Vicor's stock price took a big hit last year when Nvidia, Vicor's largest customer, announced a competing multiphase solution for their H100 GPU.

Nvidia selected the multiphase solution because Vicor's factory was not complete, and they could not guarantee delivery.

An upgraded H100 that uses Vicor lateral/vertical converters is expected to be announced by Nvidia shortly. The superior lateral/vertical solution uses existing products, but the converter is placed directly under the AI accelerator. The placement eliminates significant PDN, Power Distribution Network losses, produces significantly less heat and provides more current with less voltage drop to the silicon. The lateral/vertical solution is expected to save up to 70 Watts per GPU. This is very significant, especially when a data center may have 10s of thousands or more GPUs.

A bigger problem is that without the Vicor solution, the 70 watts turn into heat that needs to be removed and can cause the GPU to overheat or have the clock throttled back so the silicon can run cooler.

Vicor's solution may provide up to a 2X improvement in AI accelerator performance because it can deliver more power without voltage drops and overheating; i.e., the system doesn't need to throttle the clock to keep the processor from running too hot.

Nvidia has its GTC conference the week of March 20. I don't expect to see a picture of the H100 with the Vicor gold bars at the conference, but it is possible, and if we do, we could see a significant jump in the share price.

In the meantime, Vicor continues to deliver their converters for the Nvidia A100, which continues to sell.

Vertical Solutions for AI Processors

I discussed Vicor's Vertical solutions in detail in my previous SA article. Vertical Solutions are a game changer, increasing Vicor's competitive lead. The efficiency and small size and their use of highly differentiated packaging are essential to Vicor's vertical solutions.

Vicor is in the final development stages of their lateral/vertical power delivery solutions and shipped prototype products to a customer, who I believe is Nvidia. I think it will be on an upcoming H100.

It is important to note that the lateral/vertical uses existing Vicor modules, but the placement of one of the modules is directly under the processor. There is less risk of product delays or performance issues by using existing converters.

With Vicor's pure vertical solutions, they expect the PDN losses can be reduced an additional 3X or more above the lateral/vertical. This is a game-changing technology and is expected late this year.

As the processor's die sizes shrink, soon to be 3nm, current requirements continue to rise. Processors now need up to 2,000 amps. A new architecture is required to provide the power necessary for these processors. Vicor's vertical architectures are vital to delivering the current that is essential for new AI processors.

ChiP fab, Vicor's New Factory:

ChiP fab, Vicor's New Facility (Vicor's web page)

Expected increases in revenue from Vicor's new ChiP, Converter housed in a Package, fab factory are over a year late. This delay significantly affected its share price. The factory is within months of completion, as the last piece of plating equipment is being delivered and installed next month. Plating was previously subcontracted to a third party, was very expensive, and contributed to long lead times.

As Vicor already realizes efficiencies from the addition, the real benefits start in Q2 when the plating is in-house and the vertical integration is complete. This integration will reduce the COGS, increase margins, turns, and cash flow, and lower lead times.

Business Plan to get to $1,000,000,000

Vicor's business plan to get to $1,000,000,000 with 65% GMs, which I reported about in my last article, is intact but delayed. Fundamentally nothing has changed, but the factory is nearing completion, and their technology lead is increasing. License revenue will be a contributing factor in getting to 65% GMs.

Patents and IP

Vicor's patent portfolio covers everything from the switching topologies, architecture, packaging, magnetics, and even the manufacturing and testing processes. They even went to the extreme effort of working with machine manufacturers to customize their equipment so Vicor could produce superior and cost-effective products. This customization caused part of the delay, but it will be well worth it when much better financial results are reported.

Their patents enable the smallest converters and important electrical characteristics that include fast transient responsiveness (i.e., the reaction of a power system to a sudden change in voltage or current levels) and noise profile (i.e., the level of electromagnetic interference created by power conversion). The size, transient responsiveness, and EMI footprint enable Vicor's Point of Load, POL, solutions for powering AI processors.

As of December 31, 2022, in the United States, Vicor has 122 patents having expirations scheduled between 2023 and 2040 and has filed several patent applications, which are expected to be issued in 2023.

Vicor believes several companies are infringing on their patents and plans to sue them. Their patent portfolio is so extensive that they down-selected the number of patents they plan to enforce. Even if a company can get around one patent, it will not be able to get around the portfolio of patents.

Auto

Vicor expects to deliver production parts to the automotive market in the middle of 2024. Phil Davies believes they have a chance of ramping auto to $100,000,000 in revenue in 2025. Last year they had significant OEM engagements and three successful auto audits. They expect qualifications to be completed by Q2 of this year.

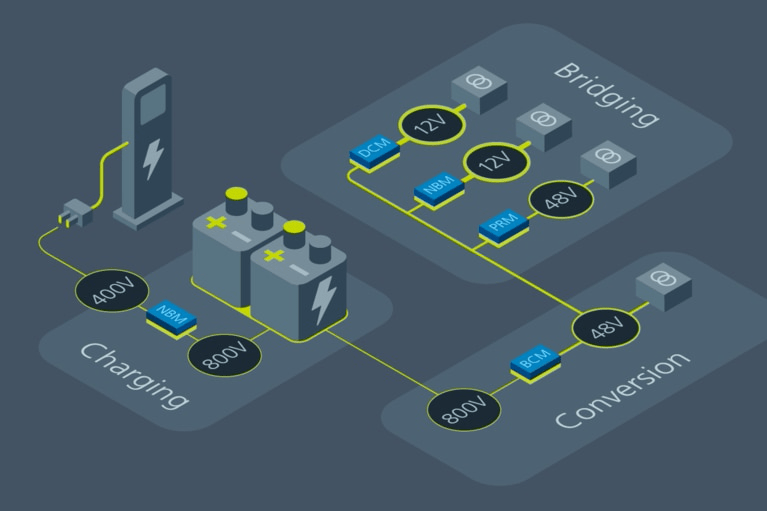

Vicor's most significant opportunity in auto is onboard charging, where 50 to 150K Watts of power is needed. Additional opportunities are with the 800/400 Volt distribution and conversion to 48V, their virtual battery, and the 48 to 12V conversion. Density and scalability are critical attributes to Vicor's success in this market. Vicor plans five automobile modules that can easily scale with parallelization (adding additional modules for different applications and power levels) and be used for other platforms.

Vicor's products are so compelling to the Automotive market that manufacturers have paid Vicor from $100,000 to over $1,000,000 in NRE to help Vicor customize their products for their cars. These investments demonstrate the commitment the manufacturers have to Vicor's automotive solutions.

On April 18th and 19th, Vicor will deliver four presentations about solving the most challenging automotive electrification problems at World Congress 2023 in Detroit, Michigan.

ChiP, Converter housed in a Package (Vicor's web page)

Competition

GaN and SiC are the latest buzzwords in the industry, and several companies make power converters using these materials. Wolfspeed (WOLF) uses SiC, and while they are seeing significant revenue growth, they continue to report large losses. Navitas Semiconductor (NVTS) makes GaN power converters, and they are seeing revenue growth but are also reporting substantial losses.

GaN and SiC are materials that can be used for part of a design in a power supply. Vicor can use either GaN or SiC, but Vicor uses Si because it is more stable and cost-effective, and they see performance advantages using Si over GaN or SiC.

Unlike WOLF and NVTS, Vicor is profitable and is expected to grow its EPS significantly in the coming years.

Several companies also make competing multiphase products. Multiphase has the advantage of being multi-sourced, but it cannot effectively work in the new AI processors that demand up to 1,000 and higher Watts of power.

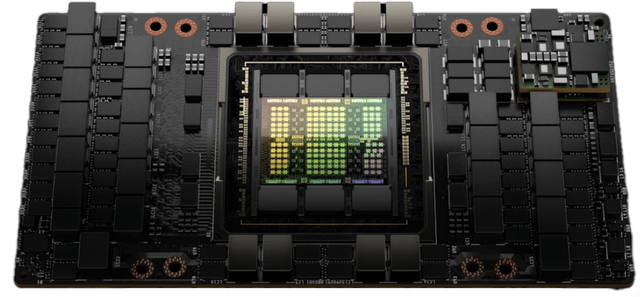

Pictures of Vicor's solution and the competing multiphase solution are below. Vicor's solution has gold bars on the Nvidia processor package. As you can easily see, it is a much cleaner and more efficient solution with significantly fewer parts.

Nvidia's A100 with Vicor's Gold Converters (Nvidia's webpage)

Nvidia's H100 (Nvidia's webpage)

A glimpse into Vicor's technology

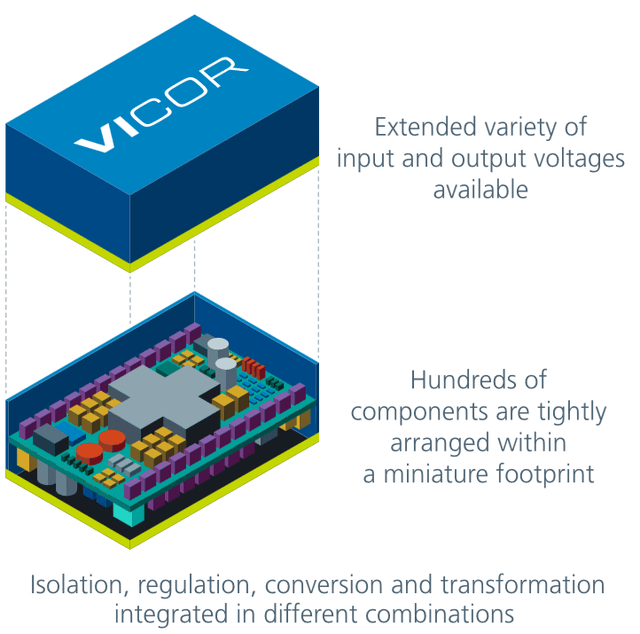

As per the picture below, Vicor has hundreds of components tightly arranged in a miniature package, hence the name ChiP. Instead of engineers using discrete components and tailoring their solutions for their particular applications, Vicor makes their job easier with converters analogous to building blocks designed and certified to work together to solve power distribution problems.

ChiP, Converter housed in a package (Vicor's website)

Generation 5 products

Vicor's cost-reduced 5th generation products, which are 1/3 the size of gen 4, are scheduled to be introduced later this year.

These new products significantly expand Vicor's market. They will be competitive and cost-effective for the new Chiplet and lower-performance CPU processors, including servers where processors draw 100 Amps of current and above.

This new market represents substantial and incremental revenue and earnings opportunities.

With the 5th generation technology, Vicor can place their converters directly on the processor dies. Having the converter on the processor die is the holy grail of POL solutions.

As I have previously reported, Vicor continues to spend heavily on R&D and has a culture of innovation. I expect other significant products to be in the works.

High Voltage, "Front End Products"

I have discussed Vicor's "front-end" products in several of my previous Seeking Alpha articles. The market for these products is as big or bigger than Vicor's Point of Load products. Vicor has consistently slipped the release of these products. Deliveries are now expected later this year or early in 2024, and when they are released, a significant increase in opportunities will quickly turn into bookings and revenue.

Succession plan

At the Needham Growth Conference, Quinn Bolton asked the CEO, Dr. Patrizio Vinciarelli, what is the succession plan for him. Dr. Vinciarelli replied that if something happened to him, the shareholders would be fine as there were many suitors for Vicor, and Vicor would be sold at a significant premium.

Dr. Patrizio Vinciarelli is 76 years old. I imagine he will be interested in selling the company at a substantial premium in the future. I expect he will want to sell before building another factory but wait until Vicor successfully enters the automotive market.

Forecast

With the help of @Shortybovine and @aahicks, I have the following forecast.

Year Revenue EPS

2023 $450,000,000 $1.00

2024 $560,000,000 $2.00

2025 $725,000,000 $3.50

2026 $900,000,000 $5.00

Applying a 50 PE ratio, which is very reasonable considering the growth rate, to a 2024 EPS of $2.00 implies a $100 share price. The share price will be much higher in the out years as Vicor executes its plan.

Risks

- Vicor is a very volatile stock with dramatic swings in the share price, and I expect we will see them again.

- Competing technology could improve to be as good or better than Vicor's.

- Companies of much bigger size and resources compete against Vicor.

- Competitors don't respect intellectual property, and the courts may not agree with Vicor's patent position.

- Vicor is new to the automotive market and has yet to prove it can be successful.

- The vertical and fifth-generation products are new, and we could see delays.

- The new facility could experience additional delays.

- Vicor's has a limited shareholder base. The CEO owns ½ of all the shares and has full voting power in the company. With this limited supply of shares, the stock price is subject to extreme price fluctuation, up and down.

- The CEO has full voting power and complete control over the company.

Conclusion

Vicor is a very volatile stock and is not for the faint of heart. They have the best technology and a new vertically integrated manufacturing factory to meet customers' demands.

Design wins in the Data Center market with existing products support substantial gains in the 2nd half of this year.

The next generation of AI processors is going to be 3nm technology. With smaller widths, processors demand higher currents. At 3nm, the Vicor vertical solutions are the only converters able to deliver the power required for these processors.

Vicor lost significant credibility with its investor base over the last year. I do not look back but forward. Everything is in place for a dramatic increase in revenue, earnings, and cash flow, and these factors will lead to an accelerating share price. It is likely that within a couple of years, Vicor's shares could easily trade back up to their old highs.

Vicor is a strong buy. The share price decline is a gift that I took advantage of.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VICR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Vicor is a very volatile stock. Please consult a financial advisor and perform your due diligence.